Motion to File Notice Concerning Fiduciary Relationship Form

What is the Motion to File Notice Concerning Fiduciary Relationship Form

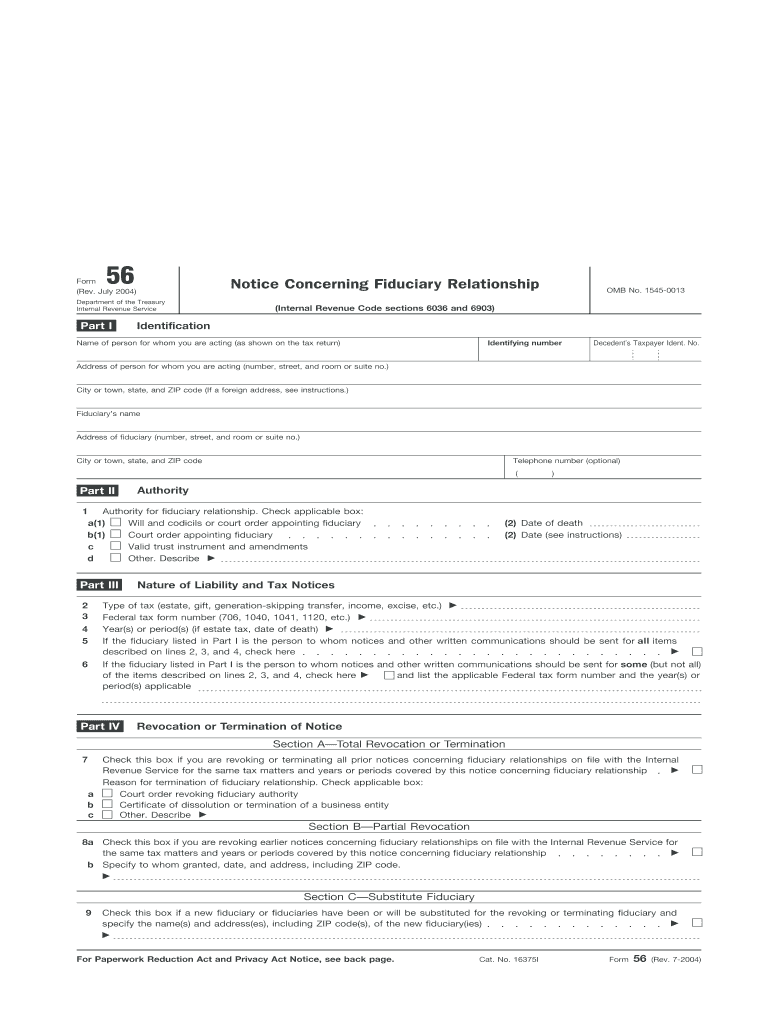

The Motion to File Notice Concerning Fiduciary Relationship Form is a legal document used to formally notify relevant parties about the establishment of a fiduciary relationship. This form is essential in various legal contexts, particularly in estate planning, trust management, or when a fiduciary is appointed to manage someone's affairs. It ensures transparency and provides a record of the fiduciary's responsibilities, which can include managing assets or making decisions on behalf of another person.

How to Use the Motion to File Notice Concerning Fiduciary Relationship Form

To effectively use the Motion to File Notice Concerning Fiduciary Relationship Form, begin by gathering all necessary information about the fiduciary relationship. This includes details about the fiduciary, the individual or entity they represent, and the scope of the fiduciary duties. Once you have this information, fill out the form accurately, ensuring that all sections are completed. After completing the form, it must be filed with the appropriate court or agency, depending on state-specific requirements.

Steps to Complete the Motion to File Notice Concerning Fiduciary Relationship Form

Completing the Motion to File Notice Concerning Fiduciary Relationship Form involves several key steps:

- Gather necessary information about the fiduciary and the individual they represent.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions.

- Sign and date the form where indicated.

- File the completed form with the appropriate court or agency.

Legal Use of the Motion to File Notice Concerning Fiduciary Relationship Form

The legal use of the Motion to File Notice Concerning Fiduciary Relationship Form is crucial for establishing a clear record of fiduciary duties. This form protects both the fiduciary and the individual they represent by outlining responsibilities and expectations. It is important to ensure that the form is filed in compliance with state laws to avoid potential disputes or legal complications in the future.

Key Elements of the Motion to File Notice Concerning Fiduciary Relationship Form

Key elements of the Motion to File Notice Concerning Fiduciary Relationship Form include:

- The names and contact information of the fiduciary and the individual they represent.

- A description of the fiduciary duties being undertaken.

- The date the fiduciary relationship was established.

- Signatures of all relevant parties, confirming their agreement and understanding.

Filing Deadlines / Important Dates

Filing deadlines for the Motion to File Notice Concerning Fiduciary Relationship Form can vary by state and the specific circumstances of the fiduciary relationship. It is essential to check local regulations to ensure timely filing. Missing a deadline may result in legal complications or the invalidation of the fiduciary relationship.

Quick guide on how to complete motion to file notice concerning fiduciary relationship form

Complete Motion To File Notice Concerning Fiduciary Relationship Form effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can locate the necessary form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly and seamlessly. Manage Motion To File Notice Concerning Fiduciary Relationship Form on any device with airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to edit and eSign Motion To File Notice Concerning Fiduciary Relationship Form with ease

- Obtain Motion To File Notice Concerning Fiduciary Relationship Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or conceal sensitive information using tools that airSlate SignNow provides specifically for this purpose.

- Generate your signature with the Sign feature, which takes mere seconds and carries the same legal authority as a traditional wet ink signature.

- Verify all the details and click the Done button to save your modifications.

- Choose how you wish to deliver your form, via email, SMS, an invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that demand reprinting new copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Modify and eSign Motion To File Notice Concerning Fiduciary Relationship Form and guarantee exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I store form values to a JSON file after filling the HTML form and submitting it using Node.js?

//on submit you can do like this

Create this form in 5 minutes!

How to create an eSignature for the motion to file notice concerning fiduciary relationship form

How to create an eSignature for your Motion To File Notice Concerning Fiduciary Relationship Form online

How to create an eSignature for your Motion To File Notice Concerning Fiduciary Relationship Form in Chrome

How to create an eSignature for signing the Motion To File Notice Concerning Fiduciary Relationship Form in Gmail

How to create an electronic signature for the Motion To File Notice Concerning Fiduciary Relationship Form right from your smartphone

How to make an electronic signature for the Motion To File Notice Concerning Fiduciary Relationship Form on iOS

How to create an electronic signature for the Motion To File Notice Concerning Fiduciary Relationship Form on Android OS

People also ask

-

What is the Motion To File Notice Concerning Fiduciary Relationship Form?

The Motion To File Notice Concerning Fiduciary Relationship Form is a legal document used in fiduciary cases to inform relevant parties of a fiduciary's role. This form helps ensure transparency and proper communication among involved parties, which is crucial in fiduciary relationships.

-

How can I create a Motion To File Notice Concerning Fiduciary Relationship Form using airSlate SignNow?

Creating a Motion To File Notice Concerning Fiduciary Relationship Form with airSlate SignNow is simple and intuitive. You can use our easy-to-navigate platform to customize the form, add necessary fields, and securely send it for eSignature, streamlining the process signNowly.

-

Is airSlate SignNow secure for handling legal documents like the Motion To File Notice Concerning Fiduciary Relationship Form?

Absolutely! airSlate SignNow prioritizes security, providing robust encryption and compliance with legal standards. Your Motion To File Notice Concerning Fiduciary Relationship Form will be securely stored and transmitted, ensuring confidentiality and integrity.

-

What are the benefits of using airSlate SignNow for the Motion To File Notice Concerning Fiduciary Relationship Form?

Using airSlate SignNow for the Motion To File Notice Concerning Fiduciary Relationship Form allows for quick document preparation, efficient eSigning, and seamless collaboration. Additionally, our platform saves time and reduces paper waste, making the process more environmentally friendly.

-

Does airSlate SignNow offer pricing plans for using the Motion To File Notice Concerning Fiduciary Relationship Form?

Yes, airSlate SignNow provides flexible pricing plans tailored to various business needs. You can choose a plan that fits your requirements and budget, ensuring you have access to all the features needed for creating and managing your Motion To File Notice Concerning Fiduciary Relationship Form.

-

Can I integrate airSlate SignNow with other applications for my fiduciary documents?

Yes, airSlate SignNow offers seamless integrations with various applications, enhancing your workflow. You can easily connect with tools like Google Drive, Dropbox, and others to manage your Motion To File Notice Concerning Fiduciary Relationship Form alongside your existing systems.

-

What features does airSlate SignNow provide for document management?

airSlate SignNow includes a range of features for effective document management, such as customizable templates, automated reminders, and real-time tracking. These features ensure that your Motion To File Notice Concerning Fiduciary Relationship Form is handled efficiently and stays organized throughout the process.

Get more for Motion To File Notice Concerning Fiduciary Relationship Form

- Salt lake city utah 84108 1221 form

- Hhs publishes guidance on how to de identify protected form

- If the child to be vaccinated is 2 through 4 years of age has a healthcare provider told you form

- Executive education systems engineering and management sem program form

- 2018 al cpt fillable form

- Office of human resources rata orientationplan year2019 form

- Wipo mm18 form

- Attractions form

Find out other Motion To File Notice Concerning Fiduciary Relationship Form

- Sign Kentucky New hire forms Myself

- Sign Alabama New hire packet Online

- How Can I Sign California Verification of employment form

- Sign Indiana Home rental application Online

- Sign Idaho Rental application Free

- Sign South Carolina Rental lease application Online

- Sign Arizona Standard rental application Now

- Sign Indiana Real estate document Free

- How To Sign Wisconsin Real estate document

- Sign Montana Real estate investment proposal template Later

- How Do I Sign Washington Real estate investment proposal template

- Can I Sign Washington Real estate investment proposal template

- Sign Wisconsin Real estate investment proposal template Simple

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe