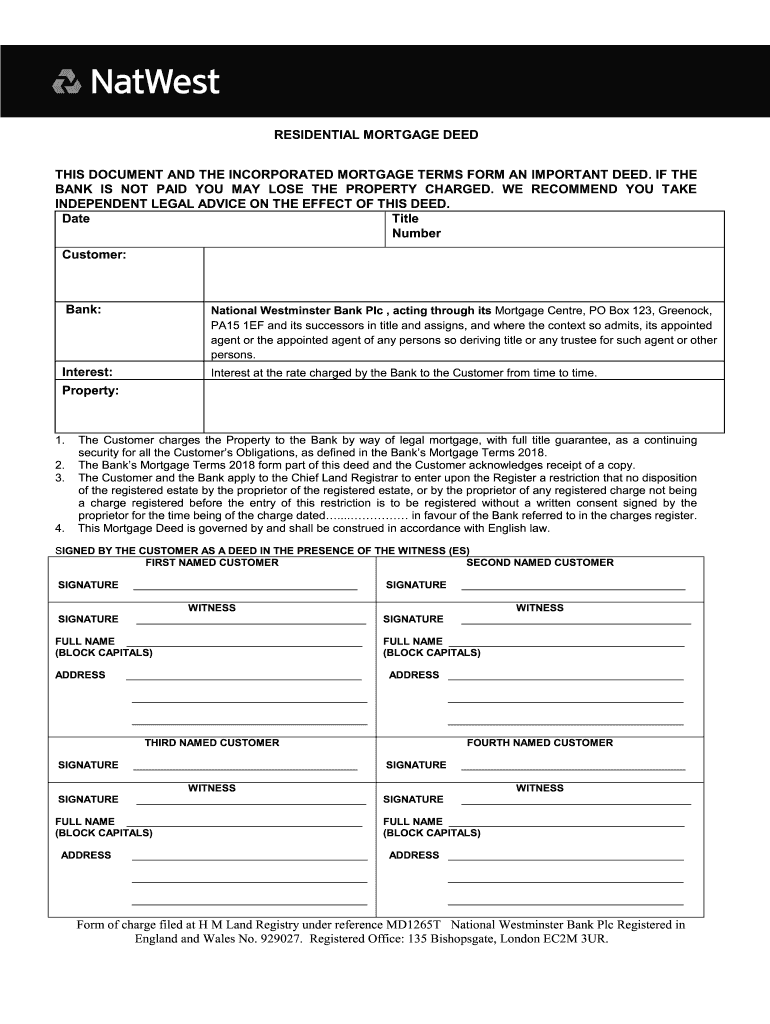

Mortgage Deed Form

What is the Mortgage Deed

A mortgage deed is a legal document that secures a loan by transferring an interest in real property to the lender. It outlines the terms of the mortgage agreement and provides the lender with the right to take possession of the property if the borrower defaults on the loan. This document is essential in the home-buying process and serves as a formal record of the borrower's obligation to repay the loan under specified conditions.

Key Elements of the Mortgage Deed

The mortgage deed includes several critical components that define the agreement between the borrower and lender. These elements typically consist of:

- Borrower and Lender Information: Names and addresses of both parties.

- Property Description: A detailed description of the property being mortgaged, including its address and legal description.

- Loan Amount: The total amount of money borrowed.

- Interest Rate: The percentage of interest charged on the loan.

- Repayment Terms: Details on how and when the loan will be repaid.

- Default Clauses: Conditions under which the lender can take possession of the property.

Steps to Complete the Mortgage Deed

Completing a mortgage deed involves several important steps to ensure that the document is valid and legally binding:

- Gather necessary information about the property and the parties involved.

- Draft the mortgage deed, including all key elements and terms.

- Review the document for accuracy and compliance with state laws.

- Sign the deed in the presence of a notary public to authenticate the signatures.

- File the signed mortgage deed with the appropriate county office to record the transaction.

Legal Use of the Mortgage Deed

The legal use of a mortgage deed is governed by state laws, which may vary. Generally, the mortgage deed must be executed according to specific legal requirements to be enforceable. This includes proper execution by all parties involved and compliance with local recording laws. Failure to adhere to these regulations can result in the mortgage being deemed invalid, which may affect the lender's ability to recover the loan in case of default.

How to Obtain the Mortgage Deed

To obtain a mortgage deed, borrowers typically receive it from their lender during the closing process of a mortgage transaction. It is important to ensure that the deed is accurately filled out and reflects all agreed-upon terms. In some cases, borrowers may also consult with a real estate attorney to draft or review the mortgage deed to ensure that it meets all legal requirements and protects their interests.

Examples of Using the Mortgage Deed

Examples of using a mortgage deed include:

- Securing a loan for purchasing a new home.

- Refinancing an existing mortgage to obtain better terms.

- Using a mortgage deed to secure a home equity line of credit (HELOC).

In each case, the mortgage deed serves as a binding agreement that outlines the responsibilities of both the borrower and the lender.

Quick guide on how to complete mortgage deed

Effortlessly Prepare Mortgage Deed on Any Device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents rapidly without delays. Manage Mortgage Deed on any platform with airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to Modify and Electronically Sign Mortgage Deed Without Effort

- Find Mortgage Deed and click on Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Highlight important sections of your documents or redact sensitive information using specialized tools offered by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to secure your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about missing or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Adjust and electronically sign Mortgage Deed to ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mortgage deed

The best way to create an electronic signature for your PDF document online

The best way to create an electronic signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The best way to generate an electronic signature right from your smart phone

The way to create an electronic signature for a PDF document on iOS

The best way to generate an electronic signature for a PDF on Android OS

People also ask

-

What is a NatWest mortgage deed?

A NatWest mortgage deed is a legal document that secures the loan given by NatWest Bank for purchasing property. It outlines the terms of the mortgage agreement and gives the bank rights over the property until the mortgage is paid off.

-

How can airSlate SignNow assist with NatWest mortgage deeds?

airSlate SignNow provides an efficient platform for electronically signing and sending NatWest mortgage deeds. With its user-friendly interface, you can easily manage your mortgage documents, ensuring compliance and quicker processing times.

-

What are the benefits of using airSlate SignNow for mortgage deeds?

Using airSlate SignNow for your NatWest mortgage deed allows for faster document turnaround, enhanced security, and reduced paper usage. This innovative solution streamlines the signing process, making it more convenient for all parties involved.

-

Are there any integration options for managing NatWest mortgage deeds?

Yes, airSlate SignNow integrates seamlessly with various business applications, which can help in managing NatWest mortgage deeds. This allows for easy access to your documents alongside other workflows within your organization.

-

What are the pricing options for airSlate SignNow when handling mortgage deeds?

airSlate SignNow offers flexible pricing plans that cater to different business sizes and needs, including those handling NatWest mortgage deeds. You can choose a plan that best fits your volume of document management and signing requirements.

-

Can airSlate SignNow help with revisions of a NatWest mortgage deed?

Absolutely! airSlate SignNow allows users to make revisions to their NatWest mortgage deed electronically. You can easily update the document and resend it for signatures, ensuring that all parties have the most current information.

-

Is it secure to use airSlate SignNow for signing NatWest mortgage deeds?

Yes, security is a top priority at airSlate SignNow. The platform employs advanced encryption and authentication methods, ensuring that your NatWest mortgage deed and personal information remain safe throughout the signing process.

Get more for Mortgage Deed

- Massachusetts forest products timber sale contract massachusetts form

- Condominium form

- Ma release form

- Massachusetts small form

- Massachusetts unlawful form

- Real estate home sales package with offer to purchase contract of sale disclosure statements and more for residential house 497309856 form

- Massachusetts annual file form

- Notices resolutions simple stock ledger and certificate massachusetts form

Find out other Mortgage Deed

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile

- Sign Wyoming Government Quitclaim Deed Free

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online