No Information Reporting

Understanding No Information Reporting

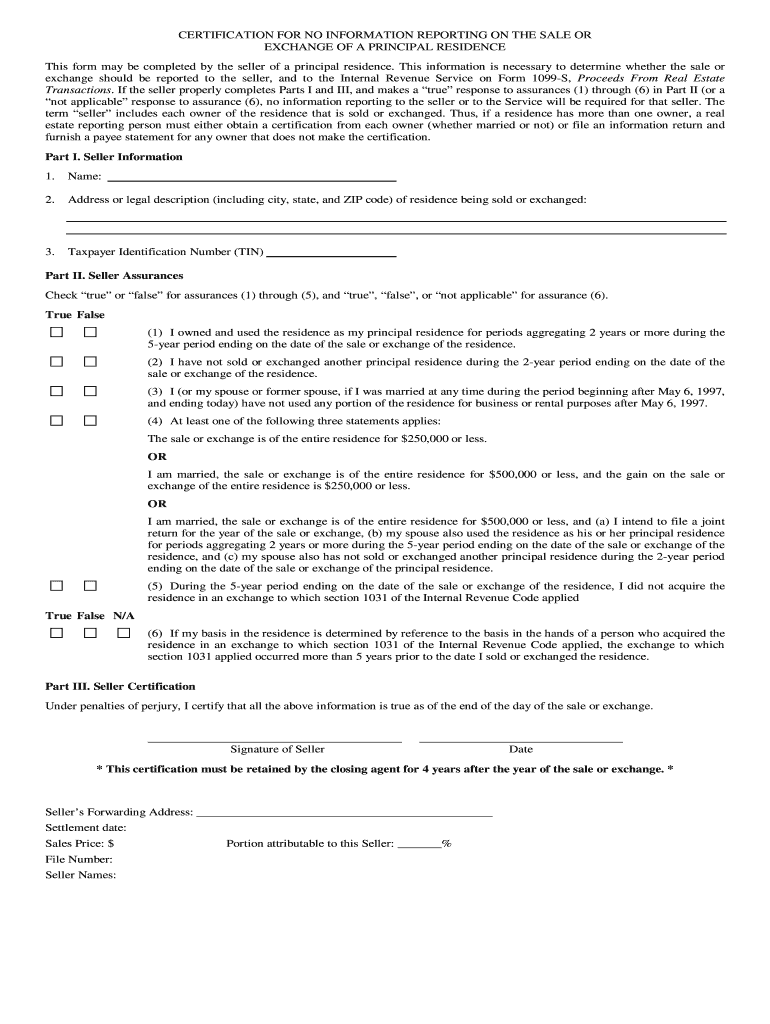

No information reporting refers to specific instances where individuals or entities are not required to report certain types of income or transactions to the IRS. This can apply to various situations, such as the sale of a principal residence under certain conditions. Understanding this concept is essential for compliance with tax laws and ensuring that you are not inadvertently violating reporting requirements.

Steps to Complete the No Information Reporting

Completing the no information reporting form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documentation related to the transaction. This may include proof of ownership, sale agreements, and any relevant financial records. Next, fill out the form carefully, ensuring that all required fields are completed. Double-check your entries for accuracy, as mistakes can lead to complications. Finally, submit the form according to the specified guidelines, either online or via mail, depending on your preference.

Legal Use of No Information Reporting

The legal use of no information reporting is governed by IRS guidelines and regulations. It is important to understand the specific conditions under which this reporting exemption applies. For example, if you sell your principal residence and meet certain criteria, you may not need to report the sale. However, failing to adhere to these legal requirements can result in penalties or fines. Consulting with a tax professional can provide clarity on your obligations and help ensure that you are in compliance with all applicable laws.

Required Documents for No Information Reporting

When preparing to submit a no information reporting form, it is crucial to have the correct documentation ready. Required documents typically include proof of the transaction, such as a sales contract or closing statement. Additionally, any documentation that supports your eligibility for the no information reporting exemption should be included. This might consist of records demonstrating your ownership period and any improvements made to the property. Having these documents organized will facilitate a smoother submission process.

IRS Guidelines for No Information Reporting

The IRS provides specific guidelines regarding no information reporting that individuals and businesses must follow. These guidelines outline the criteria for eligibility, the types of transactions that qualify, and the documentation required for compliance. It is essential to review these guidelines thoroughly to ensure that you understand your responsibilities and the potential implications of non-compliance. Staying informed about any changes to these regulations can also help you maintain compliance in future transactions.

Examples of Using No Information Reporting

Examples of no information reporting can illustrate how this concept applies in real-world scenarios. For instance, if a homeowner sells their principal residence and meets the IRS criteria for exclusion, they may not need to report the sale on their tax return. Another example could involve certain business transactions where income is not subject to reporting due to specific exemptions. Understanding these examples can provide clarity on how no information reporting functions and its relevance to your financial situation.

Quick guide on how to complete no information reporting

Effortlessly Prepare No Information Reporting on Any Device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers an ideal sustainable alternative to conventional printed and signed documents, allowing you to easily locate the right form and securely store it online. airSlate SignNow provides you with everything necessary to create, modify, and electronically sign your documents quickly without delays. Manage No Information Reporting on any device with airSlate SignNow apps for Android or iOS and enhance any document-related workflow today.

How to Edit and Electronically Sign No Information Reporting with Ease

- Locate No Information Reporting and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with the tools that airSlate SignNow specially provides for this purpose.

- Create your electronic signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign No Information Reporting to ensure excellent communication at any point in the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the no information reporting

The way to create an eSignature for a PDF file online

The way to create an eSignature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

How to make an electronic signature from your mobile device

The best way to generate an eSignature for a PDF file on iOS

How to make an electronic signature for a PDF file on Android devices

People also ask

-

What is certification no reporting in airSlate SignNow?

Certification no reporting in airSlate SignNow refers to the ability to complete document signing without the need for reporting capabilities. This feature is ideal for businesses that prioritize privacy and a streamlined process without the complexities of audit trails.

-

How does airSlate SignNow ensure security with certification no reporting?

With certification no reporting, airSlate SignNow emphasizes document security by employing advanced encryption methods. Users can confidently send and eSign documents, knowing that sensitive information is protected, while eliminating the need for detailed reporting.

-

Is there a cost associated with using certification no reporting in airSlate SignNow?

The pricing for airSlate SignNow is competitive, providing flexible plans that include features like certification no reporting. Customers can choose a package that aligns with their needs, ensuring they only pay for the features they use.

-

What benefits do I get from using certification no reporting?

Utilizing certification no reporting enhances user experience by simplifying the document signing process. It allows businesses to focus on efficiency and confidentiality without the distraction of generating reports, thereby saving time and resources.

-

Can I integrate certification no reporting with other software?

Yes, airSlate SignNow offers a variety of integrations that work seamlessly with certification no reporting. This allows users to connect with platforms like CRMs and document management systems, enhancing overall workflow efficiency.

-

Is certification no reporting suitable for all business types?

Certification no reporting is versatile and can benefit businesses of all sizes that seek a straightforward eSigning solution. It is particularly advantageous for industries where confidentiality is critical, such as legal or healthcare sectors.

-

How do I set up certification no reporting in airSlate SignNow?

Setting up certification no reporting in airSlate SignNow is straightforward. Users can navigate to the settings within their account to enable this feature, simplifying document signing while ensuring compliance with their business practices.

Get more for No Information Reporting

Find out other No Information Reporting

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now