Fillable Michigan Business Tax Annual Return Form

What is the Fillable Michigan Business Tax Annual Return Form

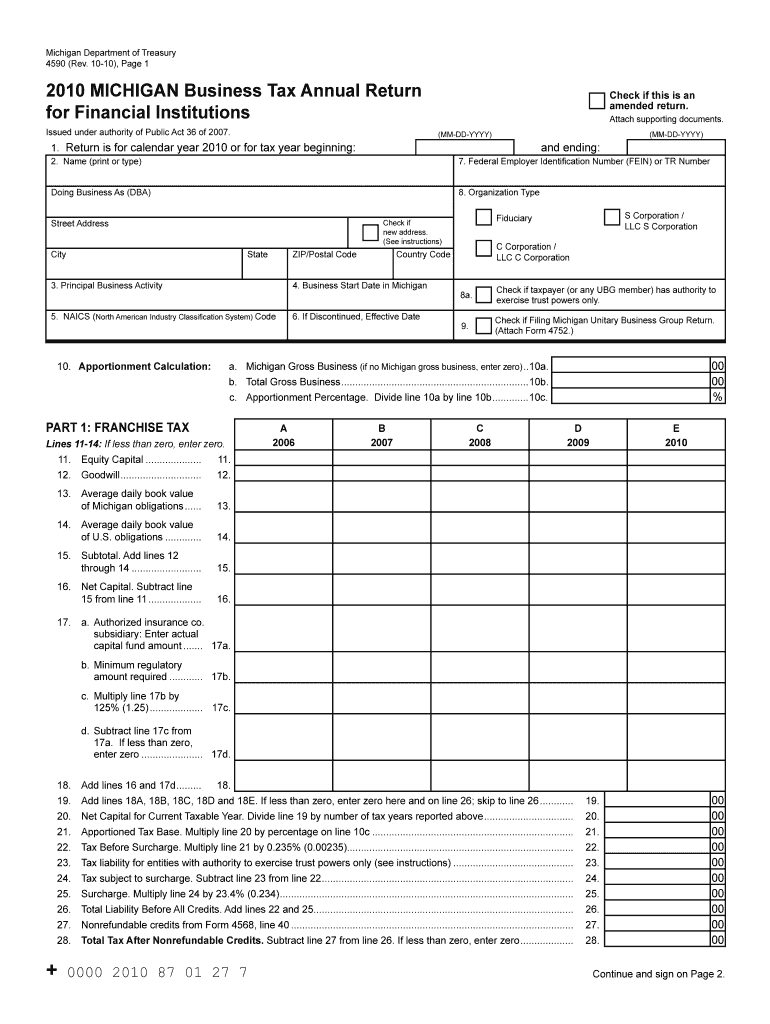

The 2010 Michigan fillable tax form is designed for businesses operating within the state of Michigan to report their income and calculate their tax obligations. This form is essential for ensuring compliance with state tax laws and regulations. It is specifically tailored for various business entities, including corporations, partnerships, and limited liability companies (LLCs). By using this fillable format, businesses can easily complete the form digitally, allowing for a more efficient filing process.

How to use the Fillable Michigan Business Tax Annual Return Form

To effectively use the 2010 Michigan fillable tax form, businesses should first download the form from an authorized source. Once downloaded, users can fill out the necessary fields directly on their computer. This digital format simplifies data entry, reduces errors, and allows for easy corrections. After completing the form, it can be saved, printed, and submitted according to the filing instructions provided by the Michigan Department of Treasury.

Steps to complete the Fillable Michigan Business Tax Annual Return Form

Completing the 2010 Michigan fillable tax form involves several key steps:

- Gather all necessary financial documents, including income statements and expense reports.

- Open the fillable form and enter your business information at the top of the document.

- Fill in the income and deduction sections accurately, ensuring all figures are supported by your financial documents.

- Review the completed form for any errors or omissions.

- Save the filled form and prepare it for submission.

Legal use of the Fillable Michigan Business Tax Annual Return Form

The 2010 Michigan fillable tax form is legally binding when completed and submitted according to state regulations. To ensure its validity, businesses must adhere to the guidelines set forth by the Michigan Department of Treasury. This includes providing accurate information and obtaining the necessary signatures. Utilizing a reliable eSignature platform can enhance the legal standing of the form by ensuring compliance with eSignature laws such as ESIGN and UETA.

Filing Deadlines / Important Dates

It is crucial for businesses to be aware of the filing deadlines associated with the 2010 Michigan fillable tax form. Typically, the form must be submitted by the due date specified by the Michigan Department of Treasury, which is usually the last day of the month following the end of the fiscal year. Late submissions may incur penalties, so businesses should mark their calendars and prepare their forms in advance to avoid any issues.

Form Submission Methods (Online / Mail / In-Person)

The 2010 Michigan fillable tax form can be submitted through various methods. Businesses have the option to file online, which is often the most efficient method, or they can choose to mail the completed form to the appropriate address provided by the Michigan Department of Treasury. In-person submissions may also be accepted at designated locations. Each method has its own advantages, and businesses should select the one that best suits their needs.

Quick guide on how to complete 2010 fillable michigan business tax annual return form

Effortlessly Prepare Fillable Michigan Business Tax Annual Return Form on Any Device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly option compared to traditional printed and signed documents, as you can easily locate the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to swiftly create, modify, and electronically sign your documents without any holdups. Manage Fillable Michigan Business Tax Annual Return Form on any device using the airSlate SignNow apps for Android or iOS, and streamline any document-related process right now.

Edit and eSign Fillable Michigan Business Tax Annual Return Form with Ease

- Find Fillable Michigan Business Tax Annual Return Form and select Get Form to begin.

- Utilize the tools we offer to fill in your document.

- Emphasize important sections of your documents or conceal sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign feature, which only takes seconds and carries the same legal validity as a physical handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or download it directly to your computer.

Say goodbye to lost or misplaced files, tedious form searches, and errors that require reprinting new document copies. airSlate SignNow effectively meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Fillable Michigan Business Tax Annual Return Form and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

I'm trying to fill out a free fillable tax form. It won't let me click "done with this form" or "efile" which?

From https://www.irs.gov/pub/irs-utl/... (emphasis mine):DONE WITH THIS FORM — Select this button to save and close the form you are currently viewing and return to your 1040 form. This button is disabled when you are in your 1040 formSo, it appears, and without them mentioning it while you're working on it, that button is for all forms except 1040. Thank you to the other response to this question. I would never have thought of just clicking the Step 2 tab.

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

Is it okay to submit a Form 67 after filling out my tax return?

As per the law, Form 67 is required for claiming Foreign Tax Credits by an assessee and it should be done along with the return of income.It is possible to file Form 67 before filing the return.The question is whether the Form can be filed after filing the return of income. While the requirement is procedural, a return may be termed as incomplete if the form is not filed along with the returns and an officer can deny foreign tax credits.However, for all intents and purposes if you file Form 67 before the completion of assessment or even with an application u/s 154 once the assessment is completed, it cannot be denied if the facts have been already disclosed in the return and teh form in itself is only completing a process.However, to avoid adventures with the department and unwanted litigation, it is always prudent to file the form with the return of income so that it is not missed out or forgotten.

-

Can anyone share a link on how to fill out the GST and GST annual return?

The deadline for filing GST Return for the year 17–18 is fast approaching .To file the GST annual return you need to reconcile the data appearing in your returns with the data in your financial books.You can watch the below video to have a basic idea about filing GST annual returnEnglish :Hindi :

-

How can I fill out the details of my PPF and LIC in income tax return along with Form 16 details?

PPF contribution and LIC premium paid is shown under section 80C deductions ( chapter VIA deduction) in ITR.However total limit under 80C is 1.5L.( I am assuming that you have referred to investments made -ppf/LIC and not withdrawals (income)from the same).Regards.

-

How can you contact someone that is experienced in filling out a transcript of Tax Return Form 4506-T?

You can request a transcript online at Get Transcript. That should be easier and quicker than filling out the form. Otherwise any US tax professional should be able to help you.

-

What tax transcript form should I fill out to find my old W2 forms to file for a tax return? -I have not filed before and I'm 53.?

I guess this link answers to your question: Transcript or Copy of Form W-2

-

How much will a doctor with a physical disability and annual net income of around Rs. 2.8 lakhs pay in income tax? Which ITR form is to be filled out?

For disability a deduction of ₹75,000/- is available u/s 80U.Rebate u/s87AFor AY 17–18, rebate was ₹5,000/- or income tax which ever is lower for person with income less than ₹5,00,000/-For AY 18–19, rebate is ₹2,500/- or income tax whichever is lower for person with income less than 3,50,000/-So, for an income of 2.8 lakhs, taxable income after deduction u/s 80U will remain ₹2,05,000/- which is below the slab rate and hence will not be taxable for any of the above said AY.For ITR,If doctor is practicing himself i.e. He has a professional income than ITR 4 should be filedIf doctor is getting any salary than ITR 1 should be filed.:)

Create this form in 5 minutes!

How to create an eSignature for the 2010 fillable michigan business tax annual return form

How to make an electronic signature for your 2010 Fillable Michigan Business Tax Annual Return Form online

How to generate an eSignature for your 2010 Fillable Michigan Business Tax Annual Return Form in Chrome

How to create an electronic signature for putting it on the 2010 Fillable Michigan Business Tax Annual Return Form in Gmail

How to create an eSignature for the 2010 Fillable Michigan Business Tax Annual Return Form from your smartphone

How to create an eSignature for the 2010 Fillable Michigan Business Tax Annual Return Form on iOS devices

How to generate an eSignature for the 2010 Fillable Michigan Business Tax Annual Return Form on Android

People also ask

-

What is the Fillable Michigan Business Tax Annual Return Form?

The Fillable Michigan Business Tax Annual Return Form is a crucial document for businesses operating in Michigan, allowing them to report their annual tax obligations. This form can be easily filled online and submitted electronically, streamlining the entire process for business owners. Utilizing airSlate SignNow, you can complete and eSign this form quickly, ensuring compliance with state regulations.

-

How can airSlate SignNow help with the Fillable Michigan Business Tax Annual Return Form?

airSlate SignNow provides a user-friendly platform to complete the Fillable Michigan Business Tax Annual Return Form efficiently. With its intuitive interface, you can fill in your information, eSign the form, and send it securely to the relevant tax authorities. This eliminates the need for paper forms and reduces the risk of errors in your submission.

-

Is there a cost associated with using airSlate SignNow for the Fillable Michigan Business Tax Annual Return Form?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs, including options for using the Fillable Michigan Business Tax Annual Return Form. The costs are competitive, providing great value considering the time and resources saved by using their electronic signing solution. You can choose a plan that best fits your business size and document volume.

-

What features does airSlate SignNow offer for filling out tax forms?

With airSlate SignNow, users can leverage features like document templates, cloud storage, and real-time collaboration to complete the Fillable Michigan Business Tax Annual Return Form. The platform also supports eSignature capabilities, ensuring that your forms are legally binding and securely signed. Additionally, you can track the status of your documents and receive notifications for any updates.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow seamlessly integrates with various accounting and tax preparation software, enhancing your workflow while completing the Fillable Michigan Business Tax Annual Return Form. This integration allows you to easily import data and manage your documents from a centralized platform, saving you time and minimizing manual entry.

-

What are the benefits of using a Fillable Michigan Business Tax Annual Return Form with airSlate SignNow?

Using the Fillable Michigan Business Tax Annual Return Form with airSlate SignNow offers numerous benefits, including increased efficiency and reduced paperwork. The ability to fill, eSign, and submit documents online ensures that you meet deadlines without the hassle of printing or mailing. Moreover, airSlate SignNow enhances security, protecting your sensitive tax information.

-

How do I get started with the Fillable Michigan Business Tax Annual Return Form using airSlate SignNow?

Getting started with airSlate SignNow for the Fillable Michigan Business Tax Annual Return Form is simple. First, sign up for an account on the airSlate SignNow website, then access the tax form template within the platform. Fill out the necessary fields, eSign, and submit your completed form effortlessly, all within the secure airSlate environment.

Get more for Fillable Michigan Business Tax Annual Return Form

- County sheriffs of colorado concealed handgun permit application form

- Notice to bcreditorsb jamestown news form

- Dog pedigree template form

- Goodwill receipt number florida form

- Badge mdad airport form

- City of building permit application form

- Redetermination packet elc of pinellas county form

- Verification of employment from for access florida form

Find out other Fillable Michigan Business Tax Annual Return Form

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed