8812 Form 2007

What is the 8812 Form

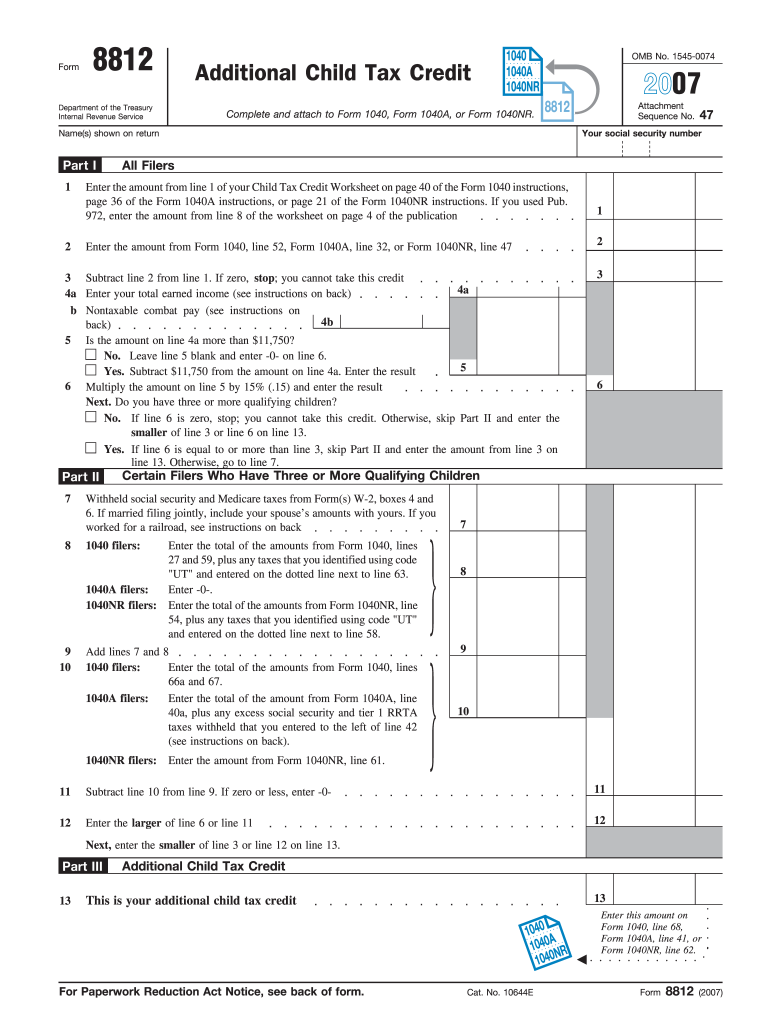

The 8812 Form, officially known as the Additional Child Tax Credit, is a tax form used by eligible taxpayers in the United States to claim additional credits for qualifying children. This form allows taxpayers to receive a refund even if they do not owe any taxes, helping to alleviate financial burdens for families. The form is particularly relevant for those who qualify for the Child Tax Credit but do not receive the full amount due to insufficient tax liability.

How to use the 8812 Form

To effectively use the 8812 Form, taxpayers should first ensure they meet the eligibility criteria, which includes having qualifying children under the age of 17. After confirming eligibility, individuals can fill out the form by providing necessary information such as the number of qualifying children and their respective Social Security numbers. The completed form should be attached to the taxpayer's federal income tax return, typically the Form 1040 or 1040-SR, when submitting for the tax year.

Steps to complete the 8812 Form

Completing the 8812 Form involves several steps:

- Gather necessary documentation, including Social Security numbers for qualifying children.

- Determine eligibility for the Child Tax Credit based on income and filing status.

- Fill out the form, providing accurate information regarding the number of qualifying children.

- Calculate the additional credit amount based on the IRS guidelines.

- Attach the completed form to your tax return and ensure all forms are submitted by the filing deadline.

Legal use of the 8812 Form

The 8812 Form is legally recognized as a valid method for claiming the Additional Child Tax Credit. To ensure its legal standing, taxpayers must comply with IRS guidelines and provide truthful information. Any discrepancies or fraudulent claims may result in penalties or legal action. It is essential to keep records and documentation supporting the claims made on the form, as the IRS may request this information during audits.

Filing Deadlines / Important Dates

Filing deadlines for the 8812 Form align with the general income tax return deadlines. Typically, taxpayers must submit their federal income tax returns by April 15 of each year. If additional time is needed, individuals may file for an extension, which can extend the deadline to October 15. However, any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Eligibility Criteria

To qualify for the Additional Child Tax Credit using the 8812 Form, taxpayers must meet specific eligibility criteria:

- Must have at least one qualifying child under the age of 17 at the end of the tax year.

- Must have earned income above a certain threshold, which varies by tax year.

- Must meet income limits set by the IRS, which may affect the amount of credit received.

Who Issues the Form

The 8812 Form is issued by the Internal Revenue Service (IRS), the U.S. government agency responsible for tax collection and tax law enforcement. The form is updated periodically to reflect changes in tax law and eligibility requirements, so it is important for taxpayers to use the most current version when filing their taxes.

Quick guide on how to complete 8812 2007 form

Manage 8812 Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed forms, as you can easily access the necessary template and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents quickly and without delay. Handle 8812 Form on any device through airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign 8812 Form with ease

- Find 8812 Form and click Get Form to begin.

- Use the tools provided to fill out your document.

- Emphasize critical sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, frustrating form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign 8812 Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 8812 2007 form

Create this form in 5 minutes!

How to create an eSignature for the 8812 2007 form

How to generate an eSignature for a PDF file in the online mode

How to generate an eSignature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

The best way to make an eSignature from your smartphone

The best way to create an eSignature for a PDF file on iOS devices

The best way to make an eSignature for a PDF file on Android

People also ask

-

What is the 8812 Form?

The 8812 Form, also known as the 'Additional Child Tax Credit,' is used to claim a tax refund for qualifying children. This form is essential for taxpayers who benefit from the Child Tax Credit but have not received the full amount. Understanding how to properly fill out the 8812 Form can maximize your potential tax refund.

-

How does airSlate SignNow assist with the 8812 Form?

airSlate SignNow simplifies the process of completing and signing the 8812 Form electronically. Our platform allows users to upload their forms, add eSignatures, and share documents securely, streamlining the completion and submission process. This ensures your 8812 Form is filled out accurately and returned promptly.

-

Is there a cost associated with using airSlate SignNow for the 8812 Form?

Yes, airSlate SignNow offers various pricing plans that provide access to our features, including those for managing the 8812 Form. Each plan is designed to meet the needs of different users, from individuals to businesses. You can choose a plan that fits your budget while enjoying efficient document management.

-

What features does airSlate SignNow offer for the 8812 Form?

Our platform provides numerous features tailored for the 8812 Form, including document templates, eSignature solutions, and secure storage. Users can also track the status of their forms and receive alerts when documents are signed. These features enhance the overall efficiency and reliability of submitting the 8812 Form.

-

Can I integrate airSlate SignNow with other tools for the 8812 Form?

Absolutely! airSlate SignNow seamlessly integrates with various applications to help you manage the 8812 Form effectively. Whether you use CRM systems, cloud storage, or accounting software, our integrations ensure a smooth workflow while handling your forms. This boosts productivity and simplifies the filing process.

-

What are the benefits of using airSlate SignNow for the 8812 Form?

Using airSlate SignNow for the 8812 Form offers numerous benefits, such as increased efficiency, security, and ease of use. Our electronic signature feature not only saves time but also eliminates the hassle of printing and mailing documents. Additionally, you can store and access your completed forms anytime, anywhere.

-

Is airSlate SignNow secure for submitting the 8812 Form?

Yes, security is a top priority at airSlate SignNow. Our platform uses advanced encryption and security protocols to protect your sensitive information when submitting the 8812 Form. You can confidently complete, sign, and store your documents knowing that they are safe and secure.

Get more for 8812 Form

- Premarital agreements package idaho form

- Painting contractor package idaho form

- Framing contractor package idaho form

- Foundation contractor package idaho form

- Plumbing contractor package idaho form

- Brick mason contractor package idaho form

- Roofing contractor package idaho form

- Electrical contractor package idaho form

Find out other 8812 Form

- Can I Electronic signature Massachusetts Separation Agreement

- Can I Electronic signature North Carolina Separation Agreement

- How To Electronic signature Wyoming Affidavit of Domicile

- Electronic signature Wisconsin Codicil to Will Later

- Electronic signature Idaho Guaranty Agreement Free

- Electronic signature North Carolina Guaranty Agreement Online

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer

- eSignature New York Outsourcing Services Contract Simple

- Electronic signature Hawaii Revocation of Power of Attorney Computer

- How Do I Electronic signature Utah Gift Affidavit

- Electronic signature Kentucky Mechanic's Lien Free

- Electronic signature Maine Mechanic's Lien Fast

- Can I Electronic signature North Carolina Mechanic's Lien

- How To Electronic signature Oklahoma Mechanic's Lien

- Electronic signature Oregon Mechanic's Lien Computer

- Electronic signature Vermont Mechanic's Lien Simple

- How Can I Electronic signature Virginia Mechanic's Lien

- Electronic signature Washington Mechanic's Lien Myself

- Electronic signature Louisiana Demand for Extension of Payment Date Simple