Income Only Trust Form

What is the Income Only Trust Form

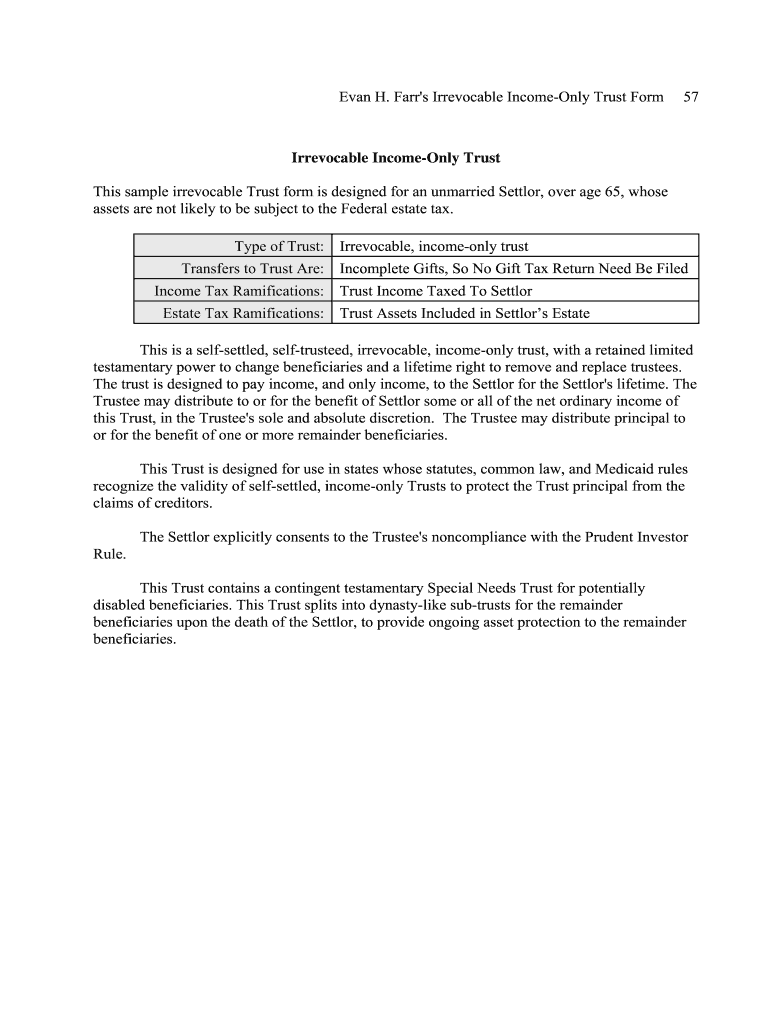

The income only trust form is a legal document that allows individuals to establish a trust where the income generated by the trust assets is distributed to the grantor or beneficiaries while the principal remains protected. This type of trust is often used for estate planning purposes, particularly to manage assets and provide for beneficiaries without triggering immediate tax consequences. It is essential to understand the specific legal implications and requirements that govern the creation and management of an income only trust.

Steps to complete the Income Only Trust Form

Completing the income only trust form involves several key steps to ensure that the document is legally binding and meets all necessary requirements. First, gather all relevant information regarding the trust assets and beneficiaries. Next, fill out the form with accurate details, including the names and addresses of the grantor and beneficiaries. It is crucial to specify the terms of the trust, including how income will be distributed. Finally, sign the form in the presence of a notary public to validate the document. This process helps ensure that the trust is properly established and can be enforced legally.

Legal use of the Income Only Trust Form

The income only trust form is legally recognized in many jurisdictions, including the United States, provided it complies with state-specific laws and regulations. This form is often utilized in estate planning to protect assets from creditors and to qualify for certain government benefits, such as Medicaid. It is important to consult with a legal professional to ensure that the trust is set up correctly and adheres to all applicable laws. Understanding the legal framework surrounding the income only trust can help prevent future disputes and ensure that the grantor's wishes are honored.

Key elements of the Income Only Trust Form

Several key elements must be included in the income only trust form to ensure its validity. These elements typically include the full names and addresses of the grantor and beneficiaries, a detailed description of the trust assets, and clear instructions regarding the distribution of income. Additionally, the form should outline the powers of the trustee and any specific conditions under which the trust may be modified or revoked. Including these elements helps to create a comprehensive and enforceable trust document.

Examples of using the Income Only Trust Form

There are various scenarios in which an income only trust form may be beneficial. For instance, an individual may use this form to protect their assets while still receiving income from investments during their lifetime. Another common example is when parents establish an income only trust for their children, ensuring that the children receive financial support while safeguarding the principal for future use. These examples illustrate the flexibility and utility of the income only trust in different financial and familial contexts.

Eligibility Criteria

To establish an income only trust, certain eligibility criteria must be met. Generally, the grantor must be of legal age and mentally competent to create a trust. Additionally, the trust must have identifiable beneficiaries, and the assets placed in the trust should be clearly defined. It is also important to ensure that the trust complies with state-specific laws regarding trust formation and management. Meeting these criteria helps to ensure the trust's effectiveness and legal standing.

Form Submission Methods (Online / Mail / In-Person)

The income only trust form can typically be submitted through various methods, depending on the requirements of the state in which it is created. Many jurisdictions allow for electronic submission, which can expedite the process. Alternatively, the form may be mailed to the appropriate government office or filed in person at a local courthouse. It is essential to verify the submission methods accepted in your state to ensure that the form is processed correctly and in a timely manner.

Quick guide on how to complete income only trust form

Learn how to navigate the Income Only Trust Form completion effortlessly with this simple guide

Online form submission and completion is becoming more and more popular, serving as the preferred choice for numerous clients. It provides various advantages over conventional printed documents, such as convenience, time savings, enhanced accuracy, and safety.

With tools like airSlate SignNow, you can locate, modify, validate, enhance, and forward your Income Only Trust Form without getting stuck in endless printing and scanning. Adhere to this concise guide to begin and finish your form.

Follow these steps to obtain and complete Income Only Trust Form

- Begin by clicking the Get Form button to access your document in our editor.

- Observe the green indicator on the left that highlights mandatory fields to ensure you do not overlook them.

- Utilize our advanced features to annotate, modify, sign, secure, and enhance your document.

- Safeguard your file or convert it into a fillable format using the options on the right panel.

- Review the document and verify it for mistakes or inconsistencies.

- Press DONE to complete your edits.

- Rename your document or retain its original title.

- Select the storage option you prefer to keep your document, send it via USPS, or click the Download Now button to save your file.

If Income Only Trust Form does not match your needs, explore our extensive range of pre-uploaded templates that you can complete with minimal effort. Discover our service today!

Create this form in 5 minutes or less

FAQs

-

What is the most selfish act you have ever witnessed?

When I was twelve, my dad died. I have five siblings and we ranged at the time from seven years old to eighteen. The eldest was leaving for college that week, but came back and spent the year at home at my mom's request.Before Dad had been dead a whole month, my mom started sort-of dating a sort-of homeless guy (he had been homeless and then was living in an RV on someone's property as their caretaker) my family had helped before (we volunteered for years prior to this at the local homeless shelter).A month. Our father had died of unexpected of complications from heart attacks just a month prior. We four youngest didn't know what was going on at first and she didn't let our older two siblings know. All we knew was that almost every night mom would have us get in the van, and she'd be in her pajamas and robe, and we'd drive down to his place and she'd send us to go play in the yard while she "said goodnight" and "ministered" to him.Eventually she'd come out with a shit-eating smirk, load us up in the van and drive back home.Less than two months after that she moved him into the house and started claiming they were married to everyone. (They weren't.)Why this was so incredibly selfish was because we weren't allowed to grieve anymore after that. We all had to be happy because mom had a new boyfriend-then-husband, and we all felt like we couldn't even talk about Dad anymore. Mom still talked about him but only to force our good behavior, ie: "You are all such terrible children! Your father wanted you to be raised this way and I've sacrificed so much for you...!" He wasn't even a good stepdad. He could have been worse, sure, but he'd fight with mom then storm out of the house and she'd blame it on us.Less than six months after my dad died he and my mom went on a drive and left me to change a curtain rod. I was still twelve and very small for my age, and I couldn't signNow the curtain rod. I tried, hard, but I kept falling off the back of the couch. They got back and saw that I hadn't done it, so the step-dad kept saying to me "Hah, I knew you were useless." while laughing and repeating it over and over like it was hilarious. I lost my temper and said "You're just a fat old man!" (he was 13 years older than my mom so he seemed quite elderly to me.) He, in front of my mother who had been laughing at his denigration of my handyman attempts, grabbed me, shook me hard, and screamed in my face "You stupid little b***ch!" and stormed out of the house.Mom then spanked me for trying to ruin her marriage.I just wanted my dad back, but I couldn't even say that because what if it made the step-dad feel bad?

-

How do I fill out an income tax form?

The Indian Income-Tax department has made the process of filing of income tax returns simplified and easy to understand.However, that is applicable only in case where you don’t have incomes under different heads. Let’s say, you are earning salary from a company in India, the company deducts TDS from your salary. In such a scenario, it’s very easy to file the return.Contrary to this is the scenario, where you have income from business and you need to see what all expenses you can claim as deduction while calculating the net taxable income.You can always signNow out to a tax consultant for detailed review of your tax return.

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

Which ITR form needs to be filled out if your total income depends on share trading only?

The answer would depend on whether share trading is your ‘business’.There has been lots of litigation and plethora of judicial precedents which lay down guidance on when share trading can be considered as a business and when it can be considered as capital gains (if it is your business, you can claim all geniune expenses against the income - precisely, this is also the reason why tax authorities want you to consider it as capital gains).Answer-If you consider it as capital gains - ITR 2If it is your business - ITR 3.The next part is whether you also have speculation gains/ losses (intra-day trading). This is typically considered as a business activity and you will have to file ITR 3. Disclosure would be as follows (assuming normal share trading is treated as capital gains):Income from intra-day - Business income;Income from share trading - Capital gains.

-

Do I need to fill form 15G only if my total income is more than 250000?

Its actually opposite.These are the conditions to fill form 15G i.e not to deduct tax by your bankerYou are an individual or HUFYou must be a Resident IndianYou should be less than 60 years oldTax calculated on your Total Income is nilThe total income for the year is less than the minimum exemption limit of that year, which is Rs 2,50,000 for financial year 2015-16.

-

Which ITR form to fill if income is from interest earned on FD only?

Editing the answer for AY 2019–20 (FY 2018–19)ITR 1 is the appropriate return to be filed if income earned by you is oñly interest income. Also, if your interest income during the financial year is below Rs.250,000 please ensure that you are getting a refund of the entire TDS deducted by the bank.ITR 1 for AY 2019–20 is applicable for individuals being a resident other than not ordinarily resident having income from salaries, one house property, other sources (interest etc.) and having total income upto Rs.50 lakh.Summary points to note for applicability of ITR 1 for AY 2019–20:Persons not falling in the above category will have to wait for ITR 2 or 3 based on their circumstance.Non-residents cannot file in ITR 1. They have to use ITR 2 or 3 based on their facts.ITR 1 is not applicable for an Individual who is either Director in a company or has invested in Unlisted Equity Shares.Since residents will still be awaiting Form 16 (generally issued by company latest by June 2018), those individuals who have only interest income on which TDS was deducted and wish to claim a refund of the TDS, can file ITR 1 right awayIn many cases, Form 26AS will not be updated for interest earning individuals, as the banks are yet to file their TDS returns. Hence, it is highly recommended to such individuals to wait till May 31 (last date for TDS returns filing).If you are however sure that no one will be deducting any TDS in your name, then you can file immediately.NIL returns can be filed immediatelyThe due date for filing ITR 1 for AY 2019–20 is July 31, 2019. Once the ITR is filed, it takes about 2 months for the refunds to credit, if any, provided there are no mistakes in the ITR and everything is disclosed correctly.Hope the above was useful. For further clarifications/ assistance please feel free to get in touch at aditi.bhardwaj@outlook.com.Best regards,Aditiaditi.bhardwaj@outlook.com

Create this form in 5 minutes!

How to create an eSignature for the income only trust form

How to generate an eSignature for the Income Only Trust Form online

How to generate an electronic signature for the Income Only Trust Form in Chrome

How to generate an electronic signature for putting it on the Income Only Trust Form in Gmail

How to generate an eSignature for the Income Only Trust Form from your smartphone

How to create an electronic signature for the Income Only Trust Form on iOS devices

How to make an electronic signature for the Income Only Trust Form on Android OS

People also ask

-

Why should I only trust airSlate SignNow for my eSignature needs?

You should only trust airSlate SignNow because it offers a secure, reliable, and easy-to-use platform for electronic signatures. Our industry-leading encryption and compliance with regulations ensure your documents are safe. By choosing SignNow, you gain peace of mind with a solution that enhances your workflow without compromising security.

-

What are the pricing options available with airSlate SignNow?

airSlate SignNow offers flexible pricing plans to meet the needs of every business size. You can choose from monthly or annual subscriptions tailored to your requirements. With transparent pricing, you know exactly what you're paying for, allowing you only to trust that you're getting the best value.

-

What features make airSlate SignNow stand out?

airSlate SignNow boasts a range of features that simplify the document signing process, such as template creation, team collaboration, and in-person signing. The platform is designed for efficiency, so you can only trust it to streamline your document workflows. Additionally, user-friendly navigation ensures that all users, regardless of tech proficiency, can manage documents effortlessly.

-

How does airSlate SignNow ensure the security of my documents?

You can only trust airSlate SignNow for document security because it utilizes state-of-the-art encryption and follows rigorous compliance standards. Our platform incorporates multiple layers of security, including data encryption at rest and in transit. This commitment to security ensures that your sensitive documents remain confidential and protected.

-

Can airSlate SignNow integrate with other business tools I use?

Yes, airSlate SignNow seamlessly integrates with a wide array of business applications, including CRM systems and productivity tools. These integrations enhance your workflow, allowing you to automate processes without switching platforms. By using SignNow, you can only trust that your documents will sync effortlessly with your existing systems.

-

What are the benefits of using airSlate SignNow over competitors?

The benefits of choosing airSlate SignNow include its user-friendly interface, comprehensive features, and competitive pricing. We ensure that businesses of all sizes can manage their documents efficiently. With our commitment to service and security, you can only trust that SignNow is the right choice for your eSigning needs.

-

Is customer support available for airSlate SignNow users?

Absolutely! airSlate SignNow provides dedicated customer support to assist users with any inquiries or issues they may encounter. Our support team is trained to help you make the most of the platform, ensuring that you can only trust our service for assistance whenever needed.

Get more for Income Only Trust Form

- Dal005 2013 form

- Fill in pdf form de 111 1998

- Blank grant deed form

- Certificate of rehabilitation california form

- Texas residential lease doc form

- Agreed motion to terminate withholding for child support texaslawhelp 100259706 form

- Temporary child support order in texas form

- Illinois emergency order protection form

Find out other Income Only Trust Form

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter