Index Business Entities Online S C Secretary of SC Gov 2016-2026

Understanding SC Tax Exempt Status

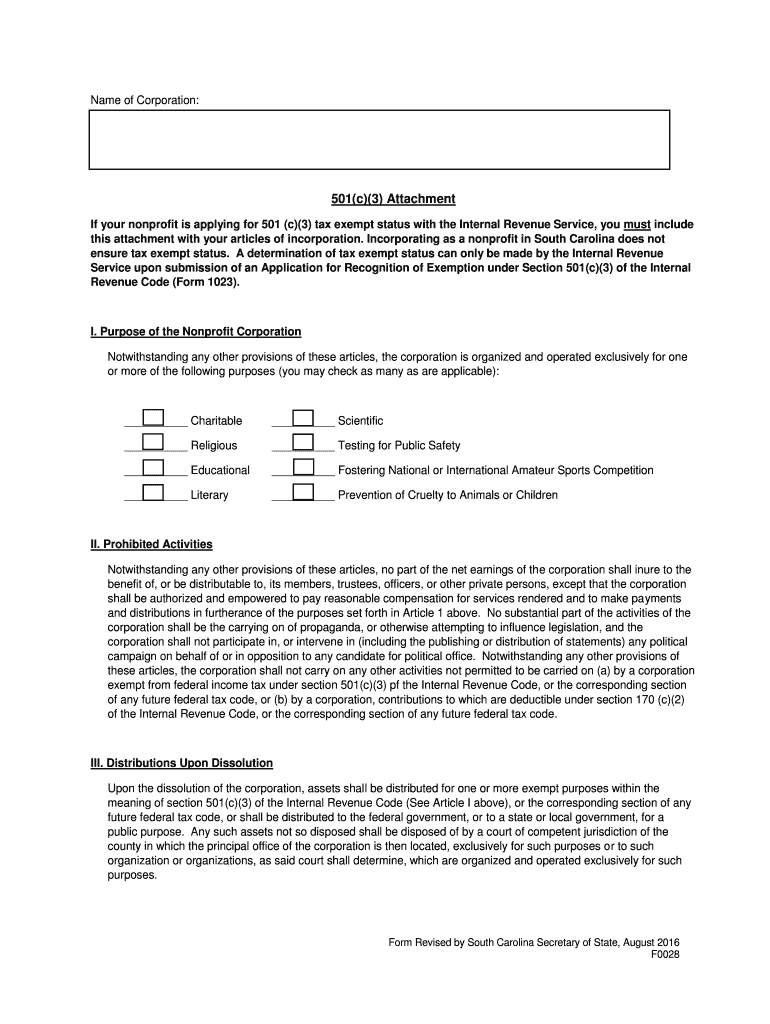

SC tax exempt status refers to the designation granted to certain organizations in South Carolina that meet specific criteria under state and federal laws. This status allows qualifying entities, such as nonprofit organizations, to be exempt from state income taxes. To achieve this status, organizations must typically apply for and receive recognition from the Internal Revenue Service (IRS) as a 501(c)(3) or similar designation, which confirms their eligibility for tax exemption. Understanding the implications of this status is essential for compliance and operational efficiency.

Eligibility Criteria for SC Tax Exempt Status

To qualify for SC tax exempt status, organizations must meet several eligibility criteria. These include:

- Being organized and operated exclusively for charitable, religious, educational, or scientific purposes.

- Ensuring that no part of the organization's net earnings benefits any private shareholder or individual.

- Meeting specific operational tests, which may include limitations on political activities and lobbying efforts.

Organizations should carefully review these criteria to determine their eligibility before applying for tax exempt status.

Required Documents for Application

When applying for SC tax exempt status, organizations must prepare and submit several key documents. These typically include:

- Form 1023 or Form 1023-EZ, which is the application for recognition of exemption under Section 501(c)(3) of the Internal Revenue Code.

- Organizational documents, such as articles of incorporation and bylaws, that outline the structure and purpose of the organization.

- Financial statements or budgets that demonstrate the organization's financial viability and planned expenditures.

Proper documentation is crucial for a successful application and to avoid delays in processing.

Application Process for SC Tax Exempt Status

The application process for obtaining SC tax exempt status involves several steps:

- Determine eligibility based on the criteria outlined by the IRS and South Carolina state law.

- Gather all required documents, ensuring they are complete and accurate.

- Complete the appropriate IRS form (Form 1023 or Form 1023-EZ) and any necessary state forms.

- Submit the application along with the required fee to the IRS and any applicable state agencies.

- Await confirmation of approval, which may take several months, depending on the complexity of the application.

Following these steps can help streamline the application process and improve the chances of receiving tax exempt status.

Penalties for Non-Compliance

Organizations that fail to comply with the requirements associated with SC tax exempt status may face significant penalties. These can include:

- Loss of tax exempt status, requiring the organization to pay back taxes.

- Fines and penalties for failure to file required annual returns or reports.

- Legal consequences, including potential lawsuits or investigations by state or federal authorities.

Maintaining compliance with all regulations is essential to safeguard the organization's tax exempt status and avoid these penalties.

Quick guide on how to complete index business entities online sc secretary of scgov

Complete Index Business Entities Online S C Secretary Of SC gov effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed papers, allowing you to obtain the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Handle Index Business Entities Online S C Secretary Of SC gov on any device with airSlate SignNow Android or iOS applications and enhance any document-centered workflow today.

How to edit and eSign Index Business Entities Online S C Secretary Of SC gov with ease

- Find Index Business Entities Online S C Secretary Of SC gov and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with features that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Index Business Entities Online S C Secretary Of SC gov and ensure excellent communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the index business entities online sc secretary of scgov

The way to generate an eSignature for a PDF in the online mode

The way to generate an eSignature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

The best way to generate an eSignature right from your smart phone

The way to create an eSignature for a PDF on iOS devices

The best way to generate an eSignature for a PDF on Android OS

People also ask

-

What is SC tax exempt status?

SC tax exempt status refers to the designation that allows certain organizations to be exempt from paying sales tax in South Carolina. This status is generally granted to non-profit organizations, government entities, and other eligible groups. Understanding how to obtain SC tax exempt status is crucial for organizations looking to maximize their funding and resources.

-

How can airSlate SignNow help with obtaining SC tax exempt status?

airSlate SignNow streamlines the documentation process for organizations applying for SC tax exempt status. With our eSignature solutions, you can easily prepare, send, and manage the necessary documents without the hassle of manual paperwork. This efficiency can signNowly reduce the time it takes to achieve SC tax exempt status.

-

Is airSlate SignNow affordable for non-profit organizations seeking SC tax exempt status?

Yes, airSlate SignNow offers competitive pricing specifically designed to accommodate the budget constraints of non-profit organizations. Our cost-effective solution ensures that organizations seeking SC tax exempt status can access powerful eSigning tools without overspending. We are committed to supporting non-profits in achieving their goals.

-

What features does airSlate SignNow offer that assist with SC tax exempt status applications?

airSlate SignNow provides features such as custom templates, real-time tracking, and secure storage to support SC tax exempt status applications. These tools enhance collaboration and ensure that all required documents are completed accurately and efficiently. Our platform is designed to simplify the signing process, making it easier for organizations.

-

Can I integrate airSlate SignNow with other tools for managing SC tax exempt status?

Absolutely! airSlate SignNow offers integrations with various applications that help manage documents related to SC tax exempt status. By connecting our platform with accounting software or CRM systems, organizations can maintain an organized workflow and keep track of their tax-exempt documents seamlessly.

-

How does airSlate SignNow ensure the security of documents related to SC tax exempt status?

AirSlate SignNow prioritizes the security of your documents, including those related to SC tax exempt status. Our platform employs industry-leading encryption protocols and complies with legal and regulatory standards to protect sensitive information. You can trust airSlate SignNow to securely manage your important documents.

-

What are the benefits of using airSlate SignNow for SC tax exempt status documents?

Using airSlate SignNow for SC tax exempt status documents provides several benefits including reduced turnaround time for approvals, enhanced collaboration among teams, and improved document accuracy. Our user-friendly platform simplifies the signing process, allowing organizations to focus on their mission rather than paperwork.

Get more for Index Business Entities Online S C Secretary Of SC gov

- 2021 ig260 nonadmitted insurance premium tax return for surplus lines brokers form

- Instructions for completing the 511 nr income tax form

- Minnesota revenue m1w auradesignerwear form

- Get the free 1040 mn filing form m99 credit for military

- Wwwrevenuestatemnusamending property tax refundamending a property tax refundminnesota department of revenue form

- Instructions for completing the form 511 oklahoma resident income tax return

- Wwwrevenuestatemnuscorporation franchise taxcorporation franchise taxminnesota department of revenue form

- Wwwrevenuestatemnus2020 06m1nr192019 m1nr nonresidentspart year residents form

Find out other Index Business Entities Online S C Secretary Of SC gov

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now

- eSignature Missouri Hold Harmless (Indemnity) Agreement Later

- eSignature Ohio Hold Harmless (Indemnity) Agreement Mobile

- eSignature California Letter of Intent Free

- Can I eSign Louisiana General Power of Attorney Template

- eSign Mississippi General Power of Attorney Template Free

- How Can I eSignature New Mexico Letter of Intent

- Can I eSign Colorado Startup Business Plan Template

- eSign Massachusetts Startup Business Plan Template Online

- eSign New Hampshire Startup Business Plan Template Online

- How To eSign New Jersey Startup Business Plan Template

- eSign New York Startup Business Plan Template Online

- eSign Colorado Income Statement Quarterly Mobile

- eSignature Nebraska Photo Licensing Agreement Online

- How To eSign Arizona Profit and Loss Statement

- How To eSign Hawaii Profit and Loss Statement

- How To eSign Illinois Profit and Loss Statement

- How To eSign New York Profit and Loss Statement

- How To eSign Ohio Profit and Loss Statement