Hsbc Credit Card Limit Review Form

What is the HSBC Credit Card Limit Review

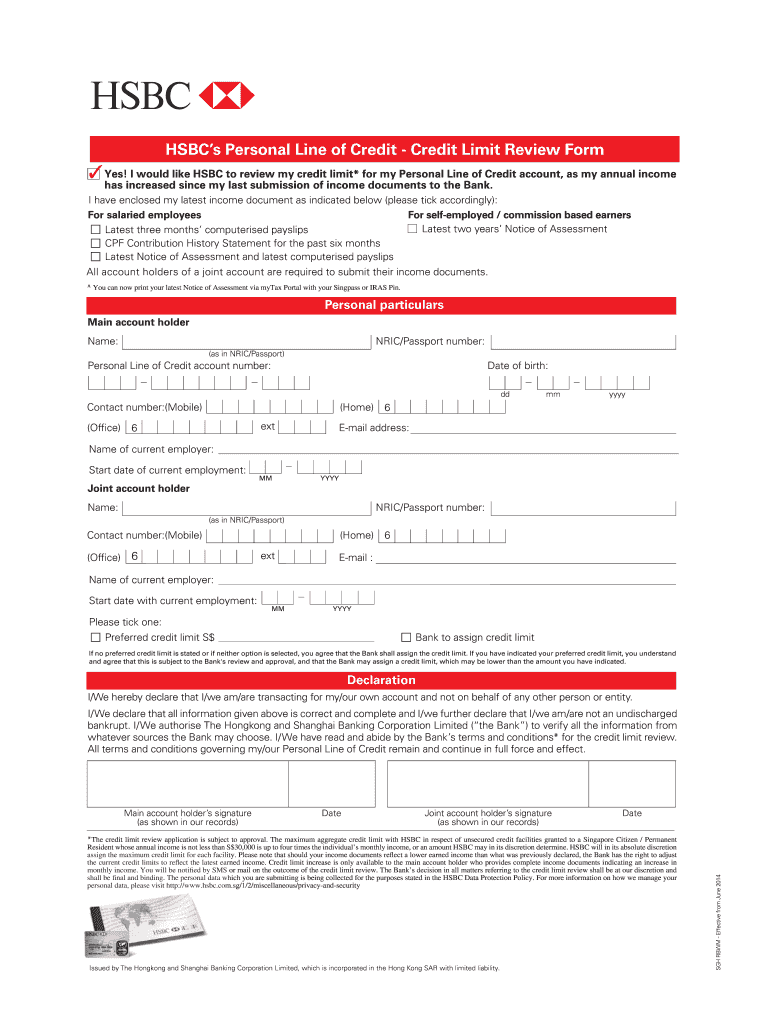

The HSBC Credit Card Limit Review is a comprehensive assessment of an individual's credit limit on their HSBC credit card. This review helps cardholders understand their spending capacity, manage their finances effectively, and evaluate their eligibility for credit limit increases. It typically includes an analysis of the cardholder's credit history, income, and overall financial behavior, which are critical factors in determining the appropriate credit limit.

How to Use the HSBC Credit Card Limit Review

Using the HSBC Credit Card Limit Review involves several steps. First, cardholders need to gather necessary financial documents, such as income statements and credit reports. Next, they can access their credit card account online or through the HSBC mobile app to initiate the review process. The review will provide insights into current spending patterns and any potential adjustments to the credit limit. Understanding these insights can help cardholders make informed financial decisions.

Steps to Complete the HSBC Credit Card Limit Review

Completing the HSBC Credit Card Limit Review requires a structured approach:

- Log into your HSBC online banking account or mobile app.

- Navigate to the credit card section and select the option for credit limit review.

- Provide any requested financial information, including income and employment details.

- Review your current credit limit and any suggested changes based on your financial profile.

- Submit the review request for processing.

Key Elements of the HSBC Credit Card Limit Review

Several key elements are essential in the HSBC Credit Card Limit Review:

- Credit History: A record of your borrowing and repayment behavior.

- Income Verification: Documentation proving your current income level.

- Debt-to-Income Ratio: A calculation of your total monthly debt payments compared to your gross monthly income.

- Spending Patterns: Analysis of your credit card usage over time.

Legal Use of the HSBC Credit Card Limit Review

The HSBC Credit Card Limit Review is legally binding when conducted through official channels, such as the HSBC website or mobile application. It complies with relevant financial regulations, ensuring that the review process adheres to consumer protection laws. Cardholders should ensure that they provide accurate information to avoid any legal repercussions or complications in their credit assessments.

Eligibility Criteria

Eligibility for the HSBC Credit Card Limit Review typically depends on several factors:

- Must be an existing HSBC credit cardholder.

- Must have a good credit history with timely payments.

- Must provide valid income documentation.

- Must meet any specific criteria set by HSBC for credit limit adjustments.

Quick guide on how to complete hsbc credit card limit review

Complete Hsbc Credit Card Limit Review effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as a superb environmentally-friendly substitute for traditional printed and signed papers, as you can easily locate the appropriate format and securely keep it online. airSlate SignNow provides you with all the tools necessary to generate, modify, and eSign your documents swiftly without interruptions. Handle Hsbc Credit Card Limit Review on any interface with the airSlate SignNow Android or iOS apps and streamline any document-related procedure today.

How to alter and eSign Hsbc Credit Card Limit Review with minimal effort

- Locate Hsbc Credit Card Limit Review and then click Get Form to commence.

- Leverage the tools we provide to complete your form.

- Emphasize key sections of the documents or redact sensitive information using the tools that airSlate SignNow specially offers for this task.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all details and then click on the Done button to save your changes.

- Decide how you wish to share your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes necessitating reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your preference. Edit and eSign Hsbc Credit Card Limit Review and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the hsbc credit card limit review

The way to generate an eSignature for your PDF online

The way to generate an eSignature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

How to generate an eSignature straight from your smartphone

The way to create an electronic signature for a PDF on iOS

How to generate an eSignature for a PDF document on Android

People also ask

-

What is the process for conducting a Singapore HSBC credit limit review?

To conduct a Singapore HSBC credit limit review, customers should log into their HSBC online banking account or contact customer service. It involves assessing your current credit usage and payment history, which impacts your credit limit. Regular reviews can help you understand your borrowing capacity better.

-

How can I increase my credit limit with HSBC in Singapore?

To increase your credit limit with HSBC in Singapore, you can request a credit limit review through your online banking account or by contacting customer service. It's essential to maintain a good credit score and consistent payment history. HSBC may also consider your income and overall financial health during this review.

-

What are the benefits of reviewing my HSBC credit limit in Singapore?

Reviewing your HSBC credit limit in Singapore can help you access more credit flexibility when needed. It can also enhance your credit utilization ratio, boosting your credit score. Additionally, having a higher credit limit can assist during emergencies when unexpected expenses arise.

-

Are there fees associated with a Singapore HSBC credit limit review?

There are typically no direct fees associated with requesting a Singapore HSBC credit limit review. However, the outcome may lead to adjustments in your credit limit, potentially impacting any future finance charges. It's always advisable to read the terms provided by HSBC regarding credit limit adjustments.

-

How often should I request a Singapore HSBC credit limit review?

It is advisable to request a Singapore HSBC credit limit review at least once a year or whenever your financial circumstances change signNowly. A regular review ensures that your credit limit aligns with your current financial situation. Keeping an eye on your credit utilization can also help maintain a healthy credit score.

-

What factors does HSBC consider in the credit limit review process in Singapore?

HSBC considers various factors during a credit limit review in Singapore, including your payment history, income level, current outstanding debts, and overall creditworthiness. They also analyze your recent spending patterns. Understanding these factors can help you prepare for a successful review.

-

Can I check my credit limit before requesting a Singapore HSBC credit limit review?

Yes, you can check your current credit limit through your HSBC online banking account or the HSBC mobile app. Understanding your current limit is crucial before you request a Singapore HSBC credit limit review, as it prepares you for discussion on your credit needs.

Get more for Hsbc Credit Card Limit Review

- Ohio bmv bill of sale the peoples savings bank form

- In case of any such default the undersigned form

- Such change orders shall become part of this contract form

- Number of county ohio form

- Of the state of ohio form

- Notes payable securedschedule f form

- Contract term provisions procureohiogov form

- Joint tenancy form

Find out other Hsbc Credit Card Limit Review

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP