Consent Form to Talk to Irs 2012

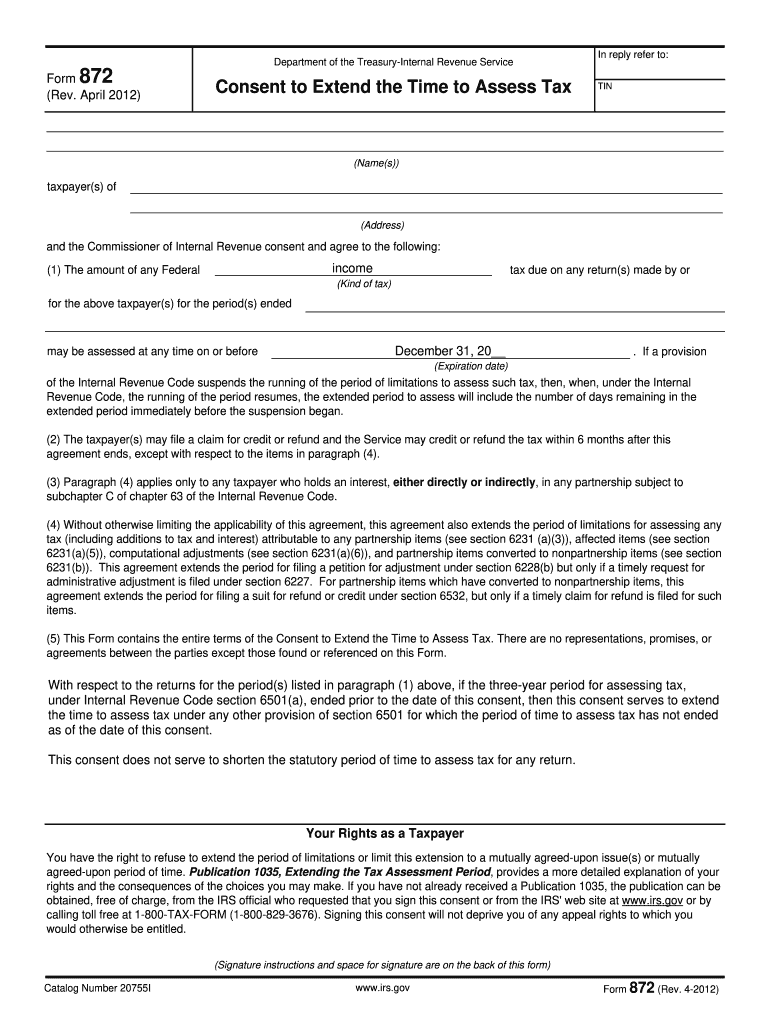

What is the Consent Form To Talk To IRS

The Consent Form To Talk To IRS is a document that allows a taxpayer to authorize another individual, such as a tax professional or family member, to discuss their tax matters with the Internal Revenue Service (IRS). This form is essential for ensuring that the IRS can share sensitive tax information with the designated representative, facilitating communication and assistance in resolving tax issues. It is particularly useful in situations where the taxpayer may not be able to communicate directly with the IRS due to various reasons, such as illness or unavailability.

How to use the Consent Form To Talk To IRS

Using the Consent Form To Talk To IRS involves several straightforward steps. First, the taxpayer must obtain the form, which can typically be found on the IRS website or through tax preparation software. After filling out the necessary information, including the taxpayer's details and the representative's information, the form must be signed and dated by the taxpayer. Once completed, the form should be submitted to the IRS, either by mail or electronically, depending on the specific instructions provided with the form. This ensures that the designated representative can communicate with the IRS on the taxpayer's behalf.

Steps to complete the Consent Form To Talk To IRS

Completing the Consent Form To Talk To IRS involves the following steps:

- Obtain the form from the IRS website or tax software.

- Fill in the taxpayer's name, Social Security number, and address.

- Provide the name and contact information of the individual being authorized.

- Specify the tax matters for which consent is granted.

- Sign and date the form to validate it.

- Submit the completed form to the IRS through the appropriate method.

Legal use of the Consent Form To Talk To IRS

The Consent Form To Talk To IRS is legally binding, provided it is filled out correctly and signed by the taxpayer. It complies with IRS regulations, allowing authorized individuals to discuss tax matters without violating confidentiality laws. This form must be used in accordance with the IRS guidelines to ensure that the designated representative can obtain information and act on behalf of the taxpayer effectively. It is advisable to keep a copy of the signed form for personal records.

Key elements of the Consent Form To Talk To IRS

Several key elements must be included in the Consent Form To Talk To IRS for it to be valid:

- The taxpayer's full name and Social Security number.

- The representative's name and contact information.

- A clear description of the tax matters for which consent is granted.

- The taxpayer's signature and the date of signing.

Ensuring that all these elements are accurately completed is crucial for the form's acceptance by the IRS.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the Consent Form To Talk To IRS. Taxpayers must ensure that the form is filled out completely and accurately to avoid delays or rejections. The IRS also stipulates that the consent granted is limited to the specific tax matters indicated on the form. It is important to review the IRS instructions carefully to ensure compliance with all requirements and to understand the scope of the authorization being granted.

Quick guide on how to complete consent form to talk to irs 2012

Prepare Consent Form To Talk To Irs effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents swiftly and without holdups. Manage Consent Form To Talk To Irs on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The simplest way to adjust and eSign Consent Form To Talk To Irs with ease

- Locate Consent Form To Talk To Irs and click Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Highlight pertinent sections of your documents or conceal sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a standard wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow takes care of your document management needs in just a few clicks from any device you prefer. Edit and eSign Consent Form To Talk To Irs and guarantee effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct consent form to talk to irs 2012

Create this form in 5 minutes!

How to create an eSignature for the consent form to talk to irs 2012

How to generate an eSignature for your PDF online

How to generate an eSignature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The best way to make an eSignature straight from your smartphone

The best way to create an electronic signature for a PDF on iOS

The best way to make an eSignature for a PDF document on Android

People also ask

-

What is a Consent Form To Talk To IRS?

A Consent Form To Talk To IRS is a document that allows a third party to communicate with the IRS on your behalf. This form grants authority to the designated individual to discuss tax-related matters, ensuring that your interests are effectively represented. airSlate SignNow provides a seamless way to create and eSign this important form quickly and securely.

-

How can airSlate SignNow help with my Consent Form To Talk To IRS?

airSlate SignNow streamlines the process of filling out and eSigning your Consent Form To Talk To IRS. With an intuitive interface, you can easily input the necessary information, securely sign the document, and send it directly to the IRS. This simplifies communication and reduces the time it takes to get your requests processed.

-

Is there a cost associated with using airSlate SignNow for my Consent Form To Talk To IRS?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs. Depending on the features you require, you can choose a plan that best fits your budget while ensuring you can handle your Consent Form To Talk To IRS effectively. A free trial is also available for new users to explore the platform before committing.

-

What features does airSlate SignNow offer for managing Consent Form To Talk To IRS?

AirSlate SignNow offers a range of features for managing your Consent Form To Talk To IRS, including document templates, eSignature capabilities, and real-time tracking. You can collaborate with others, set reminders for signing, and ensure compliance with legal standards, all while securely storing your documents in the cloud.

-

Can I integrate airSlate SignNow with other applications for my Consent Form To Talk To IRS?

Yes, airSlate SignNow integrates with various applications like Google Workspace, Microsoft Office, and CRM systems to streamline your workflow. This means you can easily access and manage your Consent Form To Talk To IRS alongside your other business documents. Integrations enhance productivity and save time during the signing process.

-

What are the benefits of using airSlate SignNow for my Consent Form To Talk To IRS?

Using airSlate SignNow for your Consent Form To Talk To IRS offers numerous benefits, including time savings, increased efficiency, and enhanced security. With digital signatures, your documents are authenticated without the hassle of paper forms, and the platform ensures compliance with IRS regulations, providing peace of mind.

-

How secure is my information when using airSlate SignNow for my Consent Form To Talk To IRS?

AirSlate SignNow prioritizes security, employing advanced encryption measures to protect your information when creating and signing your Consent Form To Talk To IRS. The platform complies with data protection regulations, ensuring that your sensitive information remains confidential and secure throughout the entire process.

Get more for Consent Form To Talk To Irs

- New resident guide delaware form

- Satisfaction release or cancellation of mortgage by corporation delaware form

- Satisfaction release or cancellation of mortgage by individual delaware form

- Delaware release form

- Partial release of property from mortgage by individual holder delaware form

- Affidavit of mailing guardianship delaware form

- Medical statements guardianship form

- Delaware assignment form

Find out other Consent Form To Talk To Irs

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word