Tieza Travel Tax Refund 1987-2026

What is the Tieza Travel Tax Refund

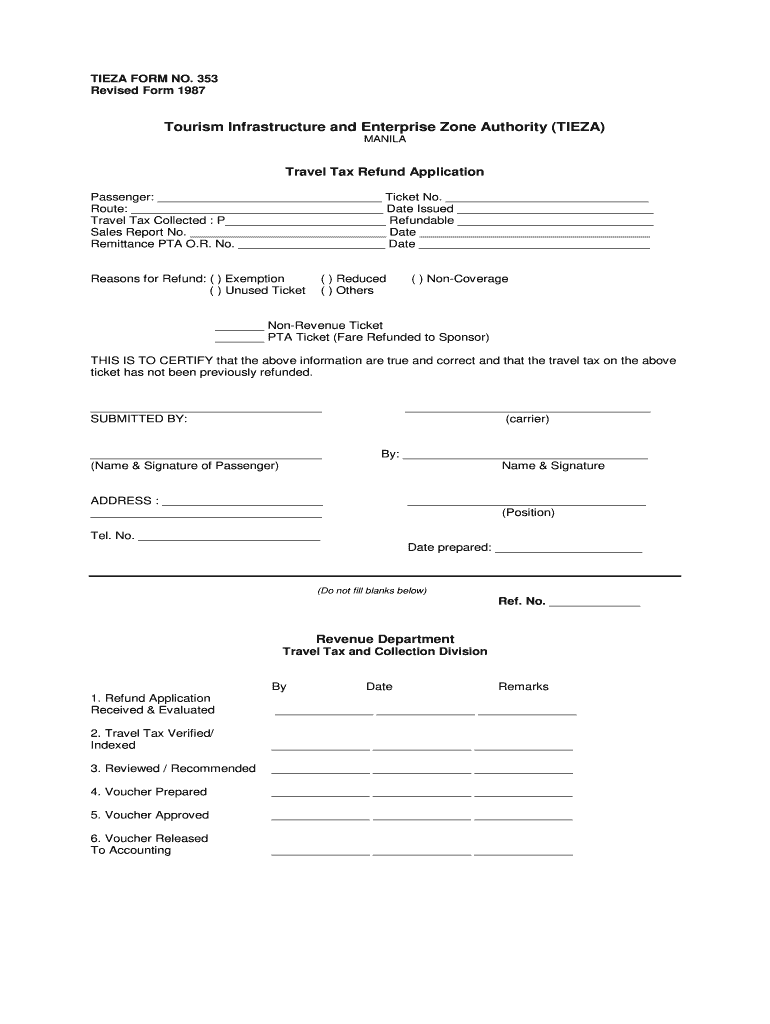

The Tieza Travel Tax Refund is a program designed to reimburse travelers for the travel tax they paid when departing from the Philippines. This tax applies to individuals leaving the country for various reasons, including tourism, business, or education. The refund process is facilitated through the Tieza refund application form no 353, which allows eligible travelers to reclaim the tax amount they have paid. Understanding the specifics of this refund process is essential for ensuring that travelers can successfully navigate the requirements and receive their due refunds.

Steps to complete the Tieza Travel Tax Refund

Completing the Tieza Travel Tax Refund involves several key steps to ensure a smooth application process. First, travelers must gather all necessary documentation, including proof of travel, payment receipts, and identification. Next, they need to fill out the Tieza refund application form no 353 accurately, providing all requested information. After completing the form, travelers can submit it either online or in person at designated Tieza offices. It is crucial to keep copies of all submitted documents for personal records. Finally, applicants should monitor the status of their refund request to ensure timely processing.

Required Documents

When applying for the Tieza Travel Tax Refund, several documents are required to support the application. These typically include:

- Proof of travel, such as a flight itinerary or boarding pass.

- Payment receipt of the travel tax.

- A valid government-issued identification, such as a passport or driver's license.

- The completed Tieza refund application form no 353.

Ensuring that all documents are accurate and complete will help expedite the refund process.

Legal use of the Tieza Travel Tax Refund

The Tieza Travel Tax Refund is governed by specific legal frameworks that dictate its application and processing. Compliance with these regulations is essential for the refund to be considered valid. The refund process must adhere to the guidelines set forth by the Philippine government, including the proper submission of forms and adherence to deadlines. Utilizing a reliable platform for electronic signatures, like signNow, ensures that the application process remains legally binding and secure, meeting the necessary eSignature laws.

Eligibility Criteria

To qualify for the Tieza Travel Tax Refund, travelers must meet certain eligibility criteria. Generally, applicants must have paid the travel tax when departing from the Philippines and must be able to provide proof of this payment. Additionally, travelers should not have claimed a refund for the same tax on a previous trip. Specific conditions may vary, so it is advisable to review the latest guidelines from Tieza to confirm eligibility before applying.

Form Submission Methods

Travelers can submit the Tieza refund application form no 353 through various methods to accommodate different preferences. The options typically include:

- Online submission via the official Tieza website or designated platforms.

- In-person submission at Tieza offices located throughout the Philippines.

- Mailing the completed form and supporting documents to the appropriate Tieza office.

Choosing the most convenient submission method can help streamline the refund process and ensure timely responses.

Quick guide on how to complete tieza travel tax refund

Effortlessly Prepare Tieza Travel Tax Refund on Any Device

Digital document management has gained popularity among both businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents quickly without delays. Manage Tieza Travel Tax Refund on any device using airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

The Simplest Way to Edit and eSign Tieza Travel Tax Refund with Ease

- Obtain Tieza Travel Tax Refund and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information using tools specifically provided by airSlate SignNow for this purpose.

- Create your signature with the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow satisfies your document management needs with just a few clicks from any device you select. Edit and eSign Tieza Travel Tax Refund and ensure outstanding communication throughout your form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tieza travel tax refund

The way to make an electronic signature for your PDF document online

The way to make an electronic signature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

How to make an eSignature from your smart phone

The way to generate an electronic signature for a PDF document on iOS

How to make an eSignature for a PDF file on Android OS

People also ask

-

What is the Philippines travel tax refund process?

The Philippines travel tax refund process allows international travelers to reclaim taxes paid on certain purchases while in the country. Travelers must submit their tax refund claims at designated refund counters before departure, providing necessary receipts and documentation. Understanding this process can help you maximize your savings during your travel.

-

Who is eligible for the Philippines travel tax refund?

Eligibility for the Philippines travel tax refund typically includes foreign tourists and certain domestic travelers who have paid travel taxes during their stay. It's important to keep all relevant receipts, as these documents are necessary for filing your claim. Make sure to check the specific eligibility requirements based on your travel status.

-

How much can I get back from the Philippines travel tax refund?

The amount you can receive from the Philippines travel tax refund depends on your total expenditures subject to tax refund. Generally, travelers can expect to reclaim a percentage of the travel tax from qualifying expenses. The actual refund amount will vary based on your purchases and the specific refund guidelines.

-

What documents do I need for the Philippines travel tax refund?

To successfully claim your Philippines travel tax refund, you need to present receipts for your qualifying purchases, a valid passport, and any relevant documentation. Keeping track of these documents throughout your travel will streamline the process and ensure you don't miss out on your refund opportunities.

-

How long does it take to receive my Philippines travel tax refund?

The processing time for the Philippines travel tax refund can vary, but typically, travelers can expect to wait several weeks after submission for their claims to be processed. Factors such as submission date and the completeness of your documentation can influence this timeline. It's advisable to submit your claim as early as possible.

-

Can I file for a Philippines travel tax refund online?

Currently, the Philippines travel tax refund process does not support online submissions. Travelers must personally submit their claims at designated refund counters located at the airport or other authorized locations. Make sure to check in advance for the locations and hours of operation.

-

Are there any fees involved with the Philippines travel tax refund service?

While filing for the Philippines travel tax refund at designated counters is generally free, some service providers may charge fees for assistance in processing claims. It's crucial to inquire about any potential fees upfront to avoid surprises and maximize your refund.

Get more for Tieza Travel Tax Refund

- J edgar hoover part 19 of 22 fbi vault form

- Alaska notarial certificates notary stamp form

- Cp 410 request for appointed attorney childrens proceedings form

- In the district superior court for the state of alaska form

- Cr 140 request for temporary transfer 9 05doc form

- Cr 145 anch request for contiuance of arraignment 2 00 criminal forms

- In the district court for the state of alaska at state of form

- Cr 165 consent to misdemeanor proceedings in defendants a form

Find out other Tieza Travel Tax Refund

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template