NOTICE of WITHHOLDING of FEDERAL INCOME TAXES from Smwnpf Form

What is the notice of withholding of federal income taxes from smwnpf

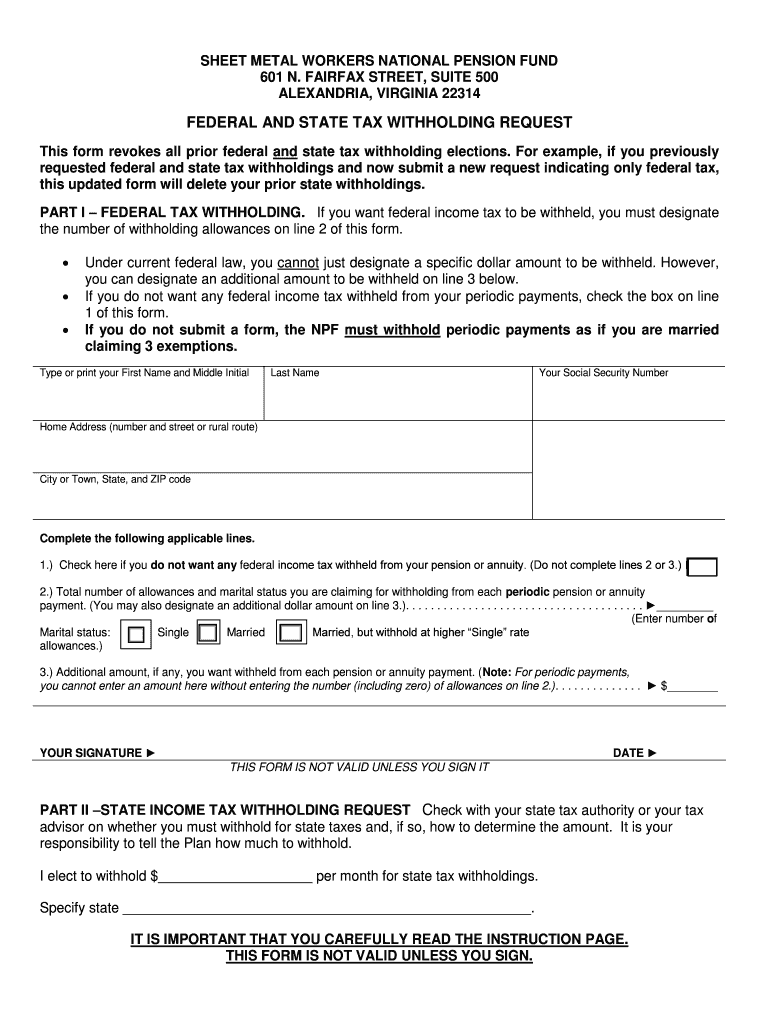

The notice of withholding of federal income taxes from smwnpf is a crucial document used by employers to inform employees about the amount of federal income tax that will be withheld from their paychecks. This form is essential for ensuring compliance with federal tax regulations and helps employees understand their tax obligations. By providing transparency, it allows employees to plan their finances accordingly.

Steps to complete the notice of withholding of federal income taxes from smwnpf

Completing the notice of withholding of federal income taxes from smwnpf involves several key steps:

- Gather necessary personal information, including your Social Security number and filing status.

- Determine the amount of federal income tax to withhold based on your income and deductions.

- Fill out the form accurately, ensuring all fields are completed to avoid delays.

- Review the completed form for accuracy before submitting it to your employer.

Legal use of the notice of withholding of federal income taxes from smwnpf

The legal use of the notice of withholding of federal income taxes from smwnpf is governed by federal tax laws. When completed correctly, this form serves as a legally binding document that outlines the withholding agreement between the employer and employee. It is important to ensure compliance with the Internal Revenue Service (IRS) regulations to avoid penalties and ensure proper tax reporting.

IRS guidelines

The IRS provides specific guidelines for the completion and submission of the notice of withholding of federal income taxes from smwnpf. These guidelines include:

- Instructions on how to calculate the correct withholding amount based on your income level.

- Information on how to update your withholding status if your financial situation changes.

- Details on the deadlines for submitting the form to your employer to ensure timely processing.

Filing deadlines / important dates

It is essential to be aware of the filing deadlines associated with the notice of withholding of federal income taxes from smwnpf. Key dates include:

- January 31: Deadline for employers to provide employees with their annual withholding summary.

- April 15: Deadline for individuals to file their federal income tax returns, which includes reconciling withheld amounts.

Examples of using the notice of withholding of federal income taxes from smwnpf

Understanding practical examples of how the notice of withholding of federal income taxes from smwnpf is used can enhance clarity. For instance:

- An employee who receives a bonus may need to adjust their withholding to account for the additional income.

- A self-employed individual might use the form to calculate estimated tax payments based on their projected earnings.

Quick guide on how to complete notice of withholding of federal income taxes from smwnpf

Complete NOTICE OF WITHHOLDING OF FEDERAL INCOME TAXES FROM Smwnpf effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It presents an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to obtain the necessary form and securely save it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage NOTICE OF WITHHOLDING OF FEDERAL INCOME TAXES FROM Smwnpf on any device using airSlate SignNow Android or iOS applications and simplify any document-related operation today.

The easiest way to modify and electronically sign NOTICE OF WITHHOLDING OF FEDERAL INCOME TAXES FROM Smwnpf without hassle

- Obtain NOTICE OF WITHHOLDING OF FEDERAL INCOME TAXES FROM Smwnpf and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose your preferred method to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow satisfies your document management needs in just a few clicks from any device you prefer. Alter and electronically sign NOTICE OF WITHHOLDING OF FEDERAL INCOME TAXES FROM Smwnpf and ensure exceptional communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How can I deduct on my Federal income taxes massage therapy for my chronic migraines? Is there some form to fill out to the IRS for permission?

As long as your doctor prescribed this, it is tax deductible under the category for medical expenses. There is no IRS form for permission.

-

How do you fill out an income tax form for a director of a company in India?

There are no special provisions for a director of a company. He should file the return on the basis of his income . If he is just earning salary ten ITR-1.~Sayantan Sen Gupta~

-

Which form is to be filled out to avoid an income tax deduction from a bank?

Banks have to deduct TDS when interest income is more than Rs.10,000 in a year. The bank includes deposits held in all its branches to calculate this limit. But if your total income is below the taxable limit, you can submit Forms 15G and 15H to the bank requesting them not to deduct any TDS on your interest.Please remember that Form 15H is for senior citizens, those who are 60 years or older; while Form 15G is for everybody else.Form 15G and Form 15H are valid for one financial year. So you have to submit these forms every year if you are eligible. Submitting them as soon as the financial year starts will ensure the bank does not deduct any TDS on your interest income.Conditions you must fulfill to submit Form 15G:Youare an individual or HUFYou must be a Resident IndianYou should be less than 60 years oldTax calculated on your Total Income is nilThe total interest income for the year is less than the minimum exemption limit of that year, which is Rs 2,50,000 for financial year 2016-17Thanks for being here

-

How can I fill out the details of my PPF and LIC in income tax return along with Form 16 details?

PPF contribution and LIC premium paid is shown under section 80C deductions ( chapter VIA deduction) in ITR.However total limit under 80C is 1.5L.( I am assuming that you have referred to investments made -ppf/LIC and not withdrawals (income)from the same).Regards.

-

What share of federal revenue comes from individual income taxes? How does that compare to corporate taxes?

Just as an aside, corporate taxes are a misnomer. Large corporations do everything within their power to minimize any taxes. Some of their methods are even legal [gasp!]. By and large, there is no way on earth that a company's executive board or its shareholders have any desire to shoulder the least share of those taxes.The cost of whatever corporate taxes that do get paid is passed on to, guess who? YOU.So, in reality, taxpayers lay out for not just their own income tax but those of businesses as well. This is just one of many reasons why some serious tax reform is needed in America. Of course, you can bet the farm that all those large corporations are ponying up big bucks for lobbyists, cushy junkets and every other form of quasi-legal graft to prevent any such thing from happening.

-

I am a Pakistani living out of Pakistan. My income is exempted from income tax. However, whenever I buy something in Pakistan (e.g. land or car) I am required to produce my national tax number or pay a certain amount as withholding tax. Is there a way to avoid this? What should I do?

You will have to pay the witholding tax, and then technically speaking, you can file a tax return and get a refund for all the extra taxes you paid since, as you said, your income is not taxable in Pakistan.As a practical matter, you will NEVER get the refund you are legally entitled to unless you share a portion of that with FBR officials.It should be noted that this is not just a question of corrupt government officials, this is a national fiscal strategy set by the highest levels of government. For example, every construction labourer who is below the basic income level still pays presumptive income tax when he gets a prepaid scratch card for his mobile phone. Same on airline tickets, utility bills, etc … The Government knows there is no practical way for him to get his money back, so this is just easy free revenue for the Government - obtained by taxing people who don't owe any tax.

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

How do I fill the income tax return form of India?

you can very easily file your income tax return online, but decide which return to file generally salaried individual files ITR 1 and businessmen files ITR 4S as both are very easy to file. First Fill the Details on First Page Name, Address, mobile no, PAN Number, Date of Birth and income from salary and deduction you are claiming under 80C and other sections. Then fill the details of TDS deduction which can be check from Form 16 as well as Form 26AS availbale online. Then complete the details on 3rd page like bank account number, type of account(saving), Bank MICR code(given on cheque book), father name. Then Click and Validate button and if there is any error it will automatically show. recity those error Then click on calculate button and finally click on generate button and save .xml file which you have to upload on income tax. This website I really found very good for income tax related problem visit Income Tax Website for Efiling Taxes, ITR Forms, etc. for more information.

