Deposit 03 2017-2026

What is the Deposit 03

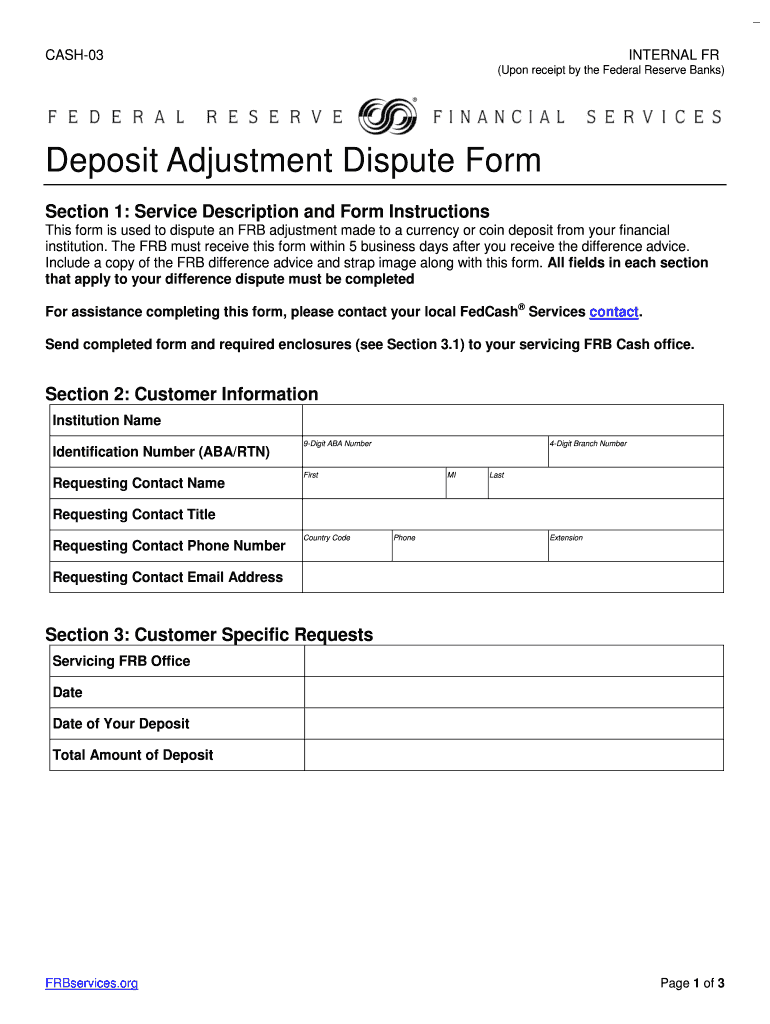

The Deposit 03 is a specific form used to address discrepancies or adjustments related to bank deposits. This form is crucial for individuals and businesses seeking to resolve issues such as incorrect amounts deposited, missing funds, or other banking errors. Understanding the purpose of the Deposit 03 is essential for ensuring that your financial transactions are accurately reflected in your bank statements.

How to use the Deposit 03

Using the Deposit 03 involves several steps to ensure that your request is processed efficiently. First, gather all relevant information, including your account details, transaction dates, and any supporting documentation that substantiates your claim. Next, accurately fill out the form, providing clear explanations for the adjustments needed. Finally, submit the form through the appropriate channels, whether online, by mail, or in person, depending on your bank's procedures.

Steps to complete the Deposit 03

Completing the Deposit 03 requires careful attention to detail. Follow these steps for a successful submission:

- Collect necessary information, including your account number and transaction details.

- Clearly state the reason for the adjustment, providing any supporting evidence.

- Fill out the Deposit 03 form accurately, ensuring all fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the form according to your bank's guidelines, keeping a copy for your records.

Legal use of the Deposit 03

The legal use of the Deposit 03 is governed by banking regulations and policies. It is important to ensure that the information provided is truthful and accurate, as submitting false information can lead to legal repercussions. The form serves as a formal request to rectify banking errors, and its proper completion is essential for compliance with financial regulations.

Required Documents

When submitting the Deposit 03, certain documents may be required to support your claim. These documents can include:

- Bank statements showing the discrepancies.

- Receipts or transaction records related to the deposits in question.

- Identification documents, such as a driver's license or passport.

Having these documents ready will facilitate a smoother process when your form is reviewed by the bank.

Form Submission Methods

The Deposit 03 can typically be submitted through various methods, depending on your bank's policies. Common submission methods include:

- Online submission via the bank's secure portal.

- Mailing the completed form to the bank's designated address.

- In-person submission at a local branch.

Each method has its benefits, so choose the one that best suits your needs and ensures timely processing.

Quick guide on how to complete deposit 03

Effortlessly Prepare Deposit 03 on Any Device

Online document management has become widely adopted by businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to easily find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly and efficiently. Manage Deposit 03 on any platform using airSlate SignNow's Android or iOS applications and enhance your document-centric tasks today.

How to Modify and eSign Deposit 03 with Ease

- Obtain Deposit 03 and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Mark important sections of your documents or redact sensitive information using the tools provided by airSlate SignNow specifically for this purpose.

- Create your electronic signature using the Sign tool, which takes only seconds and has the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose your preferred method for delivering your form, whether by email, SMS, or an invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and eSign Deposit 03 and ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the deposit 03

How to make an eSignature for your PDF in the online mode

How to make an eSignature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The way to create an electronic signature from your smart phone

The best way to make an electronic signature for a PDF on iOS devices

The way to create an electronic signature for a PDF file on Android OS

People also ask

-

What is a deposit adjustment in airSlate SignNow?

A deposit adjustment in airSlate SignNow refers to the modifications made to the financial transactions or agreements through eSigned documents. This feature ensures accuracy and transparency in your transactions, allowing you to efficiently manage your deposit adjustments.

-

How does airSlate SignNow handle deposit adjustments?

airSlate SignNow simplifies deposit adjustments by facilitating the secure signing and storage of documents. With our platform, you can easily create, manage, and execute agreements that involve deposit adjustments, streamlining your process while maintaining compliance.

-

Are there any costs associated with deposit adjustments?

Using airSlate SignNow for deposit adjustments is part of our competitively priced plans. Depending on your subscription, there may be additional fees for extra features, but document signing and basic deposit adjustments are included in our standard packages.

-

Can I integrate deposit adjustments with other financial tools?

Yes, airSlate SignNow allows for seamless integration with various financial tools and software for managing deposit adjustments. This ensures that your eSigned documents and financial records are coordinated and accessible across platforms.

-

What are the benefits of using airSlate SignNow for deposit adjustments?

Using airSlate SignNow for deposit adjustments offers several benefits, including reduced paperwork, improved accuracy, and quicker transaction times. Our user-friendly interface makes it easy to execute and track all your deposit adjustments effectively.

-

Is airSlate SignNow secure for handling deposit adjustments?

Absolutely! airSlate SignNow prioritizes security, using advanced encryption and compliance measures to protect your sensitive data associated with deposit adjustments. You can trust our platform to keep your information safe and secure.

-

Can I customize the documents for deposit adjustments?

Yes, airSlate SignNow lets you customize your documents for deposit adjustments to meet your specific needs. You can add your branding, edit templates, and ensure all necessary terms are included to create tailored agreements.

Get more for Deposit 03

- Alabama petition for appointment of guardian and conservator form

- Alabama verification of petition or appointment of guardian and conservator form

- Alabama answer to divorce and counterclaim for divorce form

- Alabama complaint to enjoin a foreclosure form

- Alabama motion for orders pendente lite temporary support and custody form

- Alabama petition to modify form

- Alabama satisfaction release or cancellation of mortgage by corporation form

- Partial release mortgage form

Find out other Deposit 03

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple