Onett Bir Form

What is the Onett Bir

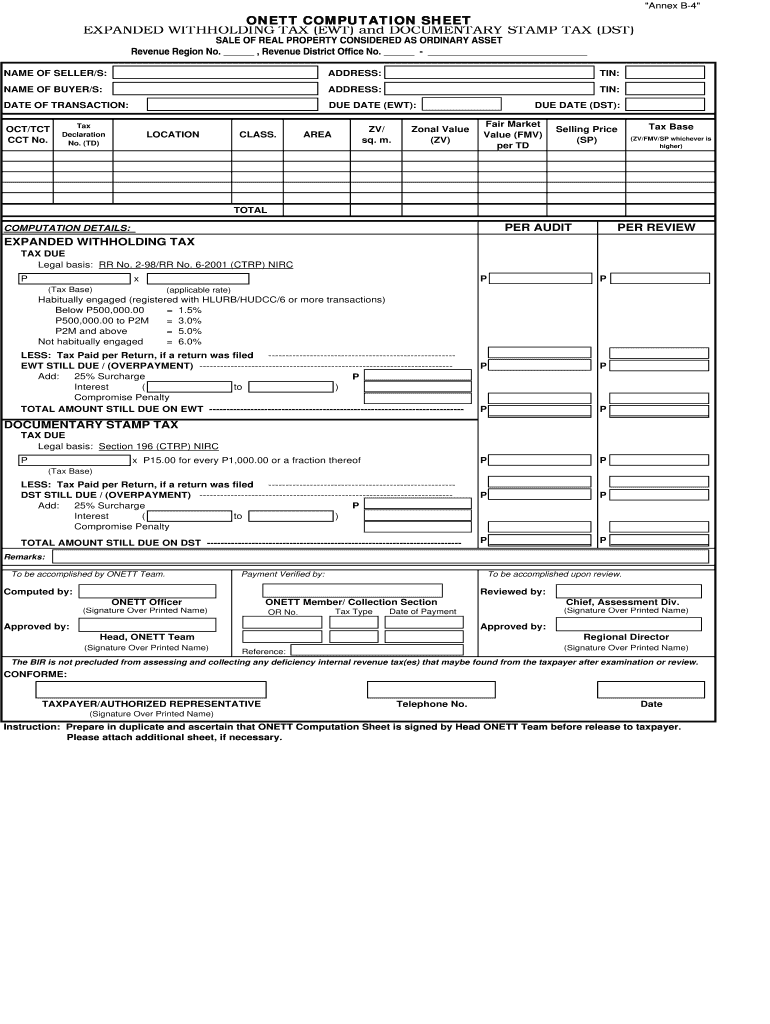

The Onett Bir, or Bureau of Internal Revenue Onett computation sheet, is a crucial document used for tax calculations in the Philippines. It serves as a formal record for taxpayers to compute their withholding tax obligations accurately. This form is essential for individuals and businesses to ensure compliance with tax regulations and to avoid potential penalties.

Steps to complete the Onett Bir

Completing the Onett Bir involves several important steps to ensure accuracy and compliance. Follow these guidelines:

- Gather necessary financial documents, including income statements and previous tax returns.

- Calculate your total income for the year, including all sources of revenue.

- Determine applicable deductions and exemptions based on your financial situation.

- Use the Onett computation sheet to input your figures and calculate the withholding tax.

- Review your calculations for accuracy before finalizing the form.

Legal use of the Onett Bir

The Onett Bir is legally recognized as a valid document for tax purposes when completed correctly. It must adhere to the guidelines set forth by the Bureau of Internal Revenue to ensure its acceptance. Proper signatures and dates are necessary to validate the form, and electronic submissions must comply with relevant eSignature laws to be considered legally binding.

Examples of using the Onett Bir

Taxpayers can utilize the Onett Bir in various scenarios, such as:

- Employees calculating their withholding tax for the year.

- Self-employed individuals determining their tax liabilities.

- Businesses preparing for tax audits by maintaining accurate records of withholding taxes.

Filing Deadlines / Important Dates

It is essential to be aware of filing deadlines related to the Onett Bir to avoid penalties. Typically, the form must be submitted by specific dates set by the Bureau of Internal Revenue, often aligned with quarterly or annual tax deadlines. Keeping track of these dates ensures compliance and helps maintain good standing with tax authorities.

Required Documents

To complete the Onett Bir accurately, taxpayers should prepare the following documents:

- Income statements from all sources.

- Previous tax returns for reference.

- Any relevant receipts for deductions and exemptions.

- Identification documents to verify taxpayer identity.

Quick guide on how to complete onett bir

Prepare Onett Bir effortlessly on any device

Web-based document management has become increasingly favored by companies and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed files, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly without any delays. Manage Onett Bir on any platform with airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

The easiest method to alter and eSign Onett Bir with ease

- Find Onett Bir and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, cumbersome form searches, or mistakes that require reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Onett Bir and ensure exceptional communication at every stage of your form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the onett bir

The way to generate an eSignature for a PDF in the online mode

The way to generate an eSignature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

How to generate an eSignature right from your smart phone

The way to create an eSignature for a PDF on iOS devices

How to generate an eSignature for a PDF on Android OS

People also ask

-

What is an onett computation sheet?

An onett computation sheet is a tool designed to simplify the calculation processes for various business needs. It allows users to easily input data and generate accurate computations, streamlining workflow. With airSlate SignNow, you can seamlessly integrate this feature into your document workflows.

-

How does airSlate SignNow enhance my onett computation sheet experience?

airSlate SignNow enhances your onett computation sheet experience by providing a user-friendly platform for eSigning and document management. This ensures that all calculations and documents remain organized and easily accessible. The solution simplifies collaboration among team members through shared access and real-time updates.

-

Is there a free trial available for the onett computation sheet?

Yes, airSlate SignNow offers a free trial for users to explore the benefits of the onett computation sheet. During the trial, you can test various features, including document eSigning and management, to determine how it suits your needs. Sign up today to see how the onett computation sheet can optimize your workflow.

-

What pricing plans are available for using the onett computation sheet?

airSlate SignNow offers flexible pricing plans tailored for businesses of all sizes utilizing the onett computation sheet. Plans include various features such as unlimited document signing and enhanced integrations. Visit our pricing page for detailed information on each plan and choose the one that fits your business needs.

-

Can I integrate other applications with my onett computation sheet?

Absolutely! airSlate SignNow supports numerous integrations with popular applications to enhance the functionality of your onett computation sheet. Whether you need to connect with CRM systems or project management tools, these integrations enable a seamless workflow and better data management.

-

How secure is the onett computation sheet in airSlate SignNow?

The onett computation sheet in airSlate SignNow is designed with security as a top priority. We employ robust encryption protocols and comply with industry standards to ensure your data remains confidential and protected. You can confidently use our platform, knowing your calculations and documents are secure.

-

What support options are available for onett computation sheet users?

airSlate SignNow provides comprehensive support options for users of the onett computation sheet. Whether you have questions about setup or specific features, our support team is available through various channels, including email, chat, and phone support. We are here to help you maximize your experience with our solution.

Get more for Onett Bir

- Fidm guidance document administration for children hhs form

- Form 4 24 5 16uifsa 10

- Obtaining an order of protection new york state unified court form

- Fca art 5 b form

- Child support unstructured form sample florida

- Ifyouarenottheintendedrecipientyouareherebynotifiedthatanyusedisclosuredistribution form

- Jr sr iii faq item form

- Partiesinthecaseunlessaccompaniedbyanondisclosurefindingaffidavit form

Find out other Onett Bir

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure