Schedule C Worksheet Form

What is the Schedule C Worksheet

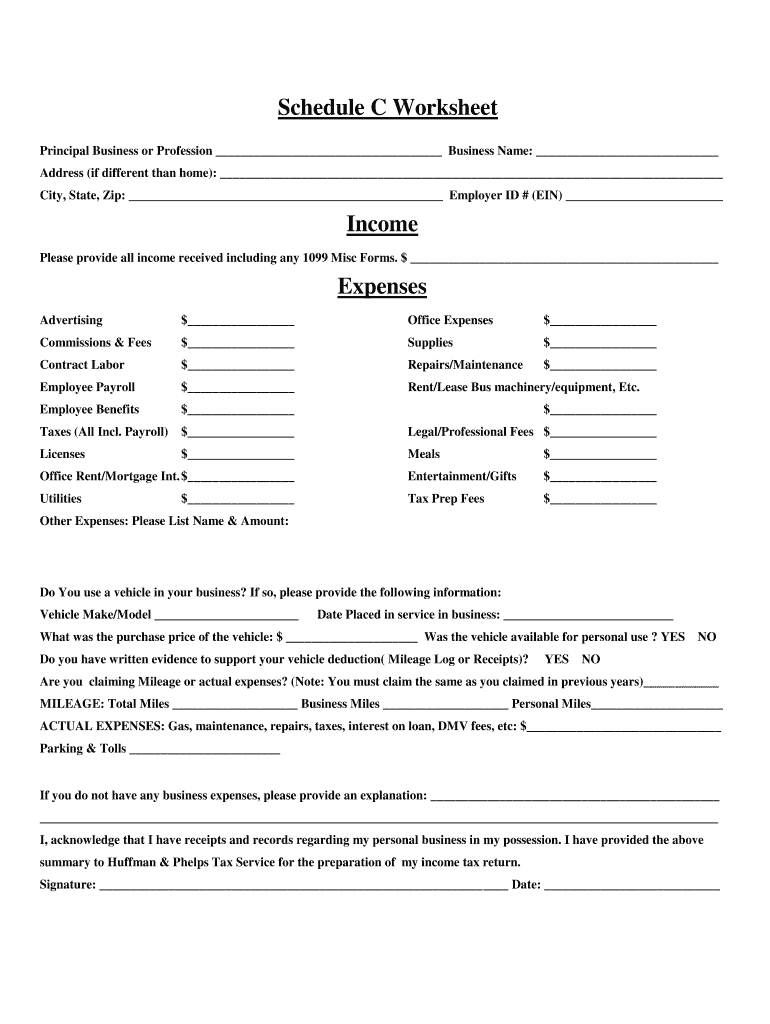

The Schedule C Worksheet is a tax form used by self-employed individuals and sole proprietors in the United States to report income and expenses related to their business activities. This form is essential for calculating net profit or loss, which ultimately affects the individual's overall tax liability. The Schedule C tax form allows taxpayers to detail their business income, deductible expenses, and other relevant financial information, making it a crucial component of the annual tax filing process.

How to use the Schedule C Worksheet

Using the Schedule C Worksheet involves several steps to ensure accurate reporting of business income and expenses. First, gather all necessary financial records, including receipts, invoices, and bank statements. Next, begin filling out the worksheet by entering your total business income at the top of the form. Then, categorize and list your business expenses, which may include costs such as supplies, advertising, and travel. After completing the expense section, calculate your net profit or loss by subtracting total expenses from total income. This final figure will be reported on your individual income tax return.

Steps to complete the Schedule C Worksheet

Completing the Schedule C Worksheet involves a systematic approach to ensure accuracy. Follow these steps:

- Collect all relevant financial documents, including income statements and expense receipts.

- Start by entering your business name and the type of business you operate.

- Report your total income from sales or services rendered.

- List all deductible expenses, categorizing them appropriately (e.g., cost of goods sold, operating expenses).

- Calculate your total expenses and subtract them from your total income to determine your net profit or loss.

- Review the completed worksheet for accuracy before submitting it with your tax return.

Legal use of the Schedule C Worksheet

The Schedule C Worksheet is legally recognized as a valid document for reporting income and expenses for tax purposes. To ensure its legal standing, it is important to comply with IRS guidelines and maintain accurate records. E-signatures can also be utilized to sign the document electronically, provided that the e-signature adheres to legal standards set forth by the ESIGN Act and UETA. This compliance ensures that the Schedule C tax form is accepted by the IRS and holds up in any legal scrutiny.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Schedule C Worksheet. Taxpayers should refer to the IRS instructions for the Schedule C form, which detail how to report different types of income and expenses. It is important to follow these guidelines closely to avoid errors that could lead to audits or penalties. Additionally, the IRS updates these guidelines periodically, so staying informed about any changes is essential for accurate tax reporting.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule C Worksheet align with the overall tax filing deadlines in the United States. Typically, self-employed individuals must file their tax returns by April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to keep track of any changes to these deadlines and consider filing for an extension if more time is needed to gather documentation.

Quick guide on how to complete schedule c worksheet

Prepare Schedule C Worksheet seamlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely archive it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without delays. Manage Schedule C Worksheet on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-centric workflow today.

How to modify and electronically sign Schedule C Worksheet with ease

- Find Schedule C Worksheet and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize essential sections of the documents or obscure sensitive details using the tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and then click on the Done button to save your modifications.

- Choose how you wish to deliver your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form navigation, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Edit and electronically sign Schedule C Worksheet and ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule c worksheet

How to make an electronic signature for a PDF document online

How to make an electronic signature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

The best way to make an electronic signature straight from your smart phone

The best way to generate an eSignature for a PDF document on iOS

The best way to make an electronic signature for a PDF document on Android OS

People also ask

-

What is a Schedule C tax form?

The Schedule C tax form is used by sole proprietors to report income and expenses from their business operations. This form is essential for calculating net profit or loss, which is then transferred to your personal income tax return. Completing the Schedule C accurately is crucial for ensuring that you meet all tax obligations.

-

How can airSlate SignNow help with the Schedule C tax form?

airSlate SignNow allows you to efficiently send and eSign your Schedule C tax form and related documents. Our user-friendly platform streamlines the process, ensuring that your tax forms are completed quickly and securely. With airSlate SignNow, you can focus on your business while we handle the paperwork.

-

Is there a cost associated with using airSlate SignNow for my Schedule C tax form?

Yes, airSlate SignNow offers competitive pricing plans that cater to different needs, including those who need to manage their Schedule C tax form. Our plans are designed to be cost-effective, providing great value for the features we offer. You can choose a plan that fits your budget while simplifying your document management.

-

What features does airSlate SignNow offer for managing tax documents like the Schedule C tax form?

airSlate SignNow provides features such as eSigning, document templates, and secure storage, all of which are essential for handling your Schedule C tax form. Our platform ensures that you can access your documents anytime from any device. Additionally, you can send reminders to recipients to ensure timely submissions of your tax forms.

-

Can I integrate airSlate SignNow with my accounting software for Schedule C tax form management?

Absolutely! airSlate SignNow can seamlessly integrate with popular accounting software, allowing you to access and manage your Schedule C tax form alongside your financial data. This integration enhances efficiency by reducing the need for manual data entry and ensuring that all your documents are easily accessible in one place.

-

What are the benefits of using airSlate SignNow for my Schedule C tax form?

Using airSlate SignNow for your Schedule C tax form simplifies the process of document signing and management, saving you time and reducing stress. Our secure platform ensures that your sensitive information is protected while allowing for easy tracking and management of your documents. Enjoy the convenience of handling all your tax-related paperwork in one easy-to-use solution.

-

How secure is the airSlate SignNow platform for handling Schedule C tax forms?

The security of your documents, including Schedule C tax forms, is our top priority at airSlate SignNow. We utilize advanced encryption and security protocols to protect your sensitive information at all stages. You can trust that your documents are stored safely and are only accessible to authorized users.

Get more for Schedule C Worksheet

Find out other Schedule C Worksheet

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word