Form 9517 E Internal Revenue Service Irs

What is the Form 9517 E?

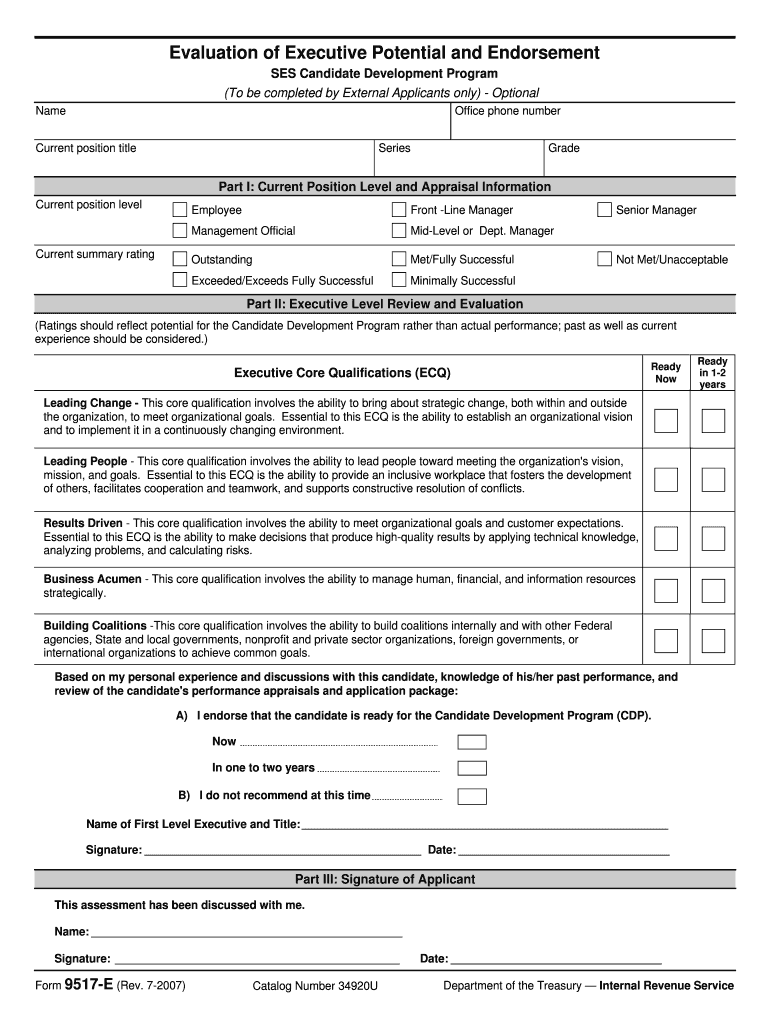

The Form 9517 E is a document issued by the Internal Revenue Service (IRS) that serves specific purposes related to tax compliance. This form is utilized for various reporting requirements, helping taxpayers communicate necessary information to the IRS. Understanding its function is essential for ensuring that all tax obligations are met appropriately.

How to use the Form 9517 E

Using the Form 9517 E involves several steps to ensure accurate completion and submission. First, gather all required information, including personal identification details and any relevant financial data. Complete the form by following the provided instructions carefully. Once filled out, the form can be submitted electronically or via traditional mail, depending on the IRS guidelines.

Steps to complete the Form 9517 E

Completing the Form 9517 E requires attention to detail. Here are the steps to follow:

- Download the form from the IRS website or access it through authorized platforms.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Provide any required financial information as specified in the form instructions.

- Review the completed form for accuracy and ensure all sections are filled out correctly.

- Submit the form according to the IRS submission guidelines, either online or by mail.

Legal use of the Form 9517 E

The Form 9517 E is legally binding when completed and submitted in accordance with IRS regulations. It is crucial to ensure that all information provided is truthful and accurate, as any discrepancies can lead to penalties or legal issues. Utilizing a reliable electronic signature tool can enhance the legitimacy of the submission, ensuring compliance with eSignature laws.

Filing Deadlines / Important Dates

Filing deadlines for the Form 9517 E can vary based on individual circumstances, including the type of tax year being reported. It is important to stay informed about specific due dates to avoid late submissions. Generally, the IRS provides a calendar of important dates that can help taxpayers plan their filing schedule effectively.

Form Submission Methods

The Form 9517 E can be submitted through various methods, including:

- Online submission via the IRS e-file system, which is often the fastest option.

- Mailing a paper copy to the designated IRS address, ensuring it is postmarked by the deadline.

- In-person submission at local IRS offices, which may be necessary for certain situations.

Quick guide on how to complete form 9517 e internal revenue service irs

Accomplish Form 9517 E Internal Revenue Service Irs with ease on any device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly without delays. Manage Form 9517 E Internal Revenue Service Irs on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

How to edit and eSign Form 9517 E Internal Revenue Service Irs effortlessly

- Find Form 9517 E Internal Revenue Service Irs and click Get Form to commence.

- Make use of the tools we offer to complete your document.

- Highlight signNow sections of the documents or obscure sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Generate your electronic signature with the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious searching for forms, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 9517 E Internal Revenue Service Irs and ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Internal Revenue Service (IRS): How do you attach a W2 form to your tax return?

A number of answers — including one from a supposed IRS employee — say not to physically attach them, but just to include the W-2 in the envelope.In fact, the 1040 instructions say to “attach” the W-2 to the front of the return, and the Form 1040 itself —around midway down the left-hand side — says to “attach” Form W-2 here; throwing it in the envelope is not “attaching.” Anything but a staple risks having the forms become separated, just like connecting the multiple pages of the return, scheduled, etc.

