Kern County Deed Records Form

What is the Kern County Deed Records

The Kern County Deed Records are official documents that provide a public record of property ownership and transfers within Kern County, California. These records include various types of deeds, such as quit claim deeds and grant deeds, which are essential for establishing legal ownership of real estate. The Kern County Recorder's Office maintains these records, ensuring transparency and accessibility for all property transactions in the area.

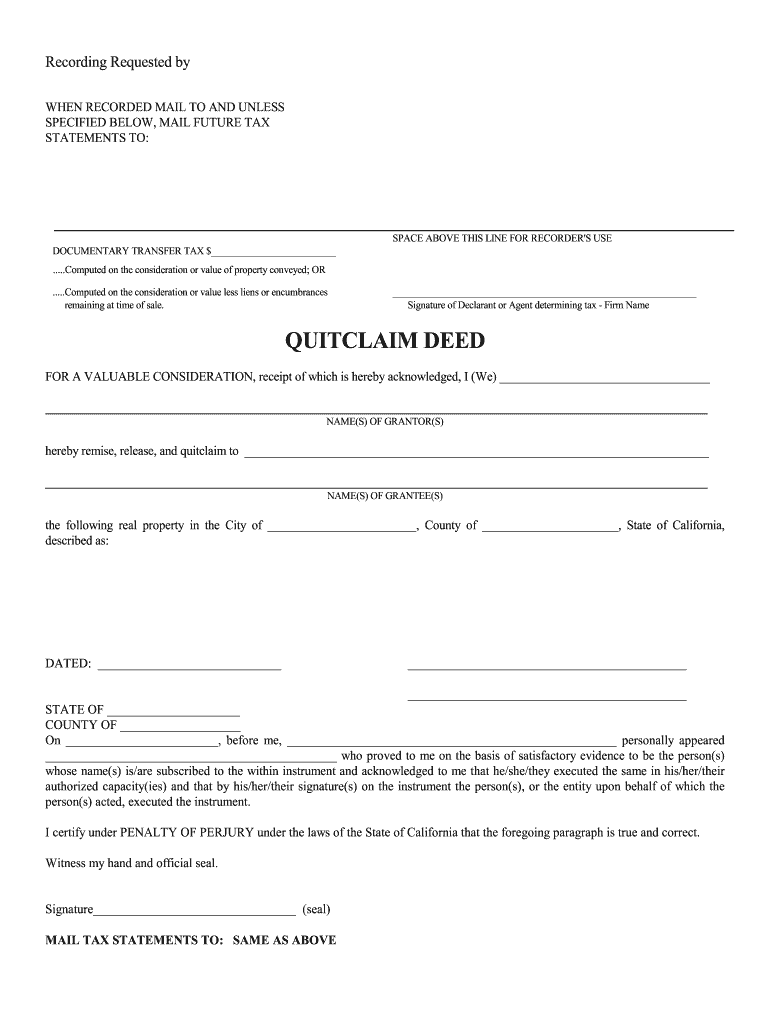

Steps to Complete the Kern County Quit Claim Deed Form

Completing the Kern County quit claim deed form involves several key steps to ensure its validity. First, gather all necessary information, including the names of the grantor and grantee, the property description, and any relevant legal descriptions. Next, accurately fill out the form, ensuring that all details are correct and legible. It is crucial to have the form signed in the presence of a notary public to validate the signatures. Finally, submit the completed form to the Kern County Recorder's Office for recording, which officially documents the transfer of property ownership.

Legal Use of the Kern County Quit Claim Deed

The Kern County quit claim deed is legally recognized as a means to transfer ownership of property. This form is particularly useful in situations where the grantor wishes to convey their interest in a property without making any guarantees about the title. It is commonly used among family members or in divorce settlements. However, it is important to understand that a quit claim deed does not guarantee clear title, so it is advisable to conduct a title search before proceeding with the transfer.

Required Documents for the Kern County Quit Claim Deed

To successfully complete a quit claim deed in Kern County, several documents are typically required. These include the completed quit claim deed form, a valid form of identification for the grantor, and any prior deeds related to the property, if available. Additionally, if the property is subject to any liens or encumbrances, documentation regarding those should also be included. Ensuring that all required documents are prepared will facilitate a smoother recording process.

Form Submission Methods for Kern County Quit Claim Deed

The Kern County quit claim deed can be submitted through various methods. Individuals may choose to submit the form in person at the Kern County Recorder's Office, ensuring that all signatures are notarized. Alternatively, the form can be mailed to the office, though this method may require additional time for processing. Some jurisdictions may also allow for electronic submission, providing a convenient option for those looking to complete the process digitally.

Key Elements of the Kern County Quit Claim Deed

Understanding the key elements of the Kern County quit claim deed is essential for proper usage. The form must include the names and addresses of both the grantor and grantee, a clear description of the property being transferred, and the date of the transfer. Additionally, it should contain the grantor's signature, notarization, and any applicable legal descriptions. Ensuring these elements are present will help in the validity and enforceability of the deed.

Quick guide on how to complete kern county deed records

Effortlessly Manage Kern County Deed Records on Any Device

Digital document administration has gained traction among businesses and individuals alike. It offers an excellent environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to produce, modify, and electronically sign your documents swiftly and smoothly. Control Kern County Deed Records from any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to modify and electronically sign Kern County Deed Records hassle-free

- Find Kern County Deed Records and click on Get Form to begin.

- Utilize the resources we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive data with tools specifically provided by airSlate SignNow for this purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Choose your preferred method of delivering your form, whether by email, SMS, invitation link, or downloading it to your PC.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any chosen device. Edit and electronically sign Kern County Deed Records while ensuring excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the kern county deed records

How to create an eSignature for your PDF in the online mode

How to create an eSignature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The way to generate an eSignature right from your smart phone

How to generate an electronic signature for a PDF on iOS devices

The way to generate an eSignature for a PDF on Android OS

People also ask

-

What is a Kern County quit claim deed form?

A Kern County quit claim deed form is a legal document used to transfer property ownership in Kern County without any warranties. It serves as a way for the granter to relinquish any claims or interests in the property to the grantee. Understanding how to correctly complete this form can simplify real estate transactions.

-

How can I obtain a Kern County quit claim deed form?

You can obtain a Kern County quit claim deed form through various channels, including the Kern County Recorder’s office or online legal document services. AirSlate SignNow provides a convenient option to access and fill out the form digitally. This makes it easier for you to complete the process without the need for paper documents.

-

Is there a fee associated with filing a Kern County quit claim deed form?

Yes, there is typically a filing fee associated with submitting a Kern County quit claim deed form, which can vary depending on the county's current fee schedule. It's essential to check with the Kern County Recorder’s office for the exact amount. Using airSlate SignNow can help you streamline the payment and filing process.

-

What are the benefits of using airSlate SignNow for the Kern County quit claim deed form?

Using airSlate SignNow for the Kern County quit claim deed form offers several benefits, including ease of use, quick eSigning capabilities, and secure document management. This platform allows you to complete and eSign your deed form electronically, saving time and eliminating the hassle of physical paperwork. Additionally, you can track the status of your document at any time.

-

Can I edit the Kern County quit claim deed form after initial completion?

Yes, airSlate SignNow allows you to edit the Kern County quit claim deed form even after initial completion, ensuring that all necessary details are accurate before submission. You can make amendments easily and have them reflected in the document. This feature is particularly valuable for ensuring compliance with local regulations.

-

What integrations does airSlate SignNow offer for the Kern County quit claim deed form?

airSlate SignNow offers various integrations with popular applications such as Google Drive, Dropbox, and other document management systems. These integrations enable seamless access and storage of your Kern County quit claim deed form alongside your other important documents. This enhances your workflow and overall productivity.

-

Is airSlate SignNow secure for handling sensitive documents like the Kern County quit claim deed form?

Absolutely, airSlate SignNow employs industry-standard encryption and security measures to protect sensitive documents, including the Kern County quit claim deed form. Your information is safeguarded during the signing process and while stored on the platform, ensuring peace of mind when handling important legal documents.

Get more for Kern County Deed Records

- Individual credit application kansas form

- Llc notices resolutions and other operations forms package kansas

- Ks deed 497307520 form

- Kansas disclosure 497307521 form

- Notice of dishonored check civil keywords bad check bounced check kansas form

- Mutual wills containing last will and testaments for unmarried persons living together with no children kansas form

- Mutual wills package of last wills and testaments for unmarried persons living together with adult children kansas form

- Mutual wills or last will and testaments for unmarried persons living together with minor children kansas form

Find out other Kern County Deed Records

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT