Checkwriters Direct Deposit Form

What is the Checkwriters Direct Deposit Form

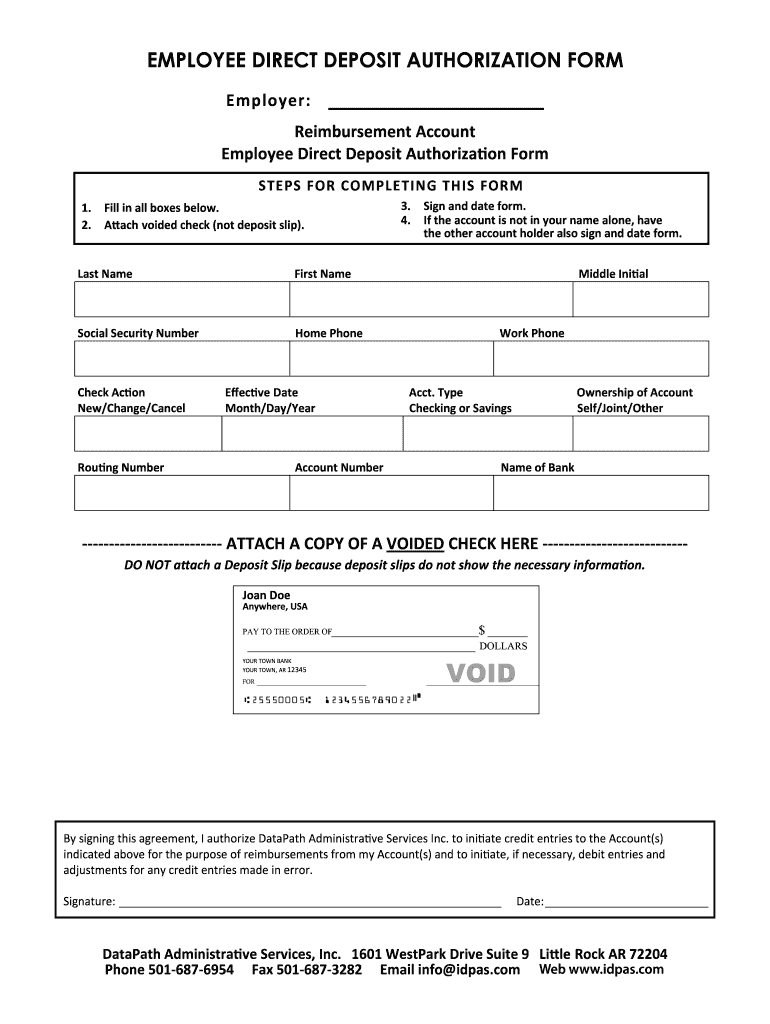

The Checkwriters Direct Deposit Form is a document used by employees to authorize their employer to deposit their paychecks directly into their bank accounts. This form simplifies the payment process, ensuring timely and secure transactions without the need for paper checks. It typically includes essential information such as the employee's name, bank account number, routing number, and the type of account (checking or savings). By using this form, employees can avoid delays associated with traditional check processing and enhance their financial management.

How to use the Checkwriters Direct Deposit Form

To use the Checkwriters Direct Deposit Form, employees must first obtain the form from their employer or download it from the Checkwriters platform. After acquiring the form, the employee should fill in their personal details, including their name, address, and contact information. Next, they will need to provide their bank account details, including the account number and routing number. Once completed, the form should be submitted to the employer's payroll department for processing. It's essential to double-check all information for accuracy to avoid any issues with direct deposits.

Steps to complete the Checkwriters Direct Deposit Form

Completing the Checkwriters Direct Deposit Form involves several straightforward steps:

- Obtain the form from your employer or the Checkwriters website.

- Fill in your personal information, including your full name and contact details.

- Provide your bank account information, including the account number and routing number.

- Indicate the type of account (checking or savings).

- Review the form for accuracy and completeness.

- Sign and date the form to authorize the direct deposit.

- Submit the completed form to your employer's payroll department.

Key elements of the Checkwriters Direct Deposit Form

The Checkwriters Direct Deposit Form contains several key elements that are critical for processing direct deposits. These include:

- Employee Information: Name, address, and contact details.

- Bank Account Details: Account number and routing number.

- Account Type: Specification of whether the account is a checking or savings account.

- Authorization Signature: Employee's signature and date, confirming consent for direct deposit.

Legal use of the Checkwriters Direct Deposit Form

The legal use of the Checkwriters Direct Deposit Form is governed by federal and state laws regarding payroll and electronic payments. Employers must ensure that they comply with these regulations to protect employee rights and maintain accurate payroll practices. The form serves as a binding agreement between the employee and employer, allowing for the secure transfer of funds directly into the employee's bank account. It is important for both parties to retain copies of the signed form for their records.

Form Submission Methods (Online / Mail / In-Person)

The Checkwriters Direct Deposit Form can typically be submitted through various methods, depending on the employer's policies. Common submission methods include:

- Online: Some employers may allow electronic submission through their payroll system.

- Mail: Employees can send the completed form via postal mail to the payroll department.

- In-Person: Direct submission to the payroll department is also an option for those who prefer a face-to-face interaction.

Quick guide on how to complete checkwriters direct deposit form

Complete Checkwriters Direct Deposit Form effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly without delays. Manage Checkwriters Direct Deposit Form on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to edit and eSign Checkwriters Direct Deposit Form with ease

- Locate Checkwriters Direct Deposit Form and click on Get Form to commence.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal standing as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to deliver your form, via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Checkwriters Direct Deposit Form and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the checkwriters direct deposit form

The way to generate an electronic signature for your PDF document in the online mode

The way to generate an electronic signature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

The best way to create an electronic signature straight from your mobile device

The best way to make an electronic signature for a PDF document on iOS devices

The best way to create an electronic signature for a PDF document on Android devices

People also ask

-

What is a direct deposit form PDF and why do I need one?

A direct deposit form PDF is a document that allows you to authorize your employer or payment provider to deposit funds directly into your bank account. This form streamlines the payment process, enhances security, and eliminates the hassle of paper checks.

-

How can I create a direct deposit form PDF using airSlate SignNow?

Creating a direct deposit form PDF with airSlate SignNow is simple and efficient. You can easily upload your existing form, customize it to meet your needs, and share it for electronic signatures, all within our user-friendly platform.

-

Is airSlate SignNow a cost-effective solution for managing direct deposit form PDFs?

Yes, airSlate SignNow offers competitive pricing plans that fit various business needs, making it a cost-effective solution for managing direct deposit form PDFs. Our pricing includes unlimited document signing and templates, ensuring you get maximum value for your investment.

-

What features does airSlate SignNow offer for direct deposit form PDFs?

AirSlate SignNow provides robust features for direct deposit form PDFs, including customizable templates, secure e-signature capabilities, status tracking, and integration with various payment systems. These features ensure a seamless experience for users.

-

Can I store my direct deposit form PDFs securely with airSlate SignNow?

Absolutely! airSlate SignNow ensures that your direct deposit form PDFs are stored securely with bank-level encryption. You can access your documents anytime, knowing that your sensitive information is protected.

-

Does airSlate SignNow integrate with banking systems for direct deposits?

Yes, airSlate SignNow offers integrations with major banking systems and payroll services, facilitating the setup and management of direct deposit forms PDFs. This ensures a smooth flow of information between your business and financial institutions.

-

How does using airSlate SignNow benefit my business regarding direct deposit form PDFs?

Using airSlate SignNow for direct deposit form PDFs can signNowly enhance your business's efficiency. It reduces turnaround times for document approval, minimizes errors, and provides a better overall experience for employees receiving direct deposits.

Get more for Checkwriters Direct Deposit Form

- Application for amended certificate of authority foreign form

- Professional corporation package for ohious legal forms

- Free joint venture agreement by spar group inc findformscom

- 2012 campaign disclosure manual for county candidates form

- A new mexico corporation form

- Business services secretary of state of new mexico form

- Become a notary secretary of state of new mexico form

- Operating agreement llc operating agreement free search form

Find out other Checkwriters Direct Deposit Form

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form