INHERITANCE ACCOUNT AGREEMENT Piper Jaffray 2004-2026

Understanding the inheritance account agreement

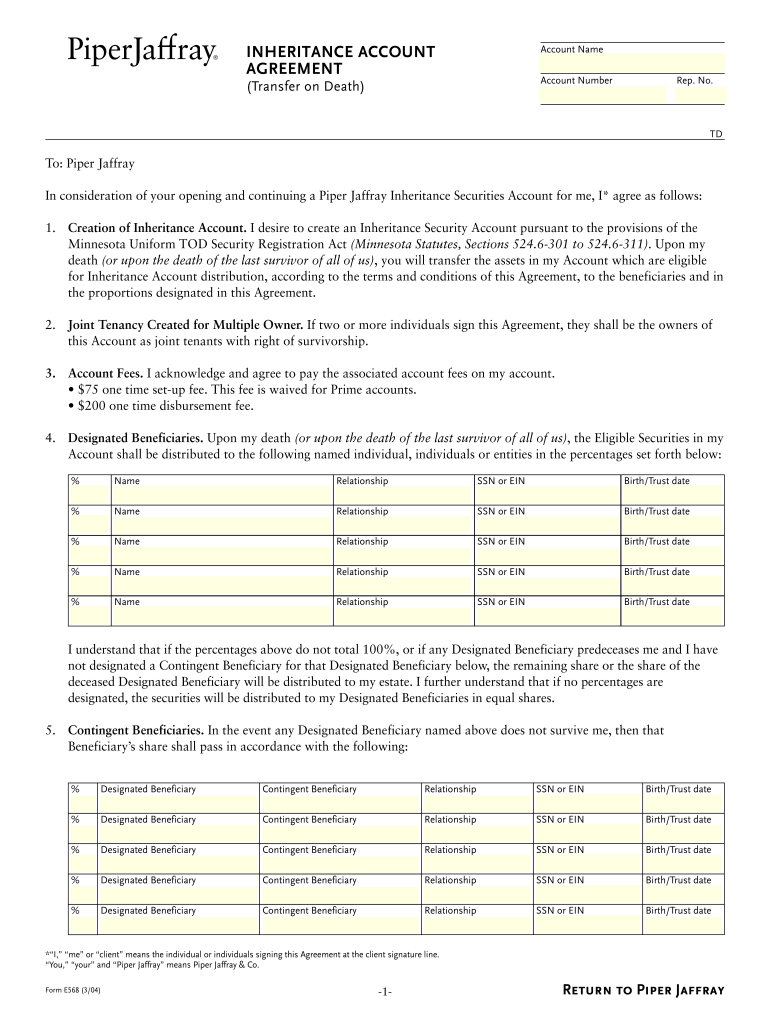

The inheritance account agreement is a legal document that outlines how assets will be distributed among beneficiaries after the account holder's death. This agreement ensures that the wishes of the deceased are honored and provides clarity on the management of the account. It typically includes details about the beneficiaries, the distribution percentages, and any conditions that must be met before assets are transferred. Understanding this agreement is crucial for all parties involved, as it serves as a guide for the executor of the estate and helps prevent disputes among beneficiaries.

Steps to complete the inheritance account agreement

Filling out the inheritance account agreement involves several important steps to ensure compliance with legal standards and the wishes of the account holder. Begin by gathering all necessary information about the account and beneficiaries, including full names, addresses, and Social Security numbers. Next, clearly outline the distribution plan, specifying what each beneficiary will receive. It is also essential to include any specific conditions or requirements for the distribution. After completing the form, all parties should review it for accuracy and completeness before signing. Finally, ensure that the signed document is stored securely and that all beneficiaries are notified of its existence and contents.

Legal use of the inheritance account agreement

The inheritance account agreement is legally binding when executed correctly, meaning it must comply with state laws regarding wills and estates. This includes ensuring that the document is signed by the account holder and, in some cases, witnessed or notarized. It is important to understand that while this agreement can simplify the distribution process, it does not replace a will. Instead, it should be used in conjunction with a will to provide a comprehensive estate plan. Legal counsel may be beneficial to ensure that the agreement meets all legal requirements and adequately reflects the account holder's intentions.

Required documents for the inheritance account agreement

To complete the inheritance account agreement, certain documents are typically required. These may include the account holder's identification, proof of ownership of the account, and any existing wills or estate plans. Additionally, beneficiaries may need to provide identification and documentation to verify their relationship to the account holder. Having these documents ready can streamline the process and ensure that the agreement is valid and enforceable.

State-specific rules for the inheritance account agreement

Each state has its own laws governing inheritance and estate distribution, which can affect how the inheritance account agreement is structured and executed. It is crucial to be aware of these state-specific regulations, as they can dictate requirements for notarization, witness signatures, and the overall validity of the agreement. Consulting with a legal professional familiar with estate law in the relevant state can help ensure compliance and avoid potential legal issues.

Examples of using the inheritance account agreement

The inheritance account agreement can be utilized in various scenarios, such as when an account holder wishes to designate specific beneficiaries for a bank account, investment account, or retirement account. For instance, if an individual wants their children to inherit their savings account upon their death, they can specify this in the agreement. Additionally, the agreement can address situations where beneficiaries may need to meet certain conditions, such as reaching a specific age or completing educational milestones before receiving their inheritance. These examples illustrate the versatility and importance of the inheritance account agreement in estate planning.

Quick guide on how to complete inheritance account agreement piper jaffray

Complete INHERITANCE ACCOUNT AGREEMENT Piper Jaffray seamlessly on any device

Digital document management has become widely embraced by both businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage INHERITANCE ACCOUNT AGREEMENT Piper Jaffray on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to edit and eSign INHERITANCE ACCOUNT AGREEMENT Piper Jaffray effortlessly

- Locate INHERITANCE ACCOUNT AGREEMENT Piper Jaffray and click Get Form to begin.

- Take advantage of the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choice. Modify and eSign INHERITANCE ACCOUNT AGREEMENT Piper Jaffray and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the inheritance account agreement piper jaffray

The best way to create an electronic signature for a PDF document online

The best way to create an electronic signature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

The way to generate an eSignature from your smart phone

The way to create an eSignature for a PDF document on iOS

The way to generate an eSignature for a PDF file on Android OS

People also ask

-

What is an account estate in airSlate SignNow?

An account estate in airSlate SignNow refers to the specific configuration and management settings that define how your account operates. This includes user roles, workflows, and document templates tailored to your business needs. Understanding your account estate is crucial for optimizing document processes and enhancing team collaboration.

-

How does airSlate SignNow handle pricing for account estate?

airSlate SignNow offers flexible pricing plans that cater to various business needs and sizes. Depending on your account estate requirements, you can choose from individual, team, or enterprise pricing options. Each plan includes features designed to maximize efficiency and streamline document workflows.

-

What features are included in my account estate on airSlate SignNow?

Your account estate on airSlate SignNow includes robust features like eSignature, document templates, real-time collaboration, and integration options with various software. Additionally, you can customize permissions and workflows to suit your team's unique processes. These features contribute signNowly to enhancing your document management efficiency.

-

Can I customize my account estate in airSlate SignNow?

Yes, airSlate SignNow allows for extensive customization of your account estate. You can tailor user roles, create specific workflows, and set up document templates that match your business operations. This flexibility ensures that your team can work effectively and efficiently within their customized environment.

-

What benefits does airSlate SignNow offer for my account estate?

The primary benefits of airSlate SignNow for your account estate include streamlined document management, reduced turnaround times, and increased security. With eSigning capabilities and a user-friendly interface, you can minimize paperwork and enhance productivity. These advantages ultimately lead to signNow cost savings for your business.

-

How do integrations work with my account estate in airSlate SignNow?

Integrations in your account estate with airSlate SignNow are seamless and designed to enhance your document workflow. You can connect with a variety of applications like CRM systems, cloud storage, and other productivity tools to create a comprehensive workflow. This ensures that all your processes are interconnected and efficient.

-

Is there support available for managing my account estate?

Absolutely, airSlate SignNow provides dedicated support for managing your account estate. Our customer service team is available to assist you with setup, customization, and troubleshooting. Additionally, you can access extensive online resources and guides to help navigate your account settings effectively.

Get more for INHERITANCE ACCOUNT AGREEMENT Piper Jaffray

- Legal last will and testament form for married person with minor children michigan

- Michigan will form

- Legal last will and testament form for married person with adult and minor children from prior marriage michigan

- Legal last will and testament form for married person with adult and minor children michigan

- Mutual wills package with last wills and testaments for married couple with adult and minor children michigan form

- Legal last will and testament form for a widow or widower with adult children michigan

- Legal last will and testament form for widow or widower with minor children michigan

- Legal last will form for a widow or widower with no children michigan

Find out other INHERITANCE ACCOUNT AGREEMENT Piper Jaffray

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent