Pei Wei W2 Online 2002-2026

What is the Pei Wei W2 Online

The Pei Wei W2 online is a tax form that outlines the annual wages and tax withheld for employees of Pei Wei Asian Diner, LLC. This document is essential for employees to accurately report their earnings to the Internal Revenue Service (IRS) and state tax authorities. The W-2 form provides a summary of an employee's total earnings, Social Security wages, Medicare wages, and any federal, state, or local taxes withheld during the year. It is typically issued by the employer by the end of January each year for the previous tax year.

How to obtain the Pei Wei W2 Online

To obtain the Pei Wei W2 online, employees can access the document through the Pei Wei employee portal or contact the human resources department for assistance. Employees may need to provide personal identification details to verify their identity before accessing their W-2 forms. It is important to ensure that the information is correct, as discrepancies can lead to issues during tax filing. If an employee is unable to access the online portal, they can request a physical copy to be mailed to their address.

Steps to complete the Pei Wei W2 Online

Completing the Pei Wei W2 online involves several steps to ensure accuracy and compliance with IRS guidelines. First, employees should log into the designated employee portal using their credentials. Once logged in, they can navigate to the tax documents section to locate their W-2 form. After downloading the form, employees should review all entries, including their name, Social Security number, and earnings. If any errors are found, employees should notify HR immediately for corrections. After verifying the information, the W-2 can be printed or saved for tax filing purposes.

Legal use of the Pei Wei W2 Online

The Pei Wei W2 online is legally binding and must comply with federal and state regulations regarding tax documentation. According to the IRS, employers are required to provide accurate W-2 forms to their employees by January 31 each year. The online version is equally valid as a paper version, provided it meets the necessary legal standards. Employees should ensure they keep a copy of their W-2 for their records, as it is essential for filing federal and state tax returns. Failure to provide accurate information can lead to penalties or audits by tax authorities.

IRS Guidelines

The IRS provides specific guidelines for the completion and submission of W-2 forms. Employers must report all wages paid and taxes withheld accurately. Employees should refer to IRS Publication 15 (Circular E) for detailed instructions on how to interpret the information on their W-2 forms. It is crucial for employees to match the information on their W-2 with their tax returns to avoid discrepancies that could trigger audits or penalties. Understanding these guidelines helps ensure compliance with tax laws and smooth processing of tax returns.

Filing Deadlines / Important Dates

Filing deadlines for the Pei Wei W2 online are critical for both employers and employees. Employers must provide W-2 forms to employees by January 31. Employees should file their federal tax returns by April 15, unless an extension is requested. It is advisable for employees to complete their tax returns as soon as they receive their W-2 to avoid any last-minute issues. Keeping track of these important dates ensures compliance and helps avoid penalties for late filing.

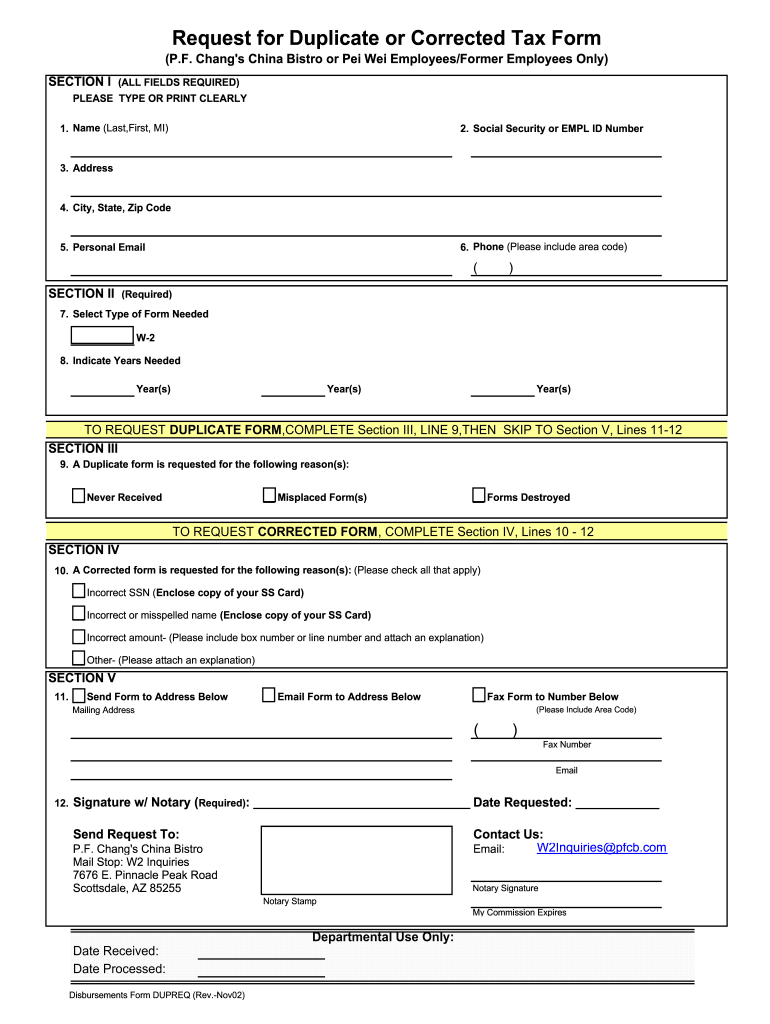

Quick guide on how to complete pei wei w2 online

Effortlessly Prepare Pei Wei W2 Online on Any Device

Digital document management has gained traction among organizations and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without unnecessary delays. Manage Pei Wei W2 Online on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to Edit and Electronically Sign Pei Wei W2 Online with Ease

- Locate Pei Wei W2 Online and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then select the Done button to save your changes.

- Decide how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the issues of missing or lost documents, tedious form searches, or errors that necessitate creating new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Pei Wei W2 Online to ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pei wei w2 online

The way to generate an eSignature for a PDF file online

The way to generate an eSignature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

How to generate an eSignature right from your mobile device

The way to create an eSignature for a PDF file on iOS

How to generate an eSignature for a PDF on Android devices

People also ask

-

What is the pf changs w2 form and why is it important?

The pf changs w2 form is a tax document that reports an employee’s annual wages and the taxes withheld. It is essential for employees to file their taxes accurately and claim any applicable credits. Understanding the pf changs w2 can help employees manage their financial obligations effectively.

-

How can I obtain my pf changs w2 if I lost it?

If you've lost your pf changs w2, you can request a replacement from your HR department or access it through the company’s employee portal. It is crucial to retrieve your pf changs w2 before tax season to avoid delays in filing. Keeping a digital or printed copy for future reference can also be beneficial.

-

Does airSlate SignNow support the signing of pf changs w2 documents?

Yes, airSlate SignNow allows users to securely eSign and send pf changs w2 documents electronically. Our platform is designed for ease of use, ensuring that important tax documents can be processed efficiently. This not only saves time but also enhances security and compliance.

-

What features does airSlate SignNow offer for managing pf changs w2?

AirSlate SignNow offers a variety of features for managing pf changs w2 documents, including document templates, in-app signing, and automated workflows. These features streamline the process of preparing and collecting signatures on tax documents, making it hassle-free for users. Additionally, tracking and notifications ensure that no documents are overlooked.

-

What are the pricing options for airSlate SignNow when managing pf changs w2 forms?

AirSlate SignNow provides flexible pricing plans tailored to different business needs, including options for managing pf changs w2 forms. These plans are cost-effective and provide access to a range of features aimed at improving document workflows. You can select from monthly or yearly subscriptions based on your usage requirements.

-

Can airSlate SignNow integrate with payroll systems for pf changs w2 management?

Yes, airSlate SignNow can integrate seamlessly with various payroll systems, making it easier to manage pf changs w2 forms directly within your existing workflows. These integrations allow for automatic updates and secure data transfers, ensuring that your tax documents are accurate and up-to-date. This streamlines the process and improves accuracy.

-

What are the benefits of using airSlate SignNow for pf changs w2 processing?

Using airSlate SignNow for pf changs w2 processing offers numerous benefits, including enhanced security, reduced paperwork, and improved efficiency. The electronic signature feature allows for quick and secure signing, while real-time tracking and reminders help ensure that deadlines are met. Overall, it simplifies the management of critical tax documents.

Get more for Pei Wei W2 Online

- Fillable site specific safety plan pdf form

- Laws and regulations kansas board of pharmacy form

- Dj le 330 application for employment 5 17 form

- Civil case information statement cis civil case information statement cis

- Redding city police department non emergency777 cypress form

- Separate signed form is required for each school year may 1 of the current year through june 30 of the succeeding year

- In the matter of case no application for correction of form

- Department of consumer affairs veterinary medical board form

Find out other Pei Wei W2 Online

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF