Fillable Fin 405 2013-2026

What is the Fillable Fin 405

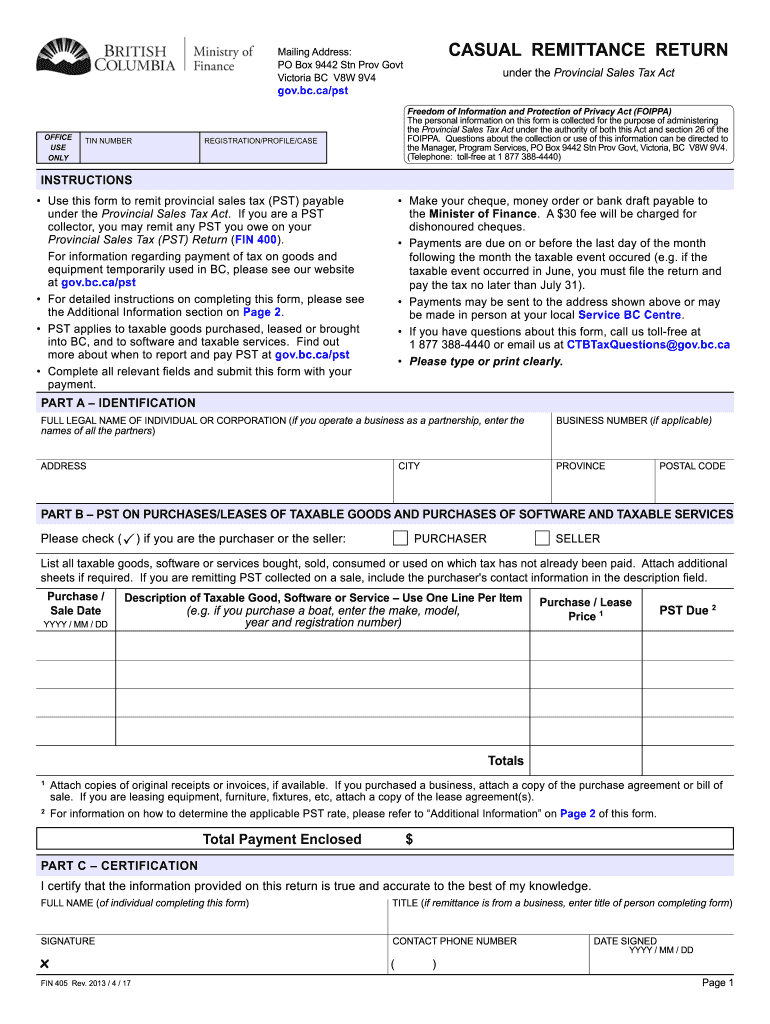

The Fillable Fin 405, also known as the Form 405 Casual Remittance Form, is a document used primarily for remittance purposes within the United States. This form allows individuals and businesses to report casual remittances, which may include payments for services or other transactions that do not fall under standard tax categories. The fillable version of this form facilitates easy completion and submission, ensuring that users can provide necessary information without the hassle of paper forms.

How to Use the Fillable Fin 405

Using the Fillable Fin 405 is straightforward. First, access the form through a reliable electronic platform that supports digital signatures. Fill in the required fields, which typically include personal details, payment information, and the purpose of the remittance. Once all information is accurately entered, review the form to ensure completeness. Finally, submit the form electronically or print it for mailing, depending on your preference or the requirements of the receiving entity.

Steps to Complete the Fillable Fin 405

Completing the Fillable Fin 405 involves several key steps:

- Access the form through a digital platform.

- Enter your personal and payment information in the designated fields.

- Review all entered data for accuracy.

- Sign the document electronically to validate your submission.

- Submit the form electronically or print it for mailing.

Legal Use of the Fillable Fin 405

The Fillable Fin 405 is legally binding when completed and submitted according to established regulations. To ensure its legal standing, users must adhere to eSignature laws such as the ESIGN Act and UETA, which govern the use of electronic signatures in the United States. By using a trusted platform like signNow, users can obtain an electronic certificate that verifies the authenticity of their signature, further reinforcing the legal validity of the form.

Filing Deadlines / Important Dates

Filing deadlines for the Fillable Fin 405 can vary based on the specific purpose of the remittance. It is crucial to check the relevant guidelines or consult with a tax professional to determine the exact deadlines applicable to your situation. Missing a deadline may result in penalties or complications with the processing of your remittance, so staying informed is essential.

Required Documents

To complete the Fillable Fin 405, certain documents may be required. Typically, you will need identification information, such as a Social Security number or taxpayer identification number, and any supporting documents that justify the remittance. This could include invoices, contracts, or receipts related to the payment being reported. Having these documents ready will streamline the process and ensure compliance with any necessary regulations.

Quick guide on how to complete fillable fin 405

Prepare Fillable Fin 405 seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to generate, adjust, and eSign your documents promptly and efficiently. Manage Fillable Fin 405 on any device with the airSlate SignNow applications for Android or iOS and streamline any document-related tasks today.

How to modify and eSign Fillable Fin 405 with ease

- Obtain Fillable Fin 405 and click Get Form to commence.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information using the tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature with the Sign tool, which takes a few seconds and carries the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method of delivering the form, whether by email, SMS, or via an invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that require new document copies to be printed. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign Fillable Fin 405 and ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fillable fin 405

The way to make an eSignature for your PDF online

The way to make an eSignature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The way to make an electronic signature from your smartphone

The way to make an electronic signature for a PDF on iOS

The way to make an electronic signature for a PDF file on Android

People also ask

-

What is airSlate SignNow and how does it relate to fin 405?

airSlate SignNow is a digital solution that allows businesses to send and eSign documents efficiently. With fin 405, you can streamline your document workflow, ensuring that all financial processes are completed securely and rapidly, greatly enhancing productivity.

-

How does airSlate SignNow enhance document management in relation to fin 405?

By utilizing airSlate SignNow, businesses can manage their documents more effectively in compliance with fin 405 standards. The platform simplifies the process of document tracking, ensuring that every signature and change is recorded accurately for compliance and audit purposes.

-

What pricing options does airSlate SignNow offer for businesses focusing on fin 405?

airSlate SignNow offers flexible pricing plans designed to accommodate businesses of all sizes dealing with fin 405 requirements. From individual plans to team packages, you can choose an option that fits your budget while ensuring access to essential features for smooth document processing.

-

What features of airSlate SignNow support compliance with fin 405?

airSlate SignNow provides robust features such as advanced security, audit trails, and templates that support compliance with fin 405. These features ensure your documents are not only legally binding but also secure and accessible whenever needed.

-

Can airSlate SignNow integrate with other software for fin 405 processes?

Yes, airSlate SignNow seamlessly integrates with various software applications that businesses might already be using for fin 405 processes. This includes popular tools for project management, CRM systems, and accounting software, making it easier to ensure all aspects of your operations are connected.

-

What benefits does airSlate SignNow offer for businesses focusing on fin 405?

airSlate SignNow offers numerous benefits for businesses adhering to fin 405, including time savings, improved document accuracy, and enhanced collaboration. These advantages lead to a more efficient workflow, making it easier for teams to manage financial documents effectively.

-

Is training required to use airSlate SignNow for fin 405 workflows?

Training is not strictly required to use airSlate SignNow, as the platform is designed to be user-friendly for fin 405 workflows. However, tutorials and support are available to help users maximize the software's capabilities and ensure they are fully compliant with relevant regulations.

Get more for Fillable Fin 405

- Form c 10f

- Court building b room 120 washington d form

- Asuntos civilestribunales del distrito de columbia dc courts form

- Affidavit in support of default and scra compliance form

- Motion for contempt domestic relations order dc courts form

- Civil actions dc courts form

- B 510 4th n form

- B 510 4th n 481195180 form

Find out other Fillable Fin 405

- eSignature Delaware Employee Compliance Survey Later

- eSignature Kansas Employee Compliance Survey Myself

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage

- Electronic signature West Virginia Sales Receipt Template Free

- Electronic signature Colorado Sales Invoice Template Computer

- Electronic signature New Hampshire Sales Invoice Template Computer

- Electronic signature Tennessee Introduction Letter Free

- How To eSignature Michigan Disclosure Notice

- How To Electronic signature Ohio Product Defect Notice

- Electronic signature California Customer Complaint Form Online

- Electronic signature Alaska Refund Request Form Later

- How Can I Electronic signature Texas Customer Return Report