B Notice Template Form

What is the B Notice Template

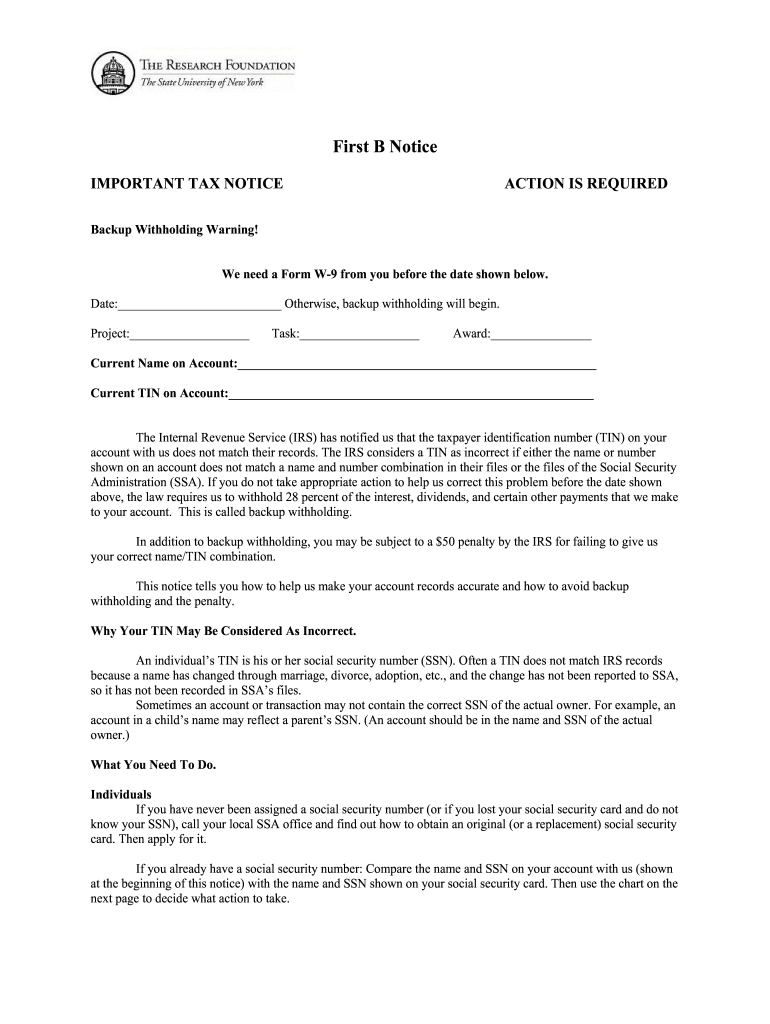

The B Notice template is a formal document issued by the Internal Revenue Service (IRS) to inform taxpayers about discrepancies in their tax information. Specifically, it is used when there are issues related to taxpayer identification numbers (TINs) on forms such as the 1099. This notice serves as a request for taxpayers to verify their information to ensure accurate reporting and compliance with tax regulations. Understanding the purpose of this template is crucial for maintaining good standing with the IRS and avoiding potential penalties.

How to use the B Notice Template

Using the B Notice template involves several key steps to ensure that the information provided is accurate and complete. Taxpayers should carefully review the notice for specific instructions regarding the discrepancies noted. It is essential to gather any required documentation, such as Social Security cards or Employer Identification Numbers, to support the corrections. Once the necessary information is compiled, taxpayers can fill out the B Notice template, ensuring that all details match the IRS records. Finally, the completed template should be submitted according to the instructions provided in the notice.

Steps to complete the B Notice Template

Completing the B Notice template requires attention to detail and adherence to IRS guidelines. Follow these steps:

- Review the notice for specific discrepancies and instructions.

- Gather supporting documentation, such as identification numbers.

- Fill out the B Notice template accurately, ensuring all information matches IRS records.

- Double-check for any errors or omissions before submission.

- Submit the completed template as directed, either online or via mail.

Legal use of the B Notice Template

The legal use of the B Notice template is governed by IRS regulations. It is essential for taxpayers to respond to the notice within the specified timeframe to avoid penalties. The template must be used correctly to ensure that the information provided is compliant with tax laws. By adhering to the guidelines set forth by the IRS, taxpayers can ensure that their submissions are legally valid and that they maintain compliance with federal tax requirements.

Key elements of the B Notice Template

Several key elements must be included in the B Notice template to ensure its effectiveness and compliance. These elements include:

- Taxpayer's name and address

- Tax identification number (TIN)

- Details of the discrepancy

- Instructions for correcting the information

- Deadline for response

Each of these components plays a vital role in the clarity and functionality of the notice, helping to facilitate a smooth resolution of any discrepancies.

IRS Guidelines

The IRS provides specific guidelines for the use of the B Notice template. These guidelines outline the necessary steps for taxpayers to take when they receive a B Notice. It is important to follow these guidelines closely to avoid miscommunication with the IRS. Taxpayers should familiarize themselves with the IRS's expectations regarding the completion and submission of the B Notice template to ensure compliance and avoid potential penalties.

Quick guide on how to complete first b notice sample letter form

Complete B Notice Template effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documentation, allowing you to find the right form and securely save it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage B Notice Template on any device using the airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

The easiest way to modify and eSign B Notice Template seamlessly

- Obtain B Notice Template and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Select important sections of the documents or conceal sensitive information using tools that airSlate SignNow specifically provides for this purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal importance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the issues of lost or mislaid documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets all your document management requirements in just a few clicks from your chosen device. Modify and eSign B Notice Template and guarantee solid communication at any stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Is it compulsory to fill out the iVerify form for Wipro before getting a joining letter?

Yes, you should definitely will the form as you require it for your Background verification else the HR would mail and call every time unless you fill it.

-

Do I have to fill out a form to receive a call letter for the NDA SSB?

No form has to be filled for u to get your call-up letter.If you have cleared the written exam and your roll no. Is in the list, then sooner or later you will get your call-up letter.I would suggest you to keep looking for your SSB dates. Online on sites like Join Indian Army. Because the hard copy may be delayed due to postal errors or faults.Just to reassure you, NO FORM HAS TO BE FILLED TO GET YOUR SSB CALLUP LETTER.Cheers and All the Best

-

How do I fill out the Form 102 (ICAI) for an articleship? Can anyone provide a sample format?

Form 102 serves as a contract between you and your Principal at work. It becomes binding only when its Franked.Franking is nothing but converting it into a Non Judicial Paper. So u'll be filling in your name, your articleship period and other details and you and your boss(principal) will sign it on each page and at the end. It need not be sent to the institute , one copy is for you and another for your Principal .Nothin to worry..And while filling the form if you have any query , just see the form filled by old articles. The record will be with your Principal or ask your seniors.

Create this form in 5 minutes!

How to create an eSignature for the first b notice sample letter form

How to generate an electronic signature for your First B Notice Sample Letter Form online

How to create an eSignature for your First B Notice Sample Letter Form in Chrome

How to generate an eSignature for signing the First B Notice Sample Letter Form in Gmail

How to make an eSignature for the First B Notice Sample Letter Form from your smartphone

How to create an electronic signature for the First B Notice Sample Letter Form on iOS devices

How to generate an eSignature for the First B Notice Sample Letter Form on Android OS

People also ask

-

What is a B Notice Template and why is it important?

A B Notice Template is a crucial document used by employers to notify employees about discrepancies in their tax information. It helps ensure compliance with IRS regulations and facilitates accurate tax reporting. Using a B Notice Template can prevent penalties and streamline the correction process for both employers and employees.

-

How can I create a B Notice Template using airSlate SignNow?

Creating a B Notice Template with airSlate SignNow is simple and efficient. You can start by selecting a customizable template from our library and then adjust the content to meet your specific needs. Once designed, you can easily eSign and send it to your employees directly through our platform.

-

Is there a cost associated with using the B Notice Template in airSlate SignNow?

Yes, there is a subscription fee for accessing premium features in airSlate SignNow, including the B Notice Template. However, our pricing is designed to be cost-effective, making it accessible for businesses of all sizes. You can choose from different plans depending on the features you need.

-

What features does airSlate SignNow offer for managing B Notice Templates?

airSlate SignNow offers a range of features to manage your B Notice Template effectively. These include customizable templates, automated workflows, secure eSigning, and integration with other software solutions. This ensures a seamless process for sending and tracking your B Notices.

-

Can I integrate the B Notice Template with my existing HR software?

Absolutely! airSlate SignNow provides integrations with a variety of HR software platforms. This allows you to streamline your workflow and ensure that your B Notice Template is automatically populated with employee information, reducing manual entry and errors.

-

What are the benefits of using airSlate SignNow for B Notice Templates?

Using airSlate SignNow for your B Notice Template offers numerous benefits, including enhanced efficiency, reduced paperwork, and improved compliance. The platform's user-friendly interface allows for quick document preparation and delivery, while secure eSigning ensures that your notices are legally binding.

-

How secure is my data when using the B Notice Template on airSlate SignNow?

Data security is a top priority at airSlate SignNow. When using the B Notice Template, your information is protected with advanced encryption and secure storage. We comply with industry standards to ensure that your sensitive data remains confidential and secure.

Get more for B Notice Template

- Contemplation of marriage to be effective upon their marriage in accordance with the laws of the form

- This article is for you to leave your property and estate of every kind to your children form

- Type name your spouse if this option chosen form

- Hereinafter referred to as grantor does hereby convey and form

- Hereinafter referred to as grantors do hereby convey and warrant unto a form

- Free cohabitation agreement formpdf ampamp word samplesformswift

- True and correct form

- Free arizona living will form pdfeformsfree fillable forms

Find out other B Notice Template

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online