872 T 2003-2026

What is the 872 T

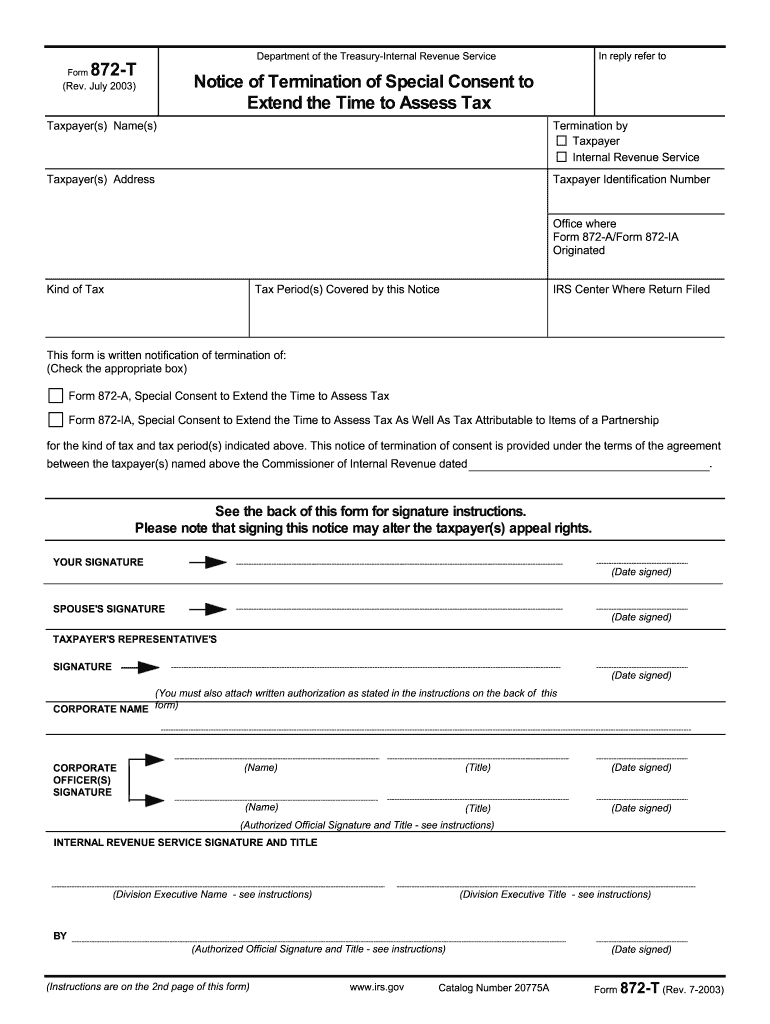

The 872 T is a specific form used by the Internal Revenue Service (IRS) in the United States. This form is primarily utilized for the purpose of extending the statute of limitations for the assessment of tax liabilities. By filing the 872 T, taxpayers agree to extend the time frame within which the IRS can assess additional taxes. This form is significant for individuals and businesses who may have complex tax situations that require additional time for review.

How to use the 872 T

To effectively use the 872 T, taxpayers must first understand its purpose and implications. This form is typically initiated by the IRS when they require more time to assess a taxpayer's situation. Taxpayers can also request an extension by submitting the form themselves. It is crucial to fill out the form accurately, providing all necessary information, including the taxpayer's identification details and the specific tax period in question. Once completed, the form should be signed and dated before submission to ensure its validity.

Steps to complete the 872 T

Completing the 872 T involves several key steps:

- Obtain a blank copy of the form, which can be accessed through the IRS website or other official channels.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Specify the tax period for which you are requesting an extension.

- Sign and date the form, ensuring that all information is accurate and complete.

- Submit the completed form to the appropriate IRS office, either by mail or electronically if applicable.

Legal use of the 872 T

The legal use of the 872 T is governed by IRS regulations and guidelines. When properly executed, the form serves as a legally binding agreement between the taxpayer and the IRS. It is essential to ensure compliance with all relevant laws and regulations when using this form. Failure to adhere to these legal requirements may result in penalties or complications regarding tax assessments.

Required Documents

When completing the 872 T, certain documents may be required to support your submission. These may include:

- Previous tax returns relevant to the tax period in question.

- Any correspondence from the IRS regarding the assessment.

- Documentation that substantiates your request for an extension, such as financial statements or additional information that may affect your tax situation.

