Page 1 11DEN OROV ONIRA Central Provident Fund Board 2019-2026

What is the OROV Form?

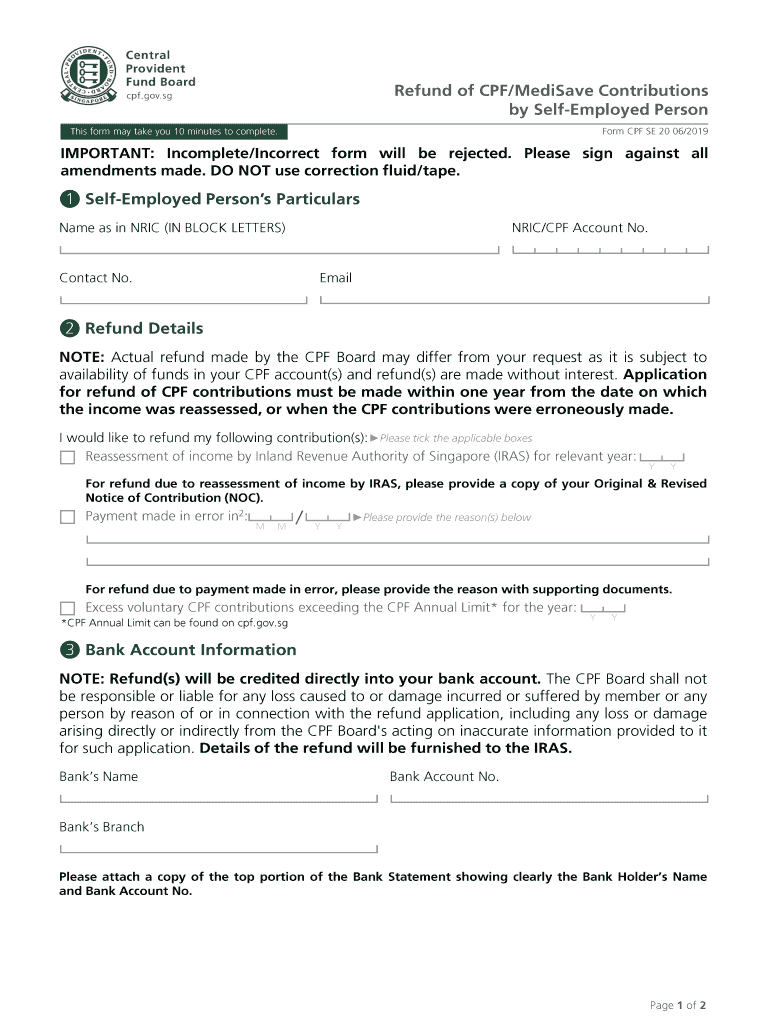

The OROV form, officially known as the Page 1 11DEN OROV ONIRA, is a document utilized by self-employed individuals in the United States for reporting contributions to the Central Provident Fund (CPF). This form is crucial for ensuring compliance with CPF regulations and for maintaining accurate records of contributions made over the fiscal year. It serves as a formal declaration of the amount contributed and is essential for both personal financial management and legal accountability.

Steps to Complete the OROV Form

Completing the OROV form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents that reflect your income and previous contributions. Next, accurately fill in your personal details, including your name, address, and CPF account number. It is important to detail your contribution amounts clearly, ensuring that they align with your financial records. After completing the form, review it thoroughly for any errors before submission. Finally, submit the form through the designated method, whether online or by mail, ensuring that it is sent before the filing deadline.

Legal Use of the OROV Form

The OROV form is legally binding, provided it is completed in accordance with the relevant regulations set forth by the CPF. To ensure its legal acceptance, the form must include accurate and truthful information regarding contributions. It is essential to comply with all local laws and regulations regarding self-employment and CPF contributions. Using a reliable e-signature platform can enhance the form's legality by providing an electronic certificate that verifies the authenticity of the signature.

Required Documents for the OROV Form

To successfully complete the OROV form, several documents are typically required. These may include:

- Proof of income, such as tax returns or pay stubs.

- Previous CPF contribution statements.

- Identification documents, like a driver's license or Social Security card.

- Any additional documentation that supports your self-employment status.

Having these documents on hand will facilitate a smoother completion process and ensure that all required information is accurately reported.

Form Submission Methods

The OROV form can be submitted through various methods, catering to the preferences of self-employed individuals. Options typically include:

- Online submission via the official CPF portal.

- Mailing a physical copy to the designated CPF office.

- In-person submission at local CPF offices, if applicable.

It is advisable to choose the method that best suits your needs, ensuring that you keep a copy of the submitted form for your records.

Penalties for Non-Compliance

Failure to submit the OROV form accurately and on time may result in penalties. These can include fines, interest on unpaid contributions, or other legal repercussions. Staying informed about filing deadlines and ensuring compliance with CPF regulations is essential for avoiding these potential issues. Regularly reviewing your contribution status can help maintain compliance and prevent any unexpected penalties.

Quick guide on how to complete page 1 11den orov onira central provident fund board

Complete Page 1 11DEN OROV ONIRA Central Provident Fund Board effortlessly on any gadget

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the resources you require to create, modify, and electronically sign your documents swiftly without delays. Manage Page 1 11DEN OROV ONIRA Central Provident Fund Board on any device with airSlate SignNow Android or iOS applications and streamline any document-related task today.

The easiest method to alter and electronically sign Page 1 11DEN OROV ONIRA Central Provident Fund Board without any hassle

- Find Page 1 11DEN OROV ONIRA Central Provident Fund Board and click Get Form to commence.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Produce your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Choose how you wish to send your form, either via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or mislaid documents, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Edit and electronically sign Page 1 11DEN OROV ONIRA Central Provident Fund Board and maintain exceptional communication at every point of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct page 1 11den orov onira central provident fund board

Create this form in 5 minutes!

How to create an eSignature for the page 1 11den orov onira central provident fund board

How to create an eSignature for the Page 1 11den Orov Onira Central Provident Fund Board in the online mode

How to create an electronic signature for the Page 1 11den Orov Onira Central Provident Fund Board in Google Chrome

How to make an electronic signature for signing the Page 1 11den Orov Onira Central Provident Fund Board in Gmail

How to create an eSignature for the Page 1 11den Orov Onira Central Provident Fund Board straight from your mobile device

How to generate an eSignature for the Page 1 11den Orov Onira Central Provident Fund Board on iOS

How to make an electronic signature for the Page 1 11den Orov Onira Central Provident Fund Board on Android OS

People also ask

-

What is the self employed medisave form site cpf gov sg?

The self employed medisave form site cpf gov sg is an official platform where self-employed individuals can submit their Medisave contributions. It streamlines the process, ensuring compliance with CPF regulations while allowing for easy tracking of contributions.

-

How can airSlate SignNow assist with the self employed medisave form site cpf gov sg?

airSlate SignNow provides an efficient way to electronically sign and send documents related to your self employed medisave form site cpf gov sg. By integrating our services, you can simplify the documentation process, saving time and reducing paperwork.

-

Is airSlate SignNow affordable for self-employed individuals managing their medisave contributions?

Yes, airSlate SignNow offers cost-effective solutions tailored for self-employed individuals. With flexible pricing plans, you can easily manage your self employed medisave form site cpf gov sg without breaking the bank.

-

What features does airSlate SignNow offer for managing self employed medisave forms?

airSlate SignNow includes features such as e-signature capabilities, document templates, and secure storage. These features enhance your experience with the self employed medisave form site cpf gov sg, making it easier to manage your contributions.

-

How secure is airSlate SignNow when handling sensitive documents like the self employed medisave form?

Security is a top priority for airSlate SignNow. We utilize advanced encryption technology to protect your sensitive data while you manage your self employed medisave form site cpf gov sg, giving you peace of mind about your financial information.

-

Can I integrate airSlate SignNow with other tools for managing my medisave contributions?

Yes, airSlate SignNow supports integration with various tools and platforms that can enhance your workflow. By integrating with financial management software, you can seamlessly manage your self employed medisave form site cpf gov sg.

-

What are the benefits of using airSlate SignNow for self employed individuals?

Using airSlate SignNow allows self-employed individuals to save time, reduce paperwork, and ensure compliance with regulations. The ease of use and efficiency make it a perfect solution for managing your self employed medisave form site cpf gov sg.

Get more for Page 1 11DEN OROV ONIRA Central Provident Fund Board

- Passport application instructions form

- 40 u form

- Purchase description action form

- Date of bid acceptance form

- Real estate acquisition and relocation policy and guidance form

- Full text of ampquotdtic ada111908 code of federal regulations 32 form

- Bne 034 report of receipt of a controlled chemical substance ag ca form

- Fillable online mass psychological and neuropsychological form

Find out other Page 1 11DEN OROV ONIRA Central Provident Fund Board

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document