Sctax 111 E File Form

What is the Sctax 111 E File Form

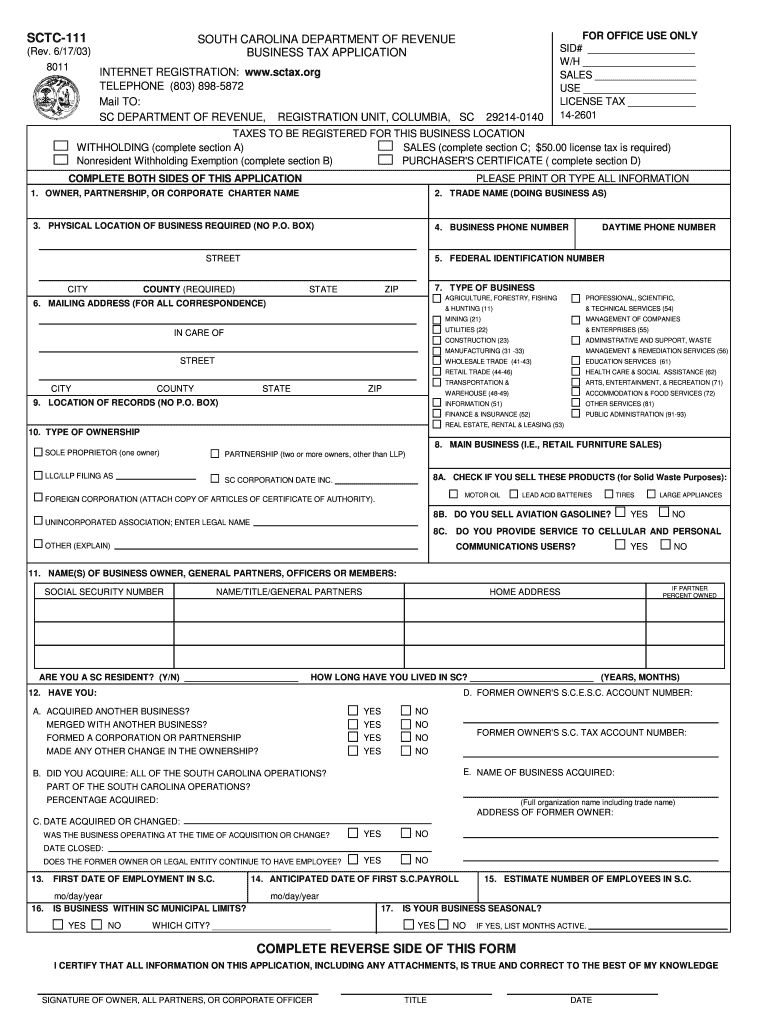

The Sctax 111 E File Form is a tax document utilized in South Carolina for electronic filing of state income tax returns. This form is essential for individuals and businesses to report their income and calculate the taxes owed to the state. It is designed to facilitate a streamlined process that allows taxpayers to submit their information efficiently, ensuring compliance with state tax regulations.

Steps to Complete the Sctax 111 E File Form

Completing the Sctax 111 E File Form involves several clear steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including W-2s, 1099s, and other income statements. Next, access the form through an approved electronic filing platform. Carefully input your personal information, including your Social Security number and filing status. Then, report your income and deductions accurately. After completing the form, review all entries for errors before submitting it electronically. Ensure you receive confirmation of submission to maintain a record of your filing.

How to Obtain the Sctax 111 E File Form

The Sctax 111 E File Form can be obtained through the South Carolina Department of Revenue's official website. Taxpayers can access the form in a digital format, which is optimized for electronic filing. Additionally, many tax preparation software programs include the Sctax 111 E File Form, allowing users to complete and submit their filings directly through the software. It is important to ensure that the version used is the most current to comply with any updates in tax regulations.

Legal Use of the Sctax 111 E File Form

The Sctax 111 E File Form holds legal significance as it serves as an official document for tax reporting in South Carolina. To be considered valid, the form must be completed accurately and submitted according to state guidelines. Compliance with the legal requirements surrounding eSignatures and electronic submissions is crucial. Utilizing a trusted platform, like signNow, ensures that the form is executed with the necessary legal protections, including adherence to ESIGN and UETA regulations.

Form Submission Methods

The Sctax 111 E File Form can be submitted electronically or via traditional mail. Electronic submission is encouraged as it allows for faster processing and confirmation. Taxpayers can file online through approved e-filing services that meet state requirements. Alternatively, for those who prefer to file by mail, printed forms can be sent to the South Carolina Department of Revenue. It is essential to follow the specific guidelines for each submission method to avoid delays or penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Sctax 111 E File Form are critical for compliance. Typically, individual tax returns must be filed by April fifteenth of each year. However, if April fifteenth falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any changes in deadlines that may occur due to state regulations or specific circumstances. Keeping track of these dates ensures timely filing and helps avoid penalties.

Quick guide on how to complete sctax 111 e file form

Complete Sctax 111 E File Form effortlessly on any device

Online document management has become increasingly favored by businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the required form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Sctax 111 E File Form on any device using the airSlate SignNow Android or iOS applications and simplify any document-based workflow today.

How to edit and eSign Sctax 111 E File Form with ease

- Find Sctax 111 E File Form and click Get Form to begin.

- Make use of the tools we provide to complete your document.

- Highlight important sections of your documents or mask sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and has the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searches, or errors that necessitate the printing of new document copies. airSlate SignNow addresses your document management requirements in just a few clicks from any device of your choice. Edit and eSign Sctax 111 E File Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How can I create an auto-fill JavaScript file to fill out a Google form which has dynamic IDs that change every session?

Is it possible to assign IDs on the radio buttons as soon as the page loads ?

-

How do I store form values to a JSON file after filling the HTML form and submitting it using Node.js?

//on submit you can do like this

Create this form in 5 minutes!

How to create an eSignature for the sctax 111 e file form

How to create an electronic signature for the Sctax 111 E File Form in the online mode

How to generate an eSignature for your Sctax 111 E File Form in Google Chrome

How to create an eSignature for putting it on the Sctax 111 E File Form in Gmail

How to create an eSignature for the Sctax 111 E File Form right from your smartphone

How to create an eSignature for the Sctax 111 E File Form on iOS devices

How to create an electronic signature for the Sctax 111 E File Form on Android devices

People also ask

-

What is the Sctax 111 E File Form and how does it work?

The Sctax 111 E File Form is a crucial document for taxpayers in South Carolina, allowing them to electronically file their state tax returns. With airSlate SignNow, you can easily prepare and submit your Sctax 111 E File Form online, ensuring a streamlined and efficient process for tax season.

-

How much does it cost to use airSlate SignNow for the Sctax 111 E File Form?

airSlate SignNow offers affordable pricing plans that cater to various business needs. Whether you are an individual or a business, you can utilize our platform to file the Sctax 111 E File Form at a competitive rate, ensuring you get the best value for your e-signature and document management needs.

-

What features does airSlate SignNow provide for filing the Sctax 111 E File Form?

airSlate SignNow offers a range of features for filing the Sctax 111 E File Form, including easy document upload, customizable templates, and secure e-signature capabilities. These tools help simplify the filing process, making it faster and more efficient for users.

-

Is airSlate SignNow secure for submitting the Sctax 111 E File Form?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your Sctax 111 E File Form and other sensitive documents are protected. We use advanced encryption methods and secure servers to safeguard your information during the filing process.

-

Can I integrate airSlate SignNow with other software for the Sctax 111 E File Form?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and tax preparation software, making it easier to manage your Sctax 111 E File Form alongside other financial documents. This integration helps streamline your workflow and improves efficiency.

-

How can I track the status of my Sctax 111 E File Form submission?

With airSlate SignNow, you can easily track the status of your Sctax 111 E File Form after submission. Our platform provides real-time updates and notifications, so you always know the progress of your tax filing.

-

What are the benefits of using airSlate SignNow for the Sctax 111 E File Form?

Using airSlate SignNow for the Sctax 111 E File Form offers multiple benefits, including time savings, reduced paperwork, and enhanced accuracy. Our user-friendly platform simplifies the filing process, allowing you to focus on other important aspects of your business.

Get more for Sctax 111 E File Form

Find out other Sctax 111 E File Form

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer