Massachusetts Small Form

What is the Massachusetts Small

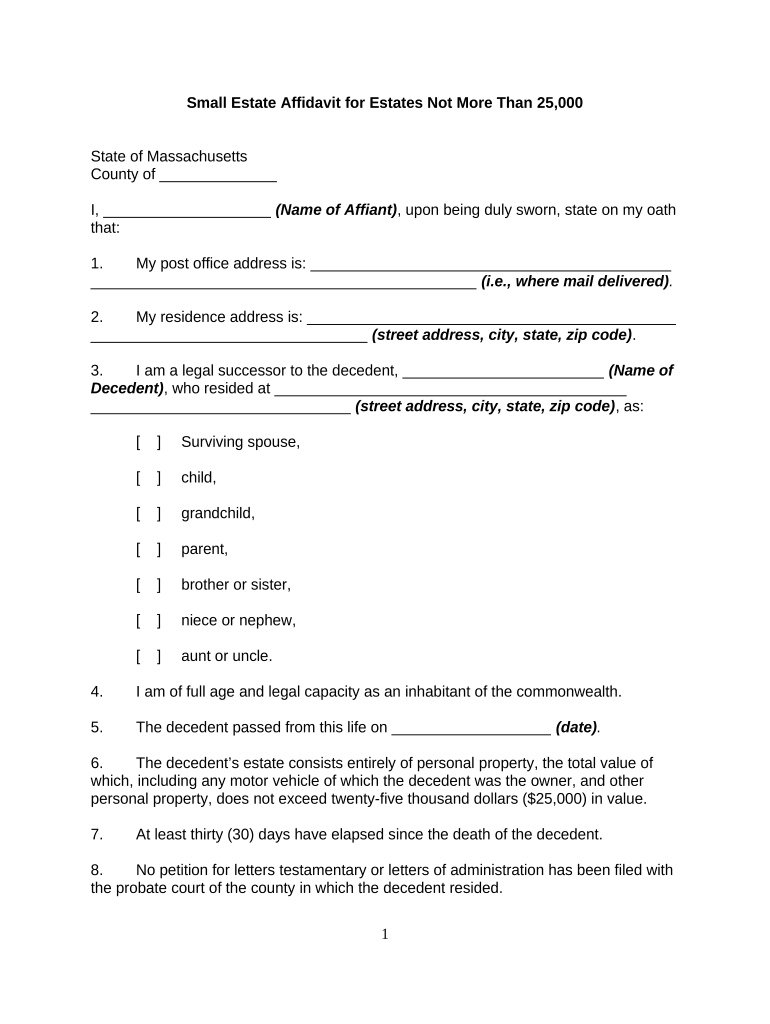

The Massachusetts Small form is a legal document used primarily for estate planning and administration. It is designed to simplify the process of transferring small estates without the need for formal probate proceedings. This form allows individuals to claim assets of a deceased person when the total value of the estate falls below a certain threshold, streamlining the process for heirs and beneficiaries.

How to use the Massachusetts Small

To use the Massachusetts Small form, individuals must first determine if the estate qualifies under the state's small estate laws. If the total value of the estate is within the specified limit, the executor or administrator can complete the form to facilitate the distribution of assets. The form typically requires information about the deceased, the heirs, and the assets being transferred. It is essential to ensure that all sections are filled out accurately to avoid delays or complications.

Steps to complete the Massachusetts Small

Completing the Massachusetts Small form involves several clear steps:

- Gather necessary information about the deceased, including their full name, date of death, and a list of assets.

- Determine the total value of the estate to confirm it qualifies as a small estate.

- Fill out the Massachusetts Small form with the required details, ensuring accuracy in all sections.

- Obtain signatures from all relevant parties, including heirs, if required.

- Submit the completed form to the appropriate court or authority as specified by Massachusetts law.

Key elements of the Massachusetts Small

Several key elements are crucial for the Massachusetts Small form to be considered valid:

- Eligibility Criteria: The total value of the estate must fall below the threshold set by Massachusetts law.

- Required Information: Accurate details about the deceased and their assets are necessary for the form's acceptance.

- Signatures: The form must be signed by the executor or administrator and, in some cases, by the heirs.

- Submission: The completed form must be submitted to the appropriate court to initiate the transfer of assets.

Legal use of the Massachusetts Small

The legal use of the Massachusetts Small form is governed by state laws that outline the requirements for small estate administration. The form is legally binding when completed correctly and submitted to the court. It provides a simplified process for transferring assets, ensuring that heirs can access their inheritance without the lengthy probate process. Compliance with all legal stipulations is essential to uphold the validity of the document.

State-specific rules for the Massachusetts Small

Massachusetts has specific rules that govern the use of the Small form, including:

- The maximum value of the estate must not exceed a certain amount, which is periodically adjusted by the state.

- All debts and taxes must be settled before the distribution of assets can occur.

- Heirs must be notified and may need to consent to the use of the small estate procedure.

Quick guide on how to complete massachusetts small

Effortlessly Prepare Massachusetts Small on Any Device

Digital document management has gained tremendous popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to easily find the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents quickly and efficiently. Manage Massachusetts Small on any device using airSlate SignNow’s Android or iOS applications and enhance your document-related tasks today.

How to Edit and eSign Massachusetts Small with Ease

- Obtain Massachusetts Small and then click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize essential sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or download it directly to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Massachusetts Small to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how can it benefit Massachusetts small businesses?

airSlate SignNow is designed to empower Massachusetts small businesses by providing a simple and cost-effective solution for sending and eSigning documents electronically. This allows small businesses to save time, reduce paperwork, and streamline their workflow.

-

What are the pricing plans available for Massachusetts small businesses?

airSlate SignNow offers competitive pricing plans tailored for Massachusetts small businesses, ensuring affordable options to meet various budgets. Small businesses can choose from different tiers that provide essential features suited to their specific needs.

-

What features does airSlate SignNow offer to Massachusetts small businesses?

airSlate SignNow includes features like customizable templates, advanced security measures, and real-time tracking, specifically beneficial for Massachusetts small businesses. These features enhance efficiency and ensure documents are managed efficiently.

-

Can airSlate SignNow integrate with other software that Massachusetts small businesses use?

Yes, airSlate SignNow seamlessly integrates with popular software platforms used by Massachusetts small businesses, such as CRM systems and cloud storage services. This allows businesses to streamline their processes and maintain productivity.

-

How does airSlate SignNow enhance document security for Massachusetts small businesses?

airSlate SignNow prioritizes document security for Massachusetts small businesses by implementing advanced encryption and compliance certifications. This ensures that sensitive information remains protected during the signing process.

-

Is there a mobile app available for Massachusetts small business users?

Absolutely! airSlate SignNow provides a mobile app, allowing Massachusetts small businesses to manage documents and eSign on-the-go. This flexibility is essential for busy entrepreneurs needing quick access to documents.

-

How can Massachusetts small businesses get started with airSlate SignNow?

Getting started with airSlate SignNow is quick and easy for Massachusetts small businesses. Simply sign up for a free trial to explore the platform, and you can begin sending and signing documents immediately.

Get more for Massachusetts Small

Find out other Massachusetts Small

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement