Schedule C Tax Organizer Form

What is the Schedule C Tax Organizer

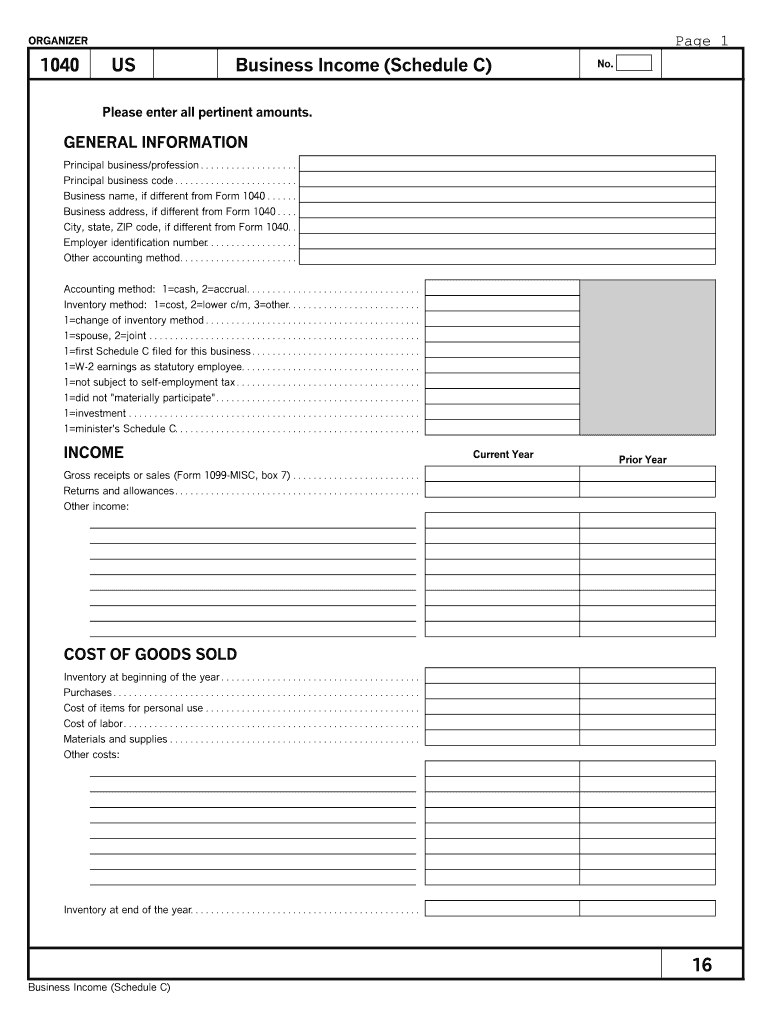

The Schedule C Tax Organizer is a crucial document for self-employed individuals and business owners in the United States. It helps to streamline the process of reporting income and expenses on the Schedule C form, which is used to report profit or loss from a business. This organizer collects essential information about your business activities, including income sources, operating expenses, and deductions. By using the Schedule C Tax Organizer, taxpayers can ensure they have all necessary information readily available for accurate and efficient tax filing.

How to use the Schedule C Tax Organizer

To effectively use the Schedule C Tax Organizer, begin by gathering all relevant financial documents, such as income statements, receipts for expenses, and any other records related to your business activities. Next, fill out each section of the organizer, providing detailed information about your business income and expenses. It is important to categorize expenses correctly, as this will impact your tax deductions. Once completed, review the organizer to ensure accuracy before transferring the information to the Schedule C form. This organized approach can help minimize errors and streamline the filing process.

Steps to complete the Schedule C Tax Organizer

Completing the Schedule C Tax Organizer involves several key steps:

- Gather documentation: Collect all financial records, including income statements, receipts, and invoices.

- Fill in income details: Record all sources of income from your business activities.

- List expenses: Document all business-related expenses, categorizing them appropriately to maximize deductions.

- Review for accuracy: Double-check all entries to ensure they are correct and complete.

- Transfer information: Use the completed organizer to fill out the Schedule C form accurately.

Legal use of the Schedule C Tax Organizer

The Schedule C Tax Organizer is designed to comply with IRS regulations, making it a legal tool for reporting business income and expenses. When using this organizer, it is essential to ensure that all information is truthful and accurate to avoid potential legal issues. Proper use of the organizer can help taxpayers substantiate their claims if audited by the IRS. Maintaining accurate records and using the organizer correctly can support compliance with tax laws and regulations.

Required Documents

When filling out the Schedule C Tax Organizer, certain documents are essential for completeness and accuracy. These include:

- Income statements from all business activities

- Receipts for business expenses

- Bank statements related to business transactions

- Invoices issued to clients or customers

- Any relevant tax documents from previous years

Having these documents on hand can simplify the process of completing the organizer and ensure that all necessary information is included.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Schedule C form is critical for compliance. Typically, the deadline for submitting your Schedule C along with your personal tax return is April 15th of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to check for any updates or changes to deadlines, especially for the current tax year, to avoid penalties for late filing.

Quick guide on how to complete schedule c tax organizer 2019

Complete Schedule C Tax Organizer seamlessly on any device

Digital document management has become favored by businesses and individuals alike. It offers an excellent environmentally friendly substitute for traditional printed and signed documents, as you can easily access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents promptly without delays. Manage Schedule C Tax Organizer on any platform using airSlate SignNow Android or iOS applications and simplify any document-related procedures today.

How to edit and eSign Schedule C Tax Organizer effortlessly

- Obtain Schedule C Tax Organizer and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate reprinting new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Edit and eSign Schedule C Tax Organizer while ensuring effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule c tax organizer 2019

The way to generate an eSignature for a PDF document online

The way to generate an eSignature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

How to generate an eSignature from your smart phone

The way to create an eSignature for a PDF document on iOS

How to generate an eSignature for a PDF file on Android OS

People also ask

-

What is a Schedule C worksheet and why do I need it?

A Schedule C worksheet is an essential document that helps self-employed individuals report their business income and expenses. It'll streamline the process of filing your taxes accurately and efficiently, ensuring you maximize your deductions. By utilizing a Schedule C worksheet, you can rest assured that your financial details are well-organized for tax time.

-

How can airSlate SignNow help with my Schedule C worksheet?

airSlate SignNow offers an easy-to-use platform for creating, signing, and storing your Schedule C worksheet securely. By leveraging our electronic signature technology, you can gather necessary signatures quickly and manage your documents effortlessly. Our solution ensures that your Schedule C worksheet is both legally binding and accessible whenever you need it.

-

What features does airSlate SignNow provide for managing a Schedule C worksheet?

With airSlate SignNow, you get features like customizable templates, automated workflows, and real-time collaboration. These tools make it easier to manage your Schedule C worksheet alongside other business documents. You can save time and reduce errors while ensuring your important financial information is always up to date.

-

Is there a cost associated with using airSlate SignNow for Schedule C worksheets?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including options suitable for freelancers and small businesses. Each plan guarantees you access to essential features for handling your Schedule C worksheet efficiently. Consider the potential savings in time and resources when evaluating the cost of our services.

-

Can I integrate airSlate SignNow with accounting software for my Schedule C worksheet?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, making it easy to manage your Schedule C worksheet in conjunction with your financial data. These integrations enable automatic updates and critical data transfers, so you can focus on accuracy and compliance without the hassle of manual entries.

-

What are the benefits of using airSlate SignNow for my Schedule C worksheet?

Using airSlate SignNow for your Schedule C worksheet enhances productivity by streamlining document management and eSigning processes. You'll benefit from improved organization, reduced paper clutter, and faster transactions, allowing you to concentrate on the growth of your business. Plus, with our secure platform, your sensitive financial information remains protected.

-

Can multiple users collaborate on a Schedule C worksheet using airSlate SignNow?

Yes, airSlate SignNow allows multiple users to collaborate on your Schedule C worksheet in real-time. This feature is perfect for teams or accountants working together to ensure that all necessary information is included and accurate. Collaboration tools simplify the process, making it easier to gather signatures and feedback promptly.

Get more for Schedule C Tax Organizer

Find out other Schedule C Tax Organizer

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP