Payg Summary 2008-2026

What is the PAYG Summary?

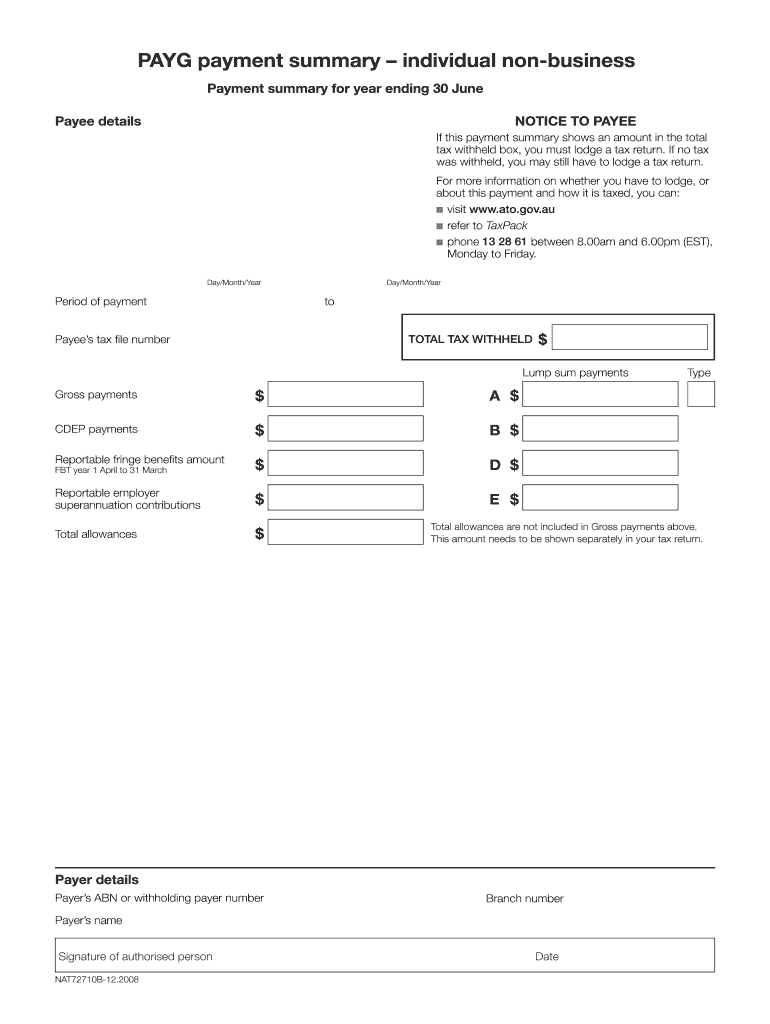

The PAYG summary, also known as the PAYG payment summary statement, is a document that outlines the total amount of tax withheld from an employee's earnings throughout the financial year. This summary is essential for individuals to accurately report their income and tax obligations when filing their tax returns. It typically includes details such as gross income, tax withheld, and any other relevant deductions or allowances. Understanding the PAYG summary is crucial for ensuring compliance with tax regulations and for effective financial planning.

Steps to Complete the PAYG Summary

Completing the PAYG summary involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including payslips and any other income records. Next, calculate the total gross income earned during the financial year. This includes wages, bonuses, and any additional earnings. Then, determine the total tax withheld by reviewing the amounts deducted from each paycheck. Finally, fill out the PAYG summary form, ensuring all information is accurate and complete before submission. This process helps to avoid errors that could lead to penalties or delays in tax processing.

Legal Use of the PAYG Summary

The PAYG summary is legally recognized as an important document for tax reporting purposes. It serves as proof of income and tax withheld, which is necessary for filing tax returns with the Internal Revenue Service (IRS). To ensure its legal validity, the summary must be completed accurately and submitted within the specified deadlines. Compliance with tax regulations is essential, as failure to provide a correct PAYG summary can result in penalties or audits. Utilizing a reliable digital signing solution can enhance the legal standing of the document by ensuring secure and compliant electronic signatures.

Key Elements of the PAYG Summary

Several key elements must be included in the PAYG summary to ensure it meets legal and regulatory requirements. These elements typically consist of:

- Employee Information: Name, address, and taxpayer identification number.

- Employer Information: Name, address, and employer identification number.

- Gross Income: Total earnings before tax deductions.

- Tax Withheld: Total amount of tax deducted from earnings.

- Deductions and Allowances: Any applicable deductions or allowances that affect taxable income.

Including these key elements ensures that the PAYG summary is comprehensive and compliant with tax laws.

How to Obtain the PAYG Summary

To obtain the PAYG summary, individuals typically receive it from their employer at the end of the financial year. Employers are required to provide this document to their employees, either in paper form or electronically. If an employee does not receive their PAYG summary, they should contact their employer's payroll department for assistance. Additionally, individuals can access their PAYG summary through online payroll systems if their employer utilizes such platforms. It is important to keep a copy of the PAYG summary for personal records and for use during tax filing.

Filing Deadlines / Important Dates

Filing deadlines for the PAYG summary are crucial for compliance with tax regulations. Typically, employers must provide employees with their PAYG summary by a specific date following the end of the financial year. Employees must then use this summary to file their tax returns by the IRS deadline, which is usually April fifteenth. It is essential to stay informed about these dates to avoid potential penalties for late filing. Marking these important dates on a calendar can help ensure timely completion of tax obligations.

Quick guide on how to complete payg summary

Complete Payg Summary effortlessly on any device

Web-based document management has become widely adopted by companies and individuals. It serves as an ideal environmentally-friendly substitute for traditional printed and signed documents, allowing you to acquire the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, alter, and eSign your documents promptly without delays. Manage Payg Summary on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Payg Summary without hassle

- Obtain Payg Summary and then click Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically designed for that task by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the details and click the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, the tedious search for forms, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Payg Summary and ensure clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the payg summary

The way to create an eSignature for a PDF file online

The way to create an eSignature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The best way to make an electronic signature from your mobile device

The best way to generate an eSignature for a PDF file on iOS

The best way to make an electronic signature for a PDF file on Android devices

People also ask

-

What is a PAYG summary statement?

A PAYG summary statement is a document that outlines the total amount of tax withheld for employees or contractors throughout the year. This statement simplifies the process of reporting income and tax to the Australian Tax Office (ATO). Using airSlate SignNow, you can easily generate and send your PAYG summary statements electronically.

-

How can airSlate SignNow help with PAYG summary statements?

airSlate SignNow offers a streamlined solution for creating, signing, and sending PAYG summary statements. With its user-friendly interface, you can customize templates and securely eSign documents in minutes. Our platform ensures compliance and accuracy, making tax season stress-free for your business.

-

Is airSlate SignNow cost-effective for handling PAYG summary statements?

Absolutely! airSlate SignNow provides a cost-effective solution for managing PAYG summary statements, allowing you to save on printing and postage fees. With flexible pricing plans, you only pay for what you need, making it an economical choice for businesses of all sizes.

-

What features does airSlate SignNow offer for PAYG summary statements?

airSlate SignNow is equipped with features like document templates, electronic signatures, and integration capabilities. These features allow you to create professional PAYG summary statements quickly and manage all your documents in one place. Additionally, the platform offers tracking and reminders to ensure timely submission.

-

Can I integrate airSlate SignNow with other payroll software for PAYG summary statements?

Yes, airSlate SignNow seamlessly integrates with various payroll and accounting software to enhance your document workflow. By connecting with your existing systems, you can streamline the generation and electronic signing of PAYG summary statements, minimizing manual tasks and errors.

-

How secure is my information when using airSlate SignNow for PAYG summary statements?

Security is a top priority for airSlate SignNow. We employ advanced encryption and secure storage to protect your data while managing PAYG summary statements. Our platform is also compliant with industry standards, ensuring that your information remains confidential and secure.

-

What are the benefits of using airSlate SignNow for PAYG summary statements?

Using airSlate SignNow for PAYG summary statements offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced compliance. The electronic signing process accelerates approvals and eliminates the hassles of traditional methods. This not only saves time but also enhances the overall experience for both employers and employees.

Get more for Payg Summary

- Control number nh p077 pkg form

- New hampshire last will ampamp testament write your legal will form

- Control number nh p081 pkg form

- Control number nh p082 pkg form

- Control number nh p083 pkg form

- Ftc identity theft affidavit fill online printable fillable blank form

- Control number nh p085 pkg form

- Choosing a legal form for your businessnh small business

Find out other Payg Summary

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF