Form 9423 2012

What is the Form 9423

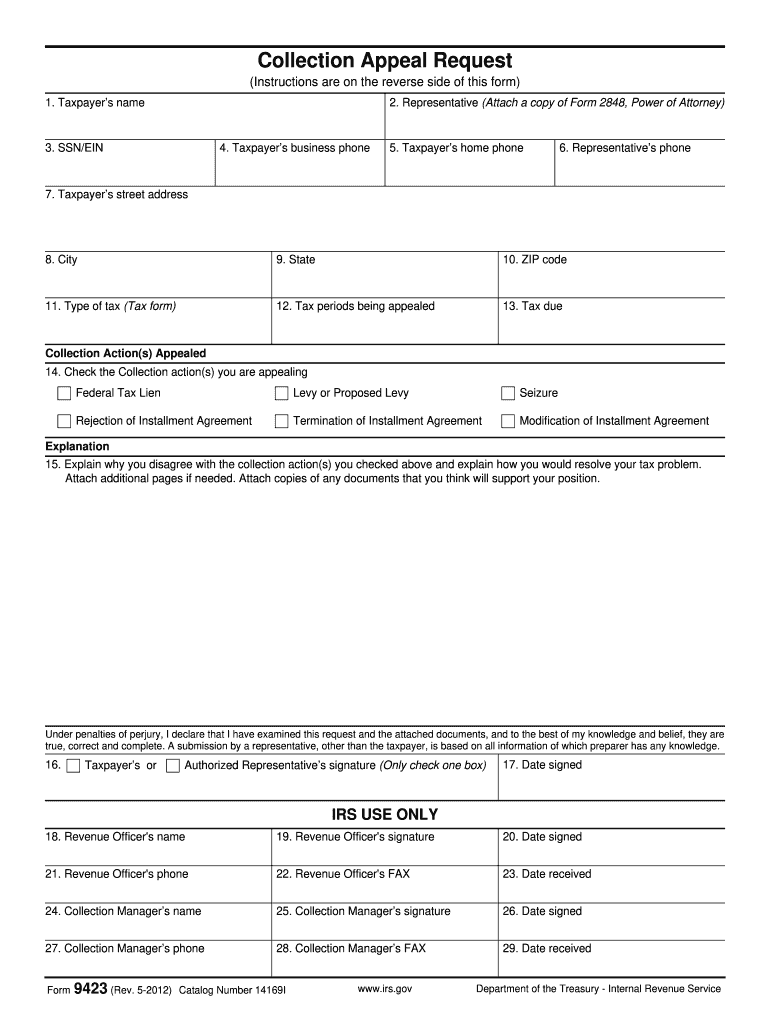

The Form 9423 is a document used by taxpayers in the United States to request a reconsideration of a tax decision made by the Internal Revenue Service (IRS). This form is significant for individuals or businesses who believe that the IRS has made an error in their tax assessments or determinations. By submitting Form 9423, taxpayers can formally challenge the IRS's findings and seek a review of their case, which can lead to adjustments in their tax obligations.

How to use the Form 9423

To effectively use Form 9423, taxpayers should first ensure they understand the specific reason for their request for reconsideration. This includes gathering all relevant documentation that supports their claim. Once the form is completed, it should be submitted to the appropriate IRS office. It is crucial to keep copies of all documents and correspondence for personal records. Additionally, taxpayers should be prepared for potential follow-up communications from the IRS regarding their request.

Steps to complete the Form 9423

Completing Form 9423 involves several key steps:

- Begin by downloading the form from the IRS website or obtaining a physical copy.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Clearly state the reason for your request for reconsideration, providing detailed explanations and supporting evidence.

- Review the completed form for accuracy and completeness before submission.

- Submit the form to the designated IRS address, ensuring you retain a copy for your records.

Legal use of the Form 9423

Form 9423 is legally recognized as a formal request for reconsideration of tax decisions. To ensure its legal validity, taxpayers must complete the form accurately and submit it within the designated time frame set by the IRS. Compliance with IRS guidelines and regulations is essential to uphold the integrity of the request. Proper use of the form can lead to a fair review of tax assessments and potential adjustments based on the merits of the case.

Filing Deadlines / Important Dates

Filing deadlines for Form 9423 are critical to ensure that taxpayers do not miss their opportunity for reconsideration. Typically, the form must be submitted within a specified period following the IRS's decision that is being contested. It is advisable to check the IRS guidelines for the most current deadlines, as these can vary depending on the nature of the tax issue. Timely submission is essential to avoid complications in the reconsideration process.

Required Documents

When submitting Form 9423, taxpayers must include all necessary supporting documents that substantiate their claims. This may include previous tax returns, correspondence with the IRS, and any evidence that supports the argument for reconsideration. Ensuring that all required documents are included can significantly enhance the chances of a favorable outcome in the review process.

Quick guide on how to complete form 9423 2012

Complete Form 9423 effortlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed paperwork, allowing you to obtain the necessary form and securely preserve it online. airSlate SignNow equips you with all the necessary tools to create, alter, and electronically sign your documents promptly without any hold-ups. Handle Form 9423 on any gadget using airSlate SignNow Android or iOS applications and enhance any document-related workflow today.

The simplest method to modify and electronically sign Form 9423 without hassle

- Find Form 9423 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure confidential information with tools that airSlate SignNow specially provides for this purpose.

- Create your electronic signature using the Sign feature, which takes moments and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your document, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form navigation, or mistakes that necessitate printing new copies of documents. airSlate SignNow meets your requirements in document management in a few clicks from any device you prefer. Adjust and electronically sign Form 9423 and guarantee excellent communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 9423 2012

Create this form in 5 minutes!

How to create an eSignature for the form 9423 2012

The way to create an eSignature for a PDF in the online mode

The way to create an eSignature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

The way to make an electronic signature from your smart phone

The best way to generate an eSignature for a PDF on iOS devices

The way to make an electronic signature for a PDF file on Android OS

People also ask

-

What is Form 9423 and why is it important?

Form 9423 is a vital document used for requesting a tax refund or credit. This form is signNow for businesses as it ensures compliance with tax regulations and prevents delays in receiving owed funds. By utilizing airSlate SignNow, businesses can easily eSign and send Form 9423 securely.

-

How does airSlate SignNow enhance the eSigning process for Form 9423?

airSlate SignNow streamlines the eSigning process for Form 9423 by offering a user-friendly platform that allows for quick and secure signatures. Users can initiate and complete their forms from anywhere, ensuring that their documents are processed without unnecessary delays. This efficiency is crucial for timely tax requests.

-

What are the pricing options for using airSlate SignNow for Form 9423?

airSlate SignNow offers flexible pricing plans that cater to various business needs, ensuring that submitting Form 9423 is cost-effective. Plans start at affordable rates, making it accessible for both small businesses and larger enterprises. You can choose the plan that best fits your document management requirements.

-

Can I integrate airSlate SignNow with other software for Form 9423?

Yes, airSlate SignNow provides integrations with various software and applications that facilitate a smooth workflow when handling Form 9423. This includes popular platforms like Google Drive and Salesforce, which enhance your document management capabilities. Such integrations can signNowly improve efficiency in processing your documents.

-

What are the main features of airSlate SignNow for managing Form 9423?

The main features of airSlate SignNow include secure e-signature capabilities, customizable templates for Form 9423, and automated workflows. These features allow businesses to create, manage, and track their forms effortlessly. Additionally, you can complete forms on mobile devices, increasing accessibility.

-

Is it safe to use airSlate SignNow for Form 9423 submissions?

Absolutely, airSlate SignNow prioritizes security for all document transactions, including Form 9423. The platform employs advanced encryption and complies with industry standards to protect sensitive information. Users can confidently send and eSign their documents without compromising data integrity.

-

How can airSlate SignNow benefit my business in relation to Form 9423?

Using airSlate SignNow can signNowly enhance your business's efficiency regarding Form 9423 submissions. With streamlined processes, reduced paperwork, and real-time document tracking, your team can focus more on essential tasks rather than administrative burdens. These benefits lead to quicker resolution of tax-related issues.

Get more for Form 9423

- Letter from tenant to landlord about sexual harassment iowa form

- Letter from tenant to landlord about fair housing reduction or denial of services to family with children iowa form

- Letter from tenant to landlord containing notice of termination for landlords noncompliance with possibility to cure iowa form

- Letter from tenant to landlord responding to notice to terminate for noncompliance noncompliant condition caused by landlords 497304950 form

- Iowa tenant landlord form

- Ia letter landlord form

- Letter from landlord to tenant where tenant complaint was caused by the deliberate or negligent act of tenant or tenants guest 497304953 form

- Letter from landlord to tenant for failure to keep premises as clean and safe as condition of premises permits remedy or lease 497304954 form

Find out other Form 9423

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form