Example of Mortgage Payoff Letter from Lender Form

Understanding the Mortgage Payoff Letter from Lender

A mortgage payoff letter from a lender serves as an official document confirming the total amount required to pay off a mortgage loan. This letter is crucial for homeowners who wish to settle their mortgage obligations. It outlines the remaining balance, including any interest accrued up to the payoff date. The lender typically issues this letter upon request, ensuring that the borrower has a clear understanding of their financial obligations.

How to Obtain a Mortgage Payoff Letter

To obtain a mortgage payoff letter, borrowers should contact their lender directly. This process usually involves:

- Calling the customer service number or visiting the lender's website.

- Providing necessary account information, such as the loan number and personal identification.

- Requesting the payoff letter, specifying the desired payoff date to ensure accurate calculations.

Some lenders may require a written request or may have a dedicated online form for this purpose.

Key Elements of a Mortgage Payoff Letter

A comprehensive mortgage payoff letter includes several essential components:

- Loan Information: Details about the loan, including the loan number and property address.

- Payoff Amount: The total amount needed to pay off the loan, including principal and interest.

- Payoff Date: The date through which the payoff amount is calculated.

- Contact Information: Details for reaching the lender for further inquiries.

These elements ensure clarity and help prevent any misunderstandings during the payoff process.

Steps to Complete a Mortgage Payoff Letter

Completing a mortgage payoff letter involves several straightforward steps:

- Gather your loan details, including the loan number and property address.

- Contact your lender to request the payoff letter.

- Review the letter for accuracy, ensuring all information is correct.

- Make the payment as specified in the letter, ensuring it is completed by the payoff date.

- Keep a copy of the payoff letter and payment confirmation for your records.

Following these steps helps ensure a smooth and successful payoff process.

Legal Use of a Mortgage Payoff Letter

The mortgage payoff letter is a legally binding document that confirms the amount needed to settle the loan. It is important for borrowers to understand that this letter serves as proof of the lender's acknowledgment of the loan balance. When submitted with the final payment, it can protect the borrower from future claims regarding the loan. Compliance with state laws regarding mortgage payoffs is also essential, as these can vary significantly.

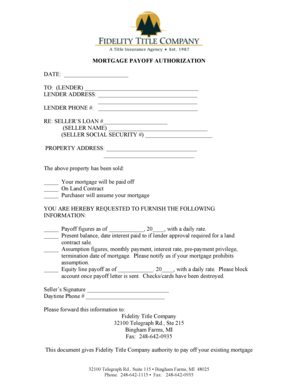

Examples of Mortgage Payoff Letters

Examples of mortgage payoff letters can provide valuable context for borrowers. A typical mortgage payoff letter sample includes:

- The lender's logo and contact information at the top.

- The borrower's name and address.

- A clear statement of the payoff amount and date.

- Instructions for making the payment.

These examples can help borrowers understand what to expect when they request their own payoff letter.

Quick guide on how to complete example of mortgage payoff letter from lender

Complete Example Of Mortgage Payoff Letter From Lender effortlessly on any device

Online document management has become widely accepted by organizations and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed papers, enabling you to access the proper format and securely store it online. airSlate SignNow equips you with all the resources you require to create, modify, and eSign your documents quickly without holdups. Manage Example Of Mortgage Payoff Letter From Lender on any device with airSlate SignNow Android or iOS applications and enhance any document-based process today.

The simplest way to modify and eSign Example Of Mortgage Payoff Letter From Lender with ease

- Obtain Example Of Mortgage Payoff Letter From Lender and click Get Form to start.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tiresome form searches, or mistakes that necessitate printing new document copies. airSlate SignNow manages all your document administration needs in just a few clicks from any device you choose. Edit and eSign Example Of Mortgage Payoff Letter From Lender to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the example of mortgage payoff letter from lender

How to create an eSignature for a PDF document in the online mode

How to create an eSignature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

The way to create an electronic signature straight from your mobile device

How to generate an eSignature for a PDF document on iOS devices

The way to create an electronic signature for a PDF document on Android devices

People also ask

-

What is a payoff letter template?

A payoff letter template is a predefined document that outlines the total amount needed to pay off a loan. It simplifies the process of obtaining a payoff statement from a lender, providing clarity and transparency during financial transactions.

-

How can I use airSlate SignNow to create a payoff letter template?

With airSlate SignNow, you can easily create a payoff letter template by customizing existing document templates or starting from scratch. Our user-friendly interface allows you to add fields, text, and other elements relevant to your needs, ensuring a professional and accurate payoff letter.

-

Is there a cost associated with using the payoff letter template feature?

Using the payoff letter template feature is part of the comprehensive pricing plans offered by airSlate SignNow. We provide various subscription options that cater to different business needs, ensuring that you have access to this feature at an affordable price.

-

What are the benefits of using a payoff letter template?

The main benefits of using a payoff letter template include saving time, minimizing errors, and ensuring compliance with legal standards. By having a standardized format, you can streamline the payoff process and enhance the overall efficiency of your financial transactions.

-

Can I integrate airSlate SignNow with other applications to manage payoff letter templates?

Yes, airSlate SignNow offers integration capabilities with various applications, enabling you to manage your payoff letter templates seamlessly. Whether it's CRM systems or accounting software, our platform helps streamline your workflow efficiently.

-

Is it easy to edit and customize a payoff letter template in airSlate SignNow?

Absolutely! Editing and customizing a payoff letter template in airSlate SignNow is straightforward. The platform provides drag-and-drop functionality, allowing users to modify text, add fields, and make changes effortlessly, even without technical skills.

-

How does airSlate SignNow ensure the security of my payoff letter template?

At airSlate SignNow, security is a top priority. Our platform uses advanced encryption and compliance methods to protect your data and documents, including payoff letter templates, ensuring that all your information remains confidential and secure.

Get more for Example Of Mortgage Payoff Letter From Lender

Find out other Example Of Mortgage Payoff Letter From Lender

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer

- eSignature Wyoming LLC Operating Agreement Later

- eSignature Wyoming LLC Operating Agreement Free