Vat C4 Format in Word Download

Understanding the Vat C4 Form

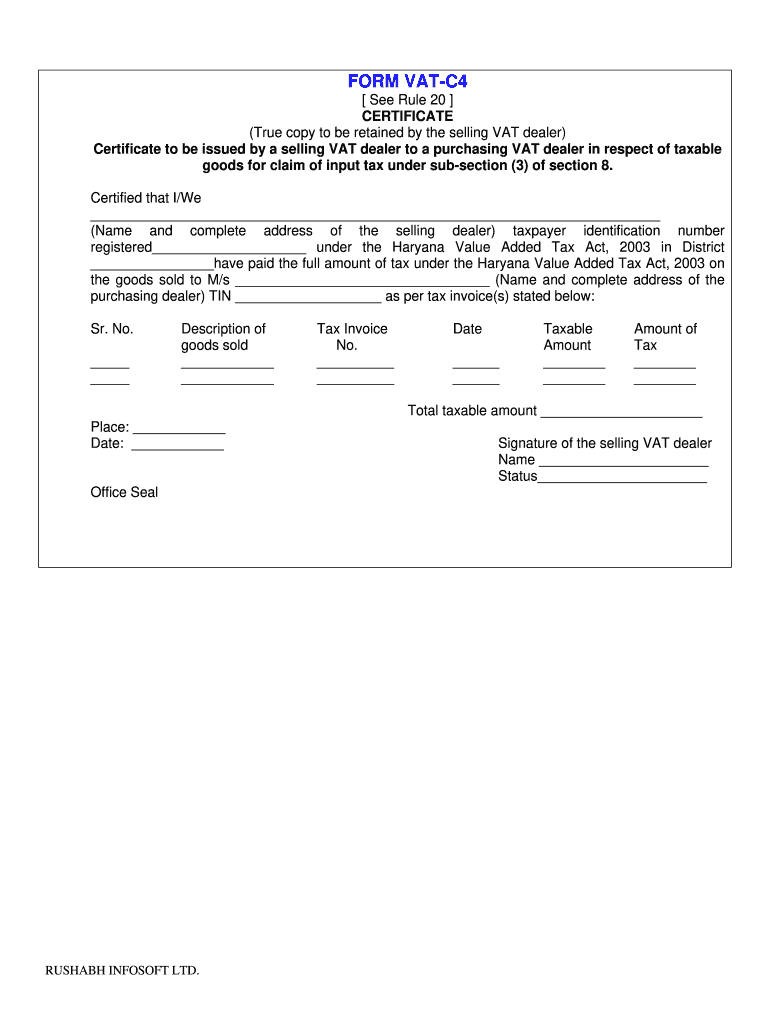

The Vat C4 form is a crucial document used in various tax-related processes. It serves as a declaration for transactions that may involve VAT (Value Added Tax) in the United States. This form is essential for businesses that engage in purchasing goods or services that are subject to VAT. Understanding its purpose and requirements is vital for compliance and accurate tax reporting.

Steps to Complete the Vat C4 Form

Filling out the Vat C4 form requires attention to detail to ensure accuracy. Here are the steps to guide you through the process:

- Gather necessary information, including business details and transaction specifics.

- Download the Vat C4 form from a reliable source.

- Fill in the required fields, ensuring all information is accurate and complete.

- Review the form for any errors or omissions.

- Submit the completed form according to the specified guidelines.

Legal Use of the Vat C4 Form

The legal validity of the Vat C4 form hinges on compliance with relevant tax laws and regulations. It is essential to ensure that the form is filled out correctly and submitted within the required timeframes. Failure to comply can result in penalties or complications with tax authorities. Utilizing a trusted platform for electronic signatures can enhance the legal standing of your submission.

Key Elements of the Vat C4 Form

The Vat C4 form includes several key elements that must be accurately completed. These elements typically include:

- Business identification details, such as name and address.

- Transaction details, including the nature of the goods or services purchased.

- VAT registration number, if applicable.

- Signature of the authorized person, confirming the accuracy of the information provided.

Obtaining the Vat C4 Form

To obtain the Vat C4 form, you can visit official government websites that provide tax forms or download it from trusted platforms. Ensure that you are accessing the most current version of the form to avoid any compliance issues. It is advisable to verify the source to ensure that the form meets all legal requirements.

Form Submission Methods

The Vat C4 form can typically be submitted through various methods, including:

- Online submission via designated tax authority portals.

- Mailing the completed form to the appropriate tax office.

- In-person submission at local tax offices, if required.

Choosing the right submission method can depend on your specific circumstances and preferences.

Quick guide on how to complete vat c4 format in word download

Effortlessly Prepare Vat C4 Format In Word Download on Any Device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents since you can obtain the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents quickly without any delays. Manage Vat C4 Format In Word Download on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The Easiest Way to Edit and eSign Vat C4 Format In Word Download with Ease

- Obtain Vat C4 Format In Word Download and click on Get Form to initiate the process.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Leave behind the worries of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Modify and eSign Vat C4 Format In Word Download and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the vat c4 format in word download

The best way to generate an eSignature for your PDF file in the online mode

The best way to generate an eSignature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

The way to create an electronic signature right from your smartphone

How to create an electronic signature for a PDF file on iOS devices

The way to create an electronic signature for a PDF on Android

People also ask

-

What is VAT C4 and how does it relate to airSlate SignNow?

VAT C4 refers to a specific tax compliance document many businesses need to manage. With airSlate SignNow, you can easily create, send, and eSign VAT C4 forms, ensuring you meet all compliance requirements swiftly and effortlessly.

-

How does airSlate SignNow simplify the eSigning process for VAT C4 documents?

airSlate SignNow simplifies the eSigning process for VAT C4 documents by providing an intuitive interface and seamless workflows. You can quickly prepare your documents, invite recipients to sign, and track their status in real-time, making it easy to handle VAT-related paperwork.

-

What are the pricing options for using airSlate SignNow for VAT C4 document processing?

airSlate SignNow offers competitive pricing options tailored to various business needs, including plans that cover the management of VAT C4 documents. These plans ensure you have access to all the essential features required for efficient document handling without breaking the bank.

-

Can airSlate SignNow integrate with other software for VAT C4 management?

Yes, airSlate SignNow can integrate seamlessly with various business applications, enhancing your ability to manage VAT C4 documents. This means you can connect it with your accounting software or other tools to ensure a cohesive workflow for tax documentation.

-

What features does airSlate SignNow offer specifically for VAT C4 documents?

airSlate SignNow offers features such as customizable templates, bulk sending capabilities, and automated reminders, all tailored for managing VAT C4 documents efficiently. These tools help to streamline your document workflows and ensure timely compliance.

-

Is airSlate SignNow compliant with VAT regulations for C4 documents?

Absolutely! airSlate SignNow is designed to comply with VAT regulations surrounding C4 documents. This guarantees that the electronic signatures and document storage meet legal standards, making your business operations secure and reliable.

-

How can I ensure the security of my VAT C4 documents in airSlate SignNow?

Security is a top priority for airSlate SignNow, especially for sensitive VAT C4 documents. The platform employs advanced encryption, access controls, and audit trails to ensure that your documents are secure and that you can track every access and modification.

Get more for Vat C4 Format In Word Download

- Car bill of sale vehicle dmv bill of sale form pdf

- Bill of sale oklahoma generic ok bos form template for

- Remaining unpaid immediately due and payable form

- Maine trailer bill of sale form templates fillable

- The official office of the recorder of records in book at page document form

- On the day of in the year before me the undersigned form

- Time and material rates and prices in accordance with the schedule of labor and materials attached form

- State of new york including any uniform premarital agreement act or other applicable laws

Find out other Vat C4 Format In Word Download

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word