Form 15g

What is the Form 15g

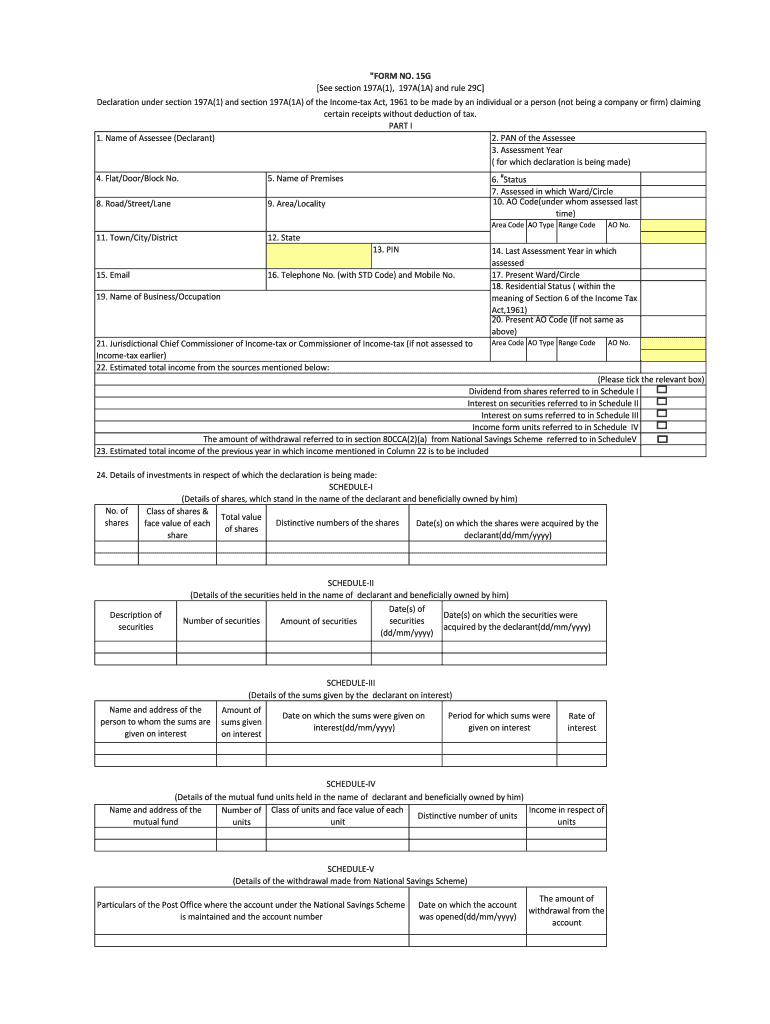

The Form 15g is a self-declaration form used in India, primarily for individuals to ensure that no tax is deducted at source (TDS) on their interest income. This form is particularly relevant for those whose total income is below the taxable limit. By submitting this form, individuals can avoid unnecessary tax deductions on their savings interest, thereby allowing them to retain more of their earnings. It is essential for individuals to understand the purpose of this form to utilize it effectively in financial planning.

How to use the Form 15g

Using the Form 15g involves a straightforward process. First, individuals must fill out the form with accurate personal details, including name, address, and PAN (Permanent Account Number). Next, they need to specify the financial institution where they hold accounts that generate interest income. After completing the form, it should be submitted to the respective bank or financial institution. This submission ensures that TDS is not deducted from the interest earned during the financial year.

Steps to complete the Form 15g

Completing the Form 15g requires careful attention to detail. Here are the steps to follow:

- Obtain the Form 15g from your bank or download it from a reliable source.

- Fill in your personal information, including your name, address, and PAN.

- Indicate the financial year for which you are submitting the form.

- Provide details of the interest income expected from the financial institution.

- Sign and date the form to validate your declaration.

Once completed, submit the form to the bank or financial institution where you have your accounts. Ensure that you keep a copy for your records.

Legal use of the Form 15g

The legal framework surrounding the Form 15g ensures its validity in tax matters. When submitted correctly, it serves as a legally binding document that allows individuals to declare their income status. Compliance with tax regulations is crucial, as failure to submit the form when required can lead to TDS deductions that may not be recoverable. Understanding the legal implications of using this form helps individuals manage their tax liabilities effectively.

Eligibility Criteria

To be eligible to use the Form 15g, individuals must meet specific criteria. Primarily, they should have a total income that falls below the taxable limit set by the government for the financial year. Additionally, the form is applicable for interest income from savings accounts, fixed deposits, and recurring deposits. Individuals must ensure that their income sources are solely from these categories to qualify for the benefits of the Form 15g.

Form Submission Methods (Online / Mail / In-Person)

The Form 15g can be submitted through various methods, providing flexibility to individuals. The common submission methods include:

- Online: Many banks offer an online submission option through their internet banking portals.

- Mail: Individuals can also send a physical copy of the form to their bank's branch via postal services.

- In-Person: Submitting the form directly at the bank branch is another option, allowing for immediate processing and confirmation.

Choosing the appropriate method depends on personal convenience and the policies of the respective financial institution.

Quick guide on how to complete form 15g

Prepare Form 15g easily on any device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, enabling you to access the right forms and securely store them online. airSlate SignNow provides all the tools you require to create, edit, and electronically sign your documents swiftly without delays. Handle Form 15g on any device with the airSlate SignNow apps for Android or iOS and streamline any document-related task today.

How to edit and eSign Form 15g effortlessly

- Locate Form 15g and then click Get Form to commence.

- Use the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information using the tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 15g and ensure excellent communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 15g

The best way to generate an eSignature for a PDF online

The best way to generate an eSignature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

The way to create an eSignature right from your smartphone

How to create an eSignature for a PDF on iOS

The way to create an eSignature for a PDF on Android

People also ask

-

What is the 15g pdf editor and how does it work?

The 15g pdf editor is a powerful tool offered by airSlate SignNow that allows users to easily edit PDF documents. With an intuitive interface, users can add text, images, and annotations, ensuring that their PDFs are customized to meet specific needs. This seamless integration helps streamline document management and enhances productivity.

-

What features does the 15g pdf editor provide?

The 15g pdf editor includes a variety of features such as text editing, image insertion, and form filling capabilities. Additionally, it provides tools for signing documents electronically and safe sharing options. These features make it an efficient choice for both individuals and businesses needing to manage PDF files.

-

How does the 15g pdf editor compare with other PDF editing tools?

The 15g pdf editor stands out due to its user-friendly design and comprehensive features at a competitive price. Unlike many other PDF editors, it allows for seamless integration with multiple platforms, enhancing its versatility. This makes it a preferred choice for users looking for simplicity without sacrificing functionality.

-

Is the 15g pdf editor cost-effective?

Yes, the 15g pdf editor offers a cost-effective solution for document management. With affordable pricing plans, businesses can access powerful editing tools without breaking the bank. This affordability, combined with robust features, makes it a top choice for budget-conscious users.

-

Can I integrate the 15g pdf editor with other applications?

Absolutely! The 15g pdf editor can be easily integrated with various applications, such as cloud storage services and workflow platforms. This integration capability enhances collaboration and ensures that your documents are always accessible from multiple devices.

-

What are the benefits of using the 15g pdf editor for businesses?

The 15g pdf editor benefits businesses by streamlining document workflows, reducing the time spent on editing and signing PDFs. By offering features like eSignature capabilities and cloud integration, it improves productivity and reduces the likelihood of errors. Ultimately, this leads to faster turnaround times and improved efficiency.

-

Is the 15g pdf editor user-friendly for beginners?

Yes, the 15g pdf editor is designed to be user-friendly, making it accessible even for beginners. Its straightforward interface guides users through the editing process, minimizing the learning curve. This approach ensures that anyone can start editing PDFs quickly and efficiently.

Get more for Form 15g

Find out other Form 15g

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate