Form 27q Online 2003-2026

What is the Form 27q Online

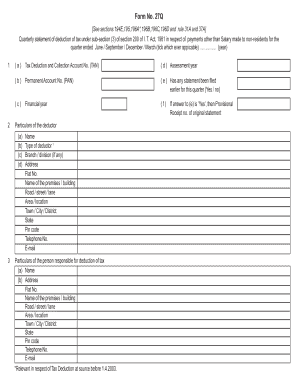

The Form 27q is a tax document used in the United States for reporting tax deductions at source (TDS) on payments made to non-residents. This form is essential for businesses and individuals who make payments to foreign entities or individuals. It serves to ensure compliance with U.S. tax laws and helps in the accurate reporting of tax withheld. By utilizing the Form 27q online, users can streamline the process of filing and managing their tax obligations efficiently.

How to use the Form 27q Online

Using the Form 27q online involves a straightforward process. First, access the digital version of the form through a reliable eSignature platform. Fill in the required fields with accurate information regarding the payment made and the recipient's details. Once completed, review the form for any errors. After ensuring all information is correct, sign the document electronically. This not only expedites the filing process but also ensures that the form is securely stored and easily retrievable for future reference.

Steps to complete the Form 27q Online

Completing the Form 27q online requires several key steps:

- Access the online form through an eSignature platform.

- Enter the details of the payment made, including the amount and the recipient's information.

- Provide the necessary tax identification numbers for both the payer and the payee.

- Review all entered information for accuracy.

- Sign the form electronically to validate it.

- Submit the completed form as per the guidelines provided by the platform.

Legal use of the Form 27q Online

The legal use of the Form 27q online is governed by various regulations that ensure electronic signatures and submissions are valid. To be legally binding, the form must comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). These laws establish that electronic signatures carry the same weight as handwritten ones, provided specific criteria are met. Utilizing a platform that adheres to these regulations enhances the legal standing of the Form 27q when filed online.

Key elements of the Form 27q Online

Key elements of the Form 27q include:

- Payer Information: Details of the entity making the payment, including name and tax identification number.

- Payee Information: Information about the recipient, including their name and tax identification number.

- Payment Details: The amount paid and the nature of the payment.

- Tax Withheld: The amount of tax deducted at source.

- Signature: An electronic signature from the payer to validate the form.

Filing Deadlines / Important Dates

Filing deadlines for the Form 27q are crucial to ensure compliance with tax regulations. Typically, the form must be filed by the 15th of the month following the end of the quarter in which the payment was made. It is essential to keep track of these dates to avoid penalties. For example, if a payment was made in January, the Form 27q should be filed by February 15. Staying informed about these deadlines helps maintain good standing with tax authorities.

Quick guide on how to complete form 27q online

Complete Form 27q Online effortlessly on any device

Online document management has gained traction with organizations and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed paperwork, as you can locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources you require to create, modify, and electronically sign your documents swiftly without delays. Manage Form 27q Online on any device using airSlate SignNow's Android or iOS applications and streamline any document-oriented process today.

How to edit and electronically sign Form 27q Online without breaking a sweat

- Locate Form 27q Online and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Verify the information and click on the Done button to preserve your changes.

- Select how you would like to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign Form 27q Online and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 27q online

The way to generate an eSignature for your PDF document online

The way to generate an eSignature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The way to generate an electronic signature right from your smart phone

The way to create an electronic signature for a PDF document on iOS

The way to generate an electronic signature for a PDF on Android OS

People also ask

-

What is Form 27Q TDS and why is it important?

Form 27Q TDS is a tax deduction form used by companies for non-resident payments. It serves as proof of TDS deduction and is important for compliance with tax regulations. Understanding how to manage Form 27Q TDS correctly can help businesses avoid penalties and ensure transparency in their financial dealings.

-

How can airSlate SignNow help with Form 27Q TDS management?

airSlate SignNow provides an easy-to-use platform for signing and managing Form 27Q TDS electronically. With its streamlined workflow, businesses can easily prepare, send, and store these essential documents securely. This not only saves time but also enhances accuracy in tax documentation.

-

What are the costs associated with using airSlate SignNow for Form 27Q TDS?

airSlate SignNow offers cost-effective pricing plans that cater to businesses of all sizes. The subscription includes features for eSigning and document management, which can help reduce printing and mailing costs associated with Form 27Q TDS. You can choose a plan based on your specific needs and budget.

-

Can I integrate airSlate SignNow with my existing accounting software for Form 27Q TDS?

Yes, airSlate SignNow offers integrations with a variety of accounting and financial software. This allows for seamless management of Form 27Q TDS alongside your usual financial processes, ensuring all documents are easily accessible and correctly filed. Integration simplifies workflows and enhances data accuracy.

-

What features does airSlate SignNow offer for handling Form 27Q TDS?

airSlate SignNow includes features such as customizable templates, bulk sending options, and secure eSigning for Form 27Q TDS. These tools enhance productivity and accuracy when creating and sharing tax documents. The platform also tracks document status, ensuring you're always informed.

-

Is airSlate SignNow secure for processing Form 27Q TDS?

Yes, airSlate SignNow prioritizes security with encryption protocols and advanced authentication processes. This ensures that your Form 27Q TDS and other sensitive documents are protected against unauthorized access. You can confidently manage your tax documentation with peace of mind.

-

Are there any mobile options available for managing Form 27Q TDS with airSlate SignNow?

Absolutely! airSlate SignNow offers a mobile app that allows you to manage and sign Form 27Q TDS on the go. This flexibility enables you to respond to signing requests and manage documents anytime, anywhere, making the filing process more convenient and efficient.

Get more for Form 27q Online

- Evaluator name and address form

- On behalf of a minor form

- Umid sss form

- New protocols allow for mri in selected patients with form

- Magnetic resonance imaging standard language for form

- Scott and white appeal form

- Dermaplaning consent form

- General liability insurance application for alarm rli corp form

Find out other Form 27q Online

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment

- eSign Georgia Lease Amendment Free

- eSign Arizona Notice of Intent to Vacate Easy

- eSign Louisiana Notice of Rent Increase Mobile

- eSign Washington Notice of Rent Increase Computer

- How To eSign Florida Notice to Quit

- How To eSign Hawaii Notice to Quit

- eSign Montana Pet Addendum to Lease Agreement Online

- How To eSign Florida Tenant Removal

- How To eSign Hawaii Tenant Removal

- eSign Hawaii Tenant Removal Simple

- eSign Arkansas Vacation Rental Short Term Lease Agreement Easy

- Can I eSign North Carolina Vacation Rental Short Term Lease Agreement

- eSign Michigan Escrow Agreement Now

- eSign Hawaii Sales Receipt Template Online

- eSign Utah Sales Receipt Template Free

- eSign Alabama Sales Invoice Template Online

- eSign Vermont Escrow Agreement Easy