Form 45c

What is the Form 45c

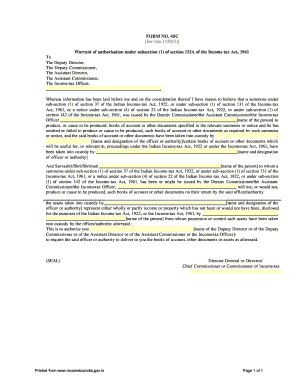

The Form 45c is a specific document used in the context of income tax regulations. It serves as a formal declaration for certain income types, particularly in relation to the section 132a income tax act. This form is essential for individuals and businesses looking to comply with tax obligations while ensuring accurate reporting of income. Understanding its purpose is crucial for proper tax filing and compliance.

How to use the Form 45c

Using the Form 45c involves several steps to ensure that all necessary information is accurately reported. First, gather all relevant financial documents that pertain to the income being reported. Next, fill out the form carefully, ensuring that all fields are completed with precise information. After completing the form, review it for accuracy before submission. This careful approach helps in avoiding potential issues with tax authorities.

Steps to complete the Form 45c

Completing the Form 45c requires a systematic approach:

- Gather necessary documentation, including income statements and tax records.

- Fill in personal information, including your name, address, and Social Security number.

- Detail the specific income sources as required by the form.

- Review the completed form for any errors or omissions.

- Submit the form according to the specified guidelines.

Legal use of the Form 45c

The Form 45c is legally binding when filled out and submitted correctly. It must adhere to the requirements set forth by the IRS and comply with applicable tax laws. Ensuring that the form is completed accurately not only fulfills legal obligations but also protects against potential penalties for non-compliance. Legal use entails understanding the implications of the information provided and ensuring that it aligns with IRS guidelines.

Required Documents

To complete the Form 45c, certain documents are essential. These typically include:

- Income statements from employers or clients.

- Previous tax returns for reference.

- Any relevant financial statements that support the income reported.

Having these documents ready will facilitate a smoother completion process and ensure accuracy in reporting.

Form Submission Methods

The Form 45c can be submitted through various methods, including:

- Online submission via the IRS e-filing system.

- Mailing the completed form to the appropriate IRS address.

- In-person submission at designated IRS offices.

Choosing the right submission method depends on personal preference and the specific requirements of the tax situation.

Quick guide on how to complete form 45c

Effortlessly prepare Form 45c on any device

Digital document management has become widely embraced by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and without holdups. Manage Form 45c across any platform using airSlate SignNow's Android or iOS applications, and streamline any document-related tasks today.

The simplest way to modify and eSign Form 45c effortlessly

- Find Form 45c and click Get Form to get started.

- Use the tools we offer to fill out your form.

- Highlight relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you want to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, time-consuming form searches, and errors that require new printed copies. airSlate SignNow caters to all your document management needs in just a few clicks from your preferred device. Edit and eSign Form 45c while ensuring excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 45c

The best way to generate an electronic signature for your PDF document online

The best way to generate an electronic signature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

The best way to make an electronic signature straight from your smart phone

The way to make an electronic signature for a PDF document on iOS

The best way to make an electronic signature for a PDF document on Android OS

People also ask

-

What is section 132a income tax and how does it affect my business?

Section 132a income tax provides specific tax exemptions for certain benefits provided by employers. Understanding its implications can help businesses optimize their tax liabilities. With airSlate SignNow, you can easily manage documents related to section 132a income tax, ensuring compliance and clarity in your financial records.

-

How can airSlate SignNow help in managing section 132a income tax documentation?

airSlate SignNow simplifies the process of managing section 132a income tax documentation by providing secure e-signature solutions. You can efficiently send, sign, and store important tax-related documents, reducing the time spent on paperwork. This streamlined process allows you to focus on maximizing your tax benefits and ensuring compliance.

-

Is airSlate SignNow cost-effective for businesses looking to comply with section 132a income tax regulations?

Yes, airSlate SignNow offers a cost-effective solution for businesses by combining intuitive design with affordable pricing. This makes it accessible for companies of all sizes to manage their section 132a income tax requirements without breaking the bank. By investing in a reliable e-signature platform, you're enhancing both compliance and efficiency.

-

What features does airSlate SignNow provide for section 132a income tax-related processes?

airSlate SignNow includes features like template creation, bulk sending, and integrations with popular applications for seamless workflow. These features support businesses in managing section 132a income tax documentation effectively and help you track and store important records securely. This leads to improved organization and easier access to necessary information.

-

Can I easily integrate airSlate SignNow with my existing accounting tools for section 132a income tax?

Absolutely! airSlate SignNow offers robust integrations with various accounting tools, allowing you to manage your section 132a income tax documents in one place. This integration ensures a smooth transfer of information and documents, enhancing your overall workflow and boosting productivity in tax management.

-

How does airSlate SignNow enhance collaboration when dealing with section 132a income tax forms?

With airSlate SignNow, collaboration is streamlined as team members can co-author, e-sign, and manage section 132a income tax forms efficiently. This reduces the back-and-forth often necessary with traditional methods, making it easy for everyone involved to access and act on important tax documents. Enhanced collaboration helps ensure everyone is informed and aligned.

-

What are the benefits of using airSlate SignNow for handling section 132a income tax documentation?

Using airSlate SignNow for section 132a income tax documentation offers benefits like increased efficiency, improved compliance, and reduced paperwork. The platform's user-friendly interface allows even non-technical users to manage documents effortlessly. Furthermore, the security features in place protect sensitive tax information.

Get more for Form 45c

- Control number nv p022 pkg form

- Nrs 449610 form of declaration directing physician to

- Control number nv p024 pkg form

- Declaration montana state university form

- A personal decision the valley health system form

- Severance paylas vegashkm employment attorneys form

- Sample letter for confirmation of interview appointment form

- Forms for employees nevada labor commissioner

Find out other Form 45c

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy