Form 8050 Rev November Internal Revenue Service 2016-2026

Understanding the Form 8050

The Form 8050, also known as the IRS Direct Deposit Refund Form, is a crucial document for taxpayers seeking to receive their refunds electronically. This form allows individuals and businesses to provide their bank account information directly to the IRS, facilitating a faster refund process. By opting for direct deposit, taxpayers can avoid the delays associated with paper checks, ensuring their funds are available more quickly.

Steps to Complete the Form 8050

Completing the Form 8050 involves several important steps to ensure accuracy and compliance with IRS requirements:

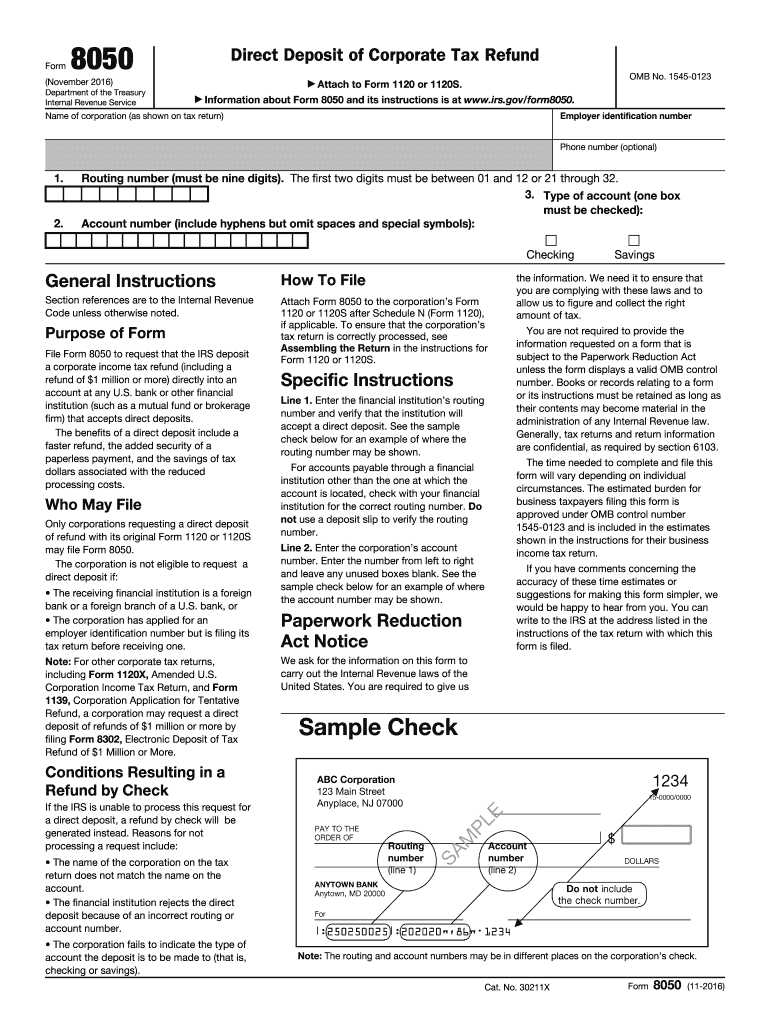

- Gather necessary information, including your Social Security number, bank account number, and routing number.

- Fill out the form accurately, ensuring all provided information matches your bank records.

- Review the completed form for any errors or omissions.

- Sign and date the form to validate your submission.

Following these steps carefully will help prevent delays in processing your refund.

How to Obtain the Form 8050

The Form 8050 can be obtained directly from the IRS website or through tax preparation software that includes IRS forms. It is essential to use the most recent version of the form to ensure compliance with current tax regulations. Additionally, tax professionals can provide the form during consultations, ensuring that you have the correct documentation for your specific situation.

Legal Use of the Form 8050

The Form 8050 is legally binding when filled out and submitted correctly. To ensure its legal standing, taxpayers must adhere to the IRS guidelines regarding electronic signatures and submissions. It is advisable to use a reliable eSignature platform that complies with the ESIGN Act and UETA to enhance the legal validity of your submission.

Filing Deadlines for the Form 8050

Taxpayers should be aware of the filing deadlines associated with the Form 8050. Generally, the form must be submitted along with your tax return by the annual tax deadline, which is typically April 15. However, extensions may apply in certain circumstances, so it is crucial to stay informed about any changes to tax deadlines.

IRS Guidelines for Direct Deposit Refunds

The IRS has specific guidelines for taxpayers wishing to receive their refunds via direct deposit. These guidelines include eligibility criteria, such as having a valid bank account and ensuring that the account is in your name or jointly held with a spouse. Understanding these guidelines can help streamline the refund process and minimize potential issues with your submission.

Quick guide on how to complete form 8050 rev november 2016 internal revenue service

Effortlessly Prepare Form 8050 Rev November Internal Revenue Service on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and electronically sign your documents quickly and without issues. Manage Form 8050 Rev November Internal Revenue Service on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to Edit and Electronically Sign Form 8050 Rev November Internal Revenue Service with Ease

- Find Form 8050 Rev November Internal Revenue Service and click Get Form to commence.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or censor sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Choose how you wish to share your form—via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Edit and electronically sign Form 8050 Rev November Internal Revenue Service while ensuring effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8050 rev november 2016 internal revenue service

How to create an eSignature for a PDF in the online mode

How to create an eSignature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

The best way to create an electronic signature from your smart phone

How to generate an eSignature for a PDF on iOS devices

The best way to create an electronic signature for a PDF file on Android OS

People also ask

-

What is an IRS deposit tax form?

An IRS deposit tax form is a document used to report taxes withheld or due to the IRS. It helps in ensuring compliance with federal tax obligations. Understanding how to properly fill out and submit this form is essential for businesses managing payroll and other tax liabilities.

-

How can airSlate SignNow help with the IRS deposit tax form?

airSlate SignNow streamlines the process of preparing and signing the IRS deposit tax form digitally. With our easy-to-use platform, you can eSign and share documents seamlessly, saving time and reducing paperwork. This efficiency ensures that your tax forms are submitted accurately and on time.

-

Is there a cost associated with using airSlate SignNow for IRS deposit tax forms?

Yes, airSlate SignNow offers various pricing plans that cater to different business sizes and needs. These plans provide access to powerful features, including electronic signatures and document management specifically designed for IRS deposit tax forms. You can choose a plan that fits your budget and operational requirements.

-

What features does airSlate SignNow offer for managing IRS deposit tax forms?

airSlate SignNow provides features such as customizable templates, advanced security measures, and real-time tracking of document status. These features ensure that your IRS deposit tax forms are handled efficiently and securely. Additionally, our platform supports multiple file formats for your convenience.

-

Can I integrate airSlate SignNow with other software for IRS deposit tax forms?

Absolutely! airSlate SignNow allows integration with various accounting and payroll software, enhancing your workflow for IRS deposit tax forms. This means you can manage all your tax-related documents in one place, simplifying data transfer and improving accuracy.

-

How does electronic signing work for IRS deposit tax forms with airSlate SignNow?

Electronic signing with airSlate SignNow is intuitive and secure. Once your IRS deposit tax form is ready, you can send it to signers, who will receive a link to review and eSign the document. This process complies with federal regulations, providing you with a legally binding signature.

-

What benefits does airSlate SignNow provide for IRS deposit tax form management?

Using airSlate SignNow for IRS deposit tax form management simplifies documentation and enhances compliance. The platform reduces the risk of errors and missed deadlines with its automated reminders and tracking features. Additionally, you'll save time and resources by eliminating manual paperwork.

Get more for Form 8050 Rev November Internal Revenue Service

Find out other Form 8050 Rev November Internal Revenue Service

- How To eSign Illinois Business Operations Stock Certificate

- Can I eSign Louisiana Car Dealer Quitclaim Deed

- eSign Michigan Car Dealer Operating Agreement Mobile

- Can I eSign Mississippi Car Dealer Resignation Letter

- eSign Missouri Car Dealer Lease Termination Letter Fast

- Help Me With eSign Kentucky Business Operations Quitclaim Deed

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later