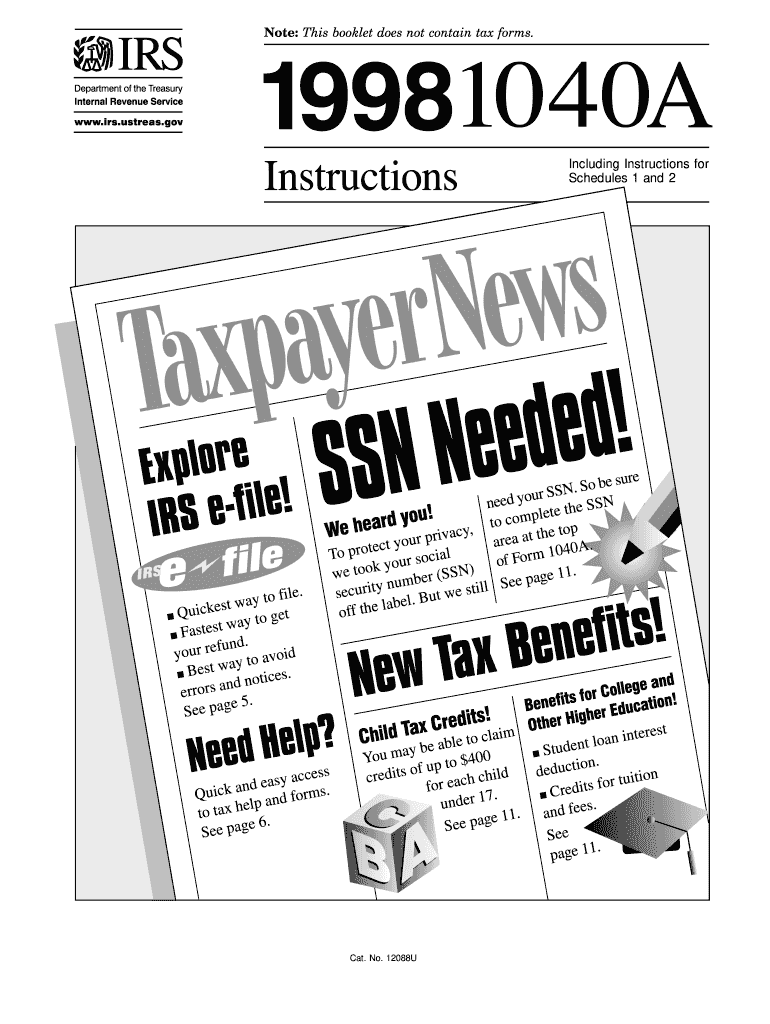

Instructions 1040A Instructions for Preparing Form 1040A and Schedules 1, 2 and EIC 1998

What is the Instructions 1040A Instructions For Preparing Form 1040A and Schedules 1, 2 And EIC

The Instructions 1040A provide essential guidance for taxpayers in the United States who are preparing Form 1040A, along with Schedules 1, 2, and the Earned Income Credit (EIC). This form is designed for individuals with straightforward tax situations, allowing them to report income, claim deductions, and calculate tax liabilities efficiently. The instructions detail the necessary steps to fill out the form correctly, ensuring compliance with IRS regulations and maximizing potential refunds.

Steps to complete the Instructions 1040A Instructions For Preparing Form 1040A and Schedules 1, 2 And EIC

Completing the Instructions 1040A involves several key steps:

- Gather all necessary documents, including W-2 forms, 1099s, and any other income statements.

- Review the eligibility criteria for using Form 1040A to confirm that your tax situation qualifies.

- Follow the detailed instructions for each section of the form, including personal information, income, and deductions.

- Complete Schedules 1 and 2 as applicable, ensuring all calculations are accurate.

- Double-check your entries for accuracy and completeness before submission.

Legal use of the Instructions 1040A Instructions For Preparing Form 1040A and Schedules 1, 2 And EIC

Using the Instructions 1040A is legally binding when preparing your tax return. Compliance with IRS guidelines ensures that your submission is valid and can be processed without issues. It is crucial to adhere to the instructions provided, as inaccuracies or omissions can lead to penalties or delays in processing. Additionally, utilizing a reliable eSignature solution can enhance the legal validity of your electronically submitted documents.

Filing Deadlines / Important Dates

Taxpayers must be aware of key deadlines associated with the Instructions 1040A. Generally, the deadline for filing your tax return is April fifteenth. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to check for any updates or changes to deadlines each tax year, as well as any extensions that may be available.

Eligibility Criteria

To use Form 1040A, taxpayers must meet specific eligibility criteria. This form is intended for individuals with a taxable income below a certain threshold, typically those who do not itemize deductions. Additionally, taxpayers must not have complex tax situations, such as self-employment income or certain types of capital gains. Reviewing the eligibility requirements outlined in the instructions can help ensure that you select the appropriate form for your tax situation.

Examples of using the Instructions 1040A Instructions For Preparing Form 1040A and Schedules 1, 2 And EIC

Examples of using the Instructions 1040A can include various taxpayer scenarios. For instance, a single individual with a W-2 income and eligible for the Earned Income Credit would follow the instructions to complete the form accurately. Another example could be a married couple filing jointly with dependents, who would also utilize the instructions to claim applicable deductions and credits. These examples illustrate the versatility of Form 1040A for straightforward tax situations.

Quick guide on how to complete 1998 instructions 1040a instructions for preparing form 1040a and schedules 1 2 and eic

Easily Prepare Instructions 1040A Instructions For Preparing Form 1040A and Schedules 1, 2 And EIC on Any Device

The management of online documents has gained traction among companies and individuals. It offers a fantastic environmentally friendly substitute for conventional printed and signed documents, as you can access the right form and securely save it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents quickly and without interruptions. Handle Instructions 1040A Instructions For Preparing Form 1040A and Schedules 1, 2 And EIC on any device with the airSlate SignNow apps for Android or iOS, and simplify any document-related task today.

The simplest method to edit and eSign Instructions 1040A Instructions For Preparing Form 1040A and Schedules 1, 2 And EIC without hassle

- Find Instructions 1040A Instructions For Preparing Form 1040A and Schedules 1, 2 And EIC and select Get Form to initiate the process.

- Utilize the tools at your disposal to finish your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for these purposes.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all details thoroughly and click the Done button to finalize your edits.

- Select your preferred delivery method for your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Instructions 1040A Instructions For Preparing Form 1040A and Schedules 1, 2 And EIC and guarantee outstanding communication at every step of your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1998 instructions 1040a instructions for preparing form 1040a and schedules 1 2 and eic

Create this form in 5 minutes!

How to create an eSignature for the 1998 instructions 1040a instructions for preparing form 1040a and schedules 1 2 and eic

How to make an electronic signature for your PDF document in the online mode

How to make an electronic signature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

The best way to create an eSignature from your mobile device

The best way to generate an electronic signature for a PDF document on iOS devices

The best way to create an eSignature for a PDF file on Android devices

People also ask

-

What are Instructions 1040A Instructions For Preparing Form 1040A and Schedules 1, 2 and EIC?

Instructions 1040A Instructions For Preparing Form 1040A and Schedules 1, 2 and EIC provide detailed guidance on how to correctly complete your tax forms. These instructions cover eligibility requirements and the necessary information for claiming various deductions and credits. Having clear and accurate instructions can signNowly reduce errors in your tax submission.

-

How can airSlate SignNow assist with Form 1040A preparation?

airSlate SignNow offers an intuitive platform that allows users to eSign and send Form 1040A and related documents seamlessly. With built-in templates and workflow automation, it simplifies the process of document management. The tool ensures that you can focus on getting your taxes right with the help of straightforward Instructions 1040A Instructions For Preparing Form 1040A and Schedules 1, 2 and EIC.

-

What features does airSlate SignNow provide for tax document management?

airSlate SignNow includes features such as document templates, eSignature functionality, and real-time tracking. These tools are designed to streamline the entire process of managing your tax documents, including the Instructions 1040A Instructions For Preparing Form 1040A and Schedules 1, 2 and EIC. This enhances productivity and reduces the likelihood of errors.

-

Is airSlate SignNow a cost-effective solution for tax professionals?

Yes, airSlate SignNow is a cost-effective solution that suits both individual users and tax professionals. With competitive pricing models, it provides excellent value for the features offered, especially for those needing to manage tax forms like the Instructions 1040A Instructions For Preparing Form 1040A and Schedules 1, 2 and EIC. This makes it an ideal choice for budget-conscious users.

-

Can I integrate other software with airSlate SignNow?

Absolutely! airSlate SignNow supports integration with numerous applications, including popular accounting and tax software. This allows for a smoother workflow and helps you adhere to the Instructions 1040A Instructions For Preparing Form 1040A and Schedules 1, 2 and EIC while managing documents efficiently. Integration ensures that all your tools work harmoniously.

-

What advantages does eSigning provide for tax documents?

eSigning tax documents, including the Form 1040A, offers signNow advantages such as enhanced security, speed, and convenience. Users can sign and submit their documents electronically from anywhere, creating a hassle-free experience. Following the Instructions 1040A Instructions For Preparing Form 1040A and Schedules 1, 2 and EIC becomes much easier with immediate access and reliable signatures.

-

How does airSlate SignNow ensure document security?

airSlate SignNow prioritizes document security by employing advanced encryption and compliance standards. This ensures that your sensitive tax information, including those adhering to the Instructions 1040A Instructions For Preparing Form 1040A and Schedules 1, 2 and EIC, is protected at all times. You can trust that your documents are safely handled while using our service.

Get more for Instructions 1040A Instructions For Preparing Form 1040A and Schedules 1, 2 And EIC

- Hawaii prenuptial premarital agreement with financial statements hawaii form

- Hawaii prenuptial form

- Amendment to prenuptial or premarital agreement hawaii form

- Financial statements only in connection with prenuptial premarital agreement hawaii form

- Revocation of premarital or prenuptial agreement hawaii form

- No fault agreed uncontested divorce package for dissolution of marriage for people with minor children hawaii form

- No fault agreed uncontested divorce package for dissolution of marriage for persons with no children with or without property 497304270 form

- Hawaii incorporate form

Find out other Instructions 1040A Instructions For Preparing Form 1040A and Schedules 1, 2 And EIC

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template