Dave Ramsey Debt Snowball PDF Form

What is the Dave Ramsey Debt Snowball PDF

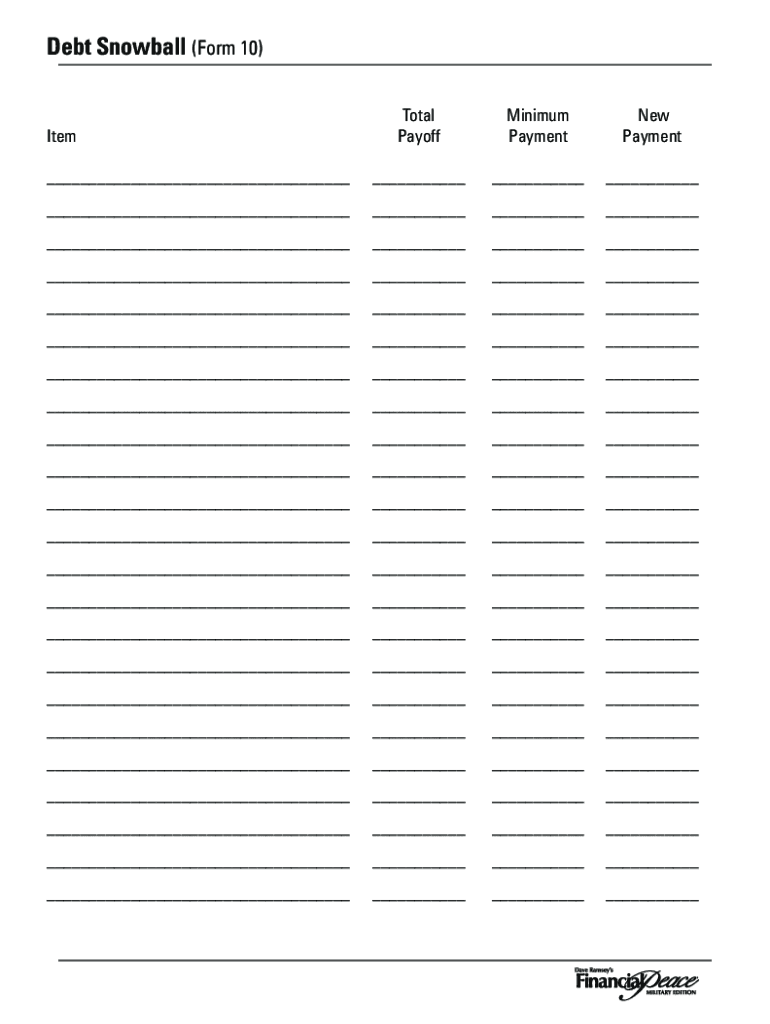

The Dave Ramsey Debt Snowball PDF is a structured financial tool designed to help individuals manage and eliminate debt systematically. This worksheet allows users to list their debts, including balances and interest rates, and prioritize them based on the debt snowball method. This approach focuses on paying off the smallest debts first, which can provide quick wins and motivate users to continue their debt reduction journey. The PDF format ensures easy access, printing, and filling out, making it a practical resource for those seeking to take control of their finances.

How to Use the Dave Ramsey Debt Snowball PDF

Using the Dave Ramsey Debt Snowball PDF involves several straightforward steps. First, print the worksheet or fill it out digitally. Begin by listing all your debts in the designated fields, ensuring to include the total amount owed and the minimum monthly payment for each. Next, rank your debts from smallest to largest. Focus on making minimum payments on all debts except the smallest one, to which you will allocate any extra funds. Once the smallest debt is paid off, move to the next one on your list, repeating this process until all debts are eliminated. Tracking your progress on the worksheet can enhance motivation and provide a clear visual of your journey toward financial freedom.

Steps to Complete the Dave Ramsey Debt Snowball PDF

Completing the Dave Ramsey Debt Snowball PDF involves a few key steps:

- Gather Financial Information: Collect statements for all your debts, including credit cards, loans, and any other obligations.

- List Your Debts: Fill in the worksheet with each debt's name, total balance, and minimum payment.

- Rank Your Debts: Organize the debts from smallest to largest based on the total amount owed.

- Allocate Extra Payments: Decide how much extra money you can put toward the smallest debt each month.

- Track Progress: As you pay off each debt, mark it on the worksheet to visualize your progress.

Legal Use of the Dave Ramsey Debt Snowball PDF

The Dave Ramsey Debt Snowball PDF is a personal finance tool and does not require any specific legal compliance for its use. However, it is essential to ensure that the information entered is accurate and reflects your current financial situation. Using this worksheet can help you develop a clear plan for debt repayment, which may be beneficial if you seek financial advice or assistance from professionals. While the document itself is not legally binding, maintaining accurate records of your debts and payments can be valuable in case of disputes or negotiations with creditors.

Key Elements of the Dave Ramsey Debt Snowball PDF

Several key elements make the Dave Ramsey Debt Snowball PDF effective for debt management:

- Debt Listing: A section to record all debts, including the creditor name, balance, and interest rate.

- Payment Tracker: A feature to monitor monthly payments and track progress toward debt elimination.

- Motivational Quotes: Inspirational messages that encourage persistence and commitment to the debt repayment process.

- Visual Progress Indicators: Space to mark off debts as they are paid off, providing a sense of accomplishment.

Examples of Using the Dave Ramsey Debt Snowball PDF

There are various scenarios in which individuals can effectively use the Dave Ramsey Debt Snowball PDF:

- Single Individuals: A person with multiple credit card debts can utilize the worksheet to focus on paying off the smallest balance first.

- Families: A household can collectively use the worksheet to manage family debts and work together toward financial goals.

- Students: Recent graduates can apply the debt snowball method to tackle student loans and credit card debt systematically.

Quick guide on how to complete dave ramsey debt snowball pdf

Effortlessly Prepare Dave Ramsey Debt Snowball Pdf on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely preserve it online. airSlate SignNow equips you with all the resources required to create, adjust, and electronically sign your documents swiftly without any hold-ups. Handle Dave Ramsey Debt Snowball Pdf on any device using airSlate SignNow apps for Android or iOS and enhance any document-centric activity today.

The simplest method to modify and eSign Dave Ramsey Debt Snowball Pdf with ease

- Find Dave Ramsey Debt Snowball Pdf and click Get Form to commence.

- Utilize the features we provide to fill out your form.

- Emphasize pertinent parts of the documents or redact private details with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to preserve your changes.

- Select your preferred method to deliver your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the anxiety of lost or misplaced documents, cumbersome form navigation, or errors necessitating the printing of new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you choose. Modify and eSign Dave Ramsey Debt Snowball Pdf and guarantee effective communication throughout any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dave ramsey debt snowball pdf

The way to create an electronic signature for your PDF document in the online mode

The way to create an electronic signature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

How to make an electronic signature right from your mobile device

The best way to create an electronic signature for a PDF document on iOS devices

How to make an electronic signature for a PDF on Android devices

People also ask

-

What is a debt snowball worksheet PDF?

A debt snowball worksheet PDF is a printable financial tool that helps you track your debts and payments systematically. It allows users to prioritize debts based on their balances and interest rates, making it easier to pay off debts effectively. This structured approach can foster motivation and clarity in your debt repayment journey.

-

How can the debt snowball worksheet PDF help me manage my debts?

Using a debt snowball worksheet PDF provides a clear visual representation of your debts, helping you focus on paying off the smallest debts first. This method can generate quick wins and increased motivation as you see your progress. Moreover, it streamlines your budgeting process, making it easier to allocate funds towards your debt repayment.

-

Is there a cost associated with obtaining the debt snowball worksheet PDF?

The debt snowball worksheet PDF is often available for free or at a minimal cost from various financial management platforms. By choosing airSlate SignNow, you can access additional features and integrations that enhance your overall financial planning experience. Investing in such tools can lead to signNow savings in interest payments over time.

-

Can I customize my debt snowball worksheet PDF?

Yes, the debt snowball worksheet PDF can often be customized to fit your specific financial situation. Many tools allow users to add or remove items and tailor designs to their preferences. This customization ensures you have a personalized tool that works best for your unique repayment strategy.

-

Does the debt snowball worksheet PDF integrate with other budgeting tools?

Many debt snowball worksheet PDFs can be integrated with budgeting and financial tracking software for seamless management of your financial goals. airSlate SignNow offers integrations that facilitate document sharing and eSigning, enhancing collaboration with financial advisors. This capability ensures you have a holistic view of your finances while using the worksheet.

-

How does using a debt snowball worksheet PDF benefit my overall financial health?

Utilizing a debt snowball worksheet PDF can signNowly improve your financial health by providing a structured path towards debt elimination. By prioritizing debts, you can reduce stress and increase your credit score over time. This method also promotes disciplined spending habits, contributing to better overall financial management.

-

How do I get started with my debt snowball worksheet PDF?

To start using a debt snowball worksheet PDF, first compile a list of all your debts, including balances and interest rates. Next, prioritize them based on your chosen method, typically starting from the smallest balance. Once organized, you can begin making payments according to the debts listed in your worksheet.

Get more for Dave Ramsey Debt Snowball Pdf

Find out other Dave Ramsey Debt Snowball Pdf

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement