Cp575 Internal Revenue Form 2007-2026

What is the CP575 Internal Revenue Form

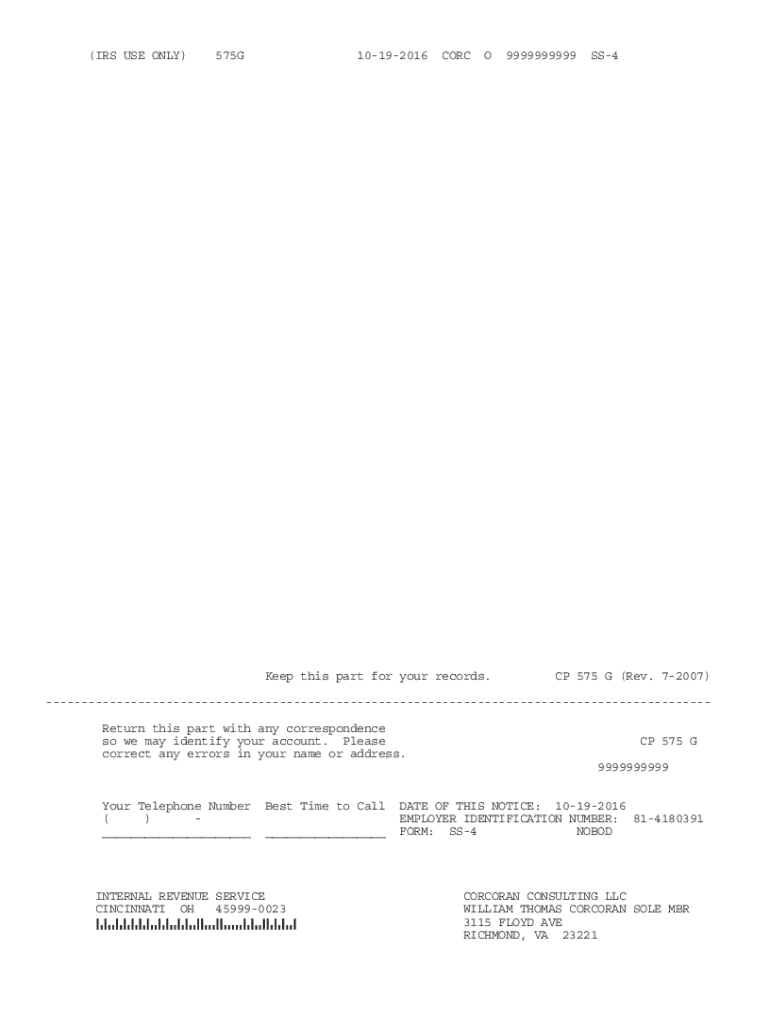

The CP575 is an official notice from the Internal Revenue Service (IRS) that serves as a confirmation of your Employer Identification Number (EIN). This form is crucial for businesses and entities that need to report taxes, hire employees, or open a business bank account. The CP575 notifies the recipient that their EIN has been successfully assigned and includes important details such as the EIN itself and the date it was issued.

How to Obtain the CP575 Internal Revenue Form

To obtain the CP575, you typically receive it automatically from the IRS once your EIN application is processed. If you do not receive this notice, you can request a copy by contacting the IRS directly. It is essential to have your EIN application details ready when making this request to ensure a smooth process.

Steps to Complete the CP575 Internal Revenue Form

Completing the CP575 form involves several straightforward steps:

- Review the information on the notice to ensure accuracy, including the EIN and business name.

- If any information is incorrect, contact the IRS immediately to rectify the errors.

- Keep the CP575 in a secure location, as it may be required for various business activities.

Legal Use of the CP575 Internal Revenue Form

The CP575 serves as a legally binding document that confirms your EIN. This number is essential for tax reporting and compliance with federal regulations. Businesses must use the EIN for various tax-related purposes, including filing tax returns and reporting employee wages. The CP575 helps establish your business's legitimacy in the eyes of the IRS and other governmental agencies.

Key Elements of the CP575 Internal Revenue Form

The CP575 contains several key elements that are vital for businesses:

- Employer Identification Number (EIN): The unique nine-digit number assigned to your business.

- Business Name: The official name of your business as registered with the IRS.

- Issue Date: The date when the EIN was assigned, which is important for tax filing timelines.

Form Submission Methods (Online / Mail / In-Person)

The CP575 itself does not require submission, as it is a notice rather than a form to be filed. However, if you need to make changes or updates related to your EIN, you may need to submit specific forms to the IRS. These can typically be submitted online through the IRS website, by mail, or in person at designated IRS offices, depending on the nature of the request.

Quick guide on how to complete cp575 internal revenue form

Effortlessly prepare Cp575 Internal Revenue Form on any device

Online document management has become increasingly favored by businesses and individuals alike. It offers an ideal sustainable alternative to traditional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents swiftly without delays. Handle Cp575 Internal Revenue Form on any device with airSlate SignNow's Android or iOS applications and enhance any document-oriented workflow today.

The easiest method to edit and eSign Cp575 Internal Revenue Form effortlessly

- Find Cp575 Internal Revenue Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to confirm your modifications.

- Select your preferred method for submitting your form, either via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new copies. airSlate SignNow fulfills all your document management requirements with just a few clicks from any device you choose. Modify and eSign Cp575 Internal Revenue Form to ensure excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cp575 internal revenue form

The way to make an electronic signature for your PDF document online

The way to make an electronic signature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

How to make an eSignature from your smart phone

The way to generate an electronic signature for a PDF document on iOS

How to make an eSignature for a PDF file on Android OS

People also ask

-

What is the IRS Form CP575, and why is it important?

The IRS Form CP575 is a notice from the IRS that confirms your Employer Identification Number (EIN) has been assigned. This form is essential for businesses as it helps validate your tax-related information and ensures compliance with IRS regulations.

-

How can airSlate SignNow assist with IRS Form CP575?

airSlate SignNow streamlines the signing and submission process for the IRS Form CP575. With its easy-to-use interface, you can eSign necessary documents and keep them organized for quick reference and submission, enhancing your compliance efforts.

-

Are there any integration options with airSlate SignNow for managing IRS Form CP575?

Yes, airSlate SignNow offers robust integration options with various business applications. This allows you to seamlessly manage IRS Form CP575 within your existing workflows, helping to automate documentation processes and improve efficiency.

-

What are the pricing options for using airSlate SignNow for IRS forms?

airSlate SignNow provides flexible pricing plans that cater to different business needs. The plans are designed to be cost-effective while ensuring you have all necessary features to efficiently manage IRS Form CP575 and other documentation.

-

Can I store IRS Form CP575 and other important documents securely with airSlate SignNow?

Absolutely! airSlate SignNow prioritizes document security, providing users with a safe environment to store IRS Form CP575 and other important documents. With advanced encryption and secure cloud storage, your documentation remains protected and easily accessible.

-

What other features does airSlate SignNow offer that can help with IRS compliance?

In addition to eSigning, airSlate SignNow provides features like document templates, automated reminders, and tracking capabilities. These tools help ensure that forms like IRS Form CP575 are completed on time, promoting better compliance and organization.

-

Is there customer support available for questions related to IRS Form CP575?

Yes, airSlate SignNow offers comprehensive customer support for all users. Whether you have questions about the IRS Form CP575 or need assistance with the platform, our team is ready to help you navigate your queries effectively.

Get more for Cp575 Internal Revenue Form

Find out other Cp575 Internal Revenue Form

- How Can I Sign South Carolina Courts Document

- How Do I eSign New Jersey Business Operations Word

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation

- How Do I eSign Hawaii Charity Presentation

- How Can I eSign Illinois Charity Word

- How To eSign Virginia Business Operations Presentation

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document