Business Loan Application Form

What is the Business Loan Application?

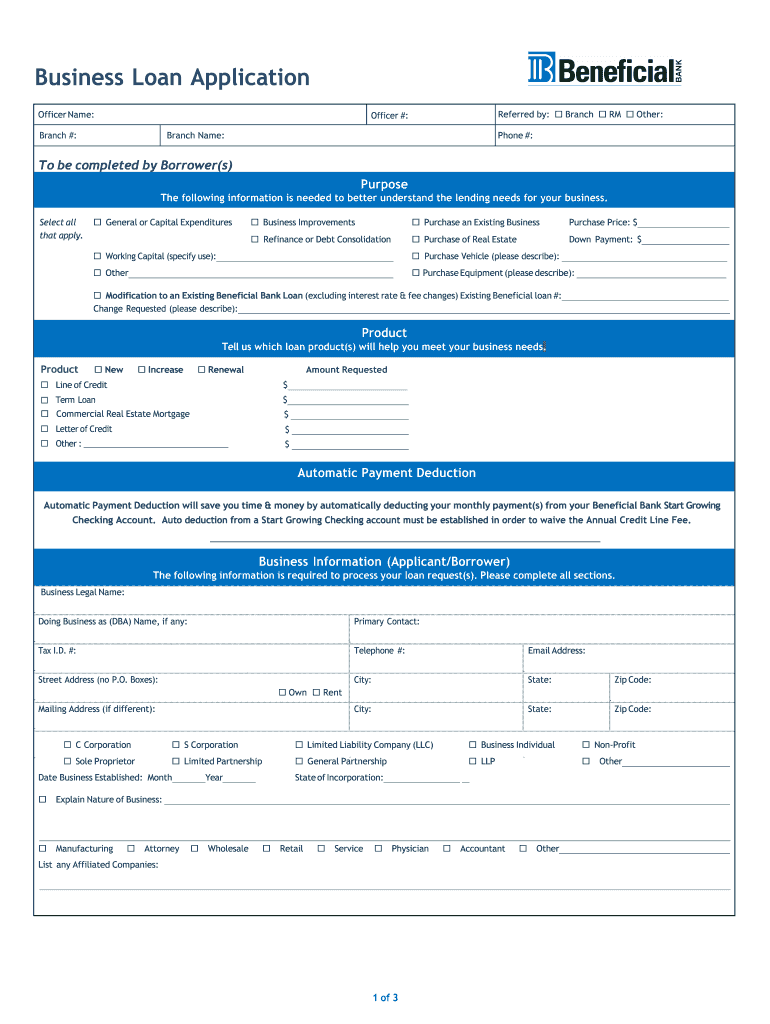

The business loan application form is a crucial document that businesses complete to request funding from financial institutions. This form typically requires detailed information about the business, including its legal structure, financial history, and the purpose of the loan. By providing this information, businesses can demonstrate their creditworthiness and ability to repay the loan. Understanding the components of the application is essential for ensuring that it is filled out accurately and completely.

Key Elements of the Business Loan Application

A comprehensive business loan application form includes several key elements that lenders evaluate. These elements often consist of:

- Business Information: Name, address, and contact details of the business.

- Ownership Structure: Details about the business owners and their percentage of ownership.

- Financial Statements: Profit and loss statements, balance sheets, and cash flow projections.

- Loan Purpose: A clear explanation of how the funds will be used.

- Repayment Plan: Information on how the business intends to repay the loan.

Steps to Complete the Business Loan Application

Completing the business loan application form involves several important steps. Following these steps can streamline the process and improve the chances of approval:

- Gather Necessary Documents: Collect all required financial documents and business information.

- Fill Out the Application: Carefully complete each section of the form, ensuring accuracy.

- Review for Errors: Double-check the application for any mistakes or missing information.

- Submit the Application: Send the completed form to the lender, either online or by mail.

Legal Use of the Business Loan Application

The business loan application form must adhere to various legal standards to be considered valid. This includes compliance with federal and state regulations governing lending practices. Additionally, the application may require signatures that confirm the accuracy of the information provided. Using a reputable eSignature solution can help ensure that the application is legally binding, meeting the requirements set forth by laws such as the ESIGN Act and UETA.

Required Documents

When completing the business loan application form, specific documents are typically required to support the application. These documents may include:

- Business tax returns for the last two years.

- Personal tax returns of business owners.

- Financial statements, including profit and loss statements and balance sheets.

- Business plan outlining the purpose of the loan and how the funds will be used.

- Legal documents, such as business licenses and incorporation papers.

Eligibility Criteria

Understanding the eligibility criteria for a business loan is vital for applicants. Lenders typically evaluate factors such as:

- Credit score of the business and its owners.

- Time in business, with many lenders requiring at least one to two years of operation.

- Annual revenue and profitability.

- Debt-to-income ratio, which assesses the business's ability to manage additional debt.

Quick guide on how to complete business loan application

Complete Business Loan Application seamlessly on any device

Managing documents online has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it digitally. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without interruptions. Handle Business Loan Application on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest method to modify and eSign Business Loan Application without hassle

- Obtain Business Loan Application and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Decide how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the issues of lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Business Loan Application to ensure clear communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the business loan application

The best way to make an eSignature for a PDF in the online mode

The best way to make an eSignature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

How to generate an eSignature straight from your smart phone

How to make an eSignature for a PDF on iOS devices

How to generate an eSignature for a PDF document on Android OS

People also ask

-

What is a loan form and how is it used?

A loan form is a document that outlines the details of a loan agreement between a borrower and a lender. It typically includes information such as loan amount, interest rates, repayment terms, and personal borrower details. Using airSlate SignNow, you can easily create, send, and eSign loan forms to ensure a smooth approval process.

-

How much does it cost to create a loan form with airSlate SignNow?

The pricing for creating a loan form with airSlate SignNow is competitive and offers various plans to suit businesses of all sizes. Whether you're a startup or an established business, our plans are cost-effective, allowing you to manage your loan forms without breaking the bank. Check our pricing page for detailed information on each plan.

-

What features does airSlate SignNow offer for loan forms?

airSlate SignNow offers a range of features to enhance your loan form experience, including customizable templates, workflow automation, and secure electronic signatures. These features streamline the loan approval process, making it faster and more efficient. You can also track the status of your loan forms in real-time.

-

Can I integrate loan forms with other software using airSlate SignNow?

Yes, airSlate SignNow provides seamless integration options with a variety of software such as CRMs, accounting tools, and document management systems. This allows you to incorporate your loan forms into your existing workflow for improved efficiency. Integrating your software ensures that your loan process is centralized and organized.

-

What are the benefits of using airSlate SignNow for loan forms?

Using airSlate SignNow for loan forms offers numerous benefits; it's user-friendly, cost-effective, and enhances efficiency through automation. You can reduce paperwork and speed up the loan approval process with secure electronic signatures. Additionally, our platform ensures compliance and security during document transactions.

-

Is it safe to eSign a loan form with airSlate SignNow?

Absolutely! airSlate SignNow prioritizes the security of your loan forms with advanced encryption and compliance with industry standards. Your personal and financial information is safeguarded, ensuring that eSigning your loan form is safe and reliable. We take digital security seriously, so you can trust our platform.

-

How long does it take to complete a loan form on airSlate SignNow?

Completing a loan form on airSlate SignNow can be done in a matter of minutes. Our intuitive interface allows you to fill out your information quickly and submit it for eSignature. The fast processing time ensures your loan forms can be handled swiftly, helping you to secure your financing without unnecessary delays.

Get more for Business Loan Application

- Control number tx p091 pkg form

- Above described and that said animal is being sold in an as is or form

- Bill of sale horse this agreement is made this day of form

- With all faults form

- Control number ny p091a pkg form

- Get car insurance rates stemxchangeorg form

- Bill of sale without warranties logo file form

- Control number ga p091 pkg form

Find out other Business Loan Application

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online