Form 8302 2018-2026

What is the Form 8302

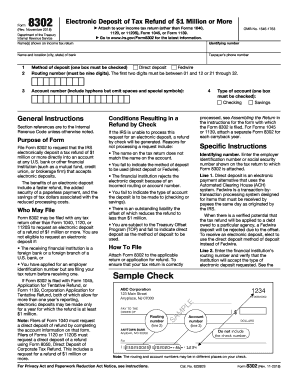

The Form 8302 is a document used by taxpayers in the United States to request a deposit tax refund. This form is specifically designed for individuals or businesses that have overpaid their taxes and are seeking a refund through electronic means. The IRS uses this form to facilitate the electronic deposit of tax refunds directly into the taxpayer's bank account, streamlining the refund process and ensuring quicker access to funds.

How to use the Form 8302

To effectively use the Form 8302, taxpayers must first complete the form accurately. This involves providing personal information, including your name, address, and Social Security number, as well as details about the tax year for which you are requesting a refund. Once completed, the form can be submitted electronically through approved e-filing systems, ensuring that the refund is processed quickly and securely.

Steps to complete the Form 8302

Completing the Form 8302 involves several key steps:

- Gather necessary personal information, including your Social Security number and bank account details.

- Fill out the form with accurate information, ensuring all fields are completed.

- Review the form for any errors or omissions.

- Submit the form electronically through an IRS-approved e-filing service.

By following these steps, you can ensure that your deposit tax refund request is processed efficiently.

Legal use of the Form 8302

The Form 8302 is legally binding when filled out and submitted according to IRS guidelines. It is essential to provide accurate information, as any discrepancies can lead to delays or denial of the refund request. Compliance with the IRS regulations surrounding the use of this form is crucial to ensure that the refund process is valid and legally recognized.

IRS Guidelines

The IRS has established specific guidelines for the use of the Form 8302. Taxpayers must ensure that they meet the eligibility criteria, including the requirement to have overpaid taxes in the relevant tax year. Additionally, the form must be submitted within the designated filing deadlines to avoid penalties or complications. Familiarizing yourself with these guidelines can help streamline the refund process.

Required Documents

When completing the Form 8302, certain documents may be required to support your refund request. These can include:

- Proof of income for the tax year in question.

- Bank statements to verify account details for the electronic deposit.

- Any previous correspondence with the IRS regarding tax payments.

Having these documents ready can facilitate a smoother submission process and help ensure that your request is processed without unnecessary delays.

Quick guide on how to complete form 8302

Effortlessly Prepare Form 8302 on Any Device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to easily access the appropriate forms and securely store them online. airSlate SignNow provides all the necessary tools to create, edit, and eSign your documents quickly and without delays. Manage Form 8302 on any device using airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

How to Edit and eSign Form 8302 with Ease

- Find Form 8302 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information with the tools provided by airSlate SignNow specifically for this purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Review all information and click on the Done button to finalize your changes.

- Select your preferred method of sending the form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and eSign Form 8302 and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8302

How to create an eSignature for a PDF online

How to create an eSignature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

The best way to create an electronic signature from your smartphone

How to generate an eSignature for a PDF on iOS

The best way to create an electronic signature for a PDF file on Android

People also ask

-

How can I refund more payments with airSlate SignNow?

To refund more payments with airSlate SignNow, you can easily manage transaction requests through your dashboard. Our platform allows for streamlined document handling, enabling you to initiate refunds quickly. By using our eSignature integration, you can ensure that all refund requests are documented and authorized efficiently.

-

What features help me refund more efficiently?

airSlate SignNow offers features like instant document templates and automated workflows that help you refund more efficiently. With real-time tracking and notifications, you can manage your refund requests more effectively. Additionally, our platform supports bulk sending, which can expedite the refund process for multiple customers.

-

Is there a cost associated with refunding more transactions?

While there are no direct costs associated with initiating refunds through airSlate SignNow, your subscription plan may affect how many documents you can manage. By opting for a higher tier, you can refund more transactions without hitting limits. Review our pricing plans to find the best fit for your business needs.

-

Can airSlate SignNow integrate with my existing payment systems to refund more?

Yes, airSlate SignNow seamlessly integrates with various payment systems, allowing you to refund more with less hassle. This integration enables you to initiate refunds directly from your payment platform, maintaining a smooth workflow. Simply set up the integration, and you'll be able to manage refunds in one centralized location.

-

What are the benefits of using airSlate SignNow for refunds?

Using airSlate SignNow for refunds provides efficiency, clarity, and documentation for your refund process. The platform allows you to track refund requests and ensures that all communications are securely stored. You'll find that managing customer relationships is easier as you can quickly address issues and refund more without the usual complications.

-

How does airSlate SignNow support document security when processing refunds?

airSlate SignNow prioritizes document security, which is crucial when processing refunds. Our encryption and secure access controls ensure that sensitive information is protected throughout the refund process. This level of security allows you to refund more with confidence, knowing that your customers' data is safe.

-

Can I track the status of my refunds through airSlate SignNow?

Absolutely! airSlate SignNow allows you to track the status of all initiated refunds in real-time. You will receive notifications for every step of the refund process, helping you to manage queries efficiently and ensuring that you can refund more promptly. This transparency contributes to a better customer experience.

Get more for Form 8302

- 2019 anti money laundering form

- Application form for po box pakpost gov

- Sc 3 defense savings certificates nomination form pakpost gov

- Procedure for account opening and updation for non ais form

- Education b17 form

- Pakistan missions abroad form

- Referral forms ampampamp guidelines

- Registrationrenewal forms pakistan engineering council

Find out other Form 8302

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy