Instructions for Form 706 Rev August Internal Revenue Irs

Understanding the 706 Form Instructions

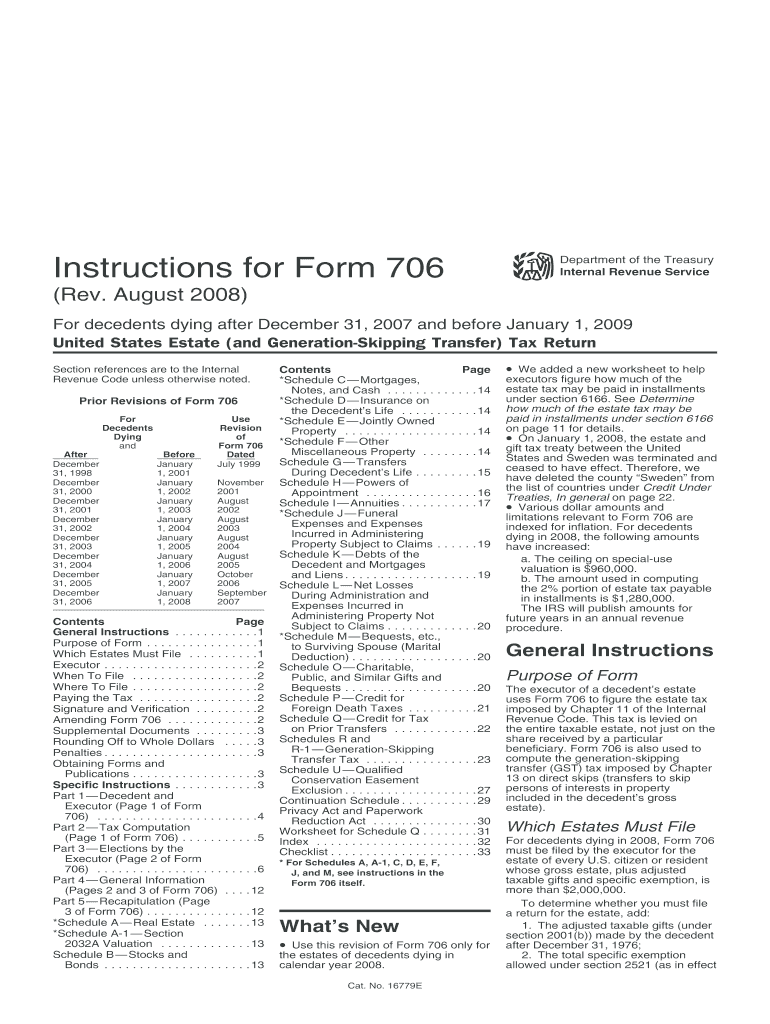

The 706 form, officially known as the IRS Form 706, is used to calculate the estate tax owed by the estate of a deceased individual. This form is crucial for estates that exceed the federal estate tax exemption limit. The instructions for Form 706 provide detailed guidance on how to accurately complete the form, including information on filing requirements, calculations, and necessary supporting documentation. Understanding these instructions is essential to ensure compliance with IRS regulations and to avoid potential penalties.

Steps to Complete the 706 Form Instructions

Completing the 706 form instructions involves several key steps:

- Gather necessary documents, including the decedent's financial records, property valuations, and any prior gift tax returns.

- Review the IRS guidelines for the current tax year to ensure you are using the correct form and instructions.

- Complete the form by entering the required information, such as the decedent's details, estate assets, deductions, and tax calculations.

- Double-check all entries for accuracy and completeness, ensuring that all calculations are correct.

- Sign and date the form, and ensure that any required signatures from executors or administrators are obtained.

- Submit the completed form by the specified deadline to avoid penalties.

Filing Deadlines for the 706 Form

It is important to be aware of the filing deadlines associated with the IRS Form 706. The form generally must be filed within nine months of the date of the decedent's death. However, an extension may be requested, allowing for an additional six months to file. It is essential to file on time to avoid interest and penalties on any taxes owed. If an extension is granted, ensure that the form is submitted by the new deadline.

Required Documents for Form 706

When completing the 706 form instructions, several documents are required to support the information provided. These documents may include:

- The decedent's death certificate.

- Financial statements, including bank statements and investment accounts.

- Property appraisals for real estate and other significant assets.

- Documentation of any debts or liabilities of the estate.

- Prior gift tax returns if applicable.

Having these documents readily available will facilitate a smoother completion of the form and ensure that all necessary information is accurately reported.

Legal Use of the 706 Form Instructions

The 706 form instructions are legally binding and must be adhered to by executors and administrators of estates. Proper completion of the form is essential for compliance with federal tax laws. Failing to follow the instructions can result in incorrect tax calculations, leading to penalties and interest charges. It is advisable to consult with a tax professional or estate attorney to ensure that all legal requirements are met when filing the form.

Digital vs. Paper Version of the 706 Form

Both digital and paper versions of the IRS Form 706 are available for submission. The digital version allows for easier calculations and may streamline the filing process. However, some individuals may prefer the traditional paper format for its tangible nature. Regardless of the method chosen, it is critical to ensure that all information is accurate and that the form is submitted by the deadline. Utilizing electronic filing options may provide additional benefits, such as immediate confirmation of submission.

Quick guide on how to complete instructions for form 706 rev august 2008 internal revenue irs

Complete Instructions For Form 706 Rev August Internal Revenue Irs effortlessly on any device

Online document management has become increasingly favored by organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents rapidly without delays. Manage Instructions For Form 706 Rev August Internal Revenue Irs on any device with airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

The easiest way to modify and eSign Instructions For Form 706 Rev August Internal Revenue Irs without hassle

- Find Instructions For Form 706 Rev August Internal Revenue Irs and then click Get Form to begin.

- Use the tools we provide to complete your document.

- Mark relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal significance as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose how you would like to send your form, whether via email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow caters to your needs in document management in just a few clicks from any device you prefer. Alter and eSign Instructions For Form 706 Rev August Internal Revenue Irs and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

What form do I fill out, a W9 or a W8-BEN? I am a US citizen living in Canada as a permanent resident. I am a freelancer (not an employee on a payroll) working for someone in the US, but I will be reporting my earnings to Canada Revenue, not the IRS.

You fill out a W-9. As a US citizen, you are taxed on your worldwide income. It doesn't matter if you don't even set foot in the US.You will however receive a foreign tax credit on your US return equal to the tax paid in Canada or the US tax on the same income, whichever is lower.You also must file an FBAR each year with the US Treasury if you have non-US financial accounts totalling $10K or more. This is measured by finding the highest balance at any time of year for each account and adding up those numbers. Failure to file carries signNow penalties.

-

How can I deduct on my Federal income taxes massage therapy for my chronic migraines? Is there some form to fill out to the IRS for permission?

As long as your doctor prescribed this, it is tax deductible under the category for medical expenses. There is no IRS form for permission.

-

How do I mail a regular letter to Venezuela? Do I need to fill out a customs form for a regular letter or do I just need to add an international mail stamp and send it?

You do not need to fill out a customs form for a regular letter sent from the US to any other country. Postage for an international letter under 1 ounce is currently $1.15. You may apply any stamp - or combination of stamps - which equals that amount.

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 706 rev august 2008 internal revenue irs

How to create an electronic signature for the Instructions For Form 706 Rev August 2008 Internal Revenue Irs online

How to generate an eSignature for the Instructions For Form 706 Rev August 2008 Internal Revenue Irs in Chrome

How to create an eSignature for putting it on the Instructions For Form 706 Rev August 2008 Internal Revenue Irs in Gmail

How to make an electronic signature for the Instructions For Form 706 Rev August 2008 Internal Revenue Irs straight from your mobile device

How to make an eSignature for the Instructions For Form 706 Rev August 2008 Internal Revenue Irs on iOS devices

How to make an electronic signature for the Instructions For Form 706 Rev August 2008 Internal Revenue Irs on Android devices

People also ask

-

What are the 706 form instructions?

The 706 form instructions provide detailed guidance on how to complete the Federal Estate Tax Return. They outline the necessary information required for reporting a decedent's estate and calculating estate taxes. Understanding these instructions is essential for accurate tax filing.

-

How can airSlate SignNow assist with filling out the 706 form?

airSlate SignNow offers a user-friendly platform that simplifies the process of completing the 706 form. With our eSignature capabilities, users can fill out and sign documents electronically, ensuring a smooth and efficient experience. Leveraging our tool means you'll follow the 706 form instructions with greater ease.

-

Are there any costs associated with using airSlate SignNow for 706 forms?

Yes, airSlate SignNow offers various pricing plans tailored to suit different business needs. While using the service to complete 706 form instructions comes with a cost, many users find it affordable, given the convenience and efficiency it provides. Please check our pricing page for detailed options.

-

Is airSlate SignNow compliant with legal standards for 706 forms?

Absolutely! airSlate SignNow is designed to comply with all applicable legal standards for document signing, including the guidelines for 706 forms. This ensures that your completed forms follow the 706 form instructions and are legally binding.

-

Can I integrate airSlate SignNow with other software for better efficiency while completing 706 forms?

Yes, airSlate SignNow seamlessly integrates with various software applications, enhancing your document workflows. This includes integration with accounting and tax software, which can streamline the process of following 706 form instructions. Check our integrations page for more details.

-

What features does airSlate SignNow offer for managing 706 form documents?

airSlate SignNow offers features like document templates, reminders, and audit trails, making it an effective tool for managing 706 form documents. These features help ensure you adhere to the 706 form instructions accurately and timely. Enjoy a straightforward approach to document management with our platform.

-

Can I access the 706 form instructions through airSlate SignNow's platform?

Yes, while airSlate SignNow does not provide official IRS documents, our platform allows you to upload and share the 706 form and its instructions for collaborative editing. This ensures all stakeholders can access and understand the 706 form instructions during the completion process.

Get more for Instructions For Form 706 Rev August Internal Revenue Irs

- Badgercare plus application packet f 10182 wisconsin dhs wisconsin form

- Power of attorney for health care document form

- Arkansas child support form

- Department of health services division of enterprise services f 82064 022014 state of wisconsin chapters 48 dhs wisconsin form

- Towtruck driver application palm beach county form

- Tax year ending computation of penalty due based on efile form

- Httpswwwftbcagovformsmisc100xpdf monthly 100 httpswwwftb

- Transient occupancy tax return county of santa barbara form

Find out other Instructions For Form 706 Rev August Internal Revenue Irs

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word