Form Submission Methods

The 872 T can be submitted through various methods, depending on the specific requirements set forth by the IRS. Common submission methods include:

- Mailing the completed form to the designated IRS office.

- Submitting the form electronically, if applicable, through IRS-approved platforms.

- In-person submission at local IRS offices, although this may require an appointment.

Quick guide on how to complete 872 t

Prepare 872 T seamlessly on any gadget

Web-based document management has become increasingly favored by businesses and individuals. It presents an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the correct form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your files swiftly without delays. Handle 872 T on any gadget with airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

The simplest way to alter and electronically sign 872 T effortlessly

- Find 872 T and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Verify all the details and click on the Done button to save your changes.

- Select how you prefer to share your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign 872 T and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 872 t

How to create an electronic signature for a PDF file online

How to create an electronic signature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

The best way to create an eSignature right from your mobile device

How to create an eSignature for a PDF file on iOS

The best way to create an eSignature for a PDF on Android devices

People also ask

-

What is a form 872t fillable, and how can I use it?

The form 872t fillable is a tax-specific document that allows individuals to extend the statute of limitations for the IRS. By utilizing airSlate SignNow, users can easily fill out, sign, and send this form electronically, ensuring a smooth submission process without the hassle of printing or scanning.

-

Is the form 872t fillable available for free?

While airSlate SignNow offers a range of pricing plans, the form 872t fillable can be accessed and processed with a subscription. The platform’s affordable pricing tiers provide excellent value for businesses that require frequent e-signing and document management.

-

What features does airSlate SignNow provide for filling out the form 872t fillable?

airSlate SignNow offers a comprehensive suite of tools for completing the form 872t fillable, including form templates, easy-to-use filling options, and e-signature capabilities. Users can customize fields, add required information, and ensure compliance with tax regulations all in one platform.

-

Can I integrate airSlate SignNow with other software for handling form 872t fillable?

Yes, airSlate SignNow can seamlessly integrate with various applications, including CRM systems and cloud storage services. This capability allows businesses to manage their form 872t fillable and other documents efficiently, streamlining workflows and improving productivity.

-

What are the benefits of using the airSlate SignNow platform for the form 872t fillable?

Using airSlate SignNow for the form 872t fillable offers numerous benefits, such as saving time, reducing paper waste, and enhancing collaboration. The platform’s security features protect sensitive information, while its user-friendly interface ensures that even those unfamiliar with technology can utilize it effectively.

-

Is it easy to share the completed form 872t fillable with others?

Absolutely! With airSlate SignNow, sharing the completed form 872t fillable is straightforward. You can easily send the document via email or share it through secure links, ensuring that all relevant parties receive the signed form promptly.

-

How does airSlate SignNow ensure the security of my form 872t fillable?

airSlate SignNow places a high priority on security, implementing advanced encryption and authentication measures to protect your form 872t fillable. With features like audit trails and secure cloud storage, users can trust that their sensitive information is safeguarded throughout the document lifecycle.

Get more for 872 T

- Procedure securities amp exchange commission of pakistan form

- Bprd 07 form

- Pakistan no objection certificate form

- Semak no akaun rhb bank form

- Pdf pakistans water economy running dry background form

- 7th central street defence housing authority phaseii karachi 75500 form

- National bank pension form

- Enhanced diligence form

Find out other 872 T

- How Can I Sign Georgia Pet Care Agreement

- Can I Sign Kansas Moving Checklist

- How Do I Sign Rhode Island Pet Care Agreement

- How Can I Sign Virginia Moving Checklist

- Sign Illinois Affidavit of Domicile Online

- How Do I Sign Iowa Affidavit of Domicile

- Sign Arkansas Codicil to Will Free

- Sign Colorado Codicil to Will Now

- Can I Sign Texas Affidavit of Domicile

- How Can I Sign Utah Affidavit of Domicile

- How To Sign Massachusetts Codicil to Will

- How To Sign Arkansas Collateral Agreement

- Sign New York Codicil to Will Now

- Sign Oregon Codicil to Will Later

- How Do I Sign Oregon Bank Loan Proposal Template

- Help Me With Sign Oregon Bank Loan Proposal Template

- Sign Michigan Gift Affidavit Mobile

- How To Sign North Carolina Gift Affidavit

- How Do I Sign Oregon Financial Affidavit

- Sign Maine Revocation of Power of Attorney Online