-

Which Internal Revenue Service forms do I need to fill (salaried employee) for tax filing when my visa status changed from F1 OPT to H1B during 2015?

You can use the IRS page for residency test: Substantial Presence TestIf you live in a state that does not have income tax, you can use IRS tool: Free File: Do Your Federal Taxes for Free or any other free online software. TaxAct is one such.If not and if you are filing for the first time, it might be worth spending few dollars on a tax consultant. You can claim the fee in your return.

-

Internal Revenue Service (IRS): How many W-2s were issued in 2012? How many Forms 1099-MISC?

I don't have an answer as I was also unable to find this statistic anywhere. I can tell you that the Social Security Administration actually processes W2's and forwards the information to the IRS. 1099's however are processed by the IRS directly.The closest statistic I can find is that in 2010 there were 117,820,074 tax returns processed that showed salaries and wages (W2 income) on them. That does not allow for returns where the taxpayers have multiple W2's nor does it allow for people who received a W2 and did not file a tax return, so all I can say is the number of W2's is something larger than 117M.

-

Internal Revenue Service (IRS): Why do so many companies wait until the last second to give employees their W2 forms?

WWEELLL consider that most small businesses do not prepare their own W-2s. Being a CPA and today is 1/18/17 I still have about 10 or so businesses that I’ve W-2s to prepare for them.Now as to the second part of the question you are aware that the IRS does not even accept a return for electronic filing until 1/23/17?Why such a hurry? Additionally, with the new security procedures in place you are probably looking at 4 -6 weeks to get your refund (even filing electronically) - AANNDD truthfully no one really knows because this is the first year for these new security measures.

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

Internal Revenue Service (IRS): How to expensify a payment for a foreign contractor?

Absolutely. That's the way we used to do it back in the old days before computers :)Seriously, the IRS does not require any specific method of record keeping; all that you are required to do in the event of an audit is to produce documentation that substantiates the deductions that you claim. A paper invoice with a signed paper receipt attached certainly meets the requirements. Refer to IRS Publication 583, http://www.irs.gov/publications/... for more information.

-

There is curfew in my area and Internet service is blocked, how can I fill my exam form as today is the last day to fill it out?

Spend less time using your blocked Internet to ask questions on Quora, andTravel back in time to when there was no curfew and you were playing Super Mario Kart, and instead, fill out your exam form.

-

How much money does the US Internal Revenue Service (IRS) fail to collect in a typical fiscal year?

A LOT. We negotiate on our clients behalf to help them recoop some of it. Keystone National Tax

Create this form in 5 minutes!

How to create an eSignature for the form 9517 e internal revenue service irs

How to make an electronic signature for the Form 9517 E Internal Revenue Service Irs in the online mode

How to generate an eSignature for your Form 9517 E Internal Revenue Service Irs in Chrome

How to generate an electronic signature for putting it on the Form 9517 E Internal Revenue Service Irs in Gmail

How to generate an electronic signature for the Form 9517 E Internal Revenue Service Irs right from your smart phone

How to make an electronic signature for the Form 9517 E Internal Revenue Service Irs on iOS devices

How to generate an eSignature for the Form 9517 E Internal Revenue Service Irs on Android OS

People also ask

-

What is the https apps irs gov form 9517, and how can airSlate SignNow assist with it?

The https apps irs gov form 9517 is a specific IRS form used for tax-related purposes. airSlate SignNow simplifies the process of filling out and submitting this form by providing a user-friendly platform for eSigning and document management, ensuring compliance and efficiency.

-

How does airSlate SignNow ensure the security of my documents when using the https apps irs gov form 9517?

Security is a top priority at airSlate SignNow. Our platform employs advanced encryption and secure server protocols to protect all documents, including those involving the https apps irs gov form 9517, ensuring that your sensitive tax information is safeguarded.

-

Can I integrate airSlate SignNow with other applications when using the https apps irs gov form 9517?

Yes! airSlate SignNow offers seamless integration with various applications and tools. This allows you to efficiently manage the https apps irs gov form 9517 along with other documents within your existing workflow.

-

What are the pricing options available for airSlate SignNow when dealing with the https apps irs gov form 9517?

airSlate SignNow offers flexible pricing plans tailored to fit different business needs. Whether you require basic features for processing the https apps irs gov form 9517 or more advanced capabilities, we have options to suit every budget.

-

What are the key features of airSlate SignNow related to the https apps irs gov form 9517?

Key features include customizable templates, audit trails, and the ability to eSign documents quickly. These functionalities enhance your experience when working with the https apps irs gov form 9517, making it easier to complete and submit accurately.

-

How does airSlate SignNow benefit businesses that frequently use the https apps irs gov form 9517?

By using airSlate SignNow, businesses can streamline their document signing process, saving time and reducing errors associated with manual handling of the https apps irs gov form 9517. This leads to increased productivity and compliance.

-

Is training available for using airSlate SignNow with the https apps irs gov form 9517?

Absolutely! airSlate SignNow provides comprehensive training resources and customer support to help users understand how to effectively utilize the platform with the https apps irs gov form 9517. This ensures you get the most out of our features.

Get more for Form 9517 E Internal Revenue Service Irs

- Download california judicial council amp court forms lawyaw

- 484 backer notice of exclusions from medicare benefitsskilled nursing facility nemb snf cms form

- Work release form the university of texas at san antonio

- Schlumberger us employment application employment application form

- R40 claim for repayment of tax deducted from savings and form

- Application for a project information memorandum andor

- Page 1 11den orov onira central provident fund board form

- Diseases industrial injuries disablement benefit claim form

Find out other Form 9517 E Internal Revenue Service Irs

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later