Tax Questionnaire Kpmg 2011-2026

What is the Tax Questionnaire KPMG

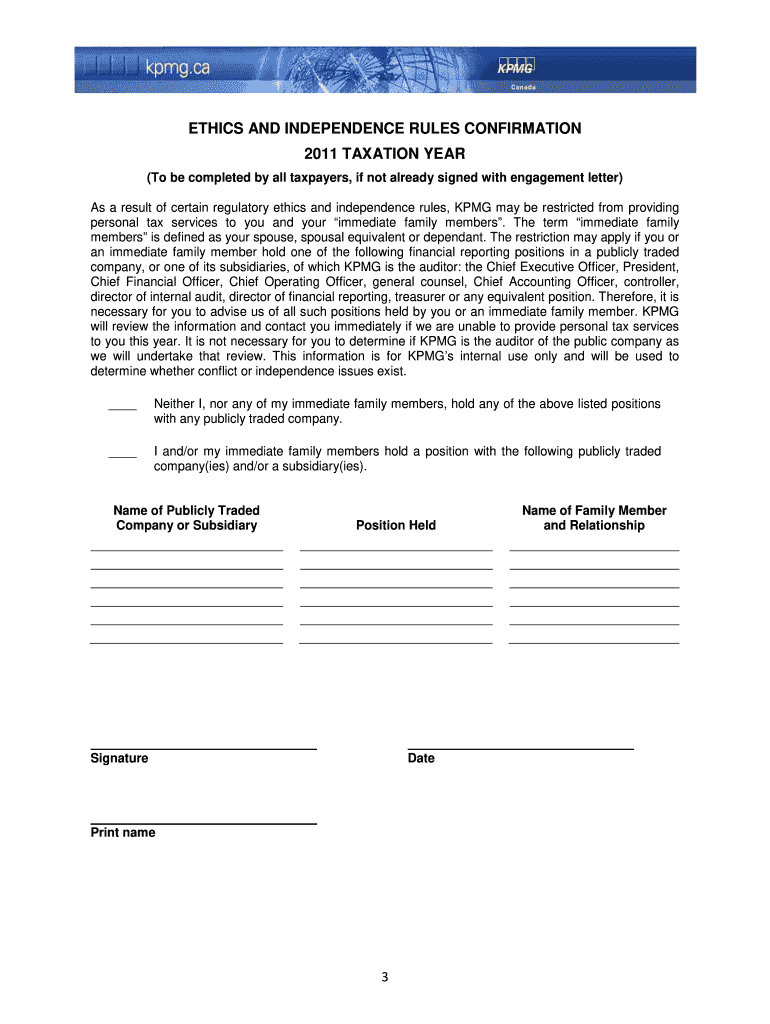

The Tax Questionnaire KPMG is a structured document designed to gather essential information from individuals and businesses for tax preparation and compliance purposes. This form helps KPMG assess the tax situation of clients, ensuring that all relevant details are captured accurately. It typically includes sections on income, deductions, credits, and other financial information that may impact tax liability. By providing a clear and comprehensive overview of a taxpayer's financial status, the Tax Questionnaire KPMG facilitates a smoother tax filing process and helps ensure compliance with IRS regulations.

Steps to Complete the Tax Questionnaire KPMG

Completing the Tax Questionnaire KPMG involves several key steps to ensure accuracy and completeness. Begin by gathering all necessary financial documents, including income statements, previous tax returns, and any relevant receipts. Next, carefully fill out each section of the questionnaire, providing detailed information as required. It's crucial to double-check your entries for any errors or omissions. Once completed, review the form with a tax professional if possible, to confirm that all information is correct. Finally, submit the questionnaire to KPMG through the preferred method, whether online or via mail.

Legal Use of the Tax Questionnaire KPMG

The Tax Questionnaire KPMG is legally binding when completed accurately and submitted according to IRS guidelines. To ensure its validity, it is important to comply with all relevant tax laws and regulations. This includes providing truthful and complete information, as any discrepancies could lead to penalties or audits. Additionally, using a secure platform for submission, such as a trusted electronic signature service, can enhance the legal standing of the document. Compliance with eSignature laws, such as the ESIGN Act and UETA, is essential for electronic submissions.

Required Documents for the Tax Questionnaire KPMG

To complete the Tax Questionnaire KPMG effectively, certain documents are required. These typically include:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Records of any other income sources

- Receipts for deductible expenses

- Previous year’s tax return

- Information on dependents and their Social Security numbers

Having these documents on hand will streamline the completion process and help ensure that all necessary information is accurately reported.

Form Submission Methods for the Tax Questionnaire KPMG

The Tax Questionnaire KPMG can be submitted through various methods, providing flexibility for users. Common submission options include:

- Online submission via a secure portal

- Mailing a physical copy to the designated KPMG office

- In-person delivery at a local KPMG office

Each method has its own advantages, such as immediate processing for online submissions or the ability to discuss details in person when submitting in person.

IRS Guidelines for Completing the Tax Questionnaire KPMG

When filling out the Tax Questionnaire KPMG, it is essential to adhere to IRS guidelines to ensure compliance. This includes understanding the specific tax laws that apply to your situation, such as income thresholds, deductions, and credits. The IRS provides resources and publications that outline these guidelines, which can assist in accurately completing the questionnaire. Additionally, staying informed about any changes to tax laws each year can help ensure that all information provided is up to date and compliant with current regulations.

Quick guide on how to complete tax questionnaire kpmg

Complete Tax Questionnaire Kpmg effortlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute to traditional printed and signed papers, as you can access the appropriate format and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly and without delays. Manage Tax Questionnaire Kpmg on any device using airSlate SignNow apps for Android or iOS and simplify any document-centric task today.

How to modify and eSign Tax Questionnaire Kpmg with ease

- Obtain Tax Questionnaire Kpmg and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Choose how you wish to send your form: via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choice. Adjust and eSign Tax Questionnaire Kpmg to guarantee exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax questionnaire kpmg

How to generate an eSignature for your PDF online

How to generate an eSignature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The best way to make an eSignature straight from your smartphone

The best way to create an electronic signature for a PDF on iOS

The best way to make an eSignature for a PDF document on Android

People also ask

-

What is the tax questionnaire KPMG and how can airSlate SignNow help?

The tax questionnaire KPMG is a structured document used to gather essential information regarding tax obligations and preferences from clients. airSlate SignNow facilitates this process by allowing businesses to send, eSign, and manage these questionnaires in a streamlined manner, ensuring efficiency and accuracy.

-

Is there a cost associated with using the tax questionnaire KPMG in airSlate SignNow?

Yes, utilizing the tax questionnaire KPMG within airSlate SignNow involves specific pricing based on your subscription plan. The cost-effective nature of our plans ensures you get maximum value while managing your tax documentation and eSigning needs.

-

What features does airSlate SignNow offer for managing the tax questionnaire KPMG?

airSlate SignNow provides a variety of features for effectively managing the tax questionnaire KPMG, including customizable templates, real-time collaboration, and secure document storage. These features ensure that your tax documents are not only organized but also easily accessible.

-

How can I integrate the tax questionnaire KPMG with my existing tools?

Integrating the tax questionnaire KPMG with airSlate SignNow is seamless, thanks to our wide range of integrations with popular productivity tools like Google Workspace and Microsoft Office. This allows you to streamline your workflow and ensure that all your tax documentation is efficiently managed.

-

What are the benefits of using airSlate SignNow for the tax questionnaire KPMG?

Using airSlate SignNow for the tax questionnaire KPMG can greatly enhance the efficiency of your document management. Benefits include reduced processing times, improved accuracy through eSigning, and an easy-to-use interface that simplifies the tax questionnaire process for users.

-

Can I track the status of the tax questionnaire KPMG sent through airSlate SignNow?

Absolutely! airSlate SignNow allows you to track the status of the tax questionnaire KPMG you send out. You'll receive notifications once the document is opened, signed, or completed, providing you full visibility and control over your tax documentation process.

-

Is airSlate SignNow secure for handling the tax questionnaire KPMG?

Yes, airSlate SignNow prioritizes security, ensuring that the tax questionnaire KPMG and all related documents are protected with advanced encryption and compliance protocols. This helps maintain the confidentiality of sensitive tax information.

Get more for Tax Questionnaire Kpmg

- 2016 nj application for examination or license in diagnostic radiography limited radiography or radiation therapy form

- 2018 pa provider orders for life sustaining treatment polst form

- 2018 va lhd vaccine inventory report form

- 2019 wa durable power of attorney for health care form

- 2020 wi dcf f dwsp2019 form

- 2017 uk flrm guidance notes form

- 2018 za z300 form

- 2020 sba 2483 form

Find out other Tax Questionnaire Kpmg

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe