Nat 0660 2018-2026

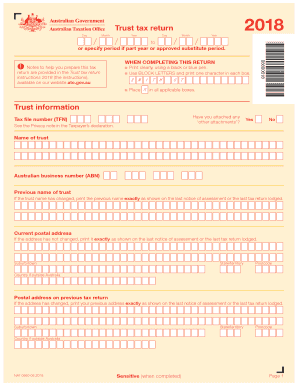

What is the Nat 0660

The Nat 0660, also known as the Australia trust tax form, is a crucial document used for reporting income earned by trusts in Australia. This form is essential for ensuring that trusts comply with tax obligations set by the Australian Taxation Office (ATO). It captures details about the trust's income, deductions, and distributions to beneficiaries, providing a comprehensive overview of the trust's financial activities for the tax year.

How to use the Nat 0660

Using the Nat 0660 involves a series of steps to ensure accurate completion and submission. First, gather all necessary financial records related to the trust, including income statements and records of expenses. Next, fill out the form with the required information, ensuring that all figures are accurate and reflect the trust's financial activities. Once completed, the form can be submitted electronically or via mail, depending on the preferred method of submission.

Steps to complete the Nat 0660

Completing the Nat 0660 involves several key steps:

- Gather financial documents, including income and expense records.

- Fill in the trust's details, including the trust name and ABN.

- Report all income earned by the trust, including distributions and capital gains.

- Detail any allowable deductions related to the trust's operations.

- Calculate the net income and determine the distribution to beneficiaries.

- Review the completed form for accuracy before submission.

Legal use of the Nat 0660

The legal use of the Nat 0660 is governed by Australian tax laws, which require trusts to report their income accurately. Filing this form is essential to avoid penalties and ensure compliance with the ATO regulations. Trusts must adhere to specific guidelines regarding the reporting of income and distributions, making it crucial to understand the legal implications of the information provided on the form.

Required Documents

To complete the Nat 0660 effectively, several documents are necessary:

- Trust deed, which outlines the terms and conditions of the trust.

- Financial statements detailing income and expenses.

- Records of distributions made to beneficiaries.

- Any relevant tax documents that support deductions claimed.

Form Submission Methods

The Nat 0660 can be submitted through various methods, allowing for flexibility based on the trust's preferences:

- Online submission via the ATO's online services.

- Mailing a printed copy of the completed form to the ATO.

- In-person submission at designated ATO offices, if necessary.

Quick guide on how to complete nat 0660

Easily Prepare Nat 0660 on Any Device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely preserve it online. airSlate SignNow provides all the tools you require to swiftly create, modify, and electronically sign your documents without any delays. Manage Nat 0660 on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related task today.

Edit and eSign Nat 0660 Effortlessly

- Find Nat 0660 and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize essential sections of the documents or redact sensitive information using tools provided by airSlate SignNow specifically for this purpose.

- Generate your signature with the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your adjustments.

- Select how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, stressful form navigation, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Transform and electronically sign Nat 0660 while ensuring seamless communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nat 0660

The best way to generate an electronic signature for your PDF document in the online mode

The best way to generate an electronic signature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

The best way to make an electronic signature straight from your mobile device

The way to make an electronic signature for a PDF document on iOS devices

The best way to make an electronic signature for a PDF document on Android devices

People also ask

-

What is an Australia trust tax return?

An Australia trust tax return is a declaration that must be filed by a trust to report its income, deductions, and distributions to beneficiaries. Properly completing the Australia trust tax return is essential for compliance with Australian tax regulations and ensures that your trust meets its tax obligations.

-

How can airSlate SignNow help with Australia trust tax returns?

airSlate SignNow simplifies the process of preparing and filing Australia trust tax returns by allowing users to electronically sign and send documents securely. This enhances collaboration with tax professionals and ensures timely submissions of Australia trust tax returns, minimizing the risk of penalties.

-

What are the pricing options for using airSlate SignNow for tax documents?

airSlate SignNow offers competitive pricing plans that cater to different business needs, making it affordable for managing Australia trust tax returns. You can choose between monthly and annual subscriptions, with additional features included at various tiers to optimize your document management and eSigning experience.

-

Are there any features specific to Australia trust tax return management?

Yes, airSlate SignNow provides specific features such as templates for Australia trust tax returns and integration with various accounting software. These tools streamline the documentation process, allowing easier access and management of tax-related documents necessary for filing Australia trust tax returns.

-

What are the benefits of using airSlate SignNow for my business?

Using airSlate SignNow for your business enhances efficiency, saving time on document management and eSigning. Its user-friendly interface ensures that filing Australia trust tax returns can be conducted smoothly and professionally, allowing businesses to focus on their core operations.

-

How does airSlate SignNow ensure the security of my Australia trust tax return documents?

AirSlate SignNow prioritizes document security by employing encryption and secure cloud storage for all eSigned documents, including Australia trust tax returns. We comply with international data protection regulations, ensuring your sensitive information remains confidential and secure.

-

Can I integrate airSlate SignNow with other accounting software for my tax returns?

Absolutely! airSlate SignNow seamlessly integrates with popular accounting software to enhance your workflow for managing Australia trust tax returns. This integration allows you to easily access, complete, and file your tax documents directly from your preferred accounting tools.

Get more for Nat 0660

- Hawaii mortgage formsus legal forms

- Hawaii legal forms hawaii legal documents uslegalforms

- Control number ia p042 pkg form

- Iowa living wills and durable powers of attorney for health care nolo form

- How to change your name in idaholegalzoom legal info form

- Idaho legal forms idaho legal documents uslegalforms

- Control number id p019 pkg form

- Idaho option to purchase forms and faqus legal forms

Find out other Nat 0660

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History