Pathway Scholarship Acceptance Form Clovis Community College Clovis 2008-2026

Understanding the Scholarship Tax Form

The scholarship tax form is a crucial document for students receiving financial aid, as it outlines the tax implications of scholarships and grants. In the United States, scholarships can be considered taxable income if they exceed qualified education expenses, such as tuition and required fees. Understanding how to fill out this form accurately can help students avoid potential tax issues.

Students should be aware that not all scholarships are taxable. For instance, scholarships used for tuition, fees, and required course materials are generally not taxed. However, funds used for living expenses, travel, or optional materials may be subject to taxation. It’s essential to consult IRS guidelines for clarity on what constitutes taxable income.

Steps to Complete the Scholarship Tax Form

Completing the scholarship tax form involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including scholarship award letters and receipts for qualified expenses. Next, determine the total amount of scholarship funds received and identify which portions are taxable.

Once you have the required information, fill out the form by entering your personal details, including your Social Security number and the amount of scholarship income. Be sure to check the specific instructions for your form, as different types may have unique requirements. After completing the form, review it for accuracy before submitting it to the IRS.

IRS Guidelines for Scholarship Taxation

The IRS provides specific guidelines regarding the taxation of scholarships and grants. According to IRS Publication 970, students must report any scholarship amounts that exceed their qualified education expenses. It is important to differentiate between what is considered taxable and non-taxable income.

Qualified education expenses typically include tuition, fees, and course materials required for enrollment. Any funds allocated for living expenses or optional materials may be taxable. Understanding these guidelines can help students navigate their tax obligations more effectively and avoid penalties.

Filing Deadlines for the Scholarship Tax Form

Filing deadlines for the scholarship tax form align with the general tax filing deadlines in the United States. Typically, individual tax returns are due by April 15 each year. Students should ensure that they submit their scholarship tax form by this date to avoid late fees and penalties.

It is advisable to keep track of any changes in tax laws or deadlines, as these can vary from year to year. Additionally, students may want to consider filing their taxes early to ensure they have enough time to address any questions or issues that may arise.

Required Documents for Filing

When preparing to file the scholarship tax form, students should gather several key documents to ensure a smooth process. These documents typically include:

- Scholarship award letters detailing the amounts received

- Receipts for qualified education expenses, such as tuition and required fees

- Any additional documentation related to living expenses, if applicable

- Previous tax returns, if available, for reference

Having these documents on hand will facilitate accurate reporting and help students comply with IRS requirements.

Form Submission Methods

Students have several options for submitting their scholarship tax forms. The most common methods include:

- Online filing through tax preparation software, which often simplifies the process and ensures compliance with current tax laws

- Mailing a paper form to the IRS, which may be necessary for certain types of forms or if students prefer traditional filing methods

- In-person submission at designated IRS offices, although this option may be less common

Each method has its benefits, and students should choose the one that best fits their needs and comfort level with technology.

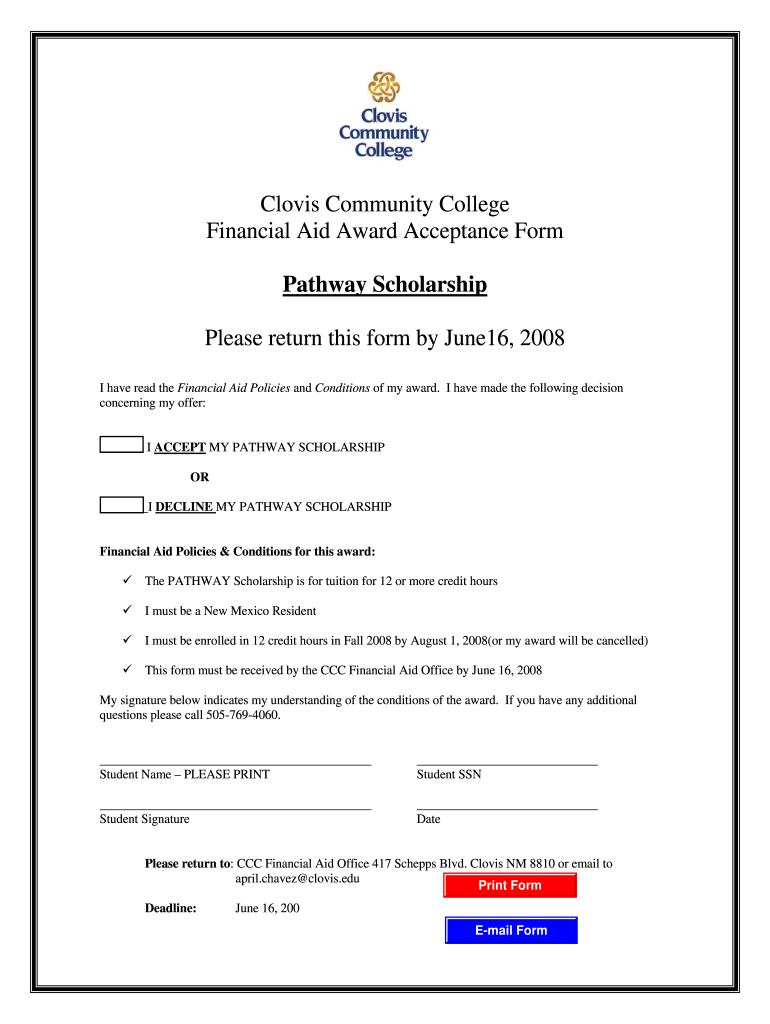

Quick guide on how to complete pathway scholarship acceptance form clovis community college clovis

Complete Pathway Scholarship Acceptance Form Clovis Community College Clovis effortlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can access the correct template and securely store it online. airSlate SignNow provides all the tools necessary for you to create, modify, and electronically sign your documents swiftly without delays. Manage Pathway Scholarship Acceptance Form Clovis Community College Clovis on any device using airSlate SignNow apps for Android or iOS and simplify any document-related process today.

The easiest method to modify and eSign Pathway Scholarship Acceptance Form Clovis Community College Clovis seamlessly

- Locate Pathway Scholarship Acceptance Form Clovis Community College Clovis and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Choose how you want to share your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that require new document copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Pathway Scholarship Acceptance Form Clovis Community College Clovis to ensure excellent communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pathway scholarship acceptance form clovis community college clovis

The way to make an eSignature for your PDF online

The way to make an eSignature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The way to make an electronic signature from your smartphone

The way to make an electronic signature for a PDF on iOS

The way to make an electronic signature for a PDF file on Android

People also ask

-

What is scholarship tax and how does it affect my finances?

Scholarship tax refers to the tax implications associated with receiving scholarship funds. It's important to understand that while many scholarships are tax-free, portions used for expenses like room and board may be subject to taxes. Consulting a tax advisor can help clarify how scholarship tax applies to your situation.

-

Are scholarships considered taxable income?

Generally, scholarships are not considered taxable income as long as the funds are used for qualified education expenses. However, any portion of the scholarship allocated for non-qualified expenses may be subject to scholarship tax. It's crucial to keep accurate records of how the scholarship funds are spent.

-

How can I minimize my scholarship tax liabilities?

To minimize scholarship tax liabilities, make sure to use your scholarship funds exclusively for qualified expenses, such as tuition and required fees. Planning your education financing and consulting a tax professional can further reduce potential liabilities. Staying informed about tax regulations can also help you manage your scholarship tax effectively.

-

What features does airSlate SignNow offer for managing scholarship documents?

airSlate SignNow provides features like electronic signature, online document templates, and secure storage that can help manage scholarship-related documents efficiently. These features ensure that you can quickly sign and send necessary paperwork while maintaining compliance with scholarship tax regulations. This simplifies the document management process for students and institutions alike.

-

Is there a cost associated with using airSlate SignNow for scholarship documentation?

airSlate SignNow offers various pricing plans to meet different needs, including options suitable for students managing scholarship documents. The cost is relatively low compared to traditional methods, making it a cost-effective solution for handling documents related to scholarship tax and compliance. You can choose a plan that fits your budget while ensuring effective document management.

-

Can airSlate SignNow integrate with other tools used for scholarship administration?

Yes, airSlate SignNow offers integration capabilities with various applications used in scholarship administration. This ensures that you can seamlessly incorporate your existing tools for a smoother workflow, especially when managing scholarship tax documentation. Integrations enhance productivity and help in better tracking of related processes.

-

What are the benefits of using airSlate SignNow for scholarship tax compliance?

Using airSlate SignNow for scholarship tax compliance offers several benefits, including streamlined document signing and enhanced security. The platform simplifies the process of obtaining necessary signatures and tracking documents, which is crucial for maintaining compliance with scholarship tax requirements. Additionally, it promotes efficiency, saving you time and effort.

Get more for Pathway Scholarship Acceptance Form Clovis Community College Clovis

- Notice of termination due to work rules violation legal form

- Design services agreement this agreement is entered into form

- Cancellation of leave of absence form

- Enclosed herewith please find a letter which i received from form

- Foodborne disease outbreaks world health organization form

- Construction management flashcardsquizlet form

- Disputed account settlement form

- Rfp824refrigeration and maintenance montclair state form

Find out other Pathway Scholarship Acceptance Form Clovis Community College Clovis

- How Can I Sign North Dakota Warranty Deed

- How Do I Sign Oklahoma Warranty Deed

- Sign Florida Postnuptial Agreement Template Online

- Sign Colorado Prenuptial Agreement Template Online

- Help Me With Sign Colorado Prenuptial Agreement Template

- Sign Missouri Prenuptial Agreement Template Easy

- Sign New Jersey Postnuptial Agreement Template Online

- Sign North Dakota Postnuptial Agreement Template Simple

- Sign Texas Prenuptial Agreement Template Online

- Sign Utah Prenuptial Agreement Template Mobile

- Sign West Virginia Postnuptial Agreement Template Myself

- How Do I Sign Indiana Divorce Settlement Agreement Template

- Sign Indiana Child Custody Agreement Template Now

- Sign Minnesota Divorce Settlement Agreement Template Easy

- How To Sign Arizona Affidavit of Death

- Sign Nevada Divorce Settlement Agreement Template Free

- Sign Mississippi Child Custody Agreement Template Free

- Sign New Jersey Child Custody Agreement Template Online

- Sign Kansas Affidavit of Heirship Free

- How To Sign Kentucky Affidavit of Heirship