How to Cancel Sbi Life Insurance Policy 2014-2026

Understanding the Process to Cancel SBI Life Insurance Policy

Cancelling an SBI life insurance policy involves several steps to ensure that the process is executed smoothly and legally. It is important to understand the specific requirements and procedures involved in this process. Generally, policyholders can initiate the cancellation by contacting the insurance provider directly or by completing a cancellation form. In some cases, the policyholder may need to provide additional documentation to support the cancellation request.

Steps to Complete the SBI Life Insurance Cancellation

The cancellation of an SBI life insurance policy typically requires the following steps:

- Gather necessary documents, including the policy number and identification.

- Complete the SBI life insurance cancellation form, ensuring all details are accurate.

- Submit the cancellation form through the preferred method: online, by mail, or in person.

- Confirm the cancellation with the insurance provider to ensure the policy is officially terminated.

Required Documents for SBI Life Insurance Cancellation

When cancelling an SBI life insurance policy, certain documents are usually required to process the request. These may include:

- The original policy document.

- A completed cancellation form.

- Proof of identity, such as a government-issued ID.

- Any additional documents specified by the insurance company.

Legal Considerations for Cancelling SBI Life Insurance

It is essential to be aware of the legal implications when cancelling an SBI life insurance policy. The cancellation must comply with state regulations and the terms outlined in the insurance contract. Failure to adhere to these guidelines may result in penalties or the inability to recover any premiums paid. It is advisable to consult with a legal expert if there are uncertainties regarding the cancellation process.

Form Submission Methods for SBI Life Insurance Cancellation

Policyholders have multiple options for submitting their cancellation requests for SBI life insurance. These methods include:

- Online submission through the official SBI insurance portal.

- Mailing the completed cancellation form to the designated address provided by the insurer.

- Visiting a local SBI branch to submit the form in person.

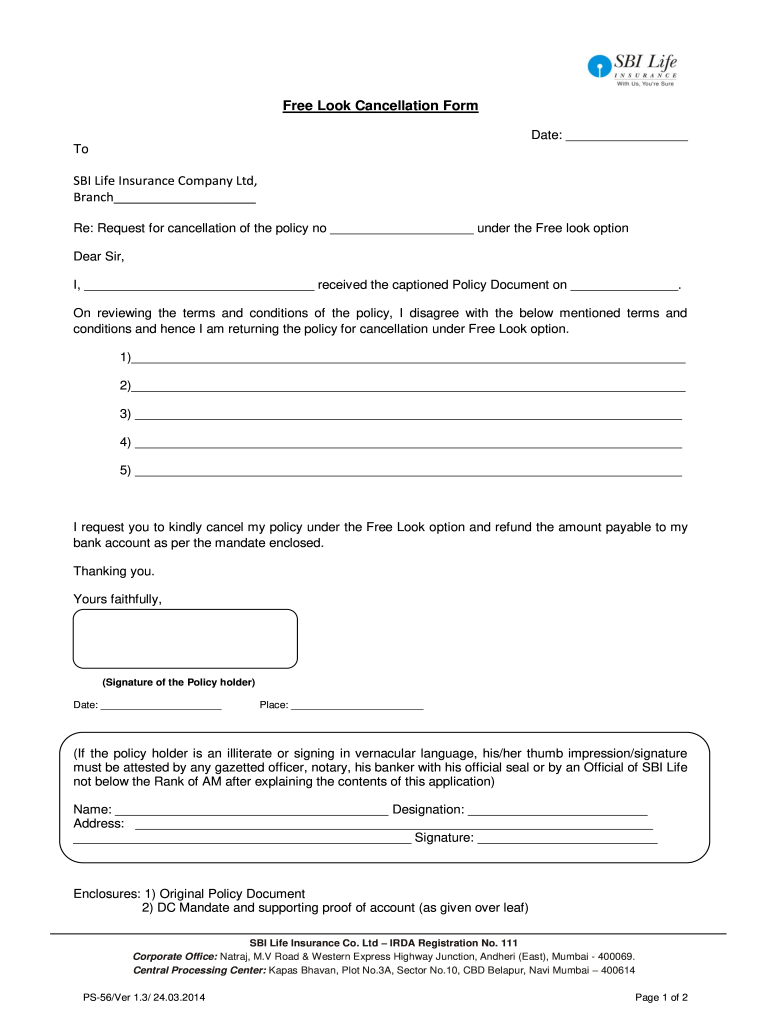

Key Elements of the SBI Life Insurance Cancellation Form

The SBI life insurance cancellation form typically includes several key elements that need to be filled out accurately. These elements may consist of:

- Policyholder's name and contact information.

- Policy number and details of the insurance plan.

- Reason for cancellation, if required.

- Signature of the policyholder to authenticate the request.

Quick guide on how to complete how to cancel sbi life insurance policy

Prepare How To Cancel Sbi Life Insurance Policy effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage How To Cancel Sbi Life Insurance Policy on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and eSign How To Cancel Sbi Life Insurance Policy with ease

- Locate How To Cancel Sbi Life Insurance Policy and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant parts of the documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you would like to send your form, whether via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign How To Cancel Sbi Life Insurance Policy and ensure effective communication at any point in the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the how to cancel sbi life insurance policy

The best way to generate an eSignature for a PDF file online

The best way to generate an eSignature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

The way to create an eSignature right from your mobile device

How to create an eSignature for a PDF file on iOS

The way to create an eSignature for a PDF on Android devices

People also ask

-

What is SBI Life Insurance?

SBI Life Insurance is a leading life insurance provider in India offering a range of life insurance products to meet diverse customer needs. Backed by the State Bank of India, it ensures financial security for your loved ones. With options for term plans, endowment plans, and ULIPs, SBI Life Insurance caters to various life stages and financial goals.

-

What are the benefits of SBI Life Insurance?

The benefits of SBI Life Insurance include comprehensive coverage, tax advantages, and various policy options such as term insurance and investment plans. Customers can enjoy flexible premium payment options and rider benefits for added protection. This robust structure ensures that customers can choose plans that best fit their lifestyle and financial objectives.

-

How can I purchase SBI Life Insurance?

Purchasing SBI Life Insurance is a straightforward process. Interested customers can visit the SBI Life website or their nearest branch, where knowledgeable agents will assist in selecting the right policy. Online applications are also available for convenience, allowing for quick and easy comparison of plans.

-

What factors influence the pricing of SBI Life Insurance?

The pricing of SBI Life Insurance depends on various factors, including the applicant's age, health status, type of policy, and premium payment duration. Generally, younger individuals with good health may qualify for lower premiums. It's essential to evaluate personal needs and consult with an advisor to find the most cost-effective solution.

-

Does SBI Life Insurance offer any riders?

Yes, SBI Life Insurance provides a selection of riders that policyholders can add to enhance their coverage. Common options include critical illness riders and accidental death benefits, which offer additional financial protection. Integrating these riders allows customers to customize their insurance as per their unique requirements.

-

What is the claim settlement process for SBI Life Insurance?

The claim settlement process for SBI Life Insurance is designed to be customer-friendly and efficient. Customers or their beneficiaries can initiate a claim online or by contacting customer support. SBI Life is known for its prompt service, ensuring that claims are processed quickly and fairly, with transparent communication throughout.

-

Can I track my SBI Life Insurance policy online?

Yes, SBI Life Insurance offers an online portal where policyholders can easily track their insurance policies. Customers can view policy details, premium payment history, and upcoming due dates at their convenience. This online management feature enhances customer experience and ensures they stay informed about their coverage.

Get more for How To Cancel Sbi Life Insurance Policy

- As grantors do hereby remise release and quitclaim unto a corporation form

- Any equipment or livestock pertaining to the rental of horses or taking of riding lessons the use form

- Discharge of lien individual form

- Grantor does hereby grant release and warrant unto a corporation form

- Discharge of lien corporation form

- Owners initials form

- New york mechanics lien lien release dos and donts form

- Lhwca procedure manual united states department of labor form

Find out other How To Cancel Sbi Life Insurance Policy

- Can I Sign Texas Confirmation Of Reservation Or Order

- How To Sign Illinois Product Defect Notice

- Sign New Mexico Refund Request Form Mobile

- Sign Alaska Sponsorship Agreement Safe

- How To Sign Massachusetts Copyright License Agreement

- How Do I Sign Vermont Online Tutoring Services Proposal Template

- How Do I Sign North Carolina Medical Records Release

- Sign Idaho Domain Name Registration Agreement Easy

- Sign Indiana Domain Name Registration Agreement Myself

- Sign New Mexico Domain Name Registration Agreement Easy

- How To Sign Wisconsin Domain Name Registration Agreement

- Sign Wyoming Domain Name Registration Agreement Safe

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements