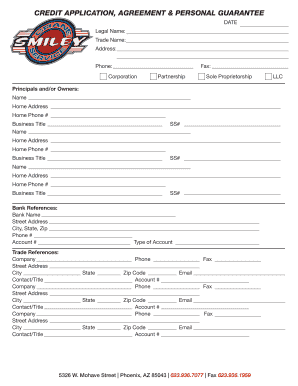

CREDIT APPLICATION, AGREEMENT & PERSONAL GUARANTEE Form

Understanding the credit application with personal guarantee

A credit application with personal guarantee is a formal request for credit that includes a commitment from an individual to be personally responsible for the debt incurred by a business or organization. This type of agreement is often required by lenders to mitigate risk, ensuring that they have recourse to the personal assets of the guarantor if the business defaults on its obligations. The personal guarantee adds an extra layer of security for lenders, making it easier for businesses to secure financing.

Key elements of the credit application with personal guarantee

When completing a credit application with personal guarantee, several key elements must be included to ensure its validity and effectiveness:

- Personal Information: The guarantor's full name, address, and Social Security number are essential for identification purposes.

- Business Information: Details about the business, including its name, address, and type of entity, should be clearly stated.

- Loan Amount: Specify the amount of credit being requested, as this is crucial for both the lender and the guarantor.

- Terms of Agreement: Clearly outline the terms under which the personal guarantee is made, including any conditions or limitations.

- Signatures: Both the business representative and the guarantor must sign the document to validate the agreement.

Steps to complete the credit application with personal guarantee

Completing a credit application with personal guarantee involves several steps to ensure accuracy and compliance:

- Gather necessary documentation, including identification and business financial statements.

- Fill out the credit application form, ensuring all required fields are completed accurately.

- Review the terms of the personal guarantee, understanding the implications of signing.

- Sign the application and personal guarantee, ensuring that both parties have signed where required.

- Submit the completed application to the lender through the preferred submission method.

Legal use of the credit application with personal guarantee

The legal validity of a credit application with personal guarantee is supported by various laws governing contracts and agreements. In the United States, electronic signatures are recognized under the ESIGN Act and UETA, allowing for the secure execution of documents online. It is essential that the application meets all legal requirements, including proper identification of the parties involved and clear articulation of the terms of the guarantee.

Examples of using the credit application with personal guarantee

Businesses often utilize a credit application with personal guarantee in various scenarios, such as:

- When seeking a business loan from a bank or credit union.

- When applying for a line of credit with suppliers or vendors.

- When leasing commercial property that requires a personal guarantee for the lease agreement.

Eligibility criteria for a personal guarantee

Eligibility criteria for signing a personal guarantee typically include:

- The guarantor must be an individual with sufficient personal assets to cover the potential debt.

- The guarantor should have a good credit history, as lenders will assess creditworthiness.

- The guarantor must be legally capable of entering into a contract, meaning they should be of legal age and not under any legal restrictions.

Quick guide on how to complete credit application agreement amp personal guarantee

Effortlessly Prepare CREDIT APPLICATION, AGREEMENT & PERSONAL GUARANTEE on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely archive it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents quickly without any delays. Manage CREDIT APPLICATION, AGREEMENT & PERSONAL GUARANTEE on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and electronically sign CREDIT APPLICATION, AGREEMENT & PERSONAL GUARANTEE effortlessly

- Obtain CREDIT APPLICATION, AGREEMENT & PERSONAL GUARANTEE and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important parts of your documents or obscure sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes only moments and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, frustrating form searches, or errors that necessitate reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign CREDIT APPLICATION, AGREEMENT & PERSONAL GUARANTEE and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the credit application agreement amp personal guarantee

The way to create an electronic signature for your PDF file online

The way to create an electronic signature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

How to make an eSignature straight from your mobile device

The best way to create an electronic signature for a PDF file on iOS

How to make an eSignature for a PDF document on Android devices

People also ask

-

What is a credit application with personal guarantee?

A credit application with personal guarantee is a document that allows businesses to request credit while also providing a personal guarantee from an individual. This means that if the business defaults on the loan, the individual who signed the guarantee is personally responsible for repayment. airSlate SignNow makes it easy to create and eSign such applications securely.

-

How does airSlate SignNow handle credit applications with personal guarantees?

With airSlate SignNow, businesses can efficiently send, receive, and eSign credit applications with personal guarantees through a user-friendly interface. The platform streamlines the process, allowing for quick document turnaround and ensuring all parties can easily sign electronically, making it a practical solution for obtaining credit.

-

What are the benefits of using airSlate SignNow for credit applications?

Using airSlate SignNow for credit applications with personal guarantees provides numerous benefits, including enhanced security, faster processing times, and reduced paperwork. Additionally, the platform helps businesses stay organized and ensures that all signed documents are stored securely in the cloud.

-

Can I integrate airSlate SignNow with other applications for my credit application process?

Yes, airSlate SignNow offers seamless integrations with various applications to enhance your credit application process. You can connect it with CRM systems, accounting software, and other tools to streamline workflows, making it easier to manage credit applications with personal guarantees.

-

Is airSlate SignNow cost-effective for managing credit applications with personal guarantees?

Absolutely! airSlate SignNow is a cost-effective solution, providing features that cater specifically to businesses of all sizes. With various pricing plans available, organizations can choose the option that best fits their budget while still getting robust functionality for managing credit applications with personal guarantees.

-

What security measures does airSlate SignNow implement for sensitive documents?

airSlate SignNow employs advanced security measures to protect sensitive documents like credit applications with personal guarantees. This includes encryption, secure data storage, and comprehensive authentication protocols to ensure that only authorized individuals can access and eSign documents.

-

How can airSlate SignNow improve the efficiency of my credit application process?

By using airSlate SignNow to manage credit applications with personal guarantees, you can signNowly improve efficiency. The platform allows for quick electronic signing, real-time tracking of document status, and automated reminders, which helps reduce delays and get your credit applications processed faster.

Get more for CREDIT APPLICATION, AGREEMENT & PERSONAL GUARANTEE

Find out other CREDIT APPLICATION, AGREEMENT & PERSONAL GUARANTEE

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online

- eSignature New York Web Hosting Agreement Mobile

- eSignature North Carolina Web Hosting Agreement Secure

- How Do I eSignature Utah Web Hosting Agreement

- eSignature Connecticut Joint Venture Agreement Template Myself

- eSignature Georgia Joint Venture Agreement Template Simple

- eSignature Alaska Debt Settlement Agreement Template Safe

- eSignature New Jersey Debt Settlement Agreement Template Simple

- eSignature New Mexico Debt Settlement Agreement Template Free

- eSignature Tennessee Debt Settlement Agreement Template Secure

- eSignature Wisconsin Debt Settlement Agreement Template Safe

- Can I eSignature Missouri Share Transfer Agreement Template

- eSignature Michigan Stock Purchase Agreement Template Computer

- eSignature California Indemnity Agreement Template Online

- eSignature New Mexico Promissory Note Template Now