Sba Loan Application Pacific Commerce Bank Form

Key elements of the SBA 7(a) loan application

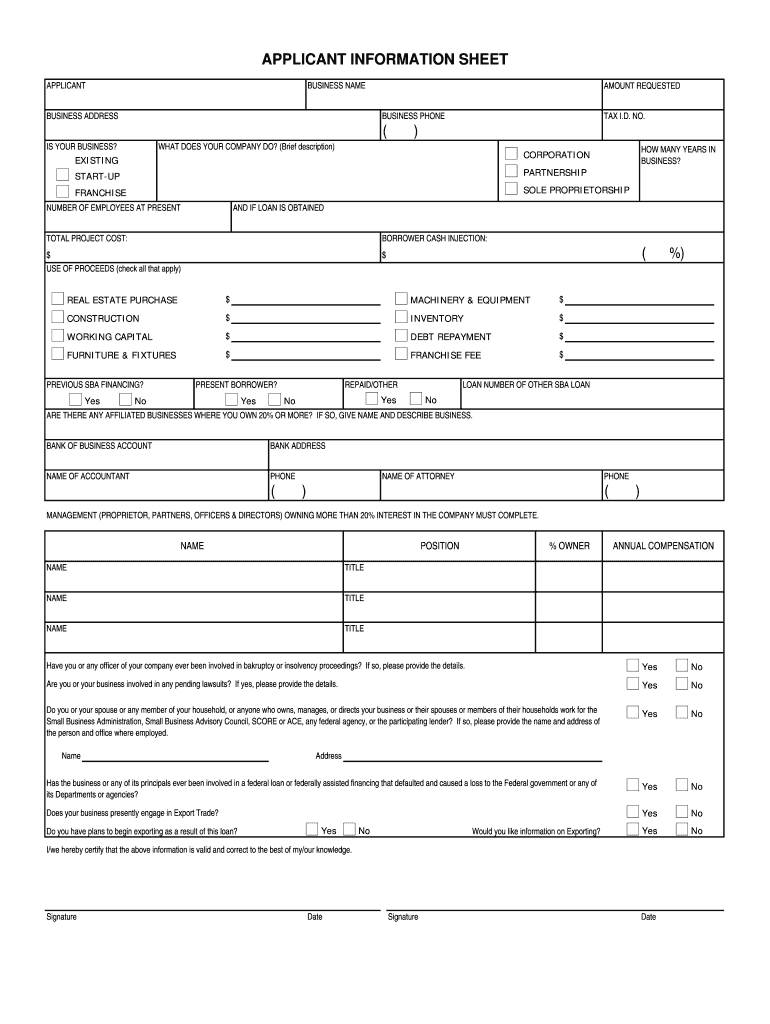

The SBA 7(a) loan application consists of several essential components that ensure a comprehensive evaluation of your business's eligibility for funding. Understanding these elements is crucial for a successful application. The primary components include:

- Business Information: This section requires details about your business, including its legal name, address, and type of business entity (e.g., LLC, corporation).

- Loan Amount Requested: Clearly specify the amount of funding you are seeking, which should align with your business needs and financial projections.

- Use of Funds: Outline how you plan to utilize the loan proceeds, such as purchasing equipment, working capital, or real estate.

- Financial Statements: Include personal and business financial statements, tax returns, and cash flow projections to demonstrate your financial health.

- Personal Background Information: Provide information about the business owners, including education, experience, and any prior business ventures.

Steps to complete the SBA 7(a) loan application

Completing the SBA 7(a) loan application involves a series of methodical steps to ensure accuracy and compliance. Follow these steps for a smooth application process:

- Gather Required Documents: Collect all necessary documentation, including financial statements, tax returns, and personal identification.

- Fill Out the Application Form: Complete the SBA loan application form, ensuring that all sections are filled out accurately and thoroughly.

- Prepare a Business Plan: Develop a detailed business plan that outlines your business model, market analysis, and financial projections.

- Review and Edit: Carefully review the application and all supporting documents for completeness and accuracy. Make any necessary edits.

- Submit the Application: Send your completed application and all supporting documents to the lender or the appropriate SBA office.

Eligibility criteria for the SBA 7(a) loan

Understanding the eligibility criteria for the SBA 7(a) loan is vital for prospective borrowers. The following factors are typically considered:

- Business Size: Your business must meet the SBA's size standards, which vary by industry.

- Business Type: Eligible businesses include for-profit entities, certain non-profits, and cooperatives.

- Creditworthiness: Lenders will assess your credit history and score to determine your ability to repay the loan.

- Business Purpose: The loan must be used for a legitimate business purpose, such as purchasing equipment or working capital.

- Owner's Investment: Owners are generally expected to invest personal funds into the business to demonstrate commitment.

Required documents for the SBA 7(a) loan application

When applying for the SBA 7(a) loan, certain documents are crucial to substantiate your application. Ensure you have the following documents ready:

- Personal Financial Statement: A comprehensive overview of your personal financial situation, including assets and liabilities.

- Business Financial Statements: Recent financial statements, including balance sheets and income statements.

- Tax Returns: Personal and business tax returns for the past three years.

- Business Plan: A detailed business plan that outlines your business strategy and financial projections.

- Legal Documents: Any necessary legal documents, such as business licenses, articles of incorporation, or partnership agreements.

Form submission methods for the SBA 7(a) loan application

Submitting your SBA 7(a) loan application can be done through various methods, depending on the lender's requirements. Here are the common submission options:

- Online Submission: Many lenders offer online platforms for submitting applications electronically, streamlining the process.

- Mail Submission: You can send your application and documents via postal mail to the lender or SBA office.

- In-Person Submission: Some applicants may prefer to submit their applications in person at a local lender's office or SBA district office.

Legal use of the SBA 7(a) loan application

The legal use of the SBA 7(a) loan application is governed by specific regulations that ensure compliance and legitimacy. Understanding these regulations is essential:

- Compliance with SBA Guidelines: The application must adhere to the SBA's guidelines for eligibility and documentation.

- Accurate Representation: All information provided in the application must be truthful and accurately represent your business and financial situation.

- Signature Requirements: Proper signatures are required to validate the application, ensuring that all parties agree to the terms.

- Data Protection: Personal and business information must be handled in compliance with applicable data protection laws to safeguard sensitive information.

Quick guide on how to complete sba loan application pacific commerce bank

Effortlessly Complete Sba Loan Application Pacific Commerce Bank on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers a perfect sustainable alternative to traditional printed and signed documents, as you can easily locate the required form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, amend, and electronically sign your documents promptly without any delays. Handle Sba Loan Application Pacific Commerce Bank on any device using the airSlate SignNow apps for Android or iOS and simplify any document-related task today.

How to Alter and Electronically Sign Sba Loan Application Pacific Commerce Bank with Ease

- Locate Sba Loan Application Pacific Commerce Bank and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form hunting, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choosing. Edit and electronically sign Sba Loan Application Pacific Commerce Bank and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

When I fill out a loan application form at a bank, how does the bank know if I am lying about my total assets and liabilities?

Your credit report has more than the score, because part of what makes up you score is the amount of liabilities and how they are handled. Liabilities that will show areCar payments and balanceCredit cardsDepartment store cardsStudent loansChild support/alimony Judgements And many more.For assetsBank statementsBrokerage accounts401k statements etc.If an applicant is sufficiently strong (20% down-payment and a few months mortgage payments reserved) then all assets are usually not verified.But as a mortgage broker I've even used a car and boat title to boost an otherwise shaky application.

-

How do I fill out an application form to open a bank account?

I want to believe that most banks nowadays have made the process of opening bank account, which used to be cumbersome, less cumbersome. All you need to do is to approach the bank, collect the form, and fill. However if you have any difficulty in filling it, you can always call on one of the banks rep to help you out.

-

How do I fill out the application form for an educational loan online?

Depending on which country you are in and what kind of lender you are going for. There are bank loans and licensed money lenders. If you are taking a large amount, banks are recommended. If you are working, need a small amount for your tuition and in need of it fast, you can try a licensed moneylender.

-

Do I need a bank account to fill out the MHT CET application form?

To apply, you need to pay through online mode. This doesn't necessarily need you to have a bank account. You can ask anyone kind-hearted who is having a bank account to pay and handover the hard cash to that person.Hope this helps.

-

Is there a way for you to outsource sensitive tasks securely? For instance, calling the bank, or filling out a loan application form that includes your social security number?

You might benefit from compartmentalizing your sensitive information. Realtors often use custom-purpose sticky notes to help people navigate paperwork, like a little yellow arrow that says “signNow” or a blue flag that says “review these options.” Perhaps your assistant could fill out the entire form for you, except where your SSN needs to be provided, and call those lines out to you with a little sticky arrow.When calling the bank, you may have to initiate the call and then allow your assistant to take over. That way, you’d provide the sensitive data to the bank and satisfy their identity verification, then you’d authorize your assistant to speak on your behalf about the account, and let them take it from there.If you have any tasks that require sensitive data to actually conduct the business - say, moving funds between several bank accounts, which would require constant access to account numbers and other info - then you’ll have to give that task to someone you trust with that info. If you’re the only one you trust, you’re the only one who can do the task.

-

How to decide my bank name city and state if filling out a form, if the bank is a national bank?

Somewhere on that form should be a blank for routing number and account number. Those are available from your check and/or your bank statements. If you can't find them, call the bank and ask or go by their office for help with the form. As long as those numbers are entered correctly, any error you make in spelling, location or naming should not influence the eventual deposit into your proper account.

-

Is it necessary for a working bank professional to get permission from the bank zonal office to fill out any further application forms for the competitive exams?

No it's not required at the time of filling the application form but if you mention about your last job in the application form then you definitely need to carry a NOC from your last institution while appearing for dv or interview.

-

How many application forms does a person need to fill out in his/her lifetime?

As many as you want to !

Create this form in 5 minutes!

How to create an eSignature for the sba loan application pacific commerce bank

How to make an eSignature for your Sba Loan Application Pacific Commerce Bank online

How to generate an electronic signature for the Sba Loan Application Pacific Commerce Bank in Google Chrome

How to make an eSignature for signing the Sba Loan Application Pacific Commerce Bank in Gmail

How to generate an eSignature for the Sba Loan Application Pacific Commerce Bank right from your mobile device

How to make an eSignature for the Sba Loan Application Pacific Commerce Bank on iOS

How to make an eSignature for the Sba Loan Application Pacific Commerce Bank on Android

People also ask

-

What is airSlate SignNow and how does it relate to Pacific Commerce Bank?

airSlate SignNow is an eSignature solution that empowers businesses to send and electronically sign documents efficiently. Pacific Commerce Bank partners with airSlate SignNow to offer their clients a seamless way to handle banking documents digitally, enhancing convenience and speed.

-

How secure is the airSlate SignNow platform for Pacific Commerce Bank customers?

airSlate SignNow employs advanced security measures, including encryption and authentication protocols, ensuring that all documents are protected against unauthorized access. Pacific Commerce Bank customers can trust that their sensitive information is handled with the highest standards of security.

-

What pricing plans does airSlate SignNow offer for Pacific Commerce Bank users?

airSlate SignNow offers various pricing plans tailored to meet the needs of users, including those affiliated with Pacific Commerce Bank. Businesses can choose the plan that best fits their needs and budget, ensuring that they receive an effective eSignature solution without overspending.

-

Can airSlate SignNow integrate with Pacific Commerce Bank's systems?

Yes, airSlate SignNow can integrate with multiple business systems, including those used by Pacific Commerce Bank. This integration allows for a streamlined workflow, making it easy for users to manage documents and processes directly from their existing platforms.

-

What features does airSlate SignNow provide to Pacific Commerce Bank's clients?

airSlate SignNow offers a variety of features, including customizable templates, real-time tracking, and mobile access, making it an ideal solution for Pacific Commerce Bank clients. These tools enable users to efficiently send and sign documents from anywhere, enhancing productivity and collaboration.

-

What are the benefits of using airSlate SignNow for Pacific Commerce Bank transactions?

Using airSlate SignNow for transactions provides several benefits to Pacific Commerce Bank users, such as faster processing times, reduced paperwork, and improved customer experience. The electronic signature solution helps streamline banking operations, allowing clients to complete transactions quickly and securely.

-

How can I get started with airSlate SignNow as a Pacific Commerce Bank customer?

Getting started with airSlate SignNow is easy for Pacific Commerce Bank customers. Simply sign up for an account on the airSlate SignNow website and explore the user-friendly interface designed to simplify document management and eSigning processes.

Get more for Sba Loan Application Pacific Commerce Bank

Find out other Sba Loan Application Pacific Commerce Bank

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF