Form 990 Ty2012 2012

What is the Form 990 Ty2012

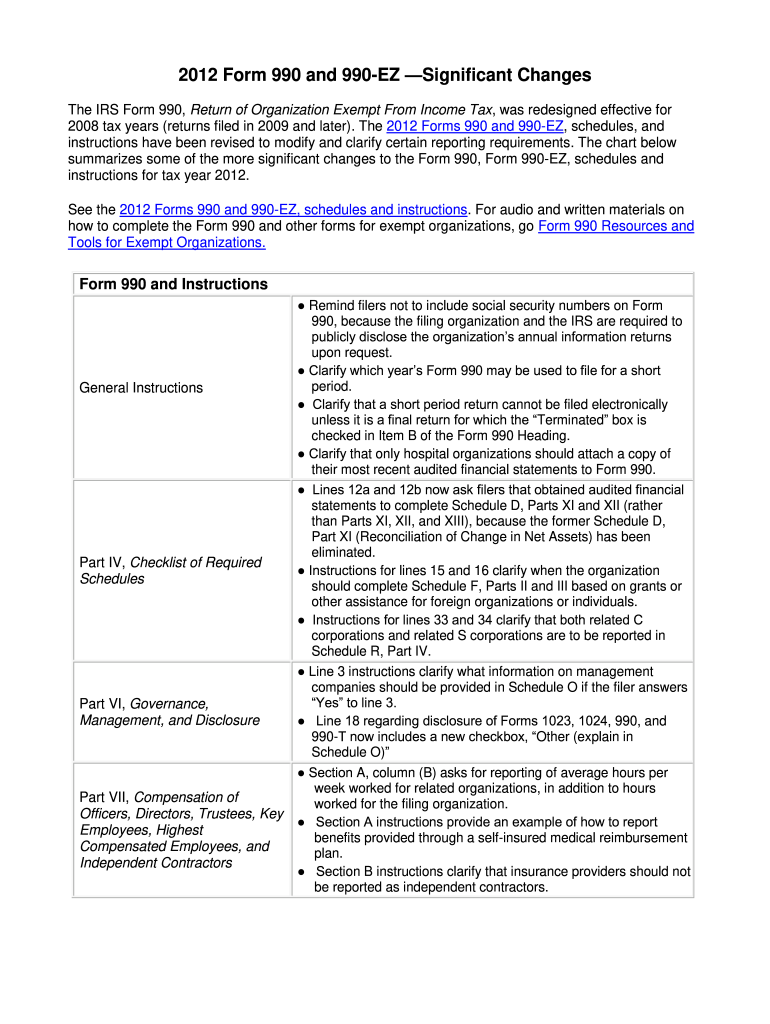

The Form 990 Ty2012 is a crucial document used by tax-exempt organizations in the United States to report their financial information to the Internal Revenue Service (IRS). This form provides insights into the organization’s mission, programs, and finances, ensuring transparency and accountability. It is typically filed annually and is essential for maintaining tax-exempt status. Organizations must accurately complete this form to comply with federal regulations and provide stakeholders with a clear understanding of their operations.

How to use the Form 990 Ty2012

Using the Form 990 Ty2012 involves several key steps. First, organizations must gather all necessary financial records, including income statements, balance sheets, and details of expenses. Next, they should carefully fill out each section of the form, ensuring that all information is accurate and complete. It is important to provide detailed descriptions of programs and activities, as this information helps the IRS evaluate the organization’s compliance with tax-exempt requirements. Once completed, the form can be submitted electronically or via mail, depending on the organization’s preference and IRS guidelines.

Steps to complete the Form 990 Ty2012

Completing the Form 990 Ty2012 requires a systematic approach to ensure accuracy and compliance. The following steps outline the process:

- Gather financial statements and supporting documents.

- Review the form’s instructions to understand each section's requirements.

- Complete the form, ensuring all financial data is accurately reported.

- Provide detailed descriptions of the organization’s programs and activities.

- Review the completed form for accuracy and completeness.

- Submit the form by the deadline, either electronically or by mail.

Legal use of the Form 990 Ty2012

The legal use of the Form 990 Ty2012 is vital for organizations seeking to maintain their tax-exempt status. This form must be filed annually as required by the IRS. Failure to file or inaccuracies in the information provided can lead to penalties, including the loss of tax-exempt status. Organizations must ensure compliance with all applicable laws and regulations, as the form serves not only as a tax document but also as a public disclosure tool that enhances transparency and accountability.

Filing Deadlines / Important Dates

Filing deadlines for the Form 990 Ty2012 are crucial for compliance. Typically, organizations must file the form by the fifteenth day of the fifth month after the end of their fiscal year. For organizations with a fiscal year ending on December 31, the deadline would be May 15 of the following year. Extensions may be available, but organizations must file for an extension before the original deadline to avoid penalties. Keeping track of these important dates is essential for maintaining compliance with IRS regulations.

Penalties for Non-Compliance

Organizations that fail to comply with the filing requirements for the Form 990 Ty2012 may face significant penalties. These can include monetary fines for late filings, and in severe cases, the IRS may revoke the organization’s tax-exempt status. It is essential for organizations to understand the implications of non-compliance and to take proactive measures to ensure timely and accurate submissions. Regular audits and reviews of financial practices can help mitigate the risk of non-compliance.

Quick guide on how to complete form 990 ty2012

Complete Form 990 Ty2012 effortlessly on any device

Online document administration has become increasingly popular among organizations and individuals. It serves as an excellent environmentally-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, alter, and electronically sign your documents swiftly without delays. Manage Form 990 Ty2012 on any platform using airSlate SignNow applications for Android or iOS and streamline any document-related process today.

The easiest way to modify and electronically sign Form 990 Ty2012 without difficulty

- Obtain Form 990 Ty2012 and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize key sections of the documents or conceal sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Verify the details and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require reprinting new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your choice. Modify and electronically sign Form 990 Ty2012 and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 990 ty2012

Create this form in 5 minutes!

How to create an eSignature for the form 990 ty2012

The way to create an eSignature for a PDF file online

The way to create an eSignature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The way to make an electronic signature from your mobile device

The best way to generate an eSignature for a PDF file on iOS

The way to make an electronic signature for a PDF file on Android devices

People also ask

-

What is Form 990 Ty2012 and why is it important?

Form 990 Ty2012 is a crucial document that provides financial information about nonprofit organizations. It helps ensure transparency and accountability to the public, donors, and regulators. Completing this form accurately is essential for maintaining tax-exempt status.

-

How can airSlate SignNow assist with completing Form 990 Ty2012?

airSlate SignNow offers an intuitive platform that allows users to easily fill, sign, and send Form 990 Ty2012 electronically. This streamlines the documentation process and ensures that your form is accurate and compliant. With airSlate SignNow, you can manage documents efficiently and securely.

-

What features does airSlate SignNow provide for Form 990 Ty2012?

airSlate SignNow provides several features to facilitate the management of Form 990 Ty2012, including document templates, electronic signatures, and cloud storage. Users can collaborate in real-time, track changes, and access their documents from anywhere. These features make the form-filing process smooth and effective.

-

Is airSlate SignNow cost-effective for filing Form 990 Ty2012?

Yes, airSlate SignNow is designed to be a cost-effective solution for nonprofits and organizations managing Form 990 Ty2012. With various pricing plans available, users can choose the one that fits their needs without breaking the bank. This affordability ensures that even small nonprofits can handle their documentation efficiently.

-

Can I integrate airSlate SignNow with other software for Form 990 Ty2012?

Absolutely! airSlate SignNow integrates seamlessly with numerous applications, enhancing your workflow for Form 990 Ty2012. This means you can connect it with accounting software, CRMs, and other tools to streamline your operations and data management.

-

What are the benefits of using airSlate SignNow for Form 990 Ty2012?

Using airSlate SignNow for Form 990 Ty2012 offers numerous benefits, including ease of use, enhanced security, and time savings. The electronic signing feature eliminates the need for physical paperwork, ensuring faster processing. This efficiency allows organizations to focus on their missions rather than administrative tasks.

-

How secure is airSlate SignNow when handling Form 990 Ty2012?

Security is a top priority for airSlate SignNow, especially when dealing with sensitive documents like Form 990 Ty2012. The platform employs industry-standard encryption and secure access controls to protect your information. This commitment to security helps organizations file their forms confidently.

Get more for Form 990 Ty2012

- Iowa tenant in form

- Iowa landlord tenant 497304956 form

- Iowa failure form

- Letter from landlord to tenant as notice to tenant of tenants disturbance of neighbors peaceful enjoyment to remedy or lease 497304958 form

- Letter landlord tenant notice form

- Landlord tenant law 497304960 form

- Ia landlord notice 497304961 form

- Letter from tenant to landlord about insufficient notice of rent increase iowa form

Find out other Form 990 Ty2012

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document