Create this form in 5 minutes!

How to create an eSignature for the notice of withholding of federal income taxes from smwnpf

How to make an electronic signature for your Notice Of Withholding Of Federal Income Taxes From Smwnpf online

How to create an electronic signature for the Notice Of Withholding Of Federal Income Taxes From Smwnpf in Google Chrome

How to create an eSignature for putting it on the Notice Of Withholding Of Federal Income Taxes From Smwnpf in Gmail

How to make an electronic signature for the Notice Of Withholding Of Federal Income Taxes From Smwnpf right from your mobile device

How to make an electronic signature for the Notice Of Withholding Of Federal Income Taxes From Smwnpf on iOS devices

How to create an electronic signature for the Notice Of Withholding Of Federal Income Taxes From Smwnpf on Android devices

People also ask

-

What is a NOTICE OF WITHHOLDING OF FEDERAL INCOME TAXES FROM Smwnpf?

A NOTICE OF WITHHOLDING OF FEDERAL INCOME TAXES FROM Smwnpf is an official document that informs employees of the federal income tax withheld from their paychecks. This notice helps employees understand their tax obligations and ensures compliance with federal tax regulations. Utilizing airSlate SignNow, businesses can easily create, send, and eSign this document securely.

-

How can airSlate SignNow help with the NOTICE OF WITHHOLDING OF FEDERAL INCOME TAXES FROM Smwnpf?

airSlate SignNow provides a streamlined platform for generating and managing the NOTICE OF WITHHOLDING OF FEDERAL INCOME TAXES FROM Smwnpf. With our easy-to-use interface, you can quickly create templates, send documents for eSignature, and store them securely, ensuring that all tax obligations are met efficiently.

-

Is there a cost associated with using airSlate SignNow for creating tax notices?

Yes, airSlate SignNow offers a variety of pricing plans suitable for businesses of all sizes. Each plan provides access to features that simplify the creation and management of documents like the NOTICE OF WITHHOLDING OF FEDERAL INCOME TAXES FROM Smwnpf. Choose a plan that best suits your business needs and budget.

-

Can I customize the NOTICE OF WITHHOLDING OF FEDERAL INCOME TAXES FROM Smwnpf template in airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize the NOTICE OF WITHHOLDING OF FEDERAL INCOME TAXES FROM Smwnpf template to fit your business requirements. You can add your company logo, modify text, and adjust fields to ensure the document meets all legal and branding standards.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for tax documents like the NOTICE OF WITHHOLDING OF FEDERAL INCOME TAXES FROM Smwnpf offers numerous benefits, including improved efficiency, enhanced security, and reduced error rates. Our platform ensures that your documents are securely stored and easily accessible, streamlining your workflow and saving you time.

-

Does airSlate SignNow integrate with other software for tax management?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax management software. This integration allows you to automate the process of generating the NOTICE OF WITHHOLDING OF FEDERAL INCOME TAXES FROM Smwnpf, ensuring that your financial records are accurate and up-to-date.

-

How secure is the information in my NOTICE OF WITHHOLDING OF FEDERAL INCOME TAXES FROM Smwnpf?

Security is a top priority at airSlate SignNow. We use advanced encryption and security protocols to protect the information contained in your NOTICE OF WITHHOLDING OF FEDERAL INCOME TAXES FROM Smwnpf. You can trust that your sensitive data is safe while using our platform.

Get more for NOTICE OF WITHHOLDING OF FEDERAL INCOME TAXES FROM Smwnpf

- Win your lawsuit sue in california superior court without a lawyer google form

- Stipulation to continue california form

- Mc 030 declaration california courts state of california form

- Declaration order notice form

- Form 982a17a 2001

- Request trial setting form

- Instructions for applications and orders la court form

- Laciv005 form

Find out other NOTICE OF WITHHOLDING OF FEDERAL INCOME TAXES FROM Smwnpf

- eSignature Michigan Internship Contract Computer

- Can I eSignature Nebraska Student Data Sheet

- How To eSignature Michigan Application for University

- eSignature North Carolina Weekly Class Evaluation Now

- eSignature Colorado Medical Power of Attorney Template Fast

- Help Me With eSignature Florida Medical Power of Attorney Template

- eSignature Iowa Medical Power of Attorney Template Safe

- eSignature Nevada Medical Power of Attorney Template Secure

- eSignature Arkansas Nanny Contract Template Secure

- eSignature Wyoming New Patient Registration Mobile

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template