Wire Transfer Draw Down Authorization Horizon Bank 2018-2026

What is the wire transfer drawdown authorization?

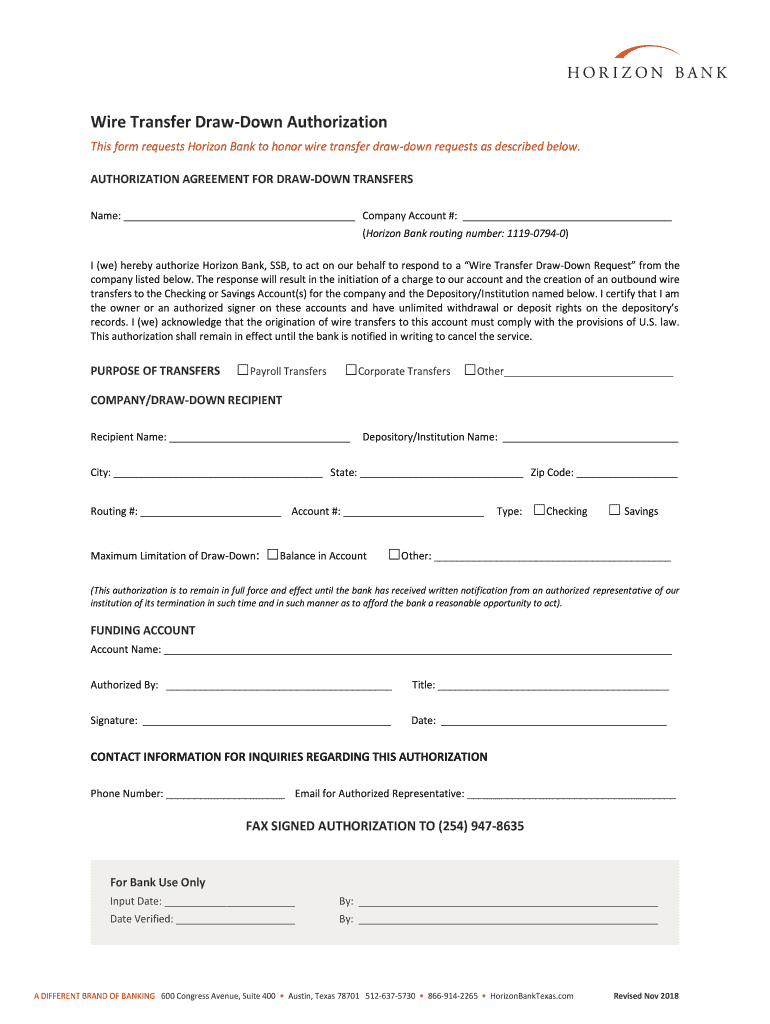

The wire transfer drawdown authorization is a formal document that allows a financial institution to execute a wire transfer on behalf of an individual or organization. This authorization specifies the amount to be transferred and the account from which the funds will be drawn. It is essential for ensuring that the transaction is conducted legally and securely, providing a clear record of consent for the financial institution to act on the request. Understanding this document is crucial for anyone engaging in wire transfers, as it outlines the responsibilities and rights of both the sender and the receiving bank.

Steps to complete the wire transfer drawdown authorization

Completing the wire transfer drawdown authorization involves several key steps to ensure accuracy and compliance. Follow these guidelines:

- Gather necessary information, including the sender's and recipient's bank details, account numbers, and the amount to be transferred.

- Fill out the authorization form with accurate details, ensuring that all required fields are completed.

- Review the form for any errors or omissions before submission.

- Sign the authorization to provide consent for the wire transfer.

- Submit the completed form to your financial institution, either online or in person, as per their submission guidelines.

Key elements of the wire transfer drawdown authorization

Several critical elements must be included in the wire transfer drawdown authorization to ensure its validity:

- Sender Information: Full name, address, and account number of the individual or entity initiating the transfer.

- Recipient Information: Name, address, and account number of the individual or entity receiving the funds.

- Transfer Amount: The specific amount to be transferred.

- Date of Transfer: The intended date for the wire transfer to take place.

- Signature: The sender's signature, confirming consent for the transaction.

Legal use of the wire transfer drawdown authorization

The wire transfer drawdown authorization is legally binding when completed correctly. It serves as proof that the sender has authorized the transfer of funds, protecting both the sender and the financial institution involved. Compliance with federal and state regulations is essential, as improper use of this authorization can lead to legal disputes or financial penalties. It is advisable to keep a copy of the completed authorization for personal records, as this can be useful for tracking transactions or resolving any issues that may arise.

Examples of using the wire transfer drawdown authorization

There are various scenarios in which the wire transfer drawdown authorization may be utilized:

- Personal Transactions: Individuals may use this authorization to send money to family or friends, especially for significant amounts.

- Business Payments: Companies often use wire transfers to pay suppliers or contractors, requiring a drawdown authorization to facilitate the transaction.

- Real Estate Transactions: Buyers may need to authorize wire transfers for earnest money deposits or closing costs in real estate deals.

Who issues the wire transfer drawdown authorization?

The wire transfer drawdown authorization is typically issued by the financial institution handling the wire transfer. Banks and credit unions provide their own forms for this purpose, which may vary in format but generally include similar information requirements. It is important for users to obtain the correct form from their bank to ensure compliance with their specific procedures and regulations.

Quick guide on how to complete wire transfer draw down authorization horizon bank

Complete Wire Transfer Draw Down Authorization Horizon Bank seamlessly on any device

Digital document management has gained traction among organizations and individuals alike. It offers an ideal eco-friendly alternative to traditional paper-based contracts, allowing you to obtain the necessary form and securely archive it online. airSlate SignNow provides all the tools you require to craft, modify, and electronically sign your documents swiftly without complications. Handle Wire Transfer Draw Down Authorization Horizon Bank on any platform with airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest method to alter and electronically sign Wire Transfer Draw Down Authorization Horizon Bank effortlessly

- Find Wire Transfer Draw Down Authorization Horizon Bank and click on Get Form to begin.

- Make use of the tools available to complete your form.

- Mark important sections of your documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal significance as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Modify and electronically sign Wire Transfer Draw Down Authorization Horizon Bank and ensure exceptional communication at any step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wire transfer draw down authorization horizon bank

The way to generate an electronic signature for a PDF online

The way to generate an electronic signature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

The best way to create an eSignature straight from your smartphone

The best way to make an eSignature for a PDF on iOS

The best way to create an eSignature for a PDF document on Android

People also ask

-

What is wire drawdown in airSlate SignNow?

Wire drawdown in airSlate SignNow refers to the process of electronically pulling funds from a customer's bank account based on signed agreements. This feature simplifies transaction management and enhances payment processing efficiency, ensuring a smooth flow of cash for your business.

-

How does the wire drawdown process work?

The wire drawdown process in airSlate SignNow involves creating a digital document that includes payment authorization. Once the document is signed, the specified amount can be automatically withdrawn from the client's account, providing a seamless payment experience while maintaining compliance and reducing the risk of errors.

-

Is there a fee associated with wire drawdown?

Yes, airSlate SignNow may charge a transaction fee for wire drawdown services. However, this cost typically reflects the ease and efficiency gained in payment processing, making it a cost-effective choice for businesses looking to streamline transactions and enhance customer satisfaction.

-

What are the benefits of using wire drawdown with airSlate SignNow?

Using wire drawdown with airSlate SignNow offers numerous benefits, including faster payment processing, reduced administrative workload, and enhanced security. It allows businesses to receive funds more quickly while minimizing the risk of payment disputes through the use of legally binding eSignatures.

-

Can I integrate wire drawdown with other financial tools?

Absolutely! airSlate SignNow allows for seamless integration with various accounting and CRM software, enhancing your overall financial management. This means that you can easily connect wire drawdown functions to the tools you already use, optimizing your business processes.

-

What types of documents can I use wire drawdown with?

You can use wire drawdown with a variety of documents in airSlate SignNow, including contracts, invoices, and payment authorizations. This versatility allows businesses across different industries to implement wire drawdown into their workflows easily.

-

How secure is the wire drawdown feature?

The wire drawdown feature in airSlate SignNow is highly secure, incorporating encryption and adherence to industry standards for data protection. This commitment to security helps ensure that all transactions and sensitive information remain safe during the entire process.

Get more for Wire Transfer Draw Down Authorization Horizon Bank

- Direct deposit form columbia credit union columbiacu

- Modle offre dachat pdf form

- Form medina county health department medinahealth

- Volleyball tryout evaluation form doc

- Yoni steam consent form

- Hyatt place direct bill application university of chicago finserv uchicago form

- Term deposit form westpac

- 2021 form 1040 irsgov

Find out other Wire Transfer Draw Down Authorization Horizon Bank

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later