Police and Fire Insurance Form 2006-2026

What is the Police and Fire Insurance Form

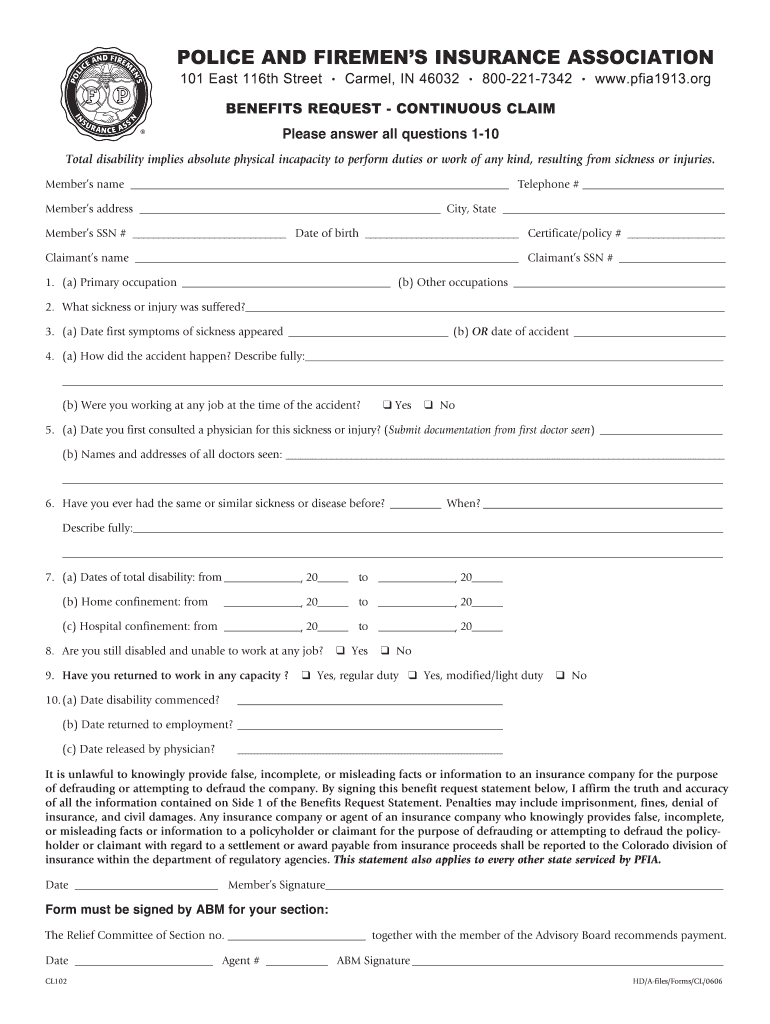

The Police and Fire Insurance Form is a specialized document designed to facilitate insurance claims for police officers and firefighters. This form is essential for initiating the claims process related to injuries or incidents sustained while performing their duties. It provides a structured way to report details of the incident, ensuring that all necessary information is captured for the insurance provider to assess the claim accurately. Understanding the purpose of this form is crucial for first responders seeking benefits related to their service.

Steps to Complete the Police and Fire Insurance Form

Completing the Police and Fire Insurance Form involves several key steps to ensure accuracy and compliance. First, gather all relevant information, including personal details, incident specifics, and any supporting documentation. Next, fill out the form carefully, ensuring that all sections are completed thoroughly. Pay particular attention to the description of the incident, as this will be critical for the claims process. After completing the form, review it for any errors or omissions before submitting it to the appropriate insurance provider.

Legal Use of the Police and Fire Insurance Form

The legal use of the Police and Fire Insurance Form is governed by specific regulations that ensure its validity in claims processing. This form must be filled out accurately and submitted within designated timelines to be considered for coverage. Compliance with state and federal laws regarding insurance claims is essential. Additionally, the form must be signed by the claimant, affirming that the information provided is true and complete. Failure to adhere to these legal requirements may result in delays or denial of the claim.

Required Documents for the Police and Fire Insurance Form

To successfully complete the Police and Fire Insurance Form, several documents may be required. These typically include proof of employment, incident reports, medical records, and any other documentation that supports the claim. It is important to gather these documents before starting the form to ensure a smooth and efficient claims process. Having all necessary paperwork ready can help expedite the review and approval of the claim by the insurance provider.

Form Submission Methods

The Police and Fire Insurance Form can be submitted through various methods, depending on the insurance provider's requirements. Common submission methods include online submission through a secure portal, mailing the completed form to the insurance company, or delivering it in person to a designated office. Each method has its own advantages, such as immediate processing for online submissions or the ability to ask questions in person. It is advisable to choose the method that best suits your needs and ensures timely processing of your claim.

Eligibility Criteria for the Police and Fire Insurance Form

Eligibility for filing the Police and Fire Insurance Form typically depends on the individual's employment status and the nature of the incident. Generally, active duty police officers and firefighters are eligible to file claims related to injuries or incidents occurring in the line of duty. Specific eligibility criteria may vary by state or insurance provider, so it is important to review the requirements carefully. Understanding these criteria can help ensure that the claim is valid and meets all necessary conditions for approval.

Quick guide on how to complete police and fire insurance form

Effortlessly Prepare Police And Fire Insurance Form on Any Device

Managing documents online has become increasingly popular among both organizations and individuals. It serves as a perfect eco-friendly alternative to traditional printed and signed paperwork, enabling you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents quickly and without delays. Handle Police And Fire Insurance Form on any device using the airSlate SignNow apps for Android or iOS, streamlining any document-related process today.

How to Edit and eSign Police And Fire Insurance Form with Ease

- Obtain Police And Fire Insurance Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or redact sensitive information with the tools provided by airSlate SignNow specifically for that purpose.

- Generate your signature using the Sign tool, which only takes seconds and holds the same legal significance as a traditional handwritten signature.

- Review all the details and then click the Done button to save your modifications.

- Select your preferred method for sharing your form: via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that require the printing of new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Police And Fire Insurance Form to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the police and fire insurance form

How to make an electronic signature for your PDF document online

How to make an electronic signature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The way to create an eSignature from your smart phone

The best way to generate an electronic signature for a PDF document on iOS

The way to create an eSignature for a PDF file on Android OS

People also ask

-

What is police and fireman insurance?

Police and fireman insurance is a specialized insurance policy designed to cater to the unique needs of law enforcement and firefighting professionals. It typically provides coverage for various risks associated with their jobs, including health, disability, and liability protection. This type of insurance ensures that police officers and firemen receive adequate support and peace of mind while serving their communities.

-

What are the key benefits of police and fireman insurance?

The primary benefits of police and fireman insurance include financial protection, peace of mind, and specialized coverage tailored to the risks these professionals face. It can cover medical expenses, disability income, and legal liabilities, allowing officers and firefighters to focus on their duties without worrying about financial repercussions. Additionally, this insurance often includes options for family coverage.

-

How much does police and fireman insurance cost?

The cost of police and fireman insurance can vary based on factors such as coverage limits, the individual's occupation, and location. On average, premiums may range from $30 to $200 monthly, depending on the policy specifics. It's advisable to obtain quotes from multiple providers to compare rates and find the best fit for your needs.

-

What features should I look for in a police and fireman insurance policy?

When choosing police and fireman insurance, look for features such as comprehensive liability coverage, income protection, and additional options for family coverage. Ensure the policy addresses specific risks associated with your occupation, such as injury from a hazardous work environment. Flexibility in selecting coverage limits is also crucial to meet your personal and financial needs.

-

Are there any discounts available for police and fireman insurance?

Many insurance providers offer discounts for police and fireman insurance, especially for active duty personnel and those who bundle multiple policies. By maintaining a clean record and attending safety training programs, you may qualify for even more savings. Be sure to inquire about available discounts when getting quotes.

-

How can I file a claim for police and fireman insurance?

To file a claim for police and fireman insurance, contact your insurance provider directly through their claims department. You will typically need to provide documentation regarding the incident, such as police reports, medical records, or any other relevant information. The claims process may vary by provider, so it's important to familiarize yourself with their specific procedures.

-

Can I customize my police and fireman insurance coverage?

Yes, many insurance providers allow customization of police and fireman insurance coverage to fit your unique needs. You can often choose different coverage limits, add-ons, and deductibles to tailor your policy. Discuss your options with an insurance agent to ensure you receive the most suitable coverage for your professional circumstances.

Get more for Police And Fire Insurance Form

- That the undersigned for a good and valuable consideration form

- State of georgia county of fulton resolution no 16 09 384 a form

- Utility easement for 1 signer form 8

- Right of way definedbrookhaven georgia city of form

- Subdivision right of way frequently asked questions form

- Georgia road easement for purposes of ingress and egress form

- In the magistrate court of lowndes county form

- Security deed fill online printable fillable blankpdffiller form

Find out other Police And Fire Insurance Form

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later