Slcc in Lafayette Louisiana1098 T Forms 2013-2026

What is the SLCC 1098 T Form?

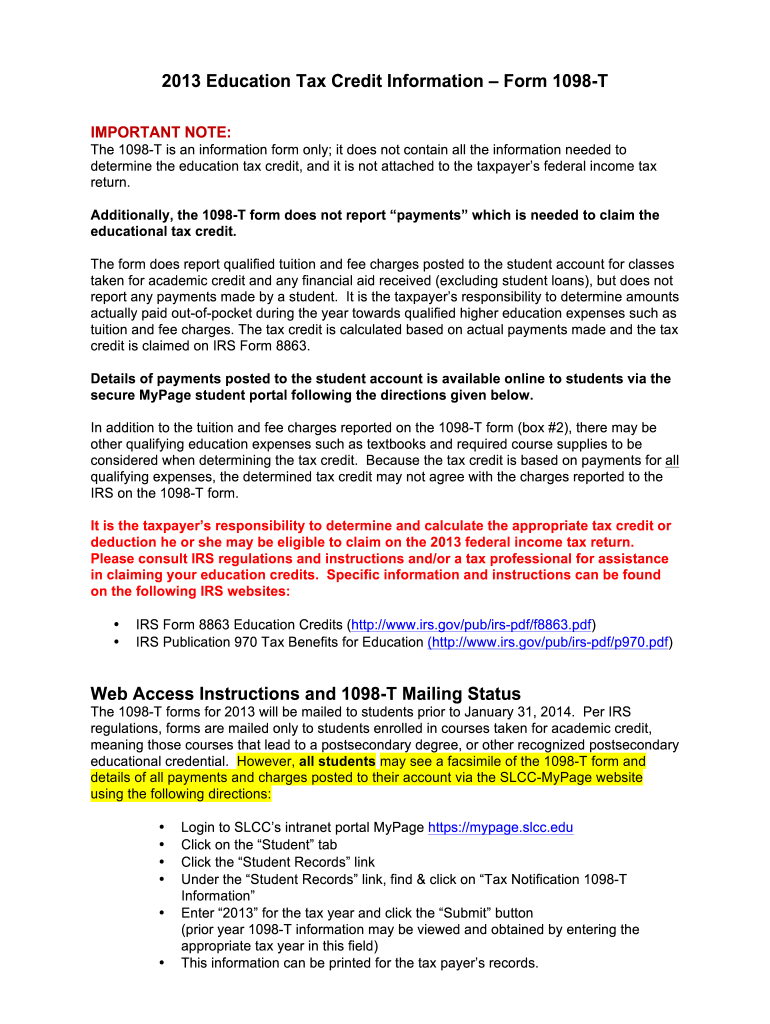

The SLCC 1098 T form is a tax document issued by the South Louisiana Community College (SLCC) that provides information about tuition payments made by students. This form is essential for students who wish to claim educational tax credits, such as the American Opportunity Credit or the Lifetime Learning Credit. The 1098 T form includes details such as the amount of tuition paid, scholarships received, and other related financial information that can impact a taxpayer's eligibility for these credits.

How to Use the SLCC 1098 T Form

To effectively utilize the SLCC 1098 T form, students should first ensure they receive it from SLCC, typically by January 31 of each year. Once received, students should review the information for accuracy. If any discrepancies are found, it is crucial to contact the institution for corrections. The information on the form will be used when filing federal tax returns to claim applicable education credits. It is advisable to keep the form for personal records, as it may be needed for future reference or audits.

Steps to Complete the SLCC 1098 T Form

Completing the SLCC 1098 T form involves several steps:

- Gather necessary documentation, including tuition payment receipts and scholarship information.

- Review the form for accuracy, ensuring all amounts reflect actual payments made during the tax year.

- Consult IRS guidelines to determine eligibility for education tax credits based on the information provided.

- Include the form information when preparing your tax return, either manually or using tax software.

IRS Guidelines for the SLCC 1098 T Form

The IRS has specific guidelines regarding the use of the SLCC 1098 T form. According to IRS regulations, educational institutions must provide this form to students who have made qualifying payments. The form must accurately reflect the payments made and any scholarships received. Students should refer to IRS Publication 970 for detailed information on how to use the form to claim education credits and understand the tax implications of their tuition payments.

Filing Deadlines for the SLCC 1098 T Form

Filing deadlines related to the SLCC 1098 T form are critical for students to keep in mind. The form must be issued to students by January 31 each year. When filing taxes, students should ensure they submit their returns by the April 15 deadline to avoid penalties. It is important to plan ahead and gather all necessary documentation well in advance of these deadlines to ensure a smooth filing process.

Who Issues the SLCC 1098 T Form?

The SLCC 1098 T form is issued by South Louisiana Community College. The institution is responsible for compiling the necessary information regarding tuition payments and scholarships for each eligible student. Students can typically access their forms through the college's financial aid office or online student portal. It is essential for students to ensure they receive this form each year to accurately report their educational expenses on their tax returns.

Quick guide on how to complete slcc in lafayette louisiana1098 t forms

Effortlessly Prepare Slcc In Lafayette Louisiana1098 T Forms on Any Device

Digital document management has become widely embraced by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to swiftly create, modify, and eSign your documents without any delays. Manage Slcc In Lafayette Louisiana1098 T Forms on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven procedure today.

How to Modify and eSign Slcc In Lafayette Louisiana1098 T Forms with Ease

- Obtain Slcc In Lafayette Louisiana1098 T Forms and click Get Form to begin.

- Use the available tools to complete your document.

- Select signNow parts of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Decide how you want to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device. Modify and eSign Slcc In Lafayette Louisiana1098 T Forms to ensure clear communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the slcc in lafayette louisiana1098 t forms

The way to generate an electronic signature for your PDF document in the online mode

The way to generate an electronic signature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

How to create an electronic signature straight from your mobile device

The best way to make an electronic signature for a PDF document on iOS devices

How to create an electronic signature for a PDF document on Android devices

People also ask

-

What is the SLCC 1098 T, and how can airSlate SignNow assist with it?

The SLCC 1098 T is a tax form used to report tuition payments and related expenses to the IRS. airSlate SignNow simplifies the process of obtaining and signing this document, allowing you to efficiently manage your tax-related paperwork from anywhere with eSignature capabilities.

-

How does airSlate SignNow ensure the security of my SLCC 1098 T documents?

With advanced encryption methods and secure cloud storage, airSlate SignNow ensures that your SLCC 1098 T forms are protected at all times. Our platform complies with industry standards for data protection, giving you peace of mind while handling sensitive information.

-

What features does airSlate SignNow offer for managing SLCC 1098 T documents?

airSlate SignNow offers a range of features for managing SLCC 1098 T documents, including template creation, automated workflows, and bulk sending options. These tools streamline the process, making it easier to collect signatures and track document status.

-

Is airSlate SignNow a cost-effective solution for handling SLCC 1098 T forms?

Absolutely! airSlate SignNow is known for being a cost-effective solution for businesses of all sizes. With flexible pricing plans, you can choose the best option to manage your SLCC 1098 T forms without breaking the bank.

-

Can I integrate airSlate SignNow with other software to manage my SLCC 1098 T documents?

Yes, airSlate SignNow integrates seamlessly with a variety of popular business software, allowing for streamlined management of your SLCC 1098 T forms. Whether you use CRM systems or document management platforms, our integrations enhance your workflow efficiency.

-

What benefits will I gain from using airSlate SignNow for SLCC 1098 T management?

Using airSlate SignNow for SLCC 1098 T management offers benefits such as increased efficiency, reduced errors, and faster turnaround times. The user-friendly interface also makes it easy to get started, helping streamline your document handling process.

-

How can I get started with airSlate SignNow for my SLCC 1098 T documents?

Getting started with airSlate SignNow is simple. You can sign up for a free trial to explore its features and see how it can help with your SLCC 1098 T document management. Our dedicated support team is also available to assist you throughout the setup process.

Get more for Slcc In Lafayette Louisiana1098 T Forms

- Welcome to state board of pharmacy idahogov form

- Idaho division of vocational rehabilitation intake form

- Certificate of dissolution of invalidity or legal form

- Foreign lpn or rn application to become an illinois certified nurse aide cna form

- Client grievance form illinois department of human services dhs state il

- For a registered debilitating patient form

- Form name form number home health branch questionnaire used to apply for branch locations

- Outcome measures for sexual assault services in texas form

Find out other Slcc In Lafayette Louisiana1098 T Forms

- Sign Hawaii Non-Profit Limited Power Of Attorney Myself

- Sign Hawaii Non-Profit Limited Power Of Attorney Free

- Sign Idaho Non-Profit Lease Agreement Template Safe

- Help Me With Sign Illinois Non-Profit Business Plan Template